- English

- 中文版

Daily Fix: Make-or-break session in Asia as traders go full risk aversion

A statement of intent from the Chinese?

We’re certainly seeing Asia opening on a sour note today, and at the heart has been the moves seen in USDCNH. The People’s Bank of China “fixed” the USDCNY midpoint 229 pips higher (at 11:15 AEST) — certainly higher than what the market had calculated in their respective models. The market took this as a message of intent from the PBoC direct to Trump, while fears of a yuan depreciation and currency wars have ramped up again. This will only compound the issue across broad financial markets, as the market really doesn’t need worries about a capital flight in China at this point in time and a subsequent tightening of financial conditions in the Chinese economy.

The fact we’ve seen report that China asked state buyers to halt US agricultural purchases isn’t going to be taken well. Are we back to square one?

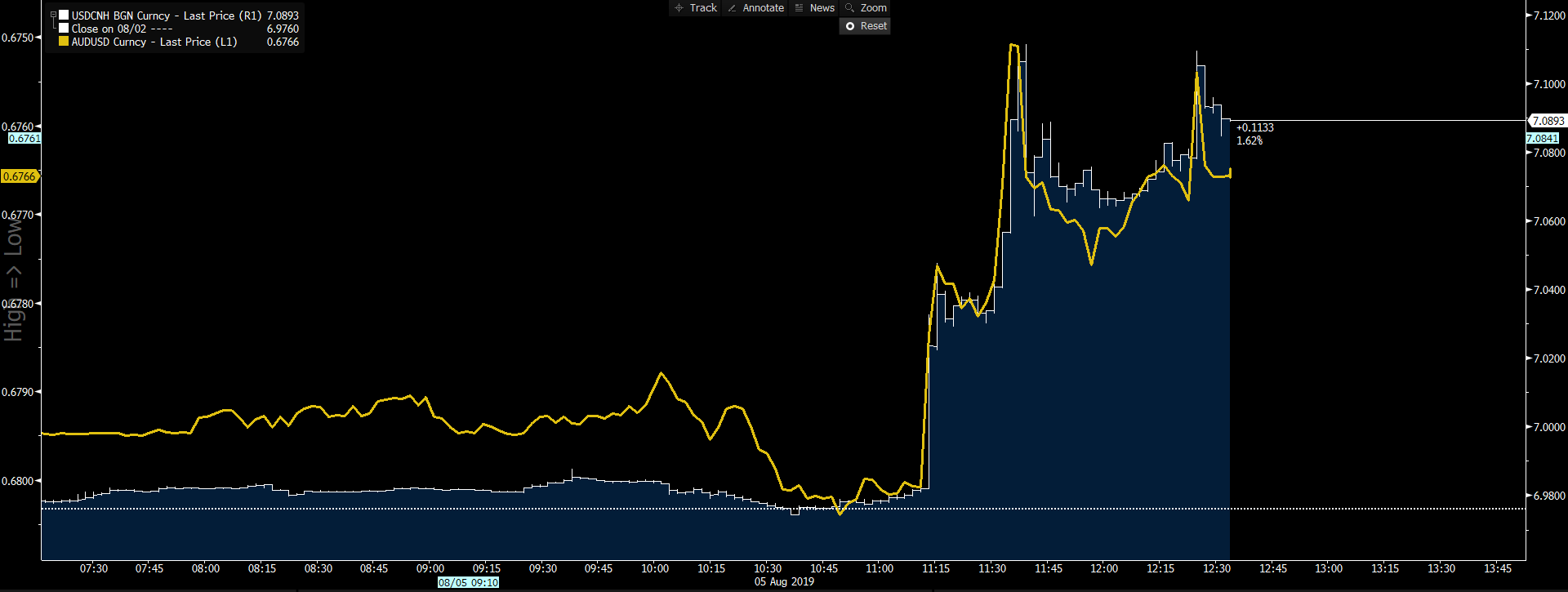

The moves in USDCNH above 7.00 are clearly resonating in a weaker AUDUSD, while USDJPY has traded below 106.00, and we’re seeing broad declines in Asian equity indices today. US Treasury futures are rallying, with US twos lower by 8bp at 1.63%.

