Key big picture themes

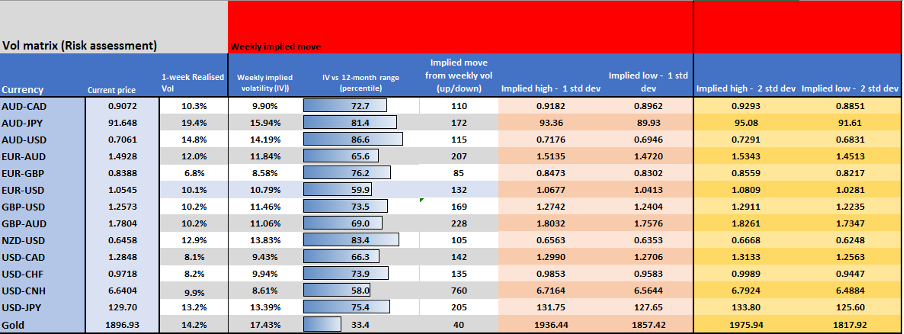

- · High cross-asset volatility – we see the VIX index pushing into 33.4%, indicating 2.1% daily swings in the S&P 500. G7 margin FX volatility sits at 10.04% and near the highest since March 2020, with AUD implied vol a standout – high volatility should be a core consideration for potentially reducing position sizing.

- · A USD position unwind? after the biggest monthly gain in the USD in 55 years, will USD longs reduce length through this week? Client positioning suggests retail traders strongly believe this to be the risk.

- · Can USDCNH push through 6.70 and put a further bid in the USD vs G10 margin FX?

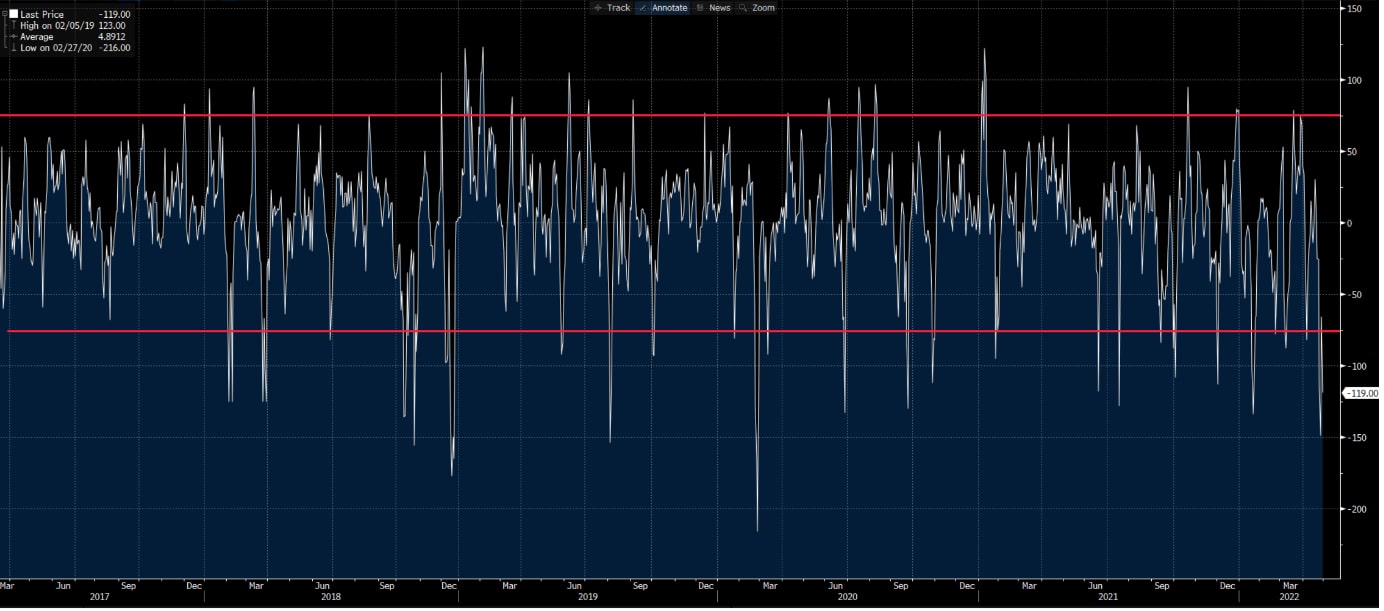

- · Extreme bearish equity sentiment – The Citigroup S&P500 overbought/oversold gauge shows bearish sentiment at extremes, while the AAII bullish-bearish read is at the lowest levels since 2009. However, as we go through a multi-decade regime change in markets, we ask is this time different or is this a buying opportunity? Is it really the time to be contrarian or to stay risk-averse?

- Bond yields to move higher? Can US 10yr real rates turn positive? Will the US 2yr move above 2.8% and the 10yr above 3%? The USD, gold, and global equities will again take their cues from the US and DM bond markets.

- · A rising risk of stagflation and/or a recession? We watch the data flow (listed below) and central bank narrative for insights here

- · Prolonged supply chain concerns? Will we hear more on this theme in the remaining US corporate earnings set to release numbers?

- · Given last week’s supportive narrative in the Politburo, are Chinese equity market set for a period of outperformance?

Citi overbought and oversold index

(A blend of various instruments to assess current sentiment)

(Source: Bloomberg - Past performance is not indicative of future performance.)

