- English

- 中文版

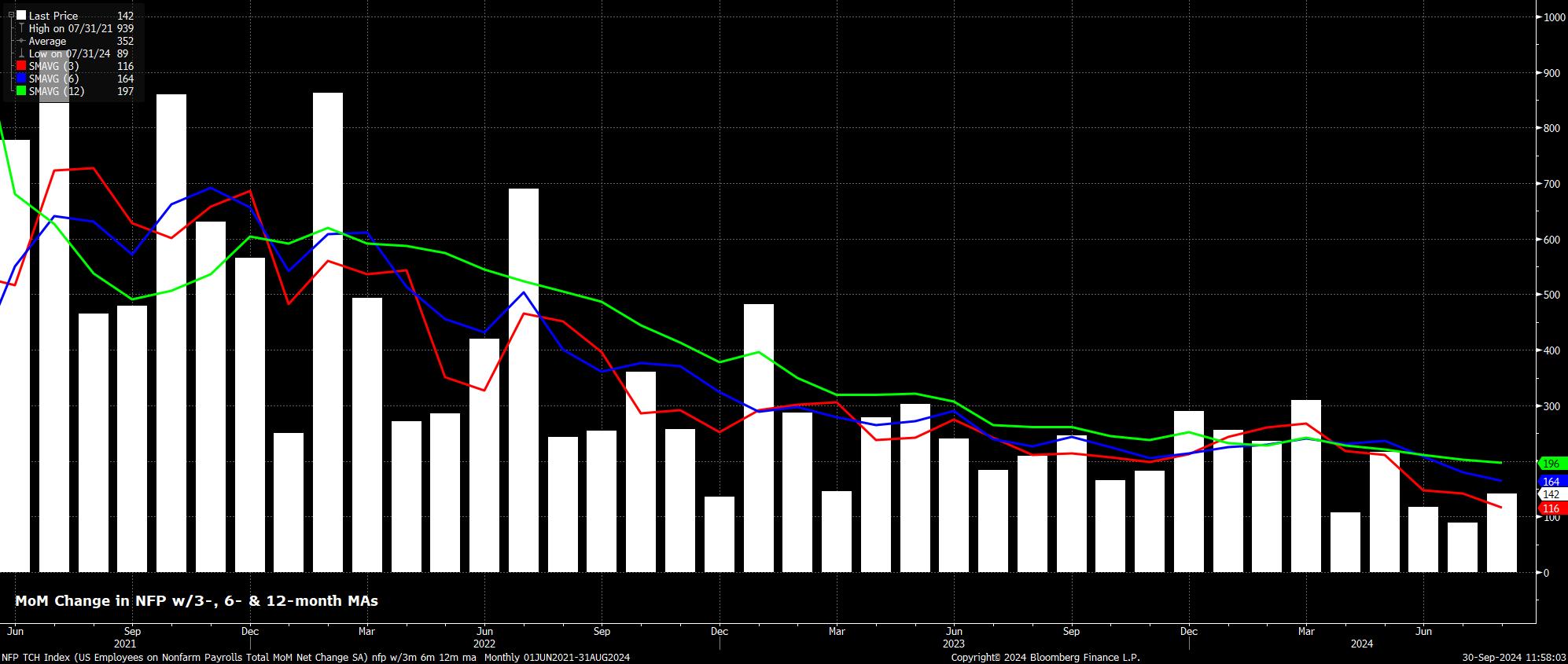

Headline nonfarm payrolls are set to have risen by +146k in September, broadly unchanged from the +142k pace seen a month prior, of course pending any revisions, which have been significant of late. Such a pace of job creation, however, would still be considerably below the breakeven pace of payrolls growth – between 225k to 250k – required for growth in employment to keep pace with the increasing size of the labour force. Although, a print in line with consensus would be above the current 3-month average of job gains which, at +116k, sits at a cycle low.

Leading indicators for the payrolls print point to the balance of risks tilting to the upside of consensus expectations.

While neither of the ISM PMI surveys have been released, at the time of writing, weekly jobless claims data does paint a positive picture. Initial claims fell by 11k between the August and September survey weeks, while continuing claims fell by 26k during the same period. While one should be cautious in over-extrapolating from unemployment data, it is worth noting that a similar decline at the same time last year produced a September NFP print of +246k.

