Analysis

Tit-for-Tat Tariffs Overshadow Strong Jobs Report

WHERE WE STAND – Just as financial markets were digesting, with ease, a solid January US jobs report, and participants were thinking of clocking off for the week, another ‘bolt from the blue’ tariff headline somewhat derailed proceedings as last week drew to a close.

Anyway, that January US labour market report was a decent-enough one, with headline nonfarm payrolls having risen +143k as the year got underway – just a whisker away from my own guesstimate of +145k! Although that figure was a touch below consensus, it was still well within the forecast range and, when the net +100k revision to the prior two prints is accounted for, the 3-month average of job gains now stands at +237k, its highest level in almost two years.

Other areas of the jobs report were similarly solid, with unemployment unexpectedly falling to 4.0%, even as participation rose to 62.6% - more people in work, and more people in the labour force looking for work, the best of both worlds! Earnings, though, were a little hotter than expected, at 0.5% MoM, though this likely owed to a shorter workweek due to the California wildfires, and hence can largely be shrugged off.

In any case, the jobs report shows nothing by way of notable labour market weakness, in turn raising the likelihood that the FOMC remain on the sidelines for the foreseeable future. January’s ‘skip’ is increasingly looking like it will turn into a more prolonged ‘pause’, with the back end of H1 now looking the most plausible time for another 25bp cut, a move which money markets now don’t fully discount until September.

Participants digested the jobs report well, with the figures close enough to consensus not to spark a great degree of cross-asset volatility. That calm, though, didn’t last particularly long, amid a renewed focus on tariffs.

Reports late Friday indicated that President Trump may issue reciprocal tariffs as early as the start of this week, in turn seeing sentiment sour significantly as the week drew to a close. To be clear, reciprocal tariffs would be those which match tariffs that are already imposed on the US. For instance, the EU currently charges 10% on US vehicle imports, whereas the US only charges 2.5% on EU imports; White House Adviser Kevin Hasset has noted that “if we were reciprocal, they could go down, or we could go up”.

Let’s be honest, I think we all know that the easiest, quickest, and most likely course of action here is for the Trump Administration to ratchet up their own trade levies, doubling or even trebling them in some cases. Importantly, these tariffs do seem to be more purely trade-related, than those which were recently imposed-then-postponed on Canada and Mexico, in a thinly-veiled negotiating gambit. Hence, the measures are more likely to be more prolonged, thus presenting increased upside inflation, and downside growth, risks.

Financial markets priced these risks rather rapidly on Friday, with stocks slumping into the close, as Treasuries sold-off led by the front-end of the curve, and the dollar vaulted higher, the latter also likely benefitting from a chunk of haven demand, which saw gold notch fresh record highs as well.

That said, the tariff headlines, which had not been widely hinted at, help to further explain the continued lack of conviction among market participants. Nobody wants to place a position, only to find that the market has moved adversely while they’ve been away from their desks; which was, in fact, exactly where I was on Friday, enjoying an afternoon of merriment, as those tariff reports broke! Consequently, position sizes are being reduced, and holding times shortened, as participants continue to adapt to considerably choppier, and more uncertain market conditions.

My bias, though, remains to be bullish USD – the buck remains the best of a bad bunch when it comes to G10 FX, while a hawkish Fed, and haven demand, should provide additional helpful tailwinds. Furthermore, while trade wars are obviously a zero-sum game, the US economy is, relatively speaking, likely to prove more resilient than peers. That said, anything close to, or above, 110 in the DXY seems a bit far-fetched for now.

Elsewhere, I’d still be a buyer of gold, with the yellow metal continuing to shine, and the current bullish momentum seemingly making a test of the $3,000/oz mark a question of ‘when’ rather than ‘if’. I also like long-end Treasuries here, with the benchmark 10-year yielding 4.50%, though the risk of long-term inflation expectations un-anchoring and sparking a sustained round of selling is a significant one.

Lastly, with the bulk of earnings season now out of the way, the S&P 500 has so far notched blended YoY earnings growth of 16.4%, the best quarter in three years. This strong earnings growth, coupled with the lack of major event risk until Nvidia’s earnings on 26th February – CPI and retail sales this week shouldn’t move the needle much – makes me relatively confident that the market should drift higher for the time being, tariff news permitting, of course.

