How to develop a trading plan

“Many people think that trading can be reduced to a few rules. Always do this or always do that. To me, trading isn’t about always at all; it is about each situation.” – Bill Lipschitz, Market Wizard.

As the age-old adage goes, if you fail to plan, then plan to fail. Trading is a risky business.

“Risky” means that, like other endeavours in life, you need to plan ahead in order to manage the inherent uncertainty of the markets, and make sure that your risk capital (which, after all, is what allows you to stay in the game) is never depleted. Notional funding, proper position sizing, and discipline are key to this part of the equation.

“Business” means that you are to treat this endeavour as a business and not as a gamble. If you had a business plan to show Warren Buffett, would he approve and invest in you? Buffett invests in businesses that will be around for the next 100 years—or at least for the foreseeable future. Businesses that are strong, with a clear strategy, with a competitive moat. You need to structure your trading business in the same way.

Developing a clear edge (your moat), sitting on your hands until your edge is in play (patience), diversifying your bets without diworsifying them, and managing correlations are key to this part of the equation. But also being in a personal position to make trading work for you. Don’t think about paying the bills with your trading. Rather, make sure you have diversified income streams that allow you to learn, survive, and then thrive, without being pressured to perform.

You need a clear and concise plan to guide you along your path to consistent trading, as your plan becomes the foundation for rational decision-making, instead of reckless emotion-driven mistake-making. But not any old plan will do. It needs to be unique and special to you. It needs to be your plan—one you own deep down.

A Trading Plan Template

When experienced traders talk about trading plans, aspiring traders usually start to yawn and get distracted. After all, isn’t it only about “learning a setup” and “executing the setup”? Unfortunately, it isn’t that simple at all.

Actual setups are only the tip of the iceberg. A real trading plan is much more like a well-prepared game of chess. You need strategy (the goals and the objectives), tactics (how to achieve the goals), and psychology (stress management).

Here is a blueprint for a solid trading plan:

Strategy

- Secure multiple income streams (i.e. get a part time job or remain on your day job while you learn and perfect your method; make sure your risk capital is capital you can afford to lose without changing your lifestyle).

- Understand how the markets work. (Learn about market structure, market dynamics, macroeconomic news events, and their implications).

- Understand your edge (and there are many edges to be exploited; so long as you find a set of conditions that are based on actual participation, you will be just fine).

- Accept uncertainty. (You will have losses, especially early on in your trading career, so plan for them, and don’t try to win every trade; try instead to select quality trades and let them work for you).

- Understand probabilities. (Anything can happen in the short term; your edge will reveal itself in the medium term as the distribution of wins/losses is rather random).

- Contingency planning. (Always have a plan B; if you cannot make your trading work within a determined time horizon—for example, one year—then seek coaching or help if you want to pursue this business; do not throw good capital after bad).

- Understand when your edge is in play, and keep tabs on it. (How many trades per week do you have? How many per month? This way, you can plan your month in advance).

Tactics

- What is your system’s aim? (Examples might be to maximize short-term gains within a momentum move; to scale into potential long term trends as they develop; to fade range extremes; etc.)

- Define the appropriate market environment. (What constitutes a trend? What constitutes a range? Where are the transition points? Which situation is ideal for my strategy?)

- Define a low-risk setup. (Breakouts or pullbacks are classic examples of ideal setups in a trend environment.)

- Define your risk per trade. (Usually, it’s best to not risk anymore than 1% of consolidated equity per trade, and that 1% should be “fit” to the amount of pips from entry to stop loss, so that larger positions are possible when stops are tighter and vice versa).

- Define how to deploy your risk. (You don’t have to enter with a full stake; you can scale-in as the price moves in your favour; you can enter a portion at market and leave a limit order to catch a retracement, etc.)

- Define your trade management criteria. (When to hold, when to fold? When to scale out or add? The objective here is to ride winners and cut losers as soon as logically possible. Unfortunately, there is no magic formula for this, and you will need to experiment.)

