Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

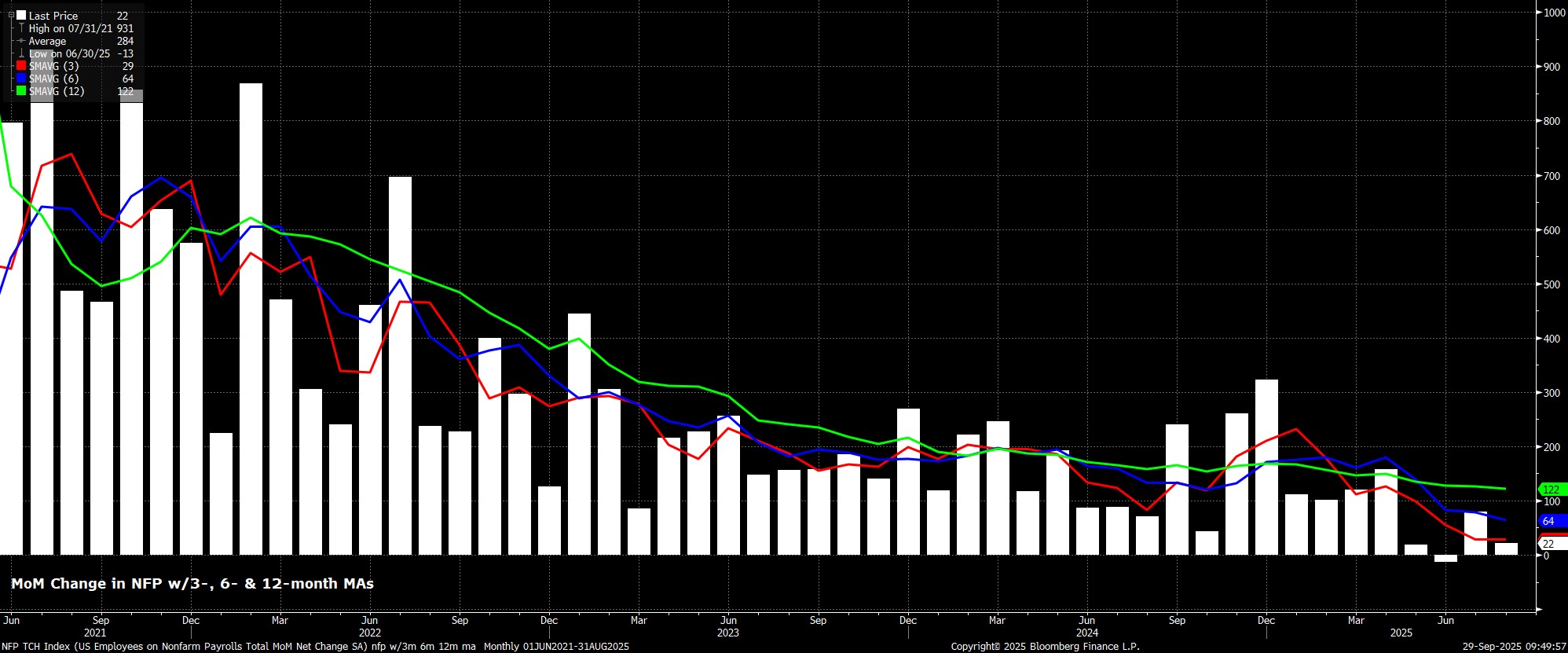

Assuming that the data is released as normal, headline nonfarm payrolls are set to have risen by +50k in September, a notable increase from the subpar +22k pace seen in August, and a rate that would be broadly in line with the breakeven pace of jobs growth outlined by Chair Powell, and other FOMC members. As is typical, the dispersion of forecasts for the headline print is incredibly wide, from -20k to the downside, to +105k to the upside.

Leading indicators for the jobs report are somewhat limited at the time of writing, with neither of the September ISM surveys, nor the ADP employment report, having yet been released. Jobless claims, however, do tilt in a positive direction, with initial claims having fallen by 2k between the August and September survey weeks, and continuing claims having fallen by 18k. That fall in initial claims, though, understates the extent to which claims fell in reality, owing to a recent surge in fraudulent claims in Texas.

