Analysis

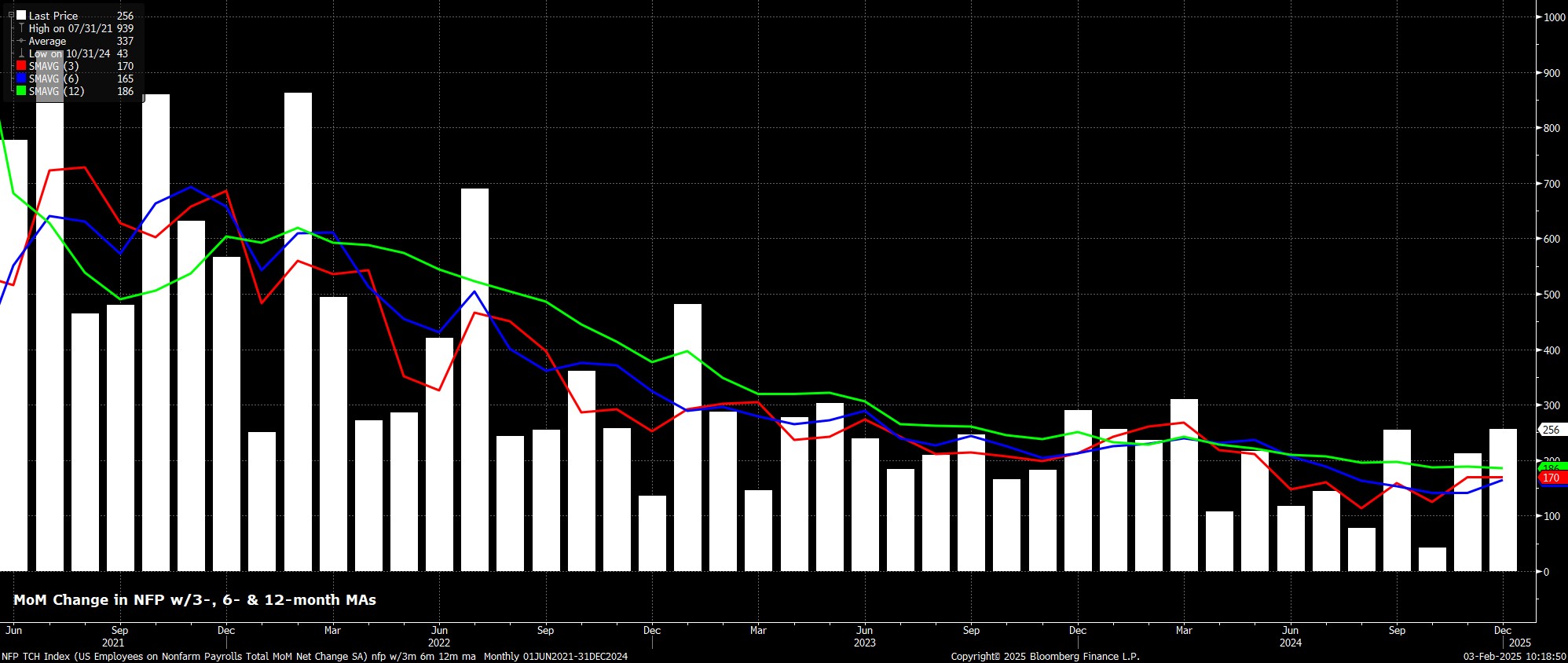

Headline nonfarm payrolls are set to have risen by +170k in January, a substantial slowdown from the blowout +256k print seen in December, albeit a pace that would be in line with the current 3-month moving average of job gains. As usual, though, the range of estimates for the payrolls print is wide, between +125k to +225k.

Risks, however, to that consensus figure appear tilted marginally to the downside, due to numerous one-off factors that are likely to have negatively influenced the payrolls print.

Firstly, wildfires in California are likely to have had a significant detrimental impact on employment in the state, with the impact set to be particularly acute owing to the fires’ peak coinciding with the BLS survey week for the January report. Secondly, the survey week also saw a significant cold weather snap sweep across the United States, likely denting employment in weather-dependent industries, such as construction. Finally, fresh industrial action may also be a modest headwind to employment. Altogether, these factors are likely to subtract somewhere between 60k and 80k from the payrolls print.

Leading indicators for the jobs report, though, paint a less pessimistic picture.

Initial jobless claims were, for all intents and purposes, unchanged from the December to January survey weeks, while continuing claims fell by 39k over the same period. At the time of writing, neither ISM survey has been released, nor has the January ADP employment print, though the latter will likely bear little resemblance to the official payrolls print. Furthermore, the NFIB’s index of business hiring intentions, which has tracked headline jobs growth well this cycle, points to a jobs gain of around +200k, albeit with this indicator having failed to predict the substantial December payrolls beat.