- Define your exit criteria. (Pre-defined targets? Volatility targets? Trailing stops? Once again, there is no magic formula and you will need to explore what works best with your method.)

- Performance monitoring. (Keep detailed statistics on your trades, especially in the beginning. Beyond the cold hard maths, keep tabs also on the approach and setups you use, because if you have a record of 50 trades, but you’ve done something different in each one of them, in reality you don’t have a statistically valid track record, because you’re using a repetitive process.)

- System improvement. (Based on your performance monitoring, you will be able to identify key areas to work on and key areas that are working well. For example, if you win frequently, but your winning trades are small compared to your losing trades, you might consider keeping tighter stop losses or finding ways to let your winners run further.)

Psychology

- What are your core beliefs (about the market, about yourself, about how the world works)?

- Do your core beliefs match those of the top market participants? (Since we tend to trade based on what we believe to be right, we need to be in tune with the markets, and reading through Market Wizards might prove to be a better exercise than reading through ZeroHedge, for example.)

- Do you have performance anxiety? (Are you afraid to lose? Are you under pressure to win? Do you feel like trading is your last hope? Any mental blocks that you have, whether you are aware of them or not, will emerge when you start to risk your capital in the markets. Be prepared to accept your mental issues and perhaps seek professional help to work through them—but do not avoid them, because it will block your performance.)

- Are you in good shape? (It’s no secret that good physical health leads to better mental health and vice versa. Avoid trading when you’re not in peak shape.)

- Work on yourself. (Mindfulness is a great practice to adopt.)

- Have iron discipline in your trading plan.

- Be grateful. (This tends to promote relaxation and appreciation, and also keeps greed away.)

The quest is not finding the Holy Grail that unlocks the secrets to market success, but rather finding an approach that fits your personality. That is the reason you need to have clear answers to all the questions above. You cannot succeed in the markets by copying someone else’s approach, because the odds are remote that their method will fit your personality.

You have to know yourself, and not try to be somebody you’re not.

The Power of a Side Income

“I’m extremely well diversified. My thought process is if I screw up in one place, I’ll always have a life preserver someplace else.” – Marty Schwartz, Market Wizard.

Much of trading effectively is about stress management. A highly stressed trader makes mistakes, and has trouble trading his plan. And stress comes from many places, so it is imperative that you stabilize your personal situation first, and then attempt to tame the markets!

Here are the main perils of trading under pressure:

- Lack of discipline.

- Looking for trades as opposed to waiting for setups to appear.

- Impossibility to treat losses like the cost of doing business and nothing more.

- Overtrading.

- Cutting winners short.

- Riding losses.

Like any endeavour in life, you need to be fully committed. For limiting mental pressure in trading, this means that it does not matter what you do, even if it involves stacking shelves part-time. It’s just important to make sure you have another source of income if you want to be a trader. Cashflow is king, as it helps you manage stress.

Build your Trading Plan

With all this said and done, it is time to get our hands dirty and build a trading system from the ground up. If you view your trading plan as an expensive sports car, aimed at taking you from point A (aspiring trader) to point B (consistent successful trader), then evidently the core component of your trading plan—the “motor”, so to speak—is the actual trading system. The psychological aspect can be seen as “how you drive the car”. It is very possible to trade a successful system poorly. That’s why you also need the psychological components to make it work.

System Overview

- What is the system’s concept? Remember that simplicity trumps complexity, in trading. So keep your system’s concept simple, for example, “it is aimed at capturing a good trend”.

- What is the system’s objective? If the “background” to the system is a trending environment, then where does your edge appear, within a trend? Does it catch deep pullbacks? Does it play shallow breakouts? When is your edge “in play”?

- Why should the system work as planned? What components of market structure and market dynamics make logical sense if approached this way?

- What is the system’s edge, clearly stated?

- What markets will you trade with the system and why are these markets ideal? à For example, it is well documented how Forex & Commodities tend to trend more than stocks and may be a better choice for a trend system.