The September ADP employment report is also yet to be released, however should continue to be ignored as a signal of where the NFP print may fall, with the correlation between the two having been close to non-existent for much of this cycle.

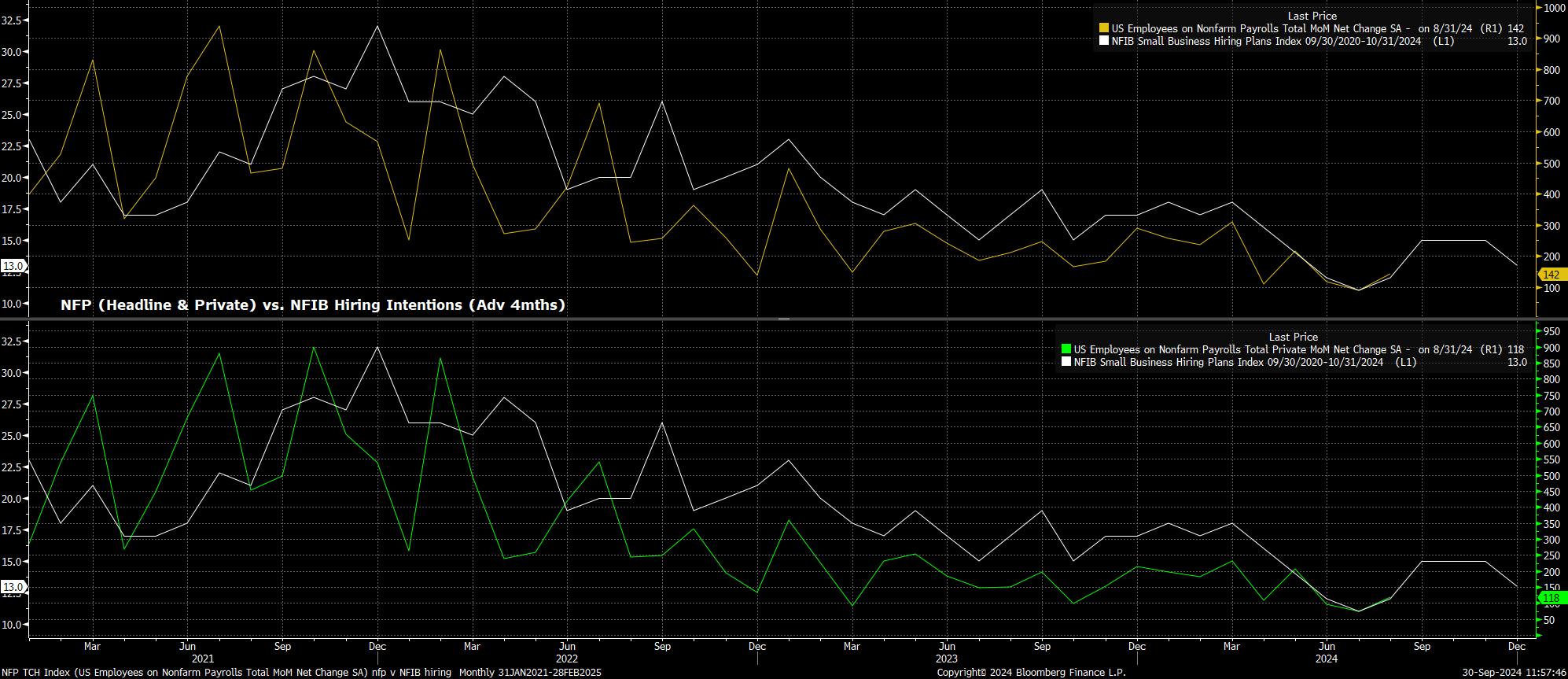

Instead, the NFIB hiring intentions gauge remains my preferred leading indicator for the NFP print, with the survey continuing to closely track both headline, and private sector, employment with a 3-4 month lag. For what it’s worth, the NFIB metric would point to a significantly above-consensus NFP print of +250k, including private sector payrolls at +225k.