Meanwhile, as is usually the case, the January jobs report will see the BLS announce the annual benchmark revisions. These revisions, which will apply to the March 2024 figure, are likely to see overall payrolls revised lower, by as much as 800k, equating to an average of around 65k per month. Such a revision would be large by historical standards, at around 0.5%, compared to the 10-year median revision of around +/-0.1%.

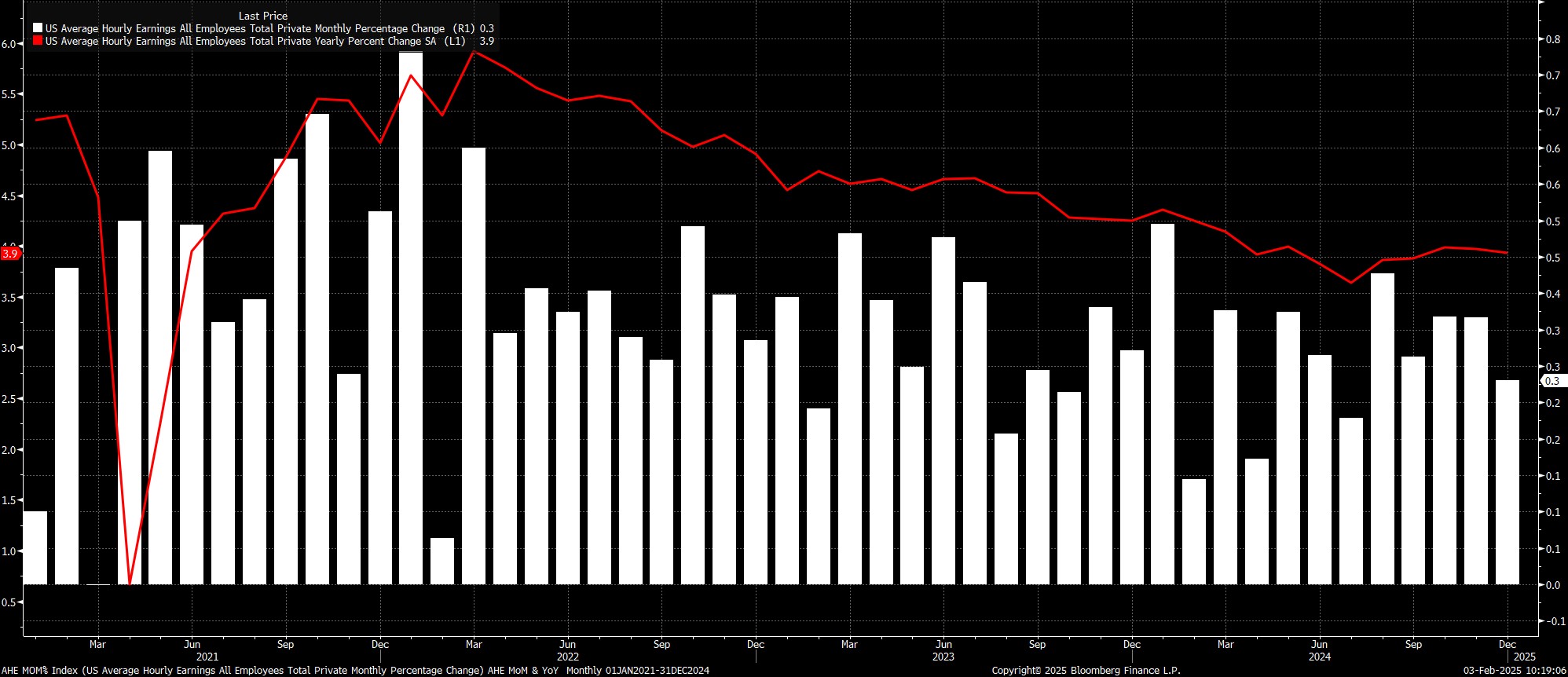

Sticking with the establishment survey, average hourly earnings are expected to have risen 0.3% MoM in January, which in turn would see the annual rate of earnings growth dip slightly, to 3.8% YoY, from 3.9% YoY in December.

Such a pace is unlikely to materially alter the policy outlook, though would further reinforce the views of FOMC policymakers who, for some time now, have noted that the labour market is not a significant source of upside inflation risks.