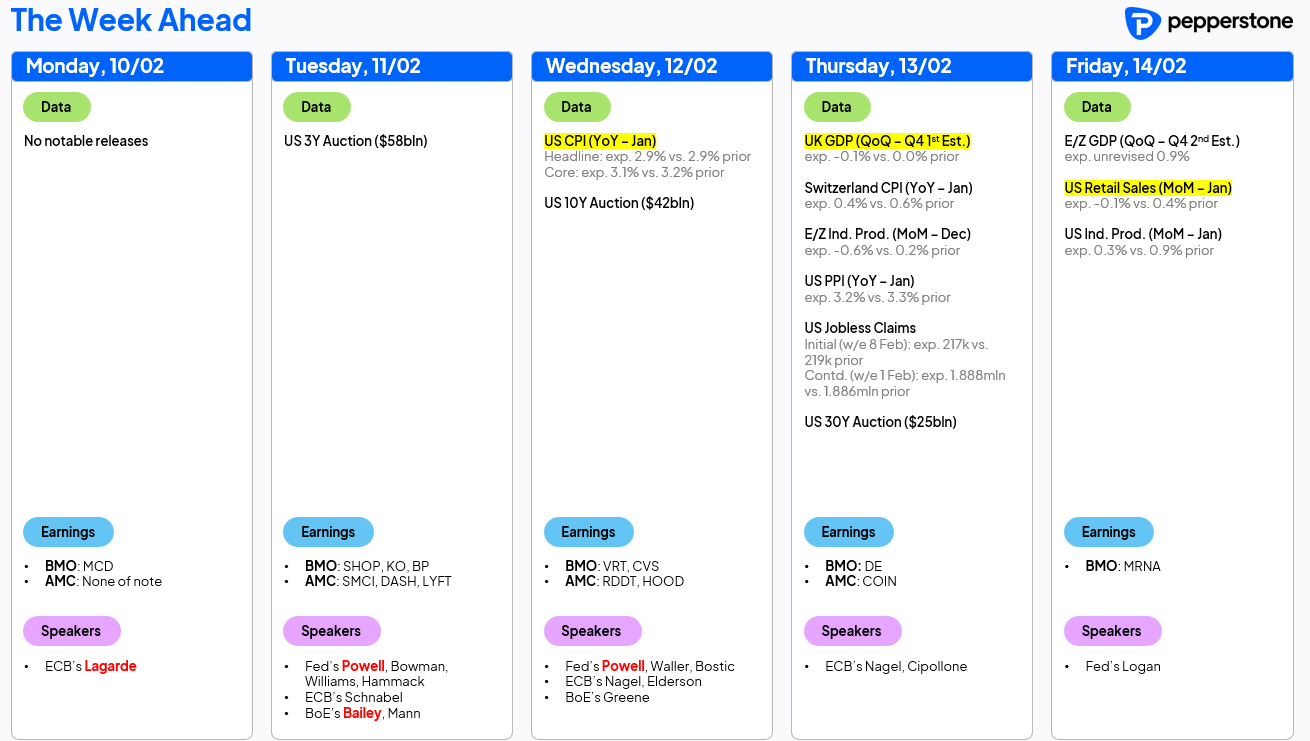

LOOK AHEAD – The data docket is relatively light this week, with neither today nor tomorrow bringing much of interest in terms of macro releases.

As alluded to, this week’s US CPI and retail sales prints are the highlights, though neither seems likely to materially alter the FOMC policy outlook. We will, though, hear two days of Congressional Testimony from Chair Powell, which could prove somewhat more significant.

Here in the UK, Thursday’s GDP figures are likely to provide further evidence of the ‘stagflationary’ backdrop facing the economy, which leads me to still have no desire whatsoever to be touching the GBP, or Gilts, with a bargepole.

Besides that, a busy week of US supply awaits with 3-, 10- and 30-year auctions all on the slate, though all should be relatively well absorbed. Earnings season also continues, though the pace of reports slows, with 78 S&P 500 firms set to release figures, and ‘megacap’ earnings season on hold until NVDA later in the month.

The full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.