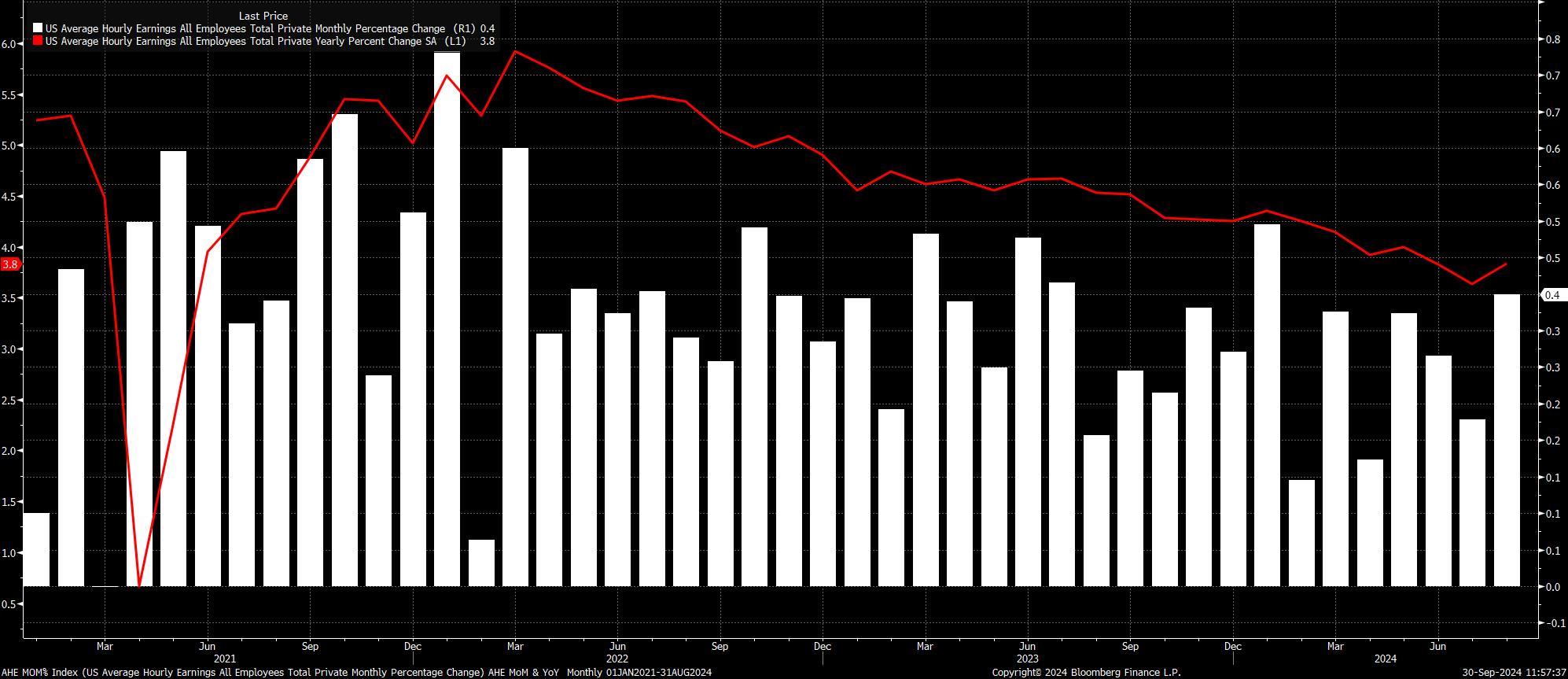

Meanwhile, average hourly earnings are set to have risen by 0.3% MoM in September, just a tick slower than the 0.4% rise seen in August. Such a monthly pace should see the annual rate remain at 3.8%, for the second straight month.

It must be said, however, that the earnings data matters relatively little at this juncture. With FOMC policymakers having obtained sufficient confidence in inflation returning sustainably to the 2% target over the medium-term, and with the labour market continuing to normalise, there is little-to-no concern over the prospect of inflationary pressures making a resurgence due to labour market developments.

