- English

- 中文版

In theory, strategists loath making such calls, but in the investment arena expected returns are important for asset allocation, so economics teams work closely together with FX, bond, and equity teams to make calls for the quarters ahead.

Naturally, if any of the many assumptions – such as GDP or consumption - prove to be incorrect it can have important flow-on effects on one’s call on bond yields and the USD, and therefore deriving a future value on equity returns can be challenging.

For traders, where a strategist sees the AUDUSD or S&P500 by Q1 or Q2 offers absolutely no information advantage at all – in fact, for some, it can lead to an emotional attachment and a directional bias. This is especially true when we consider that it is the economists/strategists who will alter their forecasts to be closer to the market if there is a big move in that market against them.

Where I think a trader can find value (from these calls) is from the thesis behind the calls.

Strategy is a key consideration here – for example, a scalper wouldn’t care one bit about the prospects of yield differentials or eroding carry values. But for a swing and certainly position traders the laid-out thesis can help identify upcoming economic, monetary policy or even political trends which can heighten their ability to manage risk and even loosely assist with sizing trades.

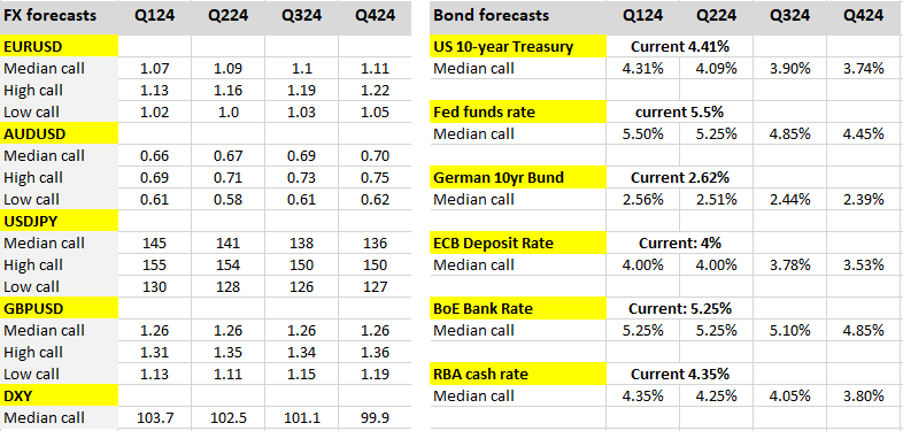

Looking into 2024, we can see Bloomberg’s survey of opinions in EURUSD, AUDUSD, GBPUSD and USDJPY for the 4 quarters of 2024, as well as the median estimate on central bank policy rates. We can that 2024 is expected to be a year of rate cuts, but it is also expected to be a year of a modestly weaker USD - as always there is a strong dispersion in views.

So, why the central theme of USD weakness?

Well at a very simplistic basis, the thesis is:

- US GDP has been incredibly resilient, but with a decline in personal consumption, we are expected to see the GDP fall to around 0.5% YoY by Q324. The FOMC central forecast of 1.5% GDP by the end of 2024 looks too optimistic and may be revised lower in the March FOMC meeting.

- US nonfarm payrolls are averaging around 200k at present, but with a cooling of the labour market, the view is we should see NFPs fall to around 30-50k per month, with some even feeling we get negative prints (i.e. net job losses) by Q324. The unemployment rate is expected to rise gradually to 4.4%.

- US Core PCE inflation is expected to fall to 2.6% by Q3 – still above the Fed’s 2% target but the trend and trajectory lower is what matters.

- Amid the economic dynamic portrayed above the Fed can cut the fed funds rate, and ease policy to a more neutral setting.

- Europe and the UK are recording low growth now, but while the US slows these economies are expected to see modestly better growth in 2H24.

- For those who subscribe to the USD ‘smile’ theory, the belief is we would see mean reversion on the right-hand side of the ‘smile’.

- China’s housing market and FDI remain a source of concern, but Beijing’s increasingly aggressive policy response to provide liquidity to developers may ring-fence many of the concerns and support GDP around 4.5% to 5% – Europe and Australia stand out as beneficiaries if the market gains greater confidence around China’s many economic risks, and should we see outperformance from China’s capital markets.

What makes me cautious about this view?

- If the Fed cuts rates in 2024, so will most other G10 and EM central banks and presumably at a faster clip

- The US swaps market is already pricing three 25bp rate cuts by November 2024 and if we consider economics in the UK and Europe, I’d argue it’s the Fed that will be less likely to live up to the level of discounted rate cuts.

- If the USD is to underperform, realistically we need to ask which currency steps up as a USD challenger….

- If not to the US, where will global investment capital flow? Unless the rest of the world improves while we see disappointing US growth and big tech becomes wholly unattractive, will we really see global investment capital headed with conviction to Europe or China?

- If the US does look like its headed for a recession, global equity markets would most likely trend lower, and credit spreads widen. If the Fed are easing in a period of equity drawdown and higher volatility, then the USD would likely still perform well

- With Donald Trump proposing a 10% tariff on all US imports, should he become President in November, that policy alone could be a big USD positive. On current polling and according to the betting markets, Trump has a fair chance of capturing the Electoral College vote to return to the White House.

- The Fed’s balance sheet will likely contract at a faster pace than that of the ECBs.

We can go on – however, the fact is traders react to price action and should be humble to changes in price action, sentiment, and cross-asset volatility. This means having an open mind to whatever comes our way in 2024. It is interesting to see the thesis for the direction of FX and rates markets, and maybe that will come to fruition to shape our trading environment.

However, so often these calls prove to be wrong, and we are reminded that having an emotional attachment to a future price or direction will serve you poorly as a trader.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.