- English

- 中文版

FOMC meeting preview – Hawkish, but will it be hawkish enough?

Setting the scene – what to watch from the meeting

Time: FOMC statement (4:00 AEST / 19:00 GMT) and Jay Powell press conference (04:30 AEST)

Once again, we see elevated expectations of near-term market movement, with G10 margin FX 1-week implied volatility at the top end of their respective 12-month ranges.

One can attribute much of this to expectations that this week’s FOMC meeting will promote market volatility, although I’m not sure we get a huge volatility trigger given so much of what we’re likely to hear is expected. It will be another case of a rich broad USD market positioning against a Fed that will be hawkish - however, given what’s already priced into interest rate markets - will they be hawkish enough to satisfy expectations?

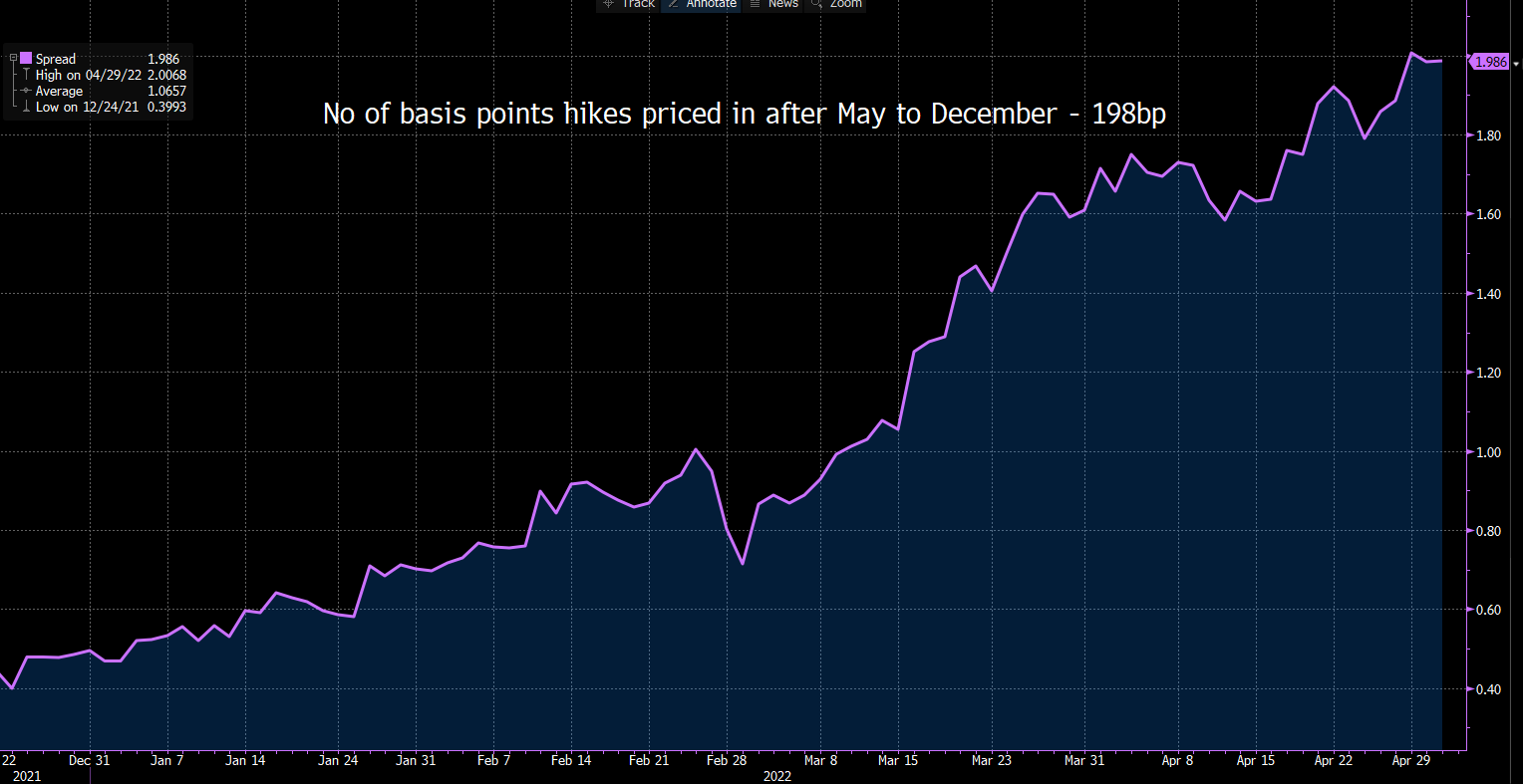

It would be an incredible surprise if the Fed didn’t lift rates by 50bp at this meeting. This is well priced, with the swaps market pricing 51bp of hikes, where we do see an issue is pricing around the June FOMC meeting, with a 25% chance of 75bp hike. This seems a tad lofty, but it has come down from 50% last week. We can also look further out at the rates curve and see a further 200bp (or 8) of hikes priced post this meeting through to year-end. Consider that the Fed see the ‘neutral’ rate (this is the policy rate that’s neither stimulatory nor restrictive relative to anticipated economic dynamics) sits at 2.4% - so under current pricing the market expects the Fed to take the fed funds rate above neutral and into restrictive territory by September – this would require 50bp hikes in May, June, July, and September.

(Source: Bloomberg - Past performance is not indicative of future performance.)

The Fed has detailed they will lift the fed funds rate “expeditiously” to neutral – so, the market knows they’re hellbent on hiking rapidly to bring demand in equilibrium with supply – the question, and the concern, is will they keep hiking well into restrictive territory even if unemployment starts to rise, housing is looking vulnerable, and inflation expectations start rolling over? This is where the policy mistake concern kicks in and right now the best way to hedge in the market's eyes has been to be long of USDs.

