Analysis

Bitcoin Rips Higher, Tesla Soars Post-Election, USD Strength, Gold Breaks Technical Levels

The central theme stemming through markets has again been expressing Trump 2.0, with this evolving thematic working concurrently with the sell China vibe that resonates, with further fallout from the lack of demand-driven policies detailed at Friday’s China’s NPC meeting.

Bitcoin Ripping Higher – How much further can it kick?

We see green on screen across the crypto complex, and while Doge (+22%) is ripping, and attracting further interest from those with a YOLO approach, and a higher risk tolerance, Bitcoin (+9.2%) is also in beast mode and now looks to test $88k. The chase is on, and with such significant inflows into the respective BTC ETF’s, many feel that a change of regulatory regime is the green light for increased institutional adoption.

Putting a near-term target on where Bitcoin can trade seems a task that offers little value, as this is now about the art of holding and pushing for that genuine outlier in the distribution. The question for traders not already set is whether there is still room to chase this red-hot play or wait for a slight retracement and for some of the heat to come out of the impulsive trend.

Tesla – Intraday price action

Tesla trades a similar dynamic to crypto and is the other big winner from the US election. On the day, the share price sits +8%, extending its rise since the election to 42%, although this impressive percentage change masks the intraday volatility that has seen day traders having to be dynamic throughout the US cash equity session. A look at the set-up on the daily and the indecision portrayed suggests Tesla may have reached an inflection point – one that will need to be resolved in the session ahead. US banks and Tesla finding the love.

The S&P500 is largely unchanged but digging below the surface we see US financials feeling the love, with both the larger US financial institutions and money centres pushing higher, with green liberally seen on screen, while smaller and regional banks outperform (the KRE ETF is +3.4%). Tech takes a backseat, with Nvidia, Apple and Microsoft lower on the day, with funds switching further into value areas of the market. Small caps outperform with the Russell 2k +1.5% and are now just a whisker away from the ATH printed back November 2021.

Materials and energy names have underperformed, with both sectors trading lower on the day, and that may filter through to the ASX200 on open, where there’s been a noticeable liquidation of long positions in gold, copper, and crude. Gold miners have been heavily impacted, where we see the GDX ETF -5.7%.

