- English

- 中文版

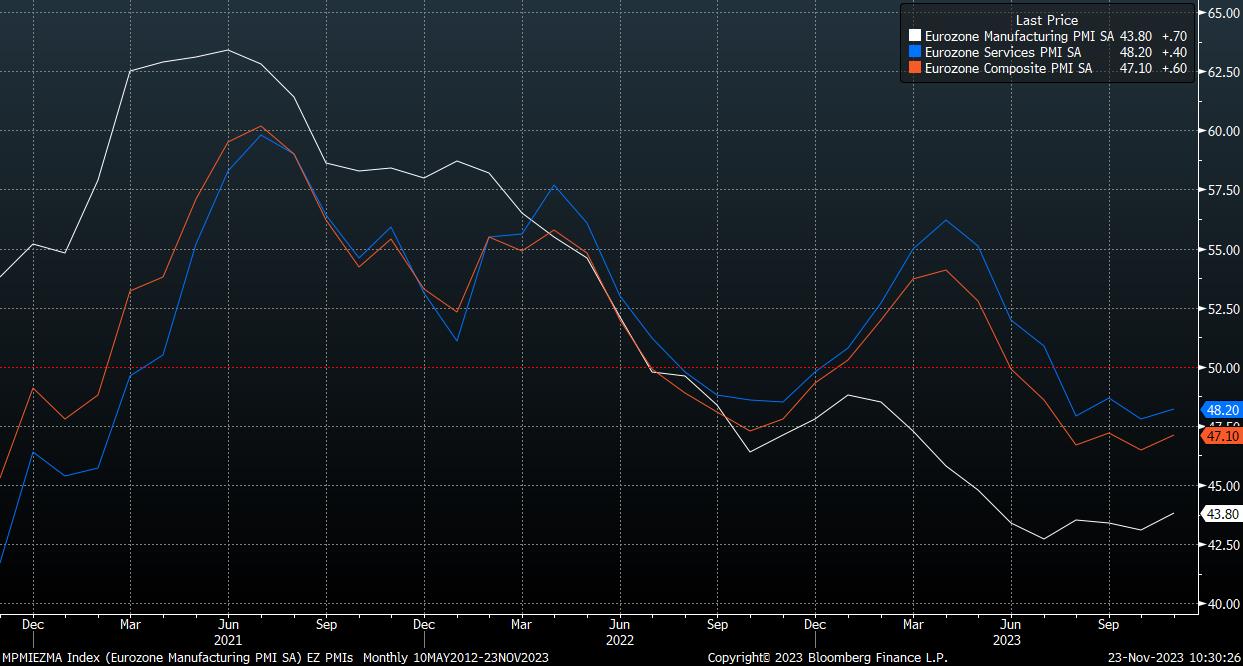

In the eurozone, the November PMIs surprised marginally to the upside, though remain below the 50 mark, implying continued contraction in all of the manufacturing, services, and composite gauges, albeit at a slower pace than seen a month prior.

Nevertheless, digging into the data, the details of the report take some of the shine off the headline prints. Overall employment, for instance, fell for the first time in three years, perhaps a sign that the ECB’s tightening campaign is beginning to exert pressure on the labour market, while purchasing activity fell for the 17th straight month. Leading indicators within the report were also rather soft, with future sentiment remaining weaker than the series average, though both input costs and selling prices did continue to rise, particularly in the services sector – a rather dismal combination for the ECB to grapple with, as risks to the outlook remain tilted to the downside.

