- English

- 中文版

August 2024 BoE Review: A Cautious Cut, More On The Way

After a ‘finely balanced’ decision to hold rates at the June MPC meeting, the Committee this time voted in favour of a 25bp rate cut, the first Bank Rate cut in 4 years, and a move to which money markets had assigned around a 2-in-3 chance prior to the announcement. This, in turns, brings to an end the 12 month period at which Bank Rate had remained at its terminal level.

Once again, however, the MPC was split in terms of views on the appropriate course of policy action.

The decision to deliver a 25bp cut was an incredibly narrow one, requiring Governor Bailey to use his casting vote to break a deadlocked MPC, forcing through a reduction in a 5-4 vote. Dissenting in favour of holding rates steady were external MPC members Greene, Haskel, and Mann, as well as – most interestingly – Chief Economist Huw Pill. A cut, clearly, was too tough a Pill for him to swallow.

Beyond the vote split, participants also paid close attention to the Bank’s policy guidance. Here, the MPC noted that policy will need to remain “sufficiently restrictive for sufficiently long”, while adopting the data-dependent, meeting-by-meeting approach that is now commonplace among G10 central banks, flagging that the “appropriate” degree of restrictiveness will be decided at each MPC confab.

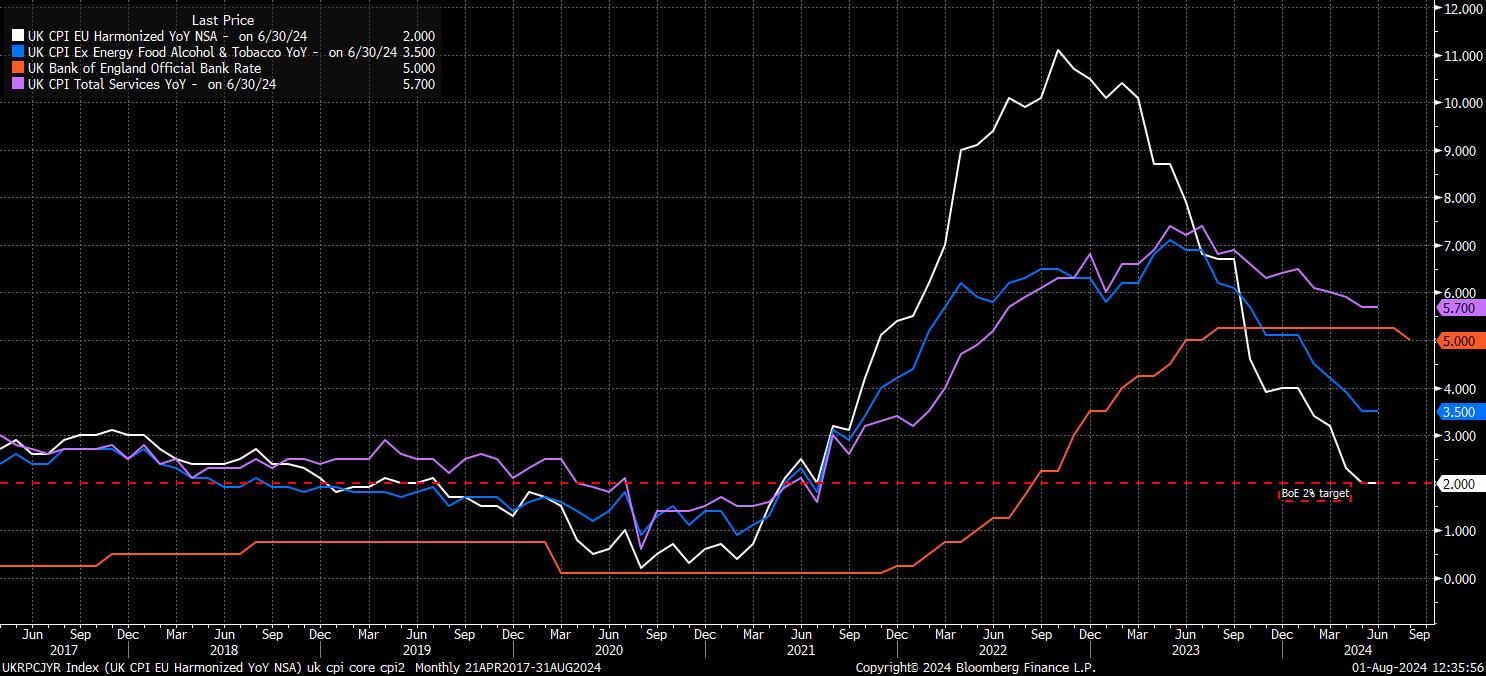

While inflationary pressures were judged to have eased enough to deliver a rate cut today, risks to the inflation outlook are still skewed to the upside, with the MPC to “closely monitor” the risks of inflation persistence within the economy. This may temper expectations of some expecting a rapid pace of easing, though the GBP OIS curve continues to discount around 35bp of easing before the end of the year.

At the press conference, Governor Bailey stressed this data-dependent approach, noting the importance of not cutting rates “too much, or too quickly”. On a somewhat less hawkish note, Bailey explained how the Bank’s forecasts are consistent with a “benign” view of inflation persistence, and that “good progress” is being made in returning inflation to target “sustainably”.