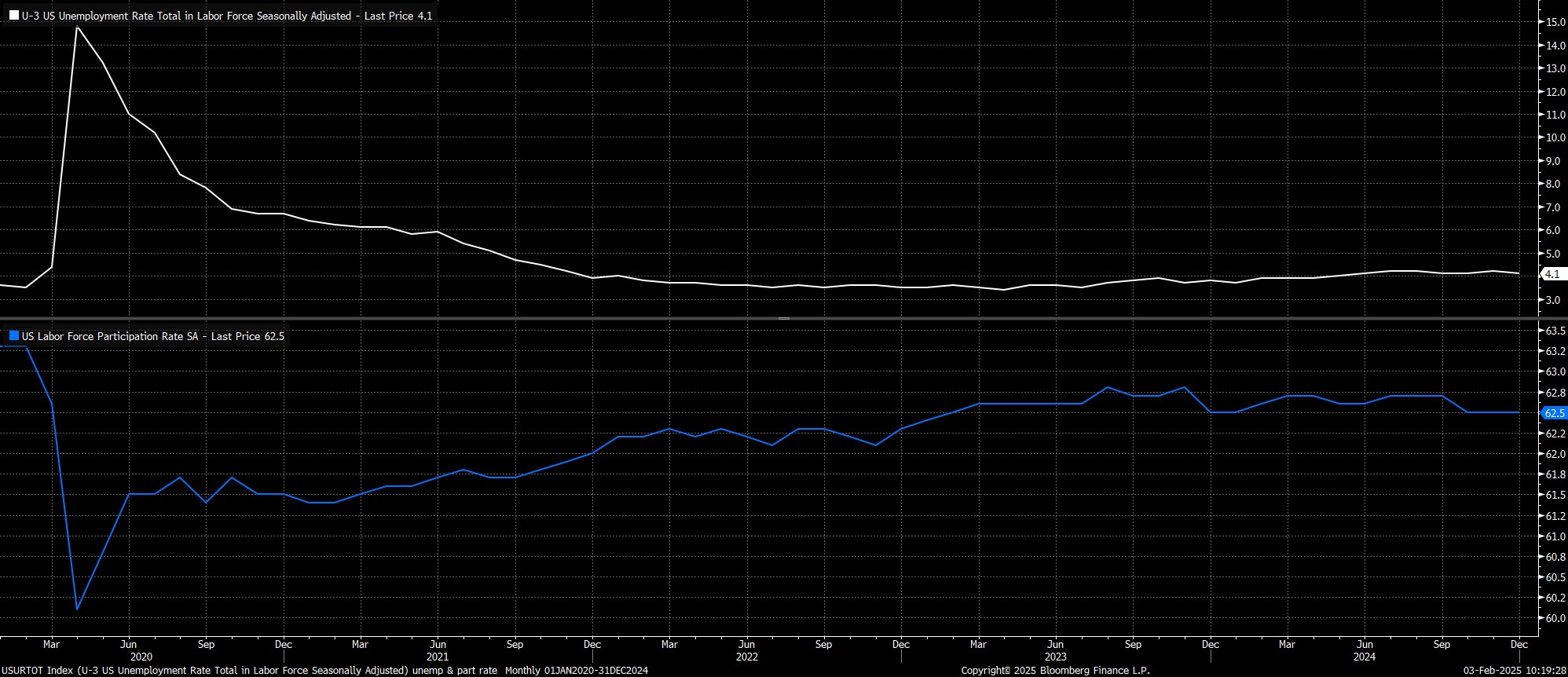

Turning to the household survey, unemployment is set to have held steady at 4.1% as 2025 got underway, with participation also likely to remain unchanged, at 62.5%. Importantly, the unrounded unemployment rate sat at 4.086% in December, thus lessening the chances of the print rounding up to 4.2% this time around.

The January HH survey will also include the annual population adjustments, which this year is likely to see a large increase in the US population, and labour force, primarily due to the impact of immigration. Importantly, though, this is a one-time shift to the January metrics and, if historical precedent is anything to go by, is unlikely to materially impact the aforementioned metrics that tend to impact market sentiment.

Taking a step back, it seems highly unlikely that the January jobs report will be a gamechanger for the policy outlook in any way.

At the January press conference, Chair Powell was clear in noting that, in order to deliver another fed funds rate cut, the Committee would need to see either “real” inflation progress, or “some” labour market weakness, with the bulk of FOMC members probably still placing greater weight on the former factor. The January jobs report, though, is unlikely to point to any degree of material weakness in labour market conditions which should limit any major impact on the policy outlook, particularly at a time when policymakers are continuing to grapple with the potential impacts of President Trump’s tariffs on the US economy.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.