White: USDCNH. Yellow: AUDUSD (inverted).

"(Source: Bloomberg)"

No support from the Fed. Yet.

Last week’s 25bp hawkish cut from the Fed didn’t meet expectations. The market thus feels exposed and vulnerable, and is missing the psychological hug from the Fed to justify the dovish implied policy path. The Fed’s “mid cycle” belief isn’t shared by the markets. So, when we marry that with renewed trade tensions, covering a basket of goods that strikes directly to the heart of the US consumer when consumption and consumer confidence are an area of relative inspiration, the market turns and demands action.

What’s the circuit-breaker?

As always, though, if risk aversion picks up for any period of time, we search frantically for the circuit-breaker that will solve all ills. If we don’t know our circuit-breaker, we become risk-averse; it becomes more problematic to price risk; and we lack the visibility to feel confident in our exposures. Markets are driven by semantics, psychology and, in most cases, randomness.

In my mind, that circuit-breaker comes more from either a series of constructive Trump tweets, which may not occur in the near term, or from global central-bank actions and easier policy, although that’s already a mature trade and much is discounted. As such, we see the market now fully discounting a 25bp cut from the European Central Bank in its September meeting, as is the case from the Fed in its September meeting. There’s even a 19% chance of a 50bp cut. Look out through to December, and the markets are pricing close to two cuts.

A rerun of the July FOMC meeting?

At this stage, we’re shaping up for a rerun of the July FOMC meeting, where the likely debate will once again be whether they go 25bp or 50bp cut. This time around the financial markets may play a greater role, as financial conditions were extremely accommodative going into the July meeting. As we can see, the Goldman Sachs Financial Conditions Index is starting to head higher, highlighting that broad financial conditions are starting to tighten and the Fed will be watching this closely.

"(Source: Bloomberg)"

Moves in the US Treasury and global bond market will also be on any policymaker’s radar. We can take the US twos-vs-tens curve and see this trading at 13bp — eyeing a test of the multimonth floor at 10bp. If this level breaks, it’d likely coincide with higher implied equity volatility and the S&P 500 through 2,900 and the 100-day MA.

Where to for the USD

The USD index (USDX) is a tough one, because nowhere else is really offering a compelling alternative. Although if this period of higher volatility is pushing capital into the JPY and CHF, they’ll work best. In Germany, we can see the yield curve negative all the way out to the 30-year maturity. Denmark and Switzerland have had negative curves for all maturities for a while, and the total pool of negative-yielding debt has racked up to US$14.5tril, or 26% of outstanding bonds.

Gold has been the net beneficiary of this uncertainty, as has the JPY. In the case of the yellow metal, we can think of it as a currency in its own right, as well as a hedge against this ballooning pool of negative-yielding assets. That said, gold in AUD terms is performing strongly, putting on over 3% last week and pushing into a new all-time high. Although that’ll be tested to a small degree given the event risk from tomorrow’s Reserve Bank of Australia meeting, as well as Friday's testimony from the governor Philip Lowe, who speaks in Canberra to the committee (09:30 AEST) ahead of the RBA’s statement on monetary policy (11:30 AEST).

Judging by AUDUSD implied volatility (expiring tomorrow), the market is expecting the move on the day of about 40 points. This implied volatility has picked up a touch of late. But we aren’t expecting fireworks, and the bigger influence on the AUD is likely moves in CNH.

USD-denominated gold is up a couple of bucks through Asia, and now sits closer to the top of its recent range. A daily close above US$1,448 would be a bullish development. Given the break of the US$1,448-to-US$1,380 consolidation range, one’d argue for an extension towards US$1,500. That’s one for the radar, but let’s see how the bond market reacts as gold bulls will be wanting to see further love for fixed income.

It promises to be a big week for markets. While we identify the circuit-breakers, they’re perhaps not immediately going to be triggered, so a more defensive stance seems logical here.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.