- English

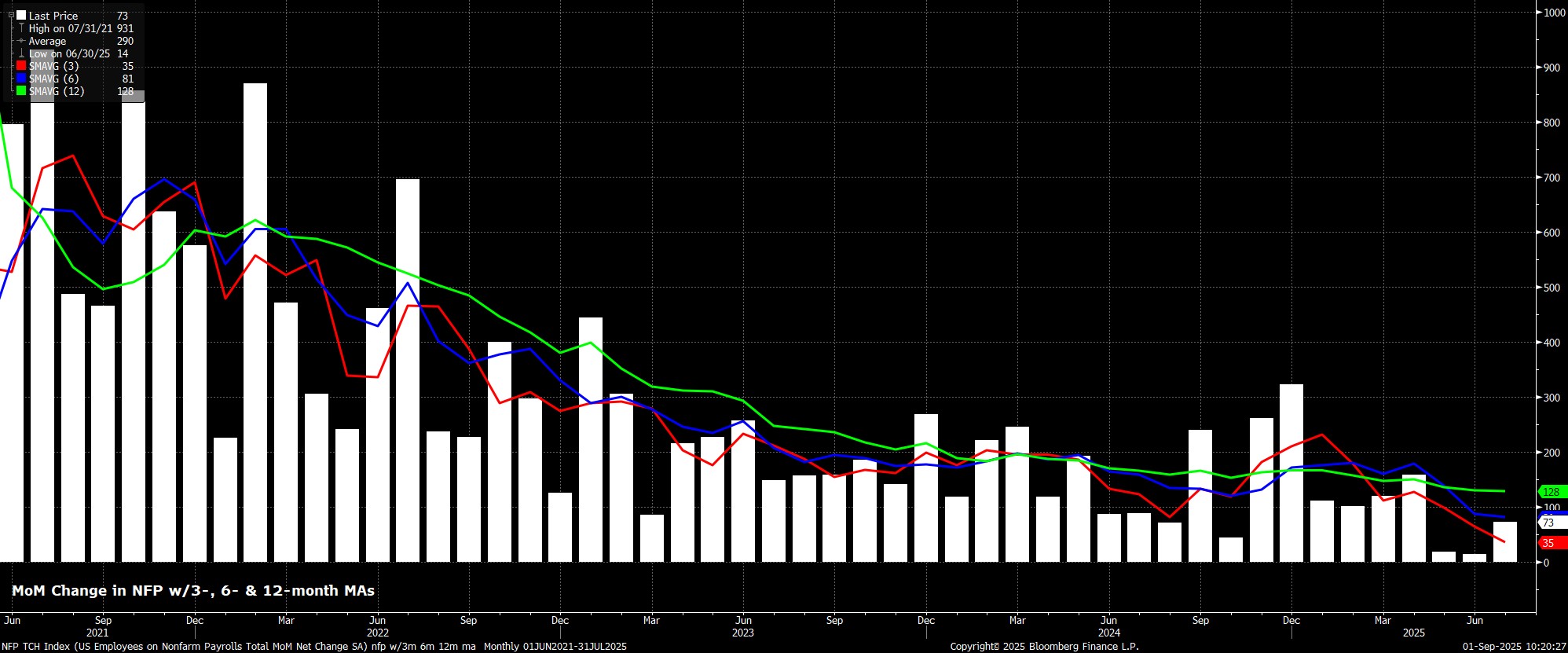

Headline nonfarm payrolls are set to have increased by +75k last month, broadly unchanged from the +73k pace seen in July, and likely also above the breakeven pace, which may now be as low as 50k. As usual, though, the range of estimates for the print is wide, from 0k to the downside, to +115k to the upside, though there is a notable clustering of estimates between +60k and +90k. Furthermore, revisions to the prior two prints bear close attention, not only given the negative trend on that front in recent months, but also after the huge -258k downward revision which came as part of the July jobs report.

Leading indicators for the payrolls print, by and large, point to a figure broadly unchanged from that seen last time out, albeit with the proviso that neither of the ISM surveys, nor the ADP employment report, have been released at the time of writing.

