- English

- 中文版

A Traders' Week Ahead Playbook - Markets to go after a more prolific central bank response

As many try to model the extent of the US and synchronized global growth slowdown, we’re at a point in the cycle where market players are facing an inability to price certainty and risk. In turn, the would-be buyers of risk stand aside, resulting in a deterioration in liquidity conditions and violent price action, de-risking, and further hedging of portfolios.

What really matters now is whether money managers and traders feel sentiment has become too pessimistic, or if this deleveraging and risk aversion manifests into even higher volatility and drawdown.

To answer this pertinent question the market needs to see the outcome of the data to offer increased confidence to price the risk of recession, and how that may feed into earnings expectations, consumer behaviours and business decisions.

If we are going to look at the data this week that has the potential influence, then the US ISM services, US weekly jobless claims and US SLOOS (Senior Loan Officer Survey) would be event risks I instinctively see as having the potentially move the dial.

US and European corporate earnings also come in thick and fast, but while these will offer idiosyncratic pockets of volatility in individual names, there should be limited read-through into broad market volatility.

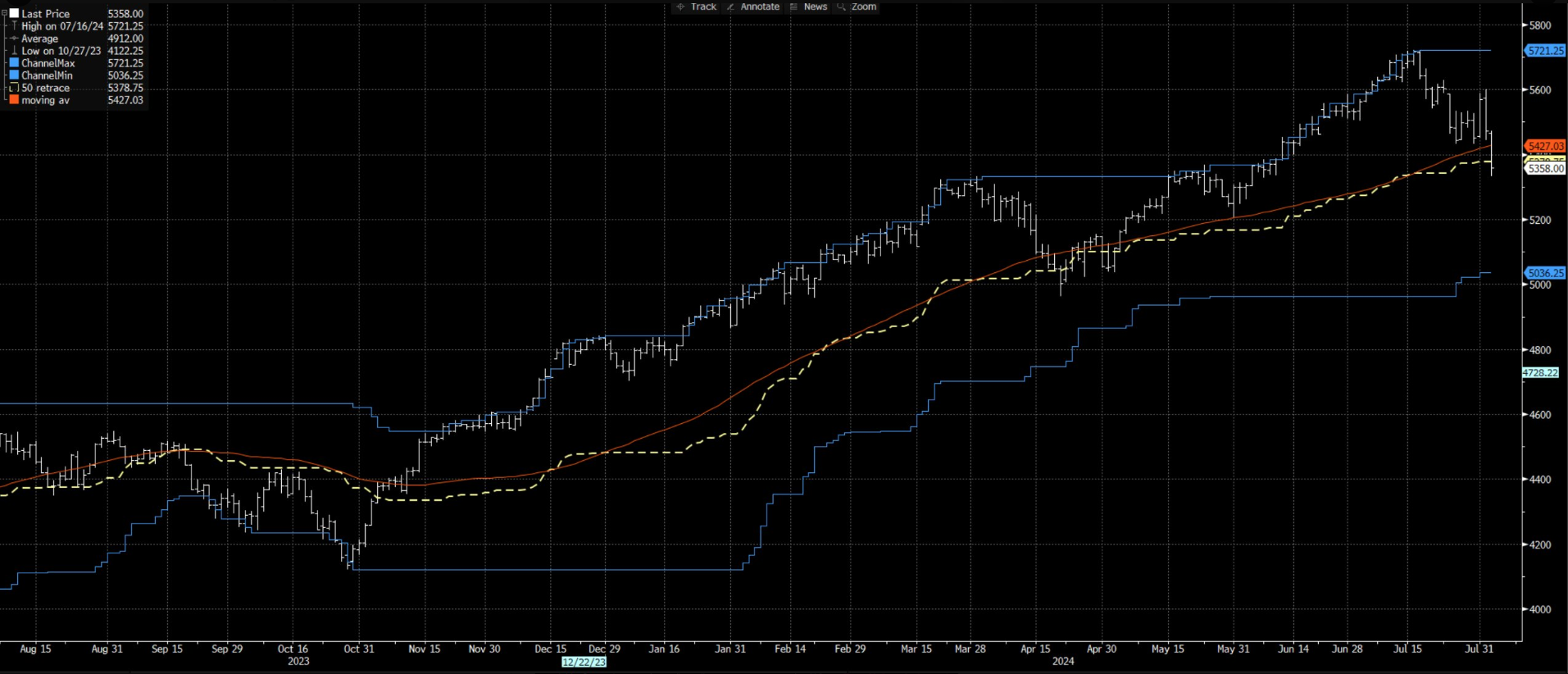

The unwind of a 9-month low vol grind higher in risky assets

What we’ve witnessed and what many have traded, is really a case of slowly, slowly then all at once.

In essence, the explosion in volatility has been the result of a 9-month grind higher in global equity bourses – and notably those within the US, Japanese and the equity indices with a large weighting to tech and high growth – where pension and hedge funds have run short volatility strategies to enhance returns. Improved earnings expectations, the reassurance of ‘the Fed put’, and a consensus view that the US economy was moving towards a soft landing -have seen pullbacks in equity and carry strategies well supported, with active players chasing price when the bullish momentum resumed.

