Scalping and day trading in volatile markets

The Pros and Cons of Scalping Vs Day Trading: During periods of high volatility many traders are unsure which trading method will work best or more importantly, best suit their trading style. Knowing which trading style suits you best may take some time to determine but during periods of uncertainty, scalping and day trading do have some distinct advantages.

Scalping is the most common trading strategy new traders gravitate to when trading forex and commodities. The idea of achieving great profits from relatively small price changes appeals to many. Generally, scalpers make trading decisions based on the lower timeframes such as 1, 5 or 15 minute charts. They wait for strong support/resistance levels, coupled with certain indicators and price action and trade accordingly.

Day Trading is also an incredibly popular trading strategy. Both scalping and day trading generally take place on the same day, but the important difference is that day traders open and close less positions per day that scalpers. Day traders generally focus more on larger timeframe trends and focus on 15-minute, 1 hour and 4hour charts for opportunities. You can use similar methods on both day trading strategies and scalping strategies but during times of uncertainty, the most important thing is to be market adaptive.

What is the VIX (Volatility Index) and how can this help Scalpers and Day Traders:

The VIX (Volatility index) is a live market index representing the market’s expectation for volatility over the coming 30 days. Investors often use the VIX to measure the level of perceived risk, stresses and fear in the market when making potential investment decisions. The VIX is derived from the price inputs of the S&P 500 index options and is available within the Pepperstone platforms in certain countries.

The VIX can help scalpers and day traders to recognise market conditions that are favourable for their trading strategies. VIX index levels above 25 generally represent a high level of fear and uncertainty, often presenting scalpers and day traders amazing opportunities as key levels of support or resistance are broken. These levels are generally explosive in their moves and the faster a market is moving, the better the chance of larger risk/reward ratios for your scalping and day trading strategies.

Day Trading Opportunities Using Patterns GBP/USD:

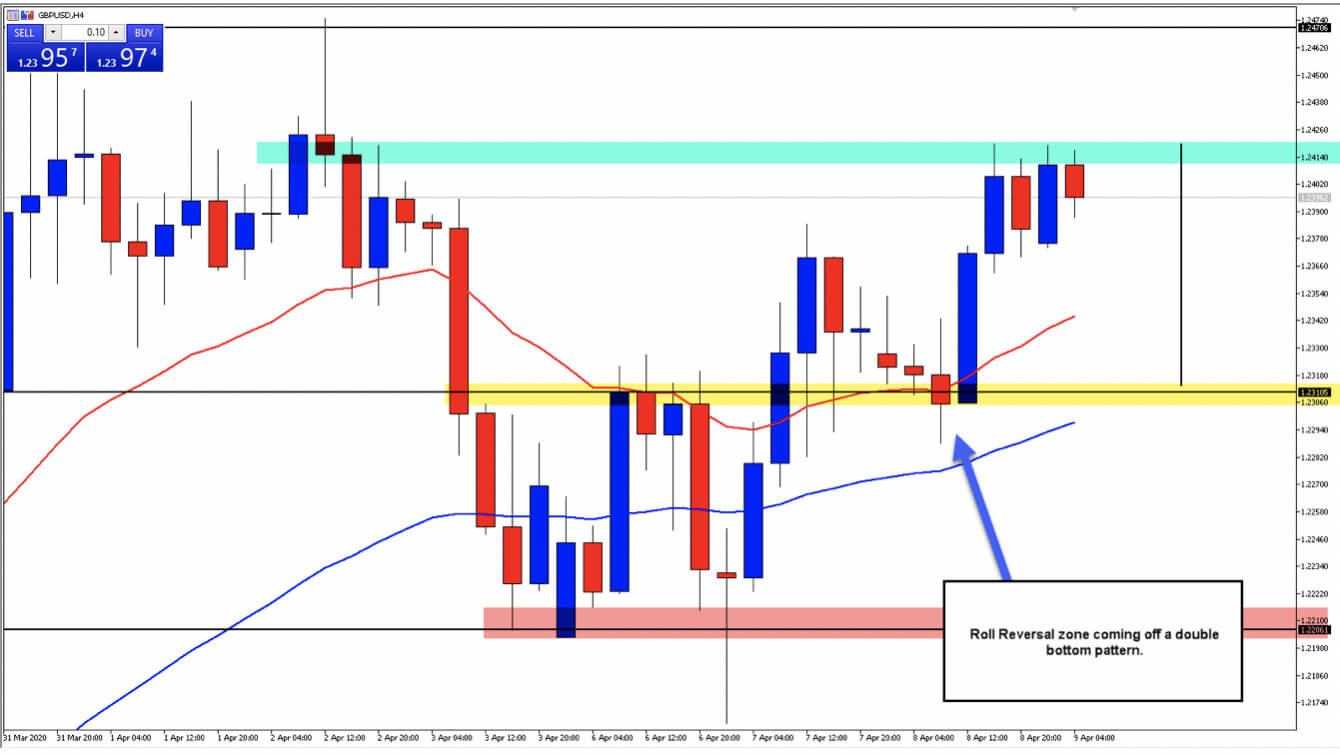

The chart above shows a double bottom pattern formation on the 4hour timeframe on the GBP/USD with a break of the intervening peak (yellow highlighted area) at a price of 1.2310. What makes this pattern so great for day traders is the way that the double bottom formed, and the direction in which the daily trend was moving.

While the trend has recently been bullish during the last week of trade, this double bottom pattern has formed during a pullback and is in the trend’s direction, adding extra confirmation for a day trader. A bullish hammer has also formed on the 4hour timeframe around the base of the double bottom which shows that the market has considered this zone and that the bulls are now in control of the market. This is then followed by the aggressive move upwards and a break of the intervening peak. The great thing for a technical trader is that a setup such as the one above gives multiple entries. An aggressive strategy would be to buy the close above the intervening peak (highlighted in yellow) while the more conservative approach would be to buy the roll reversal zone as shown by the arrow.

Scalping using the 1 2 3 Support/Resistance Method:

The 5-minute USD/JPY chart above illustrates the importance of key support, even on the smaller timeframes during periods of higher volatility. The area highlighted in yellow has been touched three times and found support before finally breaking through the zone at 108.80 (highlighted in purple) with a confirmation break candle.

The importance of waiting for three touches comes down to a consideration level of the market participants. The more times a level is touched and respected, the harder that level will break through. This is especially true during periods of high volatility and is why identifying key technical levels is a great addition to your trading methods.

Which is the Better Method to Trade During Periods of Uncertainty?

It’s clear both methods are very viable during times of high volatility and much of the decision comes down to what is going to suit you as the trader best. There are some things to consider in this decision. Scalping will be more time intensive and potentially a more stressful way of trading during highly volatility, as you will need to be very aware of news releases that can affect your trading instrument.

If you have the ability to dedicate set hours each day and the discipline to trade your strategy without emotion, scalping can be a great opportunity for you. If you prefer the idea of having a smaller amount of trade opportunities per day with the ability to only spend between 30 minutes to 1 hour setting alarms for levels, day trading might be your preferred strategy.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.