- Is the system mechanical or discretionary? Usually, having clear rules to abide by will assist in making rational decisions.

- Is the system purely technical or does it include outside information? à Outside information can be, for example, sentiment indicators, macroeconomic news, etc.)

- What time frames does the system work with? Is it a multi-time frame approach? Or does it work off one single time frame?

- How often does the system need to be monitored? Intraday? Once per day? Else?

- Potential Problems? When does the system NOT work? What situations are most difficult to assess?

Once you have the system overview completed, it might be a good idea to start demo-trading the system, so you can gradually take note and keep records on the performance and the average number of trades per day/week/month, and take note of the potential problem areas.

Remember, attempt to be systematic in your decision-making process. Attempt to identify the same kind of situation time after time. That is the only way to really investigate the odds of your system, and generate meaningful statistics.

Trading Plan Example

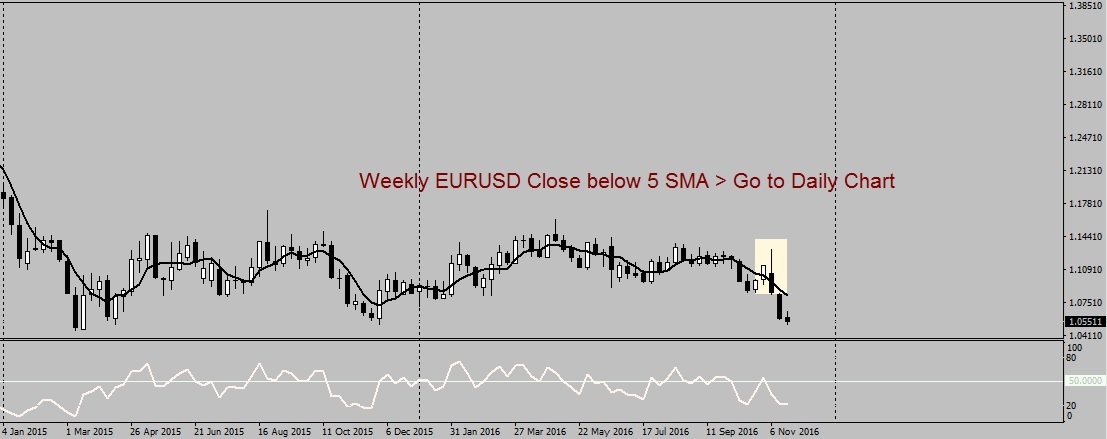

Tools: 5-week simple moving average, 5-day simple moving average, 5-day RSI, market wraps/fundamental influences.

What is the system’s concept? Trade a trending market; stay away from retracements.

What is the system’s objective? Trade in line with an established trend, when momentum is aligned with the trend.

Why should the system work as planned? When there are clear drivers pushing prices in a certain direction, it makes it easier to filter trends that should carry on for some length of time. Furthermore, we are adopting a multiple time frame approach and thus obtaining a wider-view of the landscape (avoiding short-sightedness). We are also letting the market deal us in and out of our trades, and thus not forcing anything on it.

What is the system’s edge, clearly stated? Identify trend days within trending markets and avoid choppy markets.

What markets will you trade with the system and why are these markets ideal? Forex, Gold, Silver, and Crude Oil are ideal, because they are markets that tend to trend.

Is the system mechanical or discretionary? The system is 80% mechanical and 20% discretionary. The trading rules are mechanical; the instrument selection is discretionary.

Is the system purely technical or does it include outside information? Combination.

What time frames does the system work with? Multi time frame approach (weekly, daily).

How often does the system need to be monitored? Once or twice per day.

Potential problems? Lack of discipline (attempting to trade in choppy markets); lack of evident drivers; lack of volatility.

"Weekly EURUSD Closing below 5SMA (1st rule confirmed)\u2014Pepperstone MT4."

"Daily EURUSD. So long as we remain below the 5SMA (2nd condition), now that the weekly is negative, and the RSI remains below 50 (3rd condition), we can look for entries."

