Analysis

Macro Trader: Liquidity’s Direction Matters More Than Its Level

There’s a commonly-held belief among many market participants, me included, that equities – by and large – have acted as a proxy for central bank liquidity, particularly since the GFC, and more so since the even greater policy stimulus that was enacted during the pandemic.

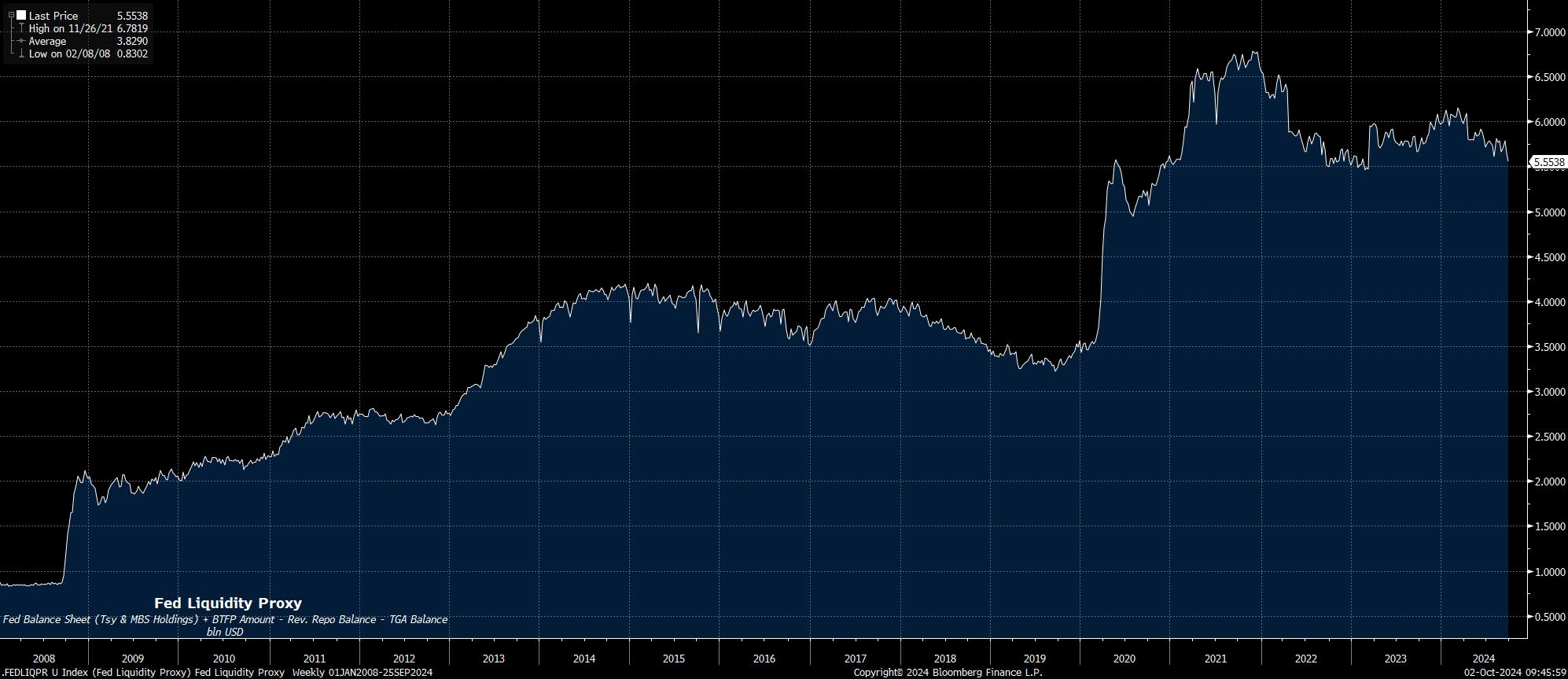

A useful way to visualise how Fed liquidity has changed over time is below, an indicator that sums the Fed’s Treasury and MBS holdings, together with the BTFP programme, minus those facilities representing cash being removed from the financial system – namely, reverse repo balances, and the Treasury general account balance. Sounds complicated, but in essence it’s a sum of cash being put into the system, minus cash being removed from it.

Unsurprisingly, as monetary policy has tightened post-covid, with the Fed having commenced quantitative tightening in June 2022, and continuing the process to this day, the aforementioned liquidity indicator has fallen, implying tighter conditions within the system. In fact, the proxy, at the end of September, sat at its lowest level since Q1 23, just before the FOMC unleashed a wave of support to the banking sector, in the midst of the SVB bankruptcy.