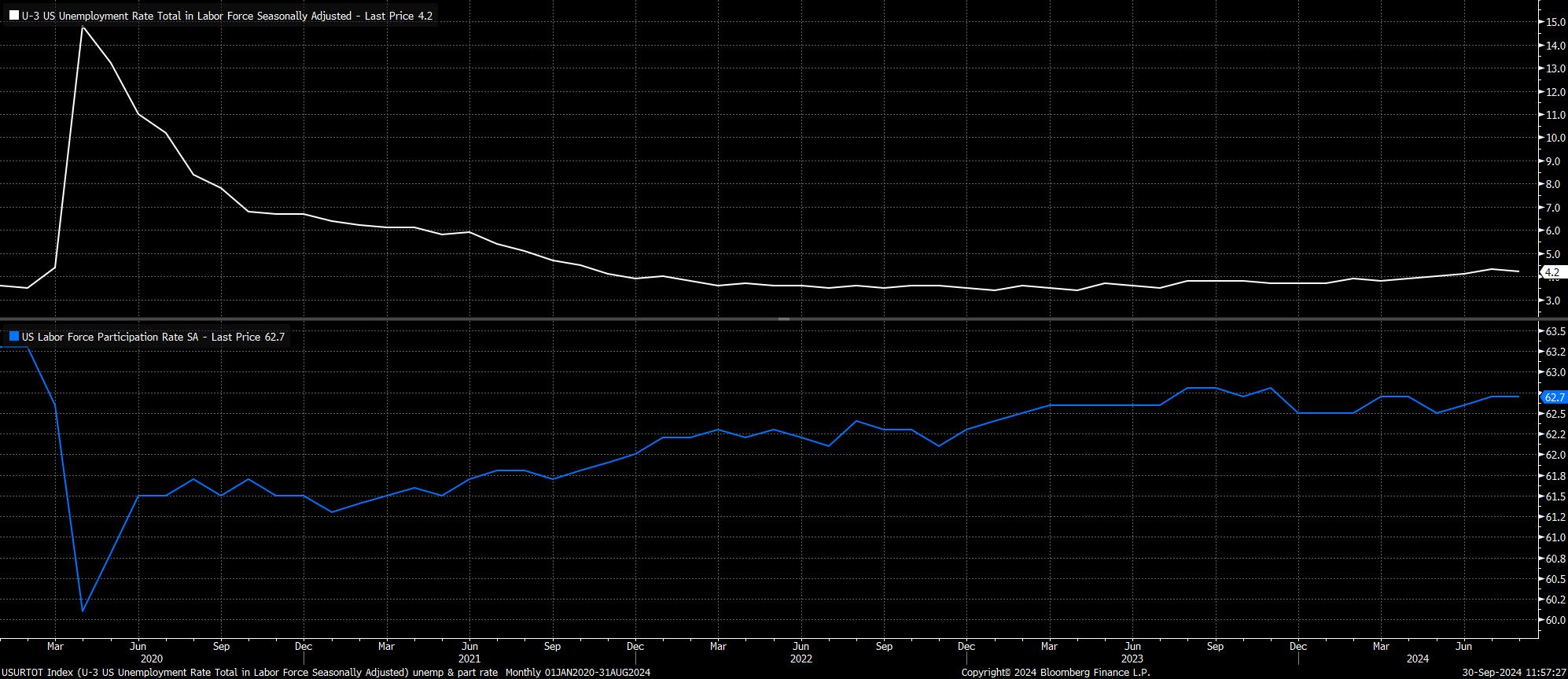

Turning to the household survey, measures of labour market slack are set to remain largely unchanged in September, having last month unwound most of the temporary weather-related weakness seen earlier in the summer.

As such, unemployment is set to remain at 4.2%, just below the cycle high 4.3% seen in July, while also being below the 2024 and 2025 median SEP forecast of 4.4%. At the same time, labour force participation is seen holding steady at 62.7%, broadly unchanged from the level it has occupied for much of the last 12 months. The household survey, though, remains considerably more volatile than usual, and seems not to have fully taken account of rising immigration, leaving significant uncertainty surrounding these forecasts.

