The central bank is watching unemployment closely to guide policy decisions as it looks over the edge to a 0.5% cash rate. If you’re an AUD or AUS200 trader, you’ll need to be prepared for this data release.

As the December employment data releases at 11:30am AEDT tomorrow, there are three crucial components to focus on: the unemployment rate, participation rate, and net employment change.

The Australian unemployment rate is currently 5.2%, and the RBA’s goal is to guide employment towards the natural, sustainable level of unemployment: which it estimates at 4.5%. Over the 12 month’s prior to the November print of 5.2%, the rate quietly hovered between 5 and 5.3%.

A series of three rate cuts last year has so far done little to boost business or consumer confidence, and tomorrow we will get a clearer understanding if they’ve started to take effect in the labour market.

The RBA has said it's watching the unemployment rate closely, and that a deterioration in the outlook would be a call for concern, with the bank’s own forecasts expecting unemployment to fall short of its goals in the coming two years.

Market pricing has the probability of a February rate cut at 56.8%.

Flat expectations

The consensus for tomorrow’s employment data is a modest increase of just 10k, with both the unemployment rate (5.2%) and participation rate (66.0%) expected to hold constant.

The average jobs change in the last twelve months is a 21.7k increase, and in the last six months a 7.6k increase. The 10k estimate seems sensible based on previous data.

A reading close to estimates, let’s say -10k to +20k with unemployment and participation held constant, and market pricing will hold its 50/50 probability and await the Q4 CPI release on 29 January.

Of course expectations aren’t always met, and we expect FX movement if the data is against consensus.

Moving markets

Let’s first consider a worse-than-expected outcome. Let’s say the employment change comes in close to the expected 10k mark but the participation rate increases, so the unemployment rate increases to 5.3%.

This would mean an unexpectedly higher number of people coming into the labour force, but not a big enough relative increase from job openings. Markets know the RBA are watching this measure closely, so an unemployment rate above consensus should see AUDUSD sell off, continuing its downtrend since last Thursday. Rate cut probabilities push above 60%.

The more tricky play here is the effect on the AUS200, which despite a poor unemployment print could be pushed higher as a rate cut becomes more likely.

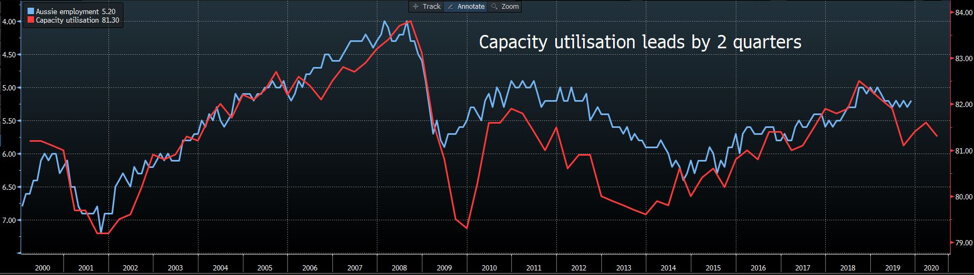

If you consider the relationship between capacity utilisation and the unemployment rate (which we’ve inverted), the chart below suggests it might be time unemployment made a delayed move lower, following that falling utilisation rate.

Source: Bloomberg

Then consider the opposite: an employment change considerably greater than the +10k expectation that could shift the unemployment rate down to 5.1%. This would be the assurance the RBA wants that its rate cuts have eased labour market pressures. In this case we would see the AUDUSD bid up as expectations of a February rate cut reduce.

If you’re a regular AUD trader, consider your exposure to tomorrow’s data risk. The release is scheduled for 11:30am AEDT.

What’s next?

Q4 CPI is due next Wednesday 29 January, with 1.7% YoY expected. If the unemployment data hasn’t done enough to confirm or deny, or the probability of a February rate cut, CPI will be the next one to watch as Australia anxiously awaits the zero-lower bound of interest rates and the promise of quantitative easing should rates eventually drop to 0.25%.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.