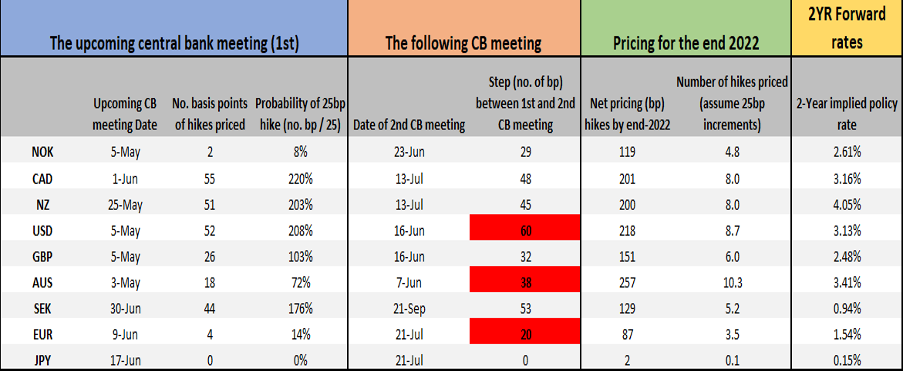

Interest rate matrix

(Source: Pepperstone - Past performance is not indicative of future performance.)

The risk manager - Events that should be front and centre in the week ahead:

- FOMC meeting & chair Jay Powell press conference (Thursday 4:00am and 4:30am AEST respectively) – the marquee event risk of the week

- As we see from the rates matrix, the market fully expects a 50bp hike at this week’s meeting, so if this becomes fact it shouldn’t move markets - neither should colour around starting to reduce its balance sheet (QT) in June, which again is priced in – more importantly, traders will react to the tone of Powell’s press conference and the appetite for a 75bp hike in the June meeting. With a further 218bp of hikes priced throughout 2022, potentially taking the fed funds rate above the neutral rate (considered to 2.40%) by September - the USD could take its cues from the perceived urgency to front-load hikes and take policy into restrictive territory.

- · RBA meeting (Tuesday 14:30 AEST) – Things could get very lively for the AUD this week

- Of the 21 economists who have given rates calls, 3 see the cash rate on hold at 10bp, 5 see a 50bp hike (more likely 40bp) and 13 see a 15bp hike - the market prices 18bp of hikes for this meeting, so should we get 15bp then we could see small AUD downside off the bat. If rates are left at 10bp then we could see a rapid move lower of 50-60 pips in the AUD. Should we get the expected 15bp hike, the focus then falls on how the statement reads relative to pricing for the June RBA meeting (38bp), and the 257bp priced through end-2022 – many question if the pricing for June is too aggressive, suggesting the distribution of probabilities offers downside risk to the AUD.

- BoE meeting (Thursday 21:00 AEST) – a 25bp hike is firmly discounted, so again we look at the statement vs what’s priced for end-2022 – will the statement justify six hikes from the BoE this year? I am sceptical – so a preference to sell rallies in GBPUSD.

- RBA Statement on Monetary Policy (Friday 11:30 AEST) – we get fresh insights into the RBA’s thinking on economics through a hiking cycle, with new GDP and CPI forecasts. Expect big increases to the banks CPI forecasts.

- · US non-farm payrolls (Friday 22:30 AEST) – the market expects 390k jobs to be created, with the US unemployment rate eyed to tick down to 3.5% (3.6%) – given the large 1.4% gain in the Employee Cost Index (ECI) on Friday all eyes fall on the average hourly earnings with expectations of 5.5% YoY - many question if we’re seeing the start of a US wage-price spiral, which again validates the need to get rates higher.

- ISM manufacturing (Tuesday 00:00 AEST) – the market expects US manufacturing to grow at a faster clip, with the diffusion index eyed at 57.5 (vs 57.1 in March) – while this is an important data point, but if recent history is any guide, it shouldn’t be a vol event. However, given the recent decline in Q1 GDP traders will watch for further risks to growth.

- Fed speakers – On the docket post the FOMC meeting we hear views from Fed members Williams, Bostic, Bullard, Waller & Daly – we assess the appetite from each member for a 75bp in the June meeting.

- ECB speakers – in the week ahead we hear from Lane, Holzman & Villeroy – as the rates matrix shows, we see 20bp, or an 80% chance of lift-off, in the July meeting – will these speakers validate this pricing? A strong preference to sell EURUSD into 1.0650, but I question if that fill is too optimistic?

- BoE speakers (all due in the days after the BoE meeting) – Mann, Pill and Tenreyo

- Canada employment change (Friday 22:30 AEST) – the market eyes 40k jobs created in April, taking the U/E rate to 5.2% (from 5.3%) – the next BoC meeting isn’t until 1 June, but expectations of a 50bp hike are fully priced. USDCAD into 1.2950 looks interesting given the set-up on the daily.

- EU manufacturing PMI series (Monday 18:00 AEST) – while inflation, geopolitical headlines and moves in EU Nat gas are key, this economic metric could affect EUR pricing given the deafening cries for ‘stagflation’ in the Eurozone.

- NZ employment (Wednesday 08:45 AEST) – the markets see a 3.1% YoY gain in employment – with the next RBNZ meeting not until 25 May, unless it’s a shocker it’s hard to see this being a lasting influence on the NZD and the daily chart is akin to catching a falling knife – the NZD is clearly oversold, but 64c is the near-term risk.

- OPEC+ meeting (Thursday) – we expect no change to its 400k barrel output increase plans – geopolitical headlines remain the ongoing driver, notably with the EU expected to propose fully phasing out Russian oil by year-end – SpotBrent holds a clear pennant consolidation pattern – if this breaks trend resistance at $111.41 then technically, I’d be looking for >$120.

(Source: Pepperstone - Past performance is not indicative of future performance.)

So, a big week ahead – what’s your position?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.