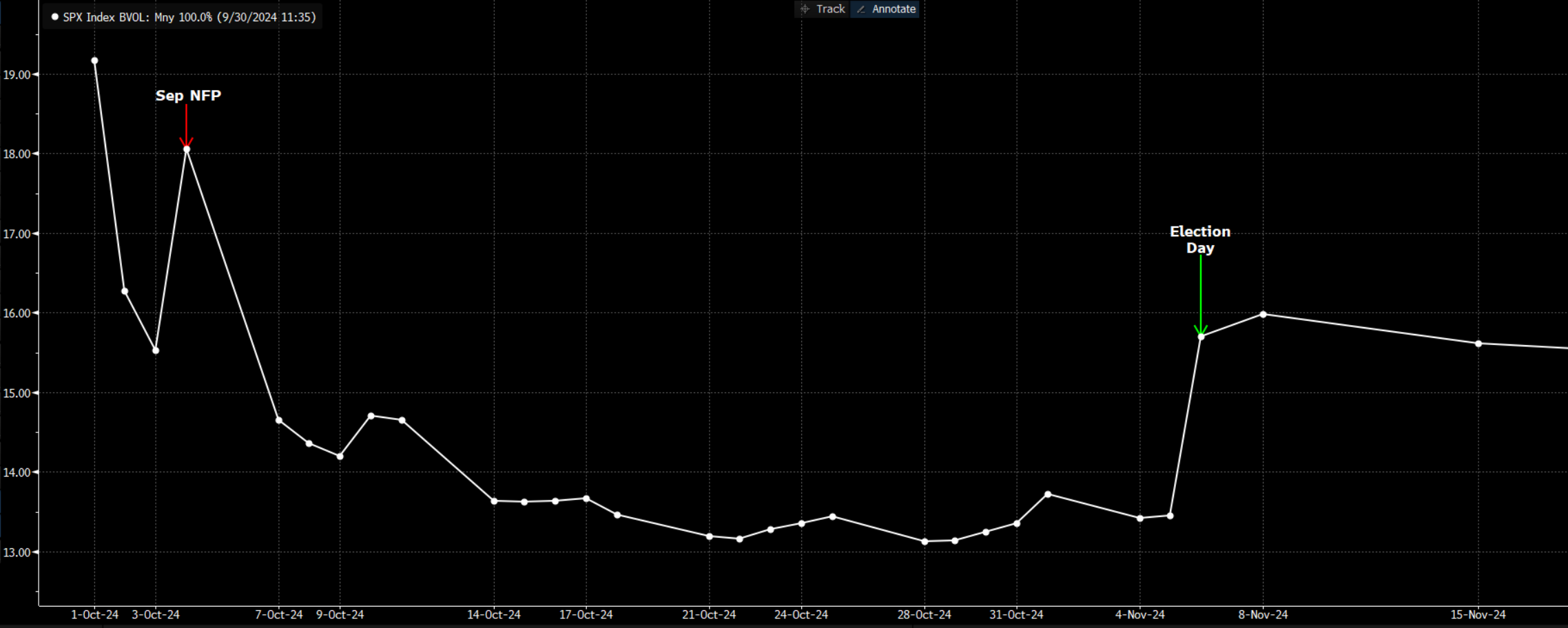

For financial markets, the September jobs report stands as the most significant event risk to navigate – per S&P options pricing – between now, and election day on 5th November. Given participants’ reaction to recent economic releases, it seems likely that the jobs report will be a case of ‘good news is good news’, and vice versa, for risk sentiment, with the market’s mind primarily focused on the macroeconomic conditions that the data signifies, as opposed to any potential stimulus implications from a poor report.

On which note, the implications of the data are likely to be binary, at least in terms of market pricing. Given policymakers’ desire not to see any further labour market weakening, a soft print is likely to make a second straight 50bp cut, at the November meeting, the base case, with markets currently assigning around a one-in-three chance to such an outcome. In contrast, a jobs report in line with, or better than, expectations will see a 25bp cut stand as the FOMC’s most likely next move.

Nevertheless, the USD seems set to continue to face relatively stiff headwinds over the medium-term, with the G10 FX market now firmly trading on a theme of the ‘race to neutral’ among central banks. Here, with the FOMC seemingly in a hurry to remove policy restriction, selling any USD rallies remains the preferred strategy, chiefly against those currencies where a more gradual approach is likely to be followed, such as the GBP, AUD, and NOK.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.