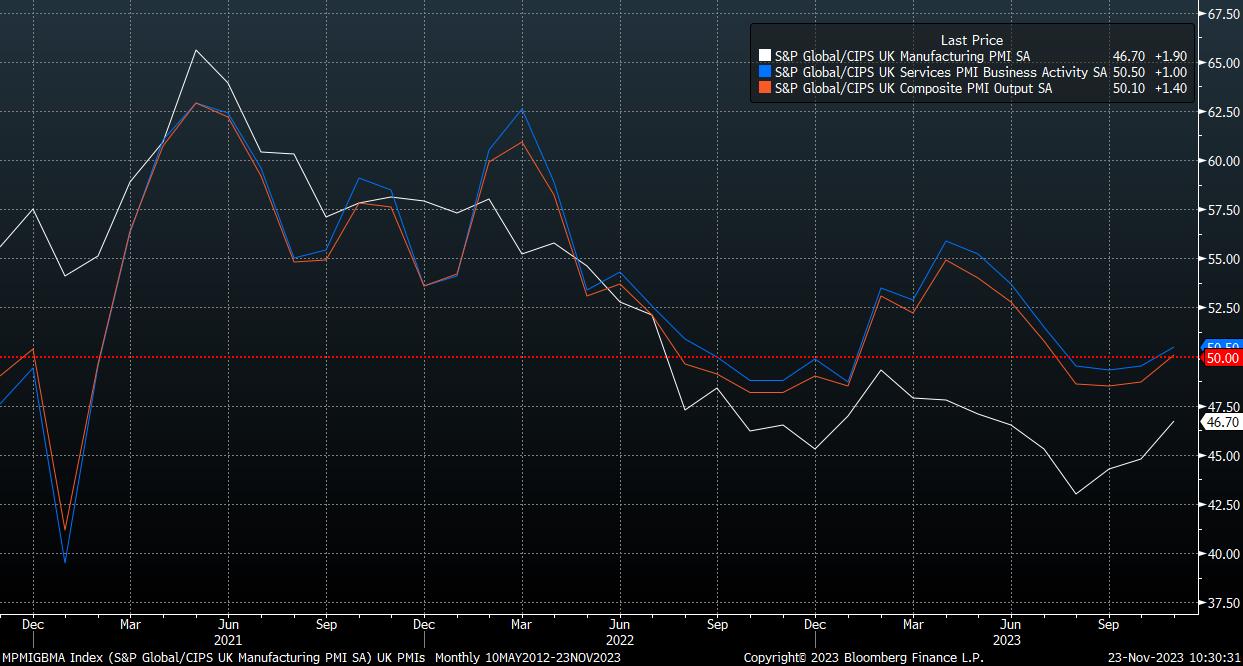

Meanwhile, in the UK, the PMIs provided a much-needed dose of economic optimism, with the services and composite gauges moving back into expansion for the first time in four months.

Once more, however, the details of the report are a little more downbeat than the headline readings. On the inflation front, signs of persistent price pressures were present once more, with input prices and prices charged increasing at a faster rate than a month prior. These pressures remain most intense in the services sector, where higher prices are largely being driven by rising labour costs, hence the BoE’s intense focus on this measure during policy deliberations, and in recent remarks.

Overall, however, neither of the PMI prints are likely to significantly alter the outlook for the ECB, or the BoE, who are both set to again bang the ‘higher for longer’ drum at the final decisions of the year next month. This message though continues to, largely, fall on deaf ears, with money markets pricing 75bp of cuts to the ECB’s deposit rate, and 50bp of cuts to Bank Rate within the next 12 months.

While punchy on both fronts, it seems likely that the ECB will ultimately end up cutting more aggressively than the BoE, particularly given the inflation stickiness seen in the UK, along with the continued dismal performance of the German economy, posing downside risks to EUR/GBP.

_2023-11-23_10-30-37.jpg)

It should be recognised, however, that OIS pricing for future policy decisions, particularly over a more prolonged time horizon, should be viewed more as a reflection of the probabilities associated with various economic outlooks, rather than a pre-set fixed path that rates will take. As has been the case for some time, it also remains true that inflation, rather than growth, is likely to be the primary driver of any policy pivot, with policymakers remaining somewhat scarred by the experience of 2021, when price pressures were deemed ‘transitory’ before the need to embark on the most rapid tightening cycle in 4 decades then became clear.

Hence, there is likely to be a preference to run the risk of over-tightening, as opposed to doing too little, and potentially letting the inflationary genie out of the bottle once more.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.