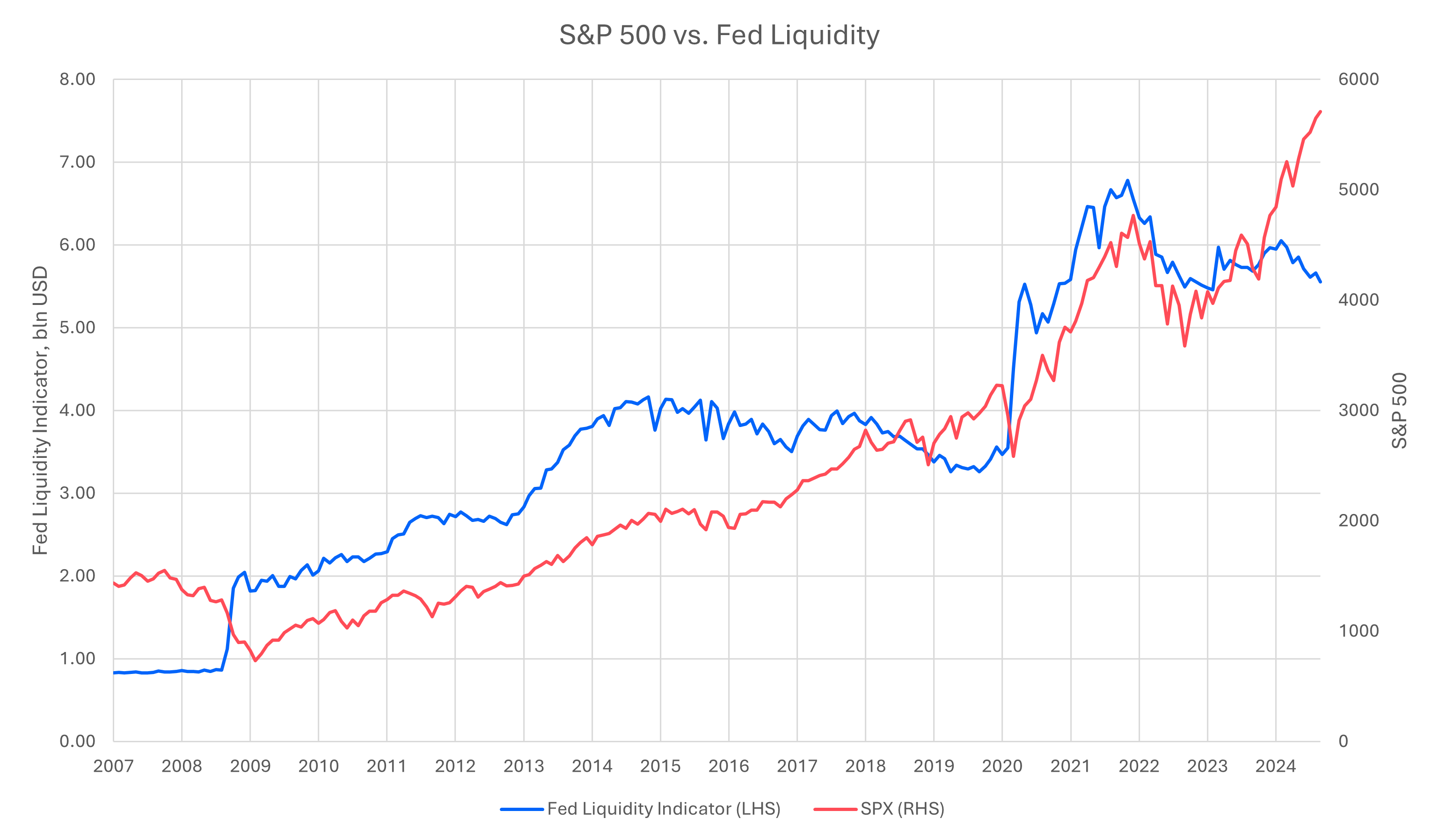

What is perhaps more surprising, though, is how the typical positive correlation between liquidity, and equities, has broken down over the same period – stocks have rallied strongly, even as liquidity conditions have tightened.

This suggests that there could well be more at play here driving equities than simply the level of, or the rate of change in, liquidity.

While, naturally, being difficult to measure, it seems likely that policymakers’ guidance is permitting participants to take less heed of shifts in liquidity than may typically be the case. Of course, what I’m referencing here is two-fold – firstly the FOMC’s stated desire, earlier in the year, to begin to normalise policy as they obtained sufficient confidence in inflation returning to target; and, secondly, the FOMC having now embarked on the rate cutting cycle, with firm rhetoric towards the possibility of forceful policy action, particularly if the labour market weakens further.

What we see, then, is something of an invisible hand at play, in the form of the ‘Fed put’. This being a representation of participants’ confidence that the FOMC are both willing and able to provide sizeable support to the economy were momentum to wane significantly. Said support could come from a range of sources, including aggressive rate cuts, and end to QT, the potential re-commencement of QE, or a host of other potential more targeted liquidity injections.

Consequently, we can deduce that it is not necessarily where liquidity is now that matters most to equities, but a combination of the likely direction of travel for financial conditions, and the degree to which that journey could accelerate in a dovish direction. In that respect, the policy backdrop remains incredibly supportive, with further rate cuts on the horizon in a relatively rapid return to neutral, and with QT likely also to come to an end before the year is out.

On top of this, there is little sign that the aforementioned ‘put’ will be removed any time soon, particularly with disinflation progressing quicker than expected, and with downside risks to the labour market increasing.

It remains the case that fighting the Fed, or the policy ‘put’ at large, is likely to be futile.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.