"EURUSD 1H Chart illustrating the trigger. The price needs to fulfil the prior three requirements, and also needs to break the prior day\u2019s range to the correct side."

Stop Loss is placed at the high of the trigger day.

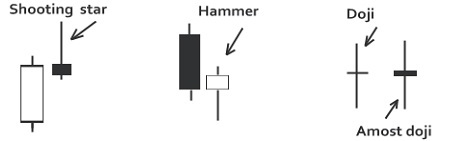

Exit condition. If a trade has been triggered, then exit the trade on the first occurrence of a neutral or counter-trend day. Usually, the candle-form of a neutral or counter-trend day takes the form of either a Shooting Star, a Hammer, or a Doji.

Probability enhancement. Attempt to take the first valid signal after a daily pullback within the broader (weekly) trend, or attempt to take the first valid signal after a weekly trend change.

Brief Idea on a Counter-Trend System

"Crude Oil, Daily Chart\u2014Pepperstone MT4."

The above example illustrates what could be a very specific system that is aimed at identifying potential reversals from prior month extremes. This means being very specific about the location of the reversal (prior month high or low) and the form of the reversal (particular candle action).

Being so specific will allow you to understand what constituted a high probability play, based on your rules. It should be there, staring you in the face when you turn on your charting software, and there should be no doubt that it is a valid setup.

Once you have established clear parameters for your system, you can start to record:

- Risk/reward ratio.

- Win/loss ratio.

- Max consecutive losses.

- Max consecutive wins.

- Most accurate currency pair (what you tend to get right).

- Least accurate currency pair (what you tend to get wrong).

- Time of entry.

- Trade duration.

This will allow you to generate an expectancy for your system, and hence structure adequate return objectives. But by doing this exercise, you will also understand, with very little margin of error:

- What time your trades usually appear.

- What a “good” setup looks like (confidence).

- What a “poor” setup looks like.

- Whether you have a trade or not.

Much of this process is about understanding when to stay flat. Too many aspiring traders (and also some experienced traders) are not clear on what constitutes a high-odds situation and what is not. By going through the same motions time after time, you can train your instincts if you are disciplined, and allow your “gut” to be in sync with your mind. Here is an example routine through which you can practice:

Before going to bed: Read a market wrap for the day, and prepare a likely watchlist of the best looking two to three currency pairs that are likely to offer setups the next day. For our trending system, this could require filtering the most evident markets based on their respective fundamental picture. Then, you could also filter the best looking trends and place pending orders on the highest quality situations.

Before work: Read up on developments during the overnight session. Is there any important news to take into consideration? Is there any evident theme in play? Is the watchlist still valid? Have any orders been executed?

At work: If possible, monitor developments around main market openings and manage open trades accordingly. So, depending on your timezone, make sure you catch a glimpse of the European Open, the New York Open, and the Wellington Open. How is price behaving at these key junctures? Does your trade need to be managed? Is everything proceeding well? Was there any unexpected news?

After work: Monitor and manage open trades as above, read up on the daily macroeconomic developments, prepare a likely watchlist for the day ahead (if there are any changes to be made on your current watchlist).

Over to You

The final objective of your trading plan is to obtain a comfortable personal situation from which to trade with, with as little pressure as possible. Remember that 12-18 months’ exposure to the markets is not generally enough to become consistent. Becoming a consistent trader is more like a marathon, rather than a sprint.

Once your personal situation is in order, focus on building repetitive habits that allow you to confront the markets in the same way, from the same angle, each day. This will allow you to obtain meaningful statistics that can tell you what needs improving and what is working well.

But most importantly, by following a structured plan, you will become a specialist of your method. And that is possibly the most powerful attribute a trader can possess.

The information provided here has been produced by a third party and does not reflect the opinion of Pepperstone. Pepperstone has reproduced the information without alteration or verification and does not represent that this material is accurate, current, or complete and therefore should not be relied upon as such. The Information is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their own advice. Reproduction or redistribution of this information is not permitted.