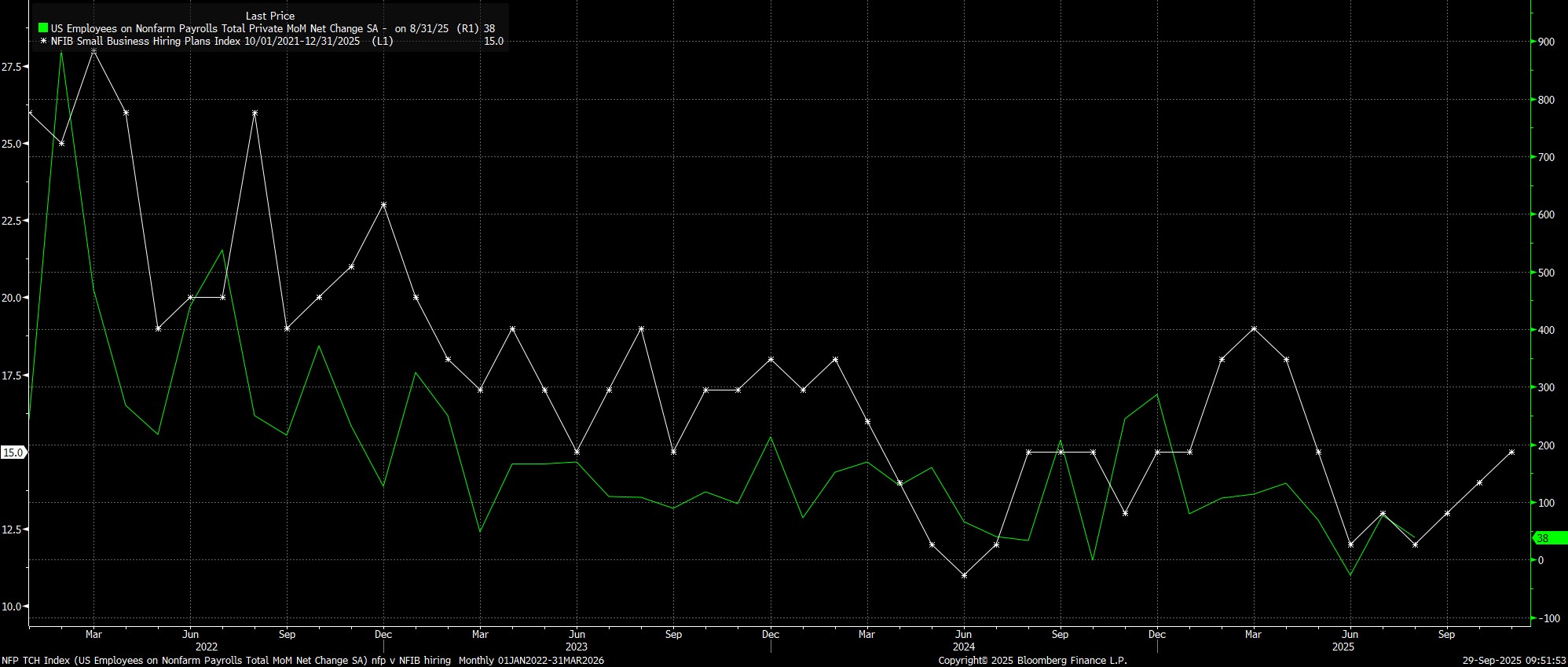

Meanwhile, the NFIB survey of hiring intentions points to growth in private payrolls of around +75k, which we can use as a proxy for the headline NFP print too, given the assumption that government employment will remain flat, as state & local hiring is again offset by a decline in federal payrolls. That said, the DOGE-linked job cuts from earlier in the year, and the accompanying deferred resignation programme, will not feed into the data until the October report, given that the approx. 150k employees who accepted these packages will be remunerated until the end of September.

Another important factor to watch in the employment report will be the composition of job gains, with the healthcare sector – where employment essentially mechanically increases MoM owing to an aging population – having almost entirely underpinned jobs growth since May. Meanwhile, by September, the majority of state & local education workers have returned after the start of the school term, removing a potential catalyst to boost employment, while a still-high level of immigration enforcement also continues to act as a headwind to jobs growth.

