A full removal of YCC seems a low probability, but it is a scenario that is on the table and one which could have big implications for global bond markets. Imaging a world where we have almost full price discovery in the Japanese government bond (JGB) market seems almost unbelievable.

.png)

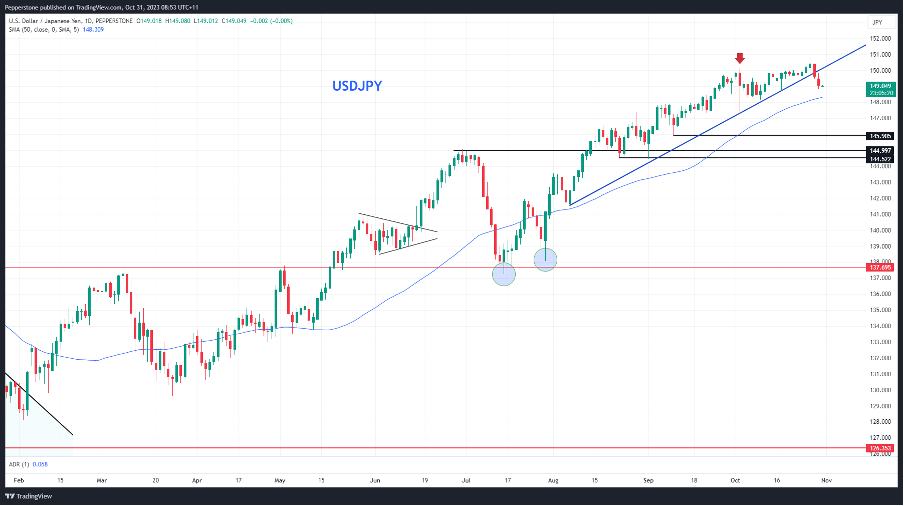

While we await the reaction in cash JGBs, we’ve seen a strong selling in Japan 10-year bond futures, and Japan 10-year swaps have risen to 1.15%, suggesting the market is primed for a policy change. The reaction in the JPY was a touch more pronounced than I expected, with USDJPY dropping 100 pips to a low of 148.81, although the pair has found support and reclaimed the 149-handle.

USDJPY daily options imply a 122-pip move in today’s trading session (higher or lower), so upbeat movement is expected, and this has big implications for traders’ position sizing and risk. The risk manager still understands that there is a potential vol event sometime between 12 pm to 3 pm today, and how exposed they are to that risk is how they live to fight another day.

All things being equal a move to lift the YCC cap from 1% to 1.5% should bring out further JPY buyers, and push USDJPY and the crosses lower through trade. That said, there is quite a bit in the price now and the risk-to-reward trade-off has shifted. Where the reaction becomes less clear cut, is it is highly likely the BoJ tweak the YCC band but accompany these changes with supportive language that they will offset unnecessary intraday volatility through buying JGBs, should the need be there.

We also need to consider the extent of the BoJ inflation upgrades, as well as guidance on the timing in lifting rates away from negative. Algo’s will likely react to headlines on action/inaction around the YCC band as its primary consideration - where the extent of the move in the JPY and JPN225 will be determined by these offsetting factors and of course liquidity and positioning.

While the options vol suggests we could see a larger move, I favour selling rallies on the day into 149.70/80. The lasting risk to JPY longs would be a melt up in equity markets and reduced volatility that leads funds to pile back into carry positions.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.