- English

- 中文版

Macro Trader: ‘Yen-tervention’ Might Not Be As Close As Some Think

Once again, folk are getting over-excitable about the JPY; as spot USD/JPY has started to grind back towards the 160 handle, so talk of ‘yentervention’ has once more begun in earnest.

This is, to a limited extent, logical, given that spot is now just a whisker away from the 160.17 highs printed in late-April, just prior to the MoF stepping in to the market. However, such an assessment is overly-simplistic, and doesn’t take account of the full range of considerations that the MoF likely make, prior to monetary intervention taking place.

_2024-06-24_10-54-23.jpg)

Before examining said considerations, however, some historical context may well be useful. Since 2022, confirmed MoF interventions have taken place on 4 occasions – twice in autumn 2022, and twice more recently, in late-April and early-May 2024.

On each of those occasions, the high-low move in USD/JPY has typically been around 5 yen to the downside. Furthermore, said interventions have typically come at a cost of $60-$65bln, though there is little concern about the sustainability of said moves, given the vast scale of Japan’s reserves.

What is, perhaps, most interesting, in terms of the most recent 2 rounds of intervention at least, was the time of day at which they occurred. In April, the MoF first intervened on a Japanese public holiday, obviously a time when significantly fewer participants than usual were trading. The second intervention round, just 2 days later, came minutes after the US cash equity market close, traditionally the quietest, and most illiquid, time of day in the FX market, with said illiquidity typically persisting for 3-4 hours, until Tokyo/Hong Kong come online.

This desire to intervene at illiquid times suggests the MoF seeking to get ‘more bang for their buck’ in terms of interventions, being able to achieve a greater magnitude of market move for similar expenditure to ‘typical’ intervention rounds. This also suggests a desire to surprise market participants, intervening when participants least expect such action, again an attempt to increase the value of said action.

_w_2024-06-24_10-54-58.jpg)

This desire to surprise also speaks to the rationale behind the MoF’s interventions.

Contrary to what seems to have become popular belief, Japanese authorities are not targeting a particular level at which spot USD/JPY should trade, nor are they defending a specific currency peg. Instead, the rationale behind MoF intervention is to deter excessive speculation, and to ensure that moves in the JPY are not out-of-line with underlying economic fundamentals. The MoF are not against a weaker JPY in its own right; they are, however, against a weaker JPY if said weakness occurs in a disorderly manner.

Hence, when attempting to second-guess the MoF’s next move, and gauge the likelihood of intervention taking place, there are a range of other factors that are important to consider.

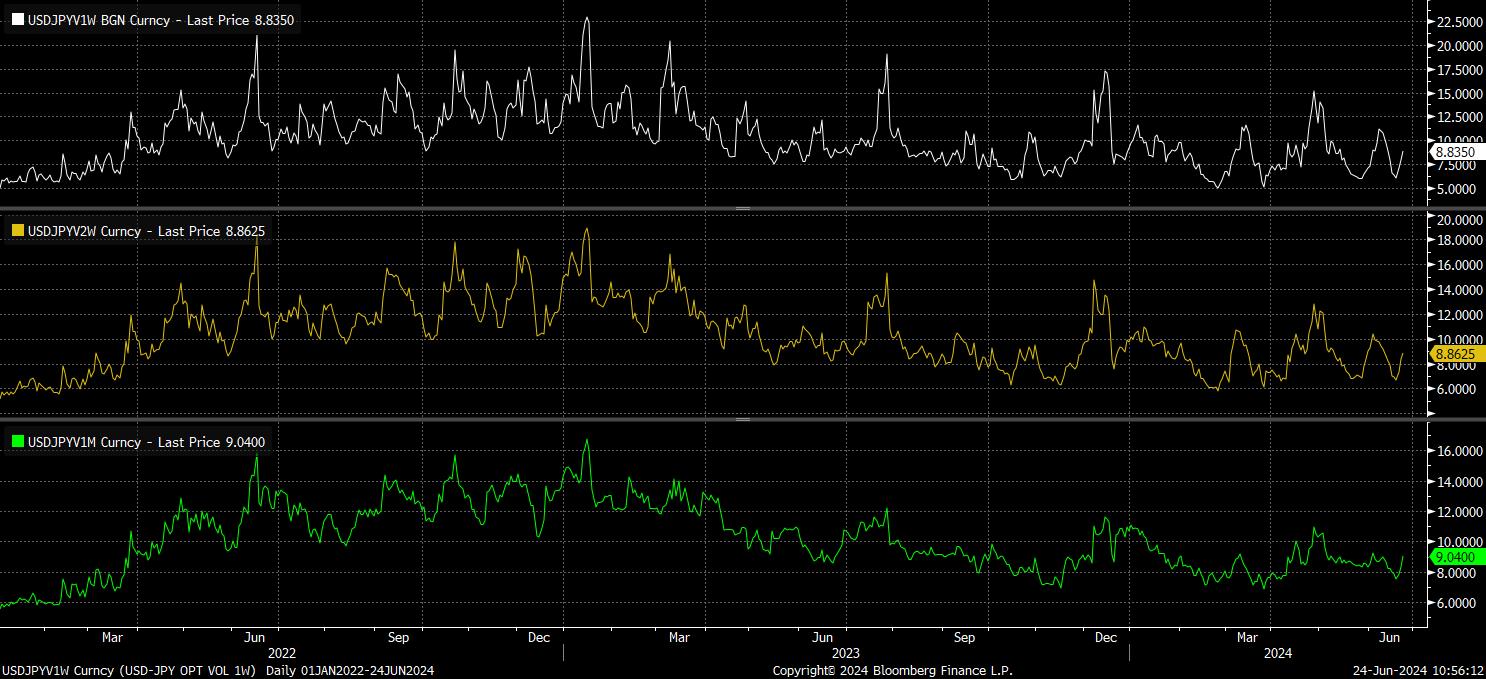

One way – albeit perhaps a little crude – of gauging whether moves are ‘disorderly’ is to look at a simple 1-, 2-, and 4-week rate of change to gauge both the magnitude, and speed, of any JPY weakness that may be occurring. As the below chart shows, on all RoC measures, we are still considerably below the speed of weakness seen prior to intervention in 2022, and back in April/May 2024.

Implied vol remains as subdued, relatively speaking, as realised vol, over the same tenors. This suggests not only that derivatives are braced for somewhat subdued conditions in the near-term – one-week implieds, for instance, are at the 25th %ile of the 52-week range – but also suggests relatively little by way of excessive speculation, at least judging by positioning in the options space.

While, of course, ‘yentervention’ is impossible to rule out, with the decision on whether or not to step in being solely within the MoF’s gift, a cross-check of a range of indicators suggests that said intervention is likely further away than spot USD/JPY kissing the 160 figure would imply at face value.

Of course, risk management should remain the key consideration for those running JPY exposures. However, the fundamental case for continued JPY weakness, one built on the BoJ’s glacial pace of policy tightening, and the FOMC continuing to push-back the timing of the first rate cut, remains concrete.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).png?height=420)