Meanwhile, the August decision also saw the release of a quarterly Monetary Policy Report, and the Bank’s updated economic forecasts.

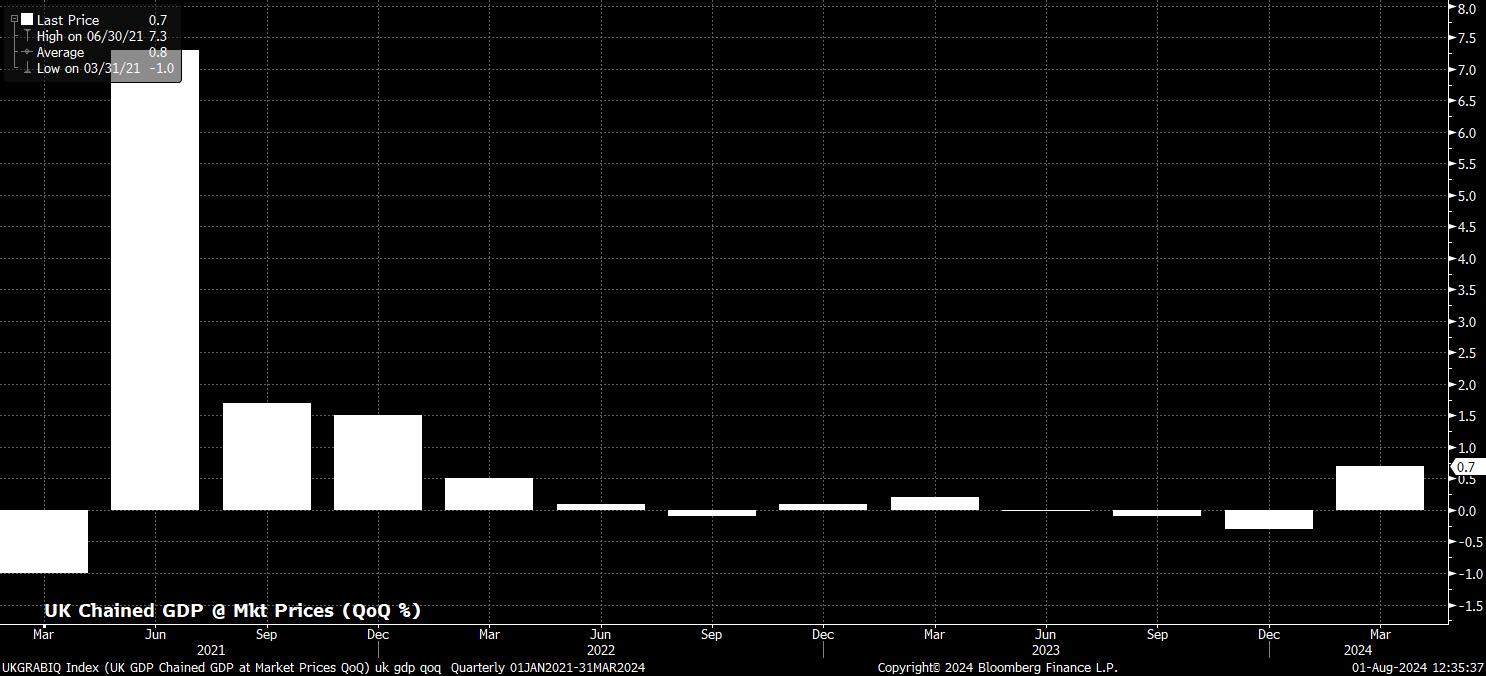

On economic growth, the Bank revised sharply higher its forecast for GDP growth this year, now seeing the economy expanding by 1.5% in the four quarters to the end of September, compared to a prior call for 0.5% GDP growth. Further out, growth expectations for both 2025, and 2026, were kept broadly unchanged.

The inflation outlook also saw some revisions. Headline inflation is still seen, on both the modal and mean forecast paths, achieving the 2% target over the medium-term, albeit risks are biased to the upside in the short-term, as the MPC noted in its statement. However, with inflation continuing to undershoot the 2% target in both 2026 and 2027, based on the market rate path, this should be interpreted as a signal that money markets are not yet discounting enough policy easing.

On the whole, GBP-denominated assets largely took the August MPC decision, and press conference, in their stride. this was, perhaps, unsurprising, given that a 25bp cut had been priced as around a 66% chance before the decision. One must also bear in mind the significant GBP downside, and gilt upside, seen during the morning session, pre-BoE. Positioning, or folk having been tipped a wink, you decide.

_2024-08-01_13-11-21.jpg)

Looking ahead, today’s Bank Rate cut is likely to be the first in a series of rate reductions, as the BoE slowly, but surely, normalise policy over the coming quarters. A quarterly pace of cuts, coinciding with the publication of a Monetary Policy Report, seems the most likely scenario for now, leaving the door open to another 25bp cut at the November MPC meeting, so long as incoming data continues to evolve in line with, or better than, expectations.

Such a pace is one that GBP money markets already discount, and one that would be – roughly – in line with that of other G10 central banks, likely limiting the extent of any prolonged GBP downside.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.