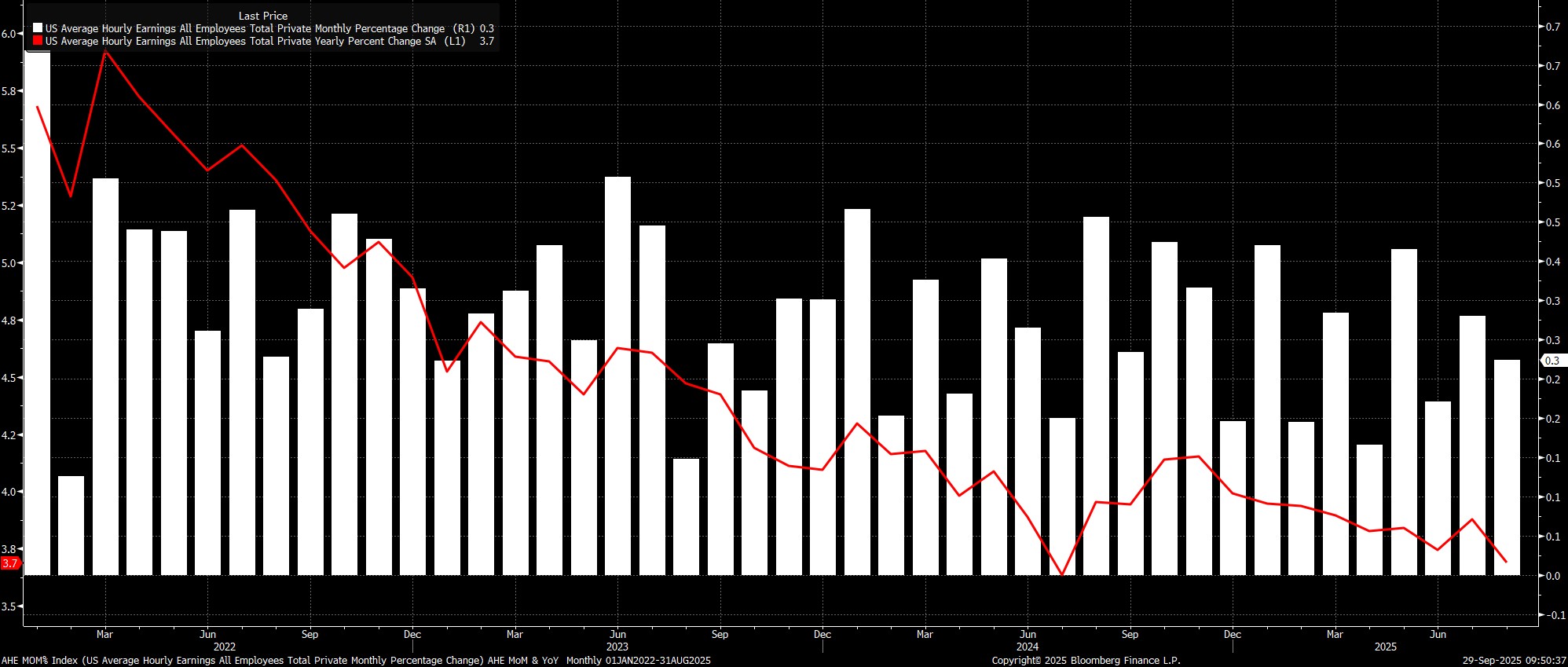

Sticking with the establishment survey, average hourly earnings are set to have risen by 0.3% MoM, unchanged from the pace seen in August, which in turn would see the annual pace of earnings growth also hold steady, at 3.7% YoY. Data of this ilk would reinforce the continued modest downtrend in pay pressures in place over the last twelve months, while also furthering the FOMC’s long-standing view that the labour market is not presently a source of significant upside inflation risk.