Is this time different?

The US and global data flow has been slowing for several months, but after last week’s poor US ISM manufacturing report, the rise in US weekly jobless claims, a weak nonfarm payrolls report (with the Sahm rule triggered), and Intel laying off 15,000 employees, some in the market are asking if the US is already in recession. The question of whether the Fed has kept rates too high for too long is also in the mix, with increased debate around whether we’re seeing evidence of a policy mistake from the Fed.

The bulls will point out that this is not the first time in the past three years that market participants have priced a high chance of US recession risk. However, the dynamic unfolding in markets does have a different feel to other episodes.

We’ve opined many times before that there is a key difference between the Fed cutting rates towards a neutral setting for insurance purposes, relative to a scenario where the Fed front load rate cuts and pull out more ‘emergency’ measures.

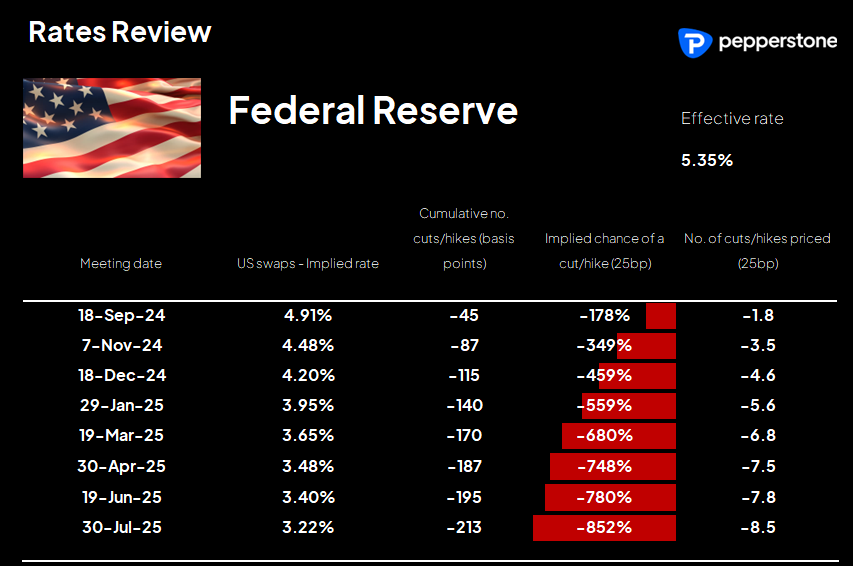

US interest rate swaps now price almost 50bp of cuts for the September FOMC meeting, and 115bp of cuts by December – essentially portraying two 50bp cuts and one 25bp cut this year, which can clearly be considered more of an ‘emergency’ measure.

Many have bought into the US 2yr Treasury, where yields fell an incredible 27bp on Friday, and 50bp on the week. This has resulted in the US Treasury yield curve (2s vs 10s) aggressively steeping on the week and where having been ‘inverted’ since July 2022 (i.e. short-term yields are higher than long-term Treasury yields) we’re now looking at the yield curve turning positive – statistically a signal that recession risk is rising.

In equity, we’ve seen a sharp drawdown (and underperformance) from US small caps, consumer discretionary names, high beta equity plays and low-quality equity, with a solid flight into staples. In the FX markets, we’ve all witnessed an incredible unwind of the JPY-funded carry trade and this is feeding into huge selling of Japanese equities, which is also weighing on other DM equity markets.

Markets to go after the Fed

This is a market that feels the Fed and other central banks need to move out of a restrictive policy setting, and with a real sense of urgency. If they don’t sense that urgency, then markets will go after central banks and take their pound of flash.

The economic concerns have spread into the corporate credit markets, with US high yield spreads widening 34bp on Friday (53bp on the week, and while at 3.59% are not yet at truly worrying levels, if the rate of change and the deterioration in the credit markets continues then equity will not take it kindly.

We can see in the options market huge hedging activity, where notably the VIX index (S&P500 30-day implied volatility) went on a wild ride on Friday pushing into 30%, before settling at 23.4%. The VIX at 23% implies a move weekly move in the S&P500 of -/+3.3%, and for those who like two-way intraday trading opportunity, this is an almost nirvana level of volatility. A VIX index above 30% - should it occur - suggests intraday moves can get a little wild and traders need to be in front of the platform to react dynamically. This level of volatility also typically leads to reduced liquidity in order books, which can perpetuate movement and lead to wider bid-offer spreads and a higher cost to trade.

We’re at a truly important juncture in markets

Better data this week could provide some confidence to a bond market that is grossly overbought and offer reassurances to equity and credit. Conversely, if the data continues to weaken and central banks don’t meet the market pricing in their narrative and one thing seems clear, buying the dip in risk may not be as effective this time around, while short sellers will have a far more prosperous hunting ground.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.