On the radar this week:

- Powell vs Brainard Fed chair nomination

- Covid trends and restrictions in Europe

- US core PCE inflation (Thursday at 2:00am AEDT)

- RBNZ and Riksbank central bank meeting

- US cash markets shut Thursday for Thanksgiving (Pepperstone US equity indices still open)

- Eurozone PMI (Tuesday 20:00 AEDT) – ECB speakers in play

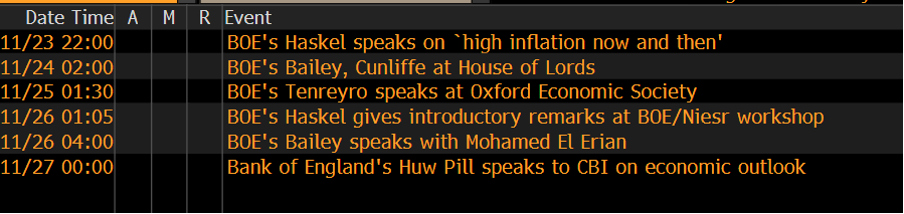

- BoE speakers to drive the GBP – will they cast doubt on a December hike?

Certainly, the NOK was the weakest G10 currency last week and GBPNOK has been a great long position – a pair to trade this week, but consider it is up for 9 straight days and has appreciated 5.2% since late October.

I questioned last week if the divergence in EURCHF plays out, and the break of 1.05 negates that, suggesting staying short this cross for now as the CHF is still a preferred safe-haven.

EURUSD has been in free-fall

EURUSD has been in free-fall and will likely get the lion’s share of attention from clients looking for a play on growing restrictions and tensions across Europe. The pair has lost 3.5% since rejecting the 50-day MA on 28 Oct and has consistently been printing lower lows since May – predominantly driven by central bank divergence and a growing premium of 2-year US Treasuries over German 2yr - with the spread blowing out from 78bp to 128bp, in favour of USD. For momentum, trend followers and tactical traders, short EUR remains attractive here.

It will be interesting to see if we see any pickup in shorting activity in EU equities – notably the GER40, with the German govt warning of lockdowns ahead. A market at all-time highs (like the GER40) is a tough one to short, but if this starts to roll over then I’d go along for a day trade. There is a raft of ECB speakers also to focus on, notably with President Lagarde due to speak on Friday.

Playing restrictions through crude

While we can play crude moves in the FX, equity and ETF space, outright shorts in crude have been looking compelling. Although we see SpotCrude now sitting on huge horizontal support and a break here brings in the 50-day MA. Of course, as oil and gasoline fall, the prospect of a release of the SPR (Strategic Petroleum Reserves) diminishes, however, the Biden administration could use this move lower move to their advantage and capitalize to keep the pressure on.

SpotCrude daily

(Source: TradingView - Past performance is not indicative of future performance.)

A rise in restrictions also means market neutral strategies (long and short) should continue to work and long tech and short energy has been popular. We can express this in our ETF complex, with the XOP ETF (oil and gas explorers) -8.1% last week and that works as a high beta short leg. Long IUSG (growth) or the QQQ ETF against this would be a good proxy on the opposing leg. In fact, looking at the moves in Apple, Nvidia, Alphabet and Amazon, we can see these ‘safe haven’ stocks are working well again, as is Tesla although for different reasons.

Stocks for the trend-followers

For the ‘buy strong’ crowd, I have scanned our equity universe for names above both their 5 and 20-day MA and at 52-week highs. Pull up a daily chart of any of these names - they should nearly always start at the bottom left and end top right.

(Source: Bloomberg - Past performance is not indicative of future performance.)

Playing the RBNZ meeting tactically

By way of event risks, the RBNZ meeting (Wed 12:00 AEDT) is one of the more interesting events to focus on. Will the RBNZ raise by 25bp or 50bp? That is the question, and of 19 calls from economists (surveyed by Bloomberg) we see 17 calling for a 25bp hike – yet the markets are fully pricing not just a 25bp hike but a 43% chance of 50bp – from a very simplistic perceptive if the RBNZ hike by ‘just’ 25bp, choosing a path of least regret, then we could see a quick 25- to 30-pip move lower in the NZD. The focus then turns to the outlook and whether the 8 further hikes priced over the coming 12 months seems to be one shared by the RBNZ.

Traders have been keen to play NZD strength via AUD, as it is more a relative play and doesn’t carry the risk on/off vibe, which you get with the USD and JPY. I’d be using strength in AUDNZD as an opportunity to initiate shorts, especially with views that RBNZ Gov Orr could talk up the possibility of inter-meeting rate hikes.

GBP to be guided by the BoE Chief

The GBP is always a play clients gravitate to, with GBPUSD and EURGBP always two of the most actively traded instruments in our universe. A 15bp hike is priced for the 16 Dec BoE meeting after last week’s UK employment and inflation data, but consider we also get UK PMI data (Tuesday 20:30 AEDT), and arguably, more importantly, speeches from BoE Governor Bailey and chief economist Huw Pill – perhaps this time around expectations of hikes can be better guided – although, a bit of uncertainty into central bank meetings is very pre-2008 and makes things a little spicy/interesting.

BoE speakers this week

(Source: Bloomberg - Past performance is not indicative of future performance.)

GBPUSD 1-week implied volatility is hardly screaming movement and at 6.5% sits at the 10th percentile of its 12-month range. The implied move is close to 130pips, so the range at this juncture (with a 68.2% level of confidence), although I multiple this by 0.8 to get closer to the options breakeven rate.

So at this stage, 100 pips (higher or lower) is the sort of move the street is looking for over the coming five days, putting a range of 1.3557 to 1.3349 in play – one for the mean reversion players. Personally, I would let it run a bit as that volatility seems a little low, and a break of 1.3400 could see volatility pick up. I’d certainly be looking for downside if that gave way.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.