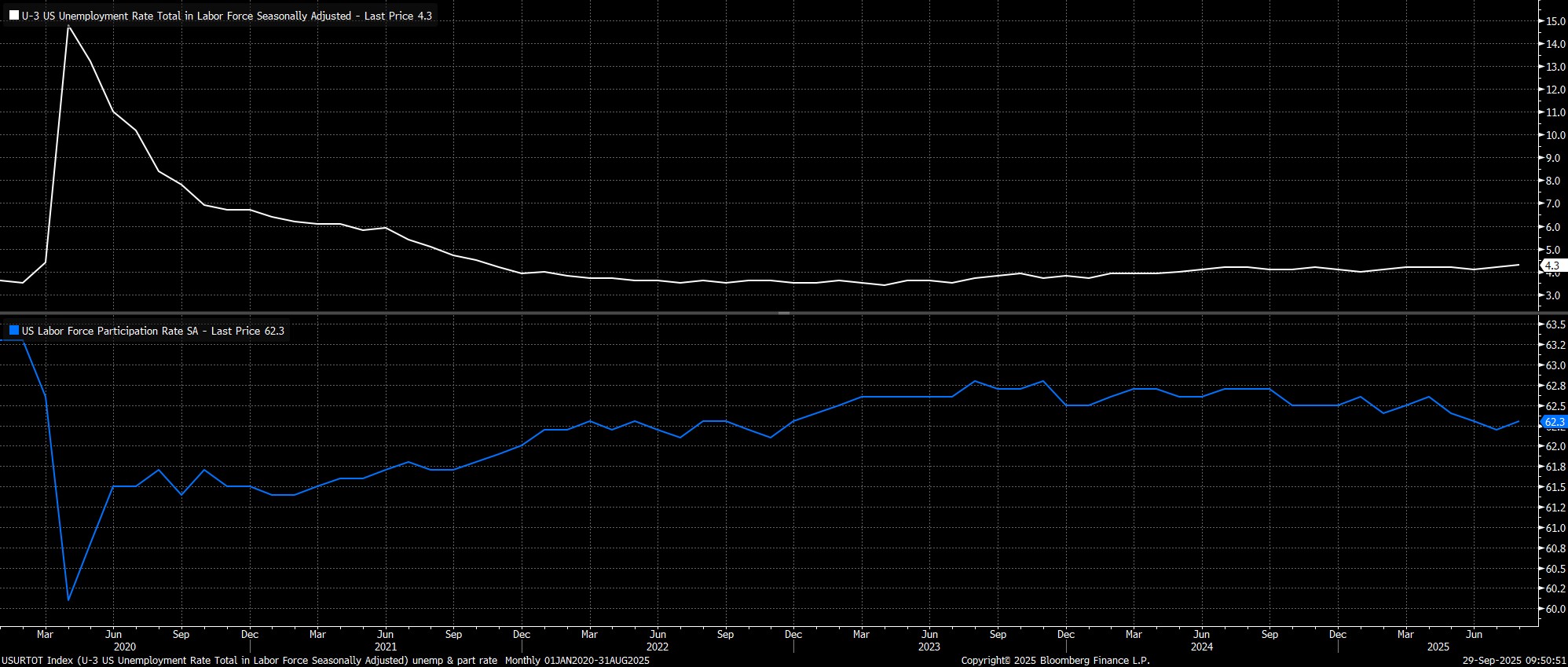

Turning to the household survey, consensus sees headline unemployment holding steady at 4.3% in September, unchanged from August. That said, on an unrounded basis, unemployment printed 4.3237% last time out, thus presenting a relatively low bar for the September figure to tick higher to 4.4%, and a fresh cycle high, when rounded.

Labour force participation, on the other hand, is set to have held steady at 62.3% last month, just 0.1pp above the cycle lows printed in mid-summer. This figure, though, as well as the entire establishment survey, must still be interpreted with some degree of caution, owing to declining survey response rates, and the rapidly-changing composition of the labour force, owing to the aforementioned heightened immigration enforcement being seen across the US.

Zooming out, the September US jobs report is likely to do little to deter the FOMC from delivering further rate reductions, with the series of ‘risk management’ cuts that begun in September, likely to continue with a 25bp cut at each of the October and December meetings, amounting to a total of 75bp easing being delivered by year-end.

That said, the upcoming employment data could well add further evidence to the idea that the labour market did bottom out over the summer months, with that loss of momentum being reflective of the economy adjusting to changing trade policies post-Liberation Day, as opposed to being a sign of deeper-rooted structural weakness.

One must also consider the scenario of the data not being released as scheduled. If the government were to shut down, the BLS would almost certainly be forced to delay the release, until such time that usual funding had been restored. While privately-collected surveys, such as the ADP and ISM figures, would continue to be released during a shutdown period, the lack of any official payrolls data could raise the bar to further policy easing until normality is restored, at least making it tougher to convince the 7 FOMC members whose dot indicates unchanged rates through year-end that further loosening is required (with the caveat that these members may well be non-voters).

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.