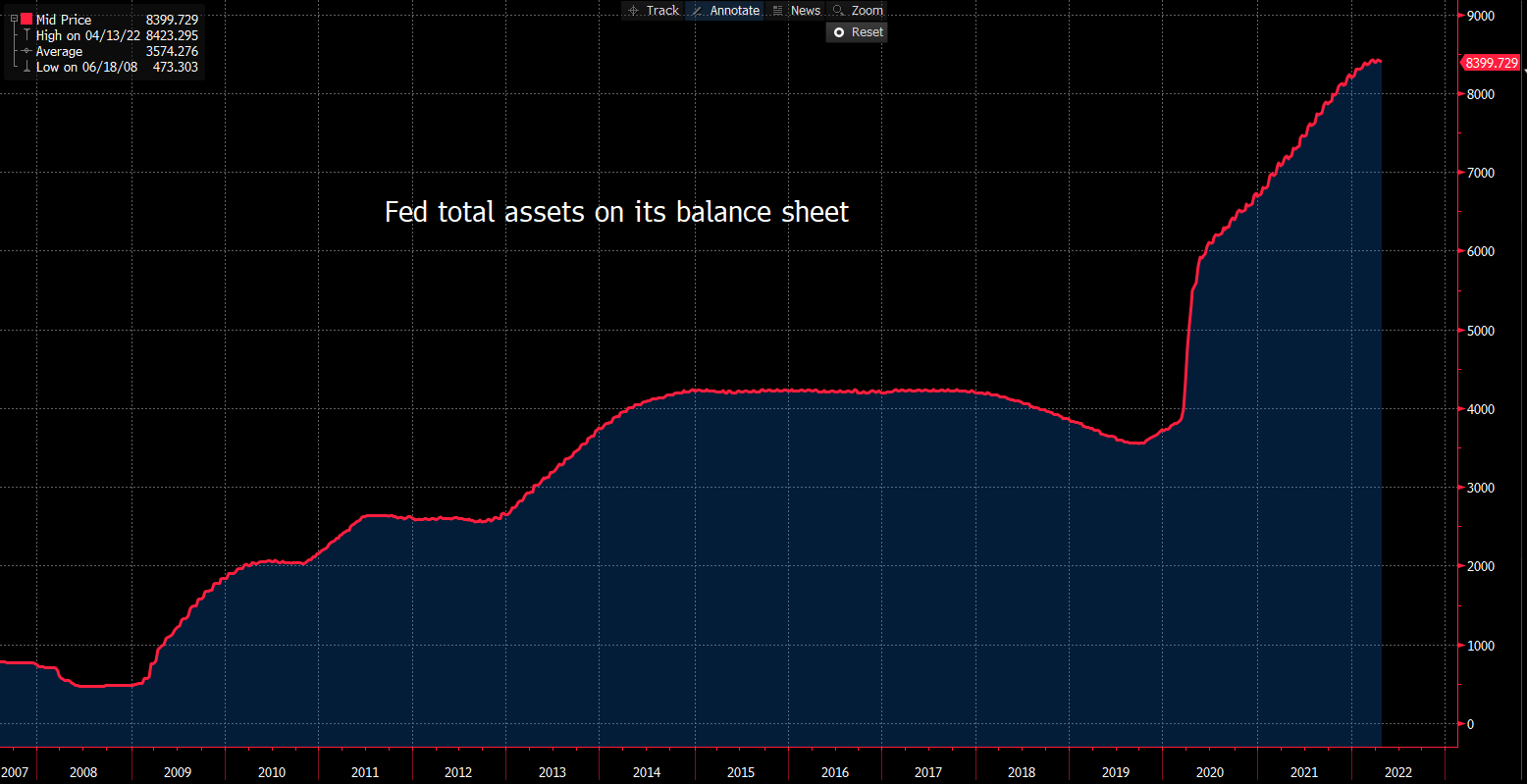

We also know the Fed will embark on balance sheet reduction or Quantitative Tightening (‘QT’) – they’ll start in June by reducing their US Treasury holdings and mortgage securities at a pace of $30b p/m and ramp this up to $95b over the following few meetings. Over 12 months QT equates to having the same effect as 50bp in additional rate hikes, so again you can see why equity traders have been so concerned with the over-tightening aspect, which has led to markets such as the NAS100 into steep declines.

Given the Fed has been incredibly vocal about reducing the assets on its balance sheet, in theory, further colour here shouldn’t shock and therefore shouldn’t move markets too intently.

(Source: Bloomberg - Past performance is not indicative of future performance.)

The wash-up of all these factors is we have a market that is expecting volatility – they are long USDs but also have high expectations of future rate hikes – they expect a hawkish Fed – the question is will they be hawkish enough?

Our client positioning is short on the USD and expecting the USD to undergo a period of mean reversion – Perhaps the purest reaction comes US 2yr Treasury yields and moves in yields portrays how the market digests the Fed statement and Powell’s press conference - the USD, NAS100 and potentially Gold should move in alignment here. Higher yields (indicating selling) should show the market seeing the meeting as hawkish and be a USD positive, and vice versa.

Ultimately, we shouldn’t underestimate the Fed’s desire to bring down inflation. This means a higher USD, a higher cost of capital (weaker demand) and lower equity prices. The question is whether the Fed statement and Powell’s presser lives up to current market pricing?

One thing is clear the market will be hanging on every word Powell says – what’s your position?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.