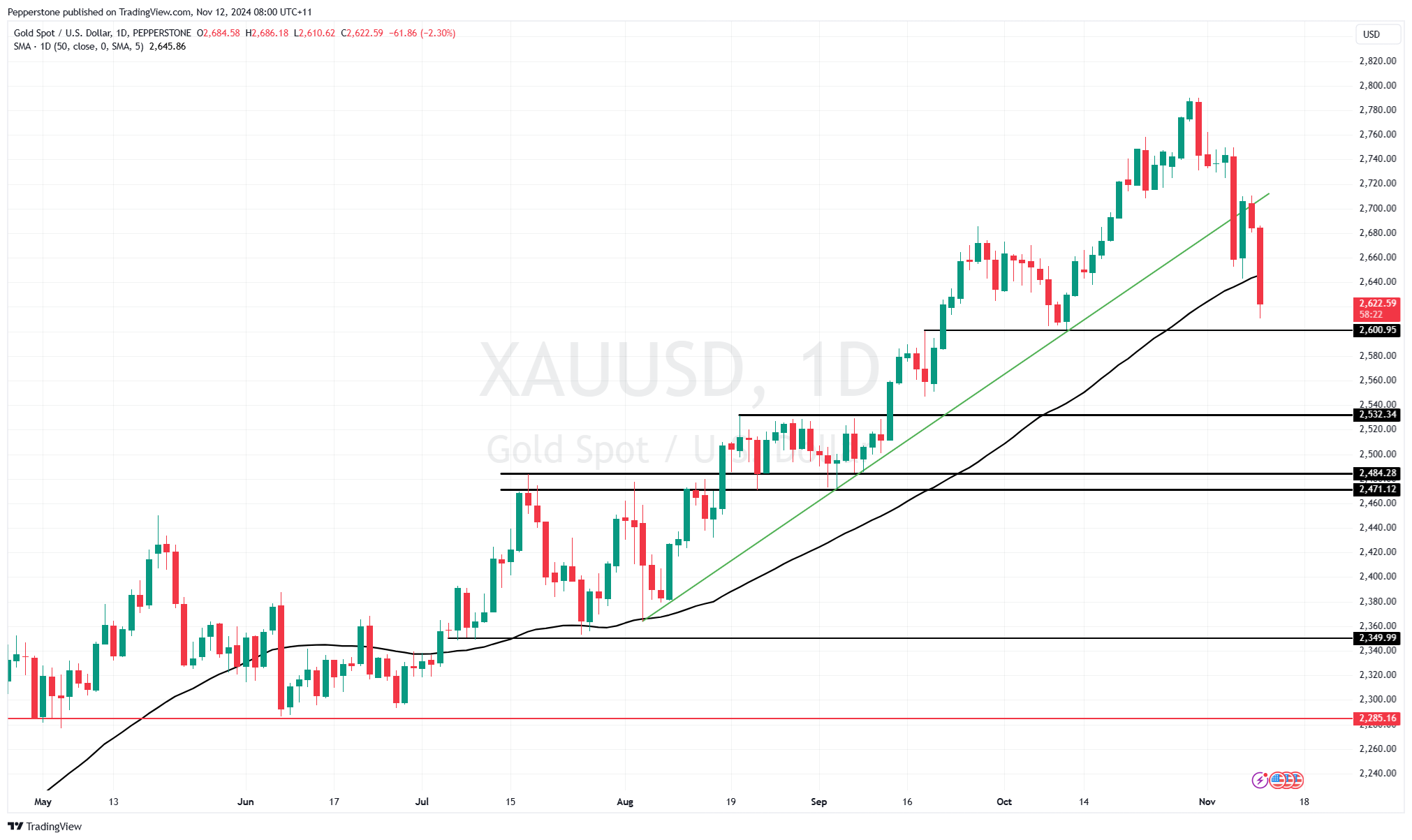

Gold’s foundations built on shaky ground

The selldown in gold is certainly catching the attention of clients where flows on the day have been significant – I’d argue this is partly technical, with the gold price breaking below both the 7 November low (2643.47) and the 50-day MA, resulting in systematic trend-following and momentum funds covering long positions. Some throw up the notion of market players switching from gold into crypto, although I am a sceptic on that view, and lean more to the camp that the gold move is USD related, with perception of China reducing demand for gold – the strong (inverse) relationship on the day between gold and USDCNH offering some belief in the call.

In FX markets, the USD has been the play and while longs may not be getting the same sort of underlying momentum seen in crypto and Tesla, we also need to consider that the USD has incredibly different liquidity dynamics and the range of market participants are also very different. USDZAR has been the big percentage mover, with the technical set-up showing the exchange rate has broken topside of the recent consolidation on the daily, and above the 50-day MA, suggesting this is one that could kick. USDPLN, USDMXN and USDJPY have also worked well on the day, with USDJPY looking for another test of 155.00.

AUDUSD, NZDUSD and USDCAD are largely unchanged on the day, and holding in well given the moves in commodity and energy markets.

Event risk for the session ahead As we turn to what should be a flat open for the ASX200 and NKY225, with the HK50 likely opening 0.7% lower, we look at the risk events for the radar and to navigate in the session ahead. In Australia, neither the Westpac consumer confidence nor NAB business confidence will impact equity or the AUD to any great degree. Looking towards the UK/EU session, we see UK employment data and wages, which could certainly influence GBPUSD and the GBP cross rates. One for the radar, with GBPUSD ominously poised for a move below 1.2800 and the set-up on the daily suggesting the risk remains for lower lowers.

In the US, we get the Senior Loan Officer’s survey (06:00 AEDT), which will offer the market a chance to see recent credit conditions, although it feels like the prospect of volatility from this report is low. We also get speeches from a number of central bankers, including BoE chief economist Pill, ECB members Holzmann and Fed gov Waller.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.