- English

- 中文版

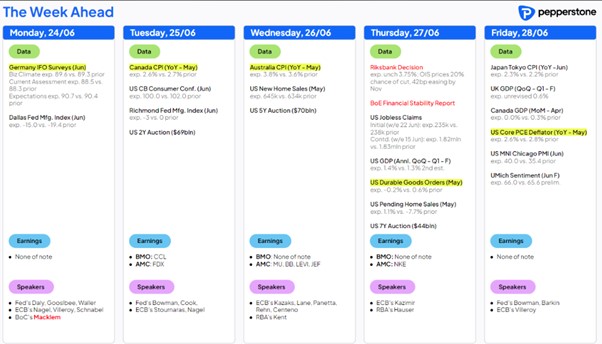

• Month and quarter-end flows to impact price action

• The US Presidential elections kick up a gear

• Managing risk around the French 1st round vote

• US Core PCE is the marquee data point of the week

• Australia's monthly CPI a potential kicker for the AUD

• Central bank meetings due this week

• Long MXN back in vogue

For the week ahead there is a fair bit for traders to prepare for and to manage, with event risk spanning economic data, politics, and central bank meetings. We also gear up for month- and quarter-end, so the usual opaque portfolio rebalancing flows impacting price action, as well as the aftermath of a monster options expiry (OPEX) and ETF rebalance on Friday.

I’ve never personally found any edge aligning trades to what I’m hearing for the needs of portfolio rebalancing flows. However, as the big portfolios rebalance (e.g. from pension funds) the flows can impact equity, FX and fixed income and produce moves that can’t readily be explained by the data and news flow – any factor that alters our trading environment needs to be considered.

The US election kicks into gear

On the political front, the US Presidential election kicks into gear with the first debate held between Biden and Trump (21:00 EST / 02:00 BST / 11:00 AEST) likely getting sizeable attention. Prediction markets currently have Trump ahead by 5ppt, which is partly a function of Trump’s superior polling in the six key battleground/swing states (Michigan, Wisconsin, Pennsylvania, Nevada, Arizona, and Georgia). While the debate may not stoke market volatility, it will be symbolic given it’s the earliest live debate since 1960, and Biden will be out to prove a point to the American voters. As the gloves come off it could get ugly on the podium, and we watch to see if the debate affects polling.

Managing exposures into the French first-round vote

For those trading the EUR, FRA40, and European equities more broadly, the first round of voting in the French election plays out on Sunday. This will have many assessing the risk of holding exposures into the weekend vote, with the very real prospect of gapping on the Monday open. We can take a stab at the outcome and base-case scenario the market is currently pricing based on the French-German 10y yield spread and current pricing in EU assets, and from that loosely devise a playbook for a potential market reaction upon learning who will go through to the second-round vote scheduled for 7 July.

Given recent polling, I’d argue the broad consensus is currently seeing two outcomes – either Le Pen’s RN party gaining a working majority and cohabiting with Macron as President or a hung parliament with the RN party the largest contribution. I’m not sure we get a massive market response if this remains the base case after the first vote. The big reaction comes with a better outcome for the left-wing NFP coalition, where they seem to have momentum with recent polls have shown greater support for the coalition - the greater sway the left has on fiscal policy the more negative the reaction in the EUR, FRA40 and broad EU assets.

EURUSD holds below 1.0700 but is finding some support below the figure. Should the France-German 10yr yield spread widen past 85 to 90bp this week (its currently at 80bp) then EURUSD could be headed towards the 16 April lows of 1.0601, with EURCHF rolling over and eyeing a move back down to 0.9500. ECB 1- & 3-year CPI expectations (due on Friday) could promote some EUR volatility, but it will be trumped by market participants positioning ahead of Sunday's vote.

US core PCE inflation a risk event

On the US data side, US core PCE inflation is on Friday and is the marquee event risk, with expectations the Fed’s inflation gauge prints +0.1% m/m, and +2.6% y/y. The last two US PCE inflation prints have come in above expectations, but historically the outcome of the data falls in line with consensus. That said, if we do get an upside surprise and a year-on-year pace at or above 2.8%, this outcome would likely impact be taken badly by equity markets and result in solid USD buying. We get relief in risky assets, USD selling, should we see the month-on-month pace come in at 0.00% m/m and certainly if we see a decline.

We also get US consumer confidence where the consensus sees a lower read at 100 (vs 102 in the prior read), a Q1 GDP revision, personal income, and spending. We also get 9 Fed speakers through the week, although I don’t see these being too much of a risk, and we need to hear speeches post-PCE inflation data.

USDJPY and USDCNH both get focus, where the upside moves in USDCNH seem to be spilling over into strength in other USD pairs – the PBoC should look to curb yuan weakness this week, but higher levels in the USDCNH cross-rate should see lend upside support for the USD.

On the data side, we see Japan's Tokyo CPI (due Friday) and China PMIs (on Sunday), where the latter offers some degree of gapping risk in Chinese markets and the China proxies (AUD, NZD, CLP) on Monday. The client’s focus is on a potential break of ¥160 (in USDJPY) and whether we start to hear more from the MoF on JPY intervention – Japan rates now only price 4bp of hikes for the July BoJ meeting, and the market is happy to hold JPY shorts despite the likelihood the BoJ drastically reduce the pace of JGB buying. The rate of change and slope of the trend in USDJPY is the bigger issue though.

Aussie CPI in play

AUD and AUS200 traders will be watching the May monthly CPI read, with the consensus eyeing a lift in headline CPI to 3.8% (from 3.6%). The notable focus will be on services inflation, which keeps the threat of an August hike on the table, so this monthly print will set expectations for the all-important Aus Q2 CPI (due 31 July), which could go some way in influencing if the RBA do consider a hike in August. We also hear from RBA members Kent (Wed 09:35 AEST) and Hauser (Thursday 20:00 AEST). Prefer AUD upside vs currencies where the central bank is cutting or holds an easing bias (EUR, GBP & CHF).

I also like AUDNZD from a central bank divergence play and would be adding to longs on a daily close above the 50-day MA (1.0883).

On the central bank front, we see meetings in Sweden (expected to leave rates at 3.75%), Mexico (unchanged at 11%), Turkey (unchanged at 50%) and Columbia (50bp cut to 11.25%).

The MXN is certainly looking perky, with a blend of short covering and aggressive longs emerging late last week – USDMXN eyes support at 18.0514 and should test this soon. Driving the MXN we’ve seen several more market-friendly appointments in the AMLO cabinet, but we’re also seeing carry trades working well as a strategy, and this week should refocus the market on MXNs compelling fundamental characteristics, with high real policy rates and improved forward rates offering excellent carry. Long MXNJPY is in beast mode at this point but comes with intervention risk.

With the moves seen in US equity on Friday, we start the week with the ASX200, HK50, and NKY225 all looking like they open on the back foot, with our opening call 0.2% lower a piece. I remain biased to trade a range in the ASX200 (7850 to 7650) and NKY225 of 39,340 to 37,860, with a small bias that we see lower levels of these ranges tested.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.