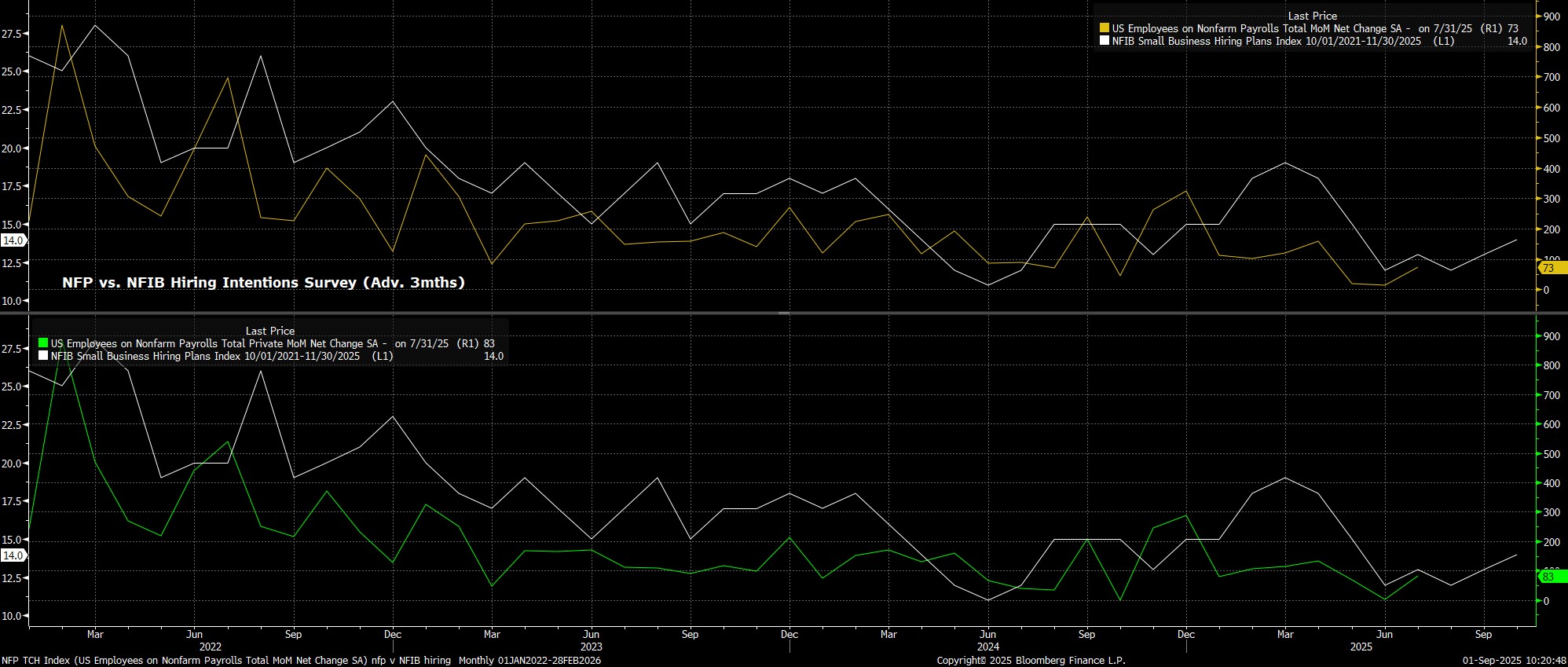

In any case, initial jobless claims rose by 13k between the July and August survey weeks, while continuing claims rose by a more modest 8k, a figure that is in fact likely to be revised down closer to zero later this week. Meanwhile, the NFIB’s hiring plans survey points to a gain in private sector payrolls of around +55k, with government payrolls growth again set to net off to zero, as federal layoffs are countered by growth in state and local employment. On that note, it shan’t be until the October report that the approx. 150k federal employees who agreed to deferred resignations begin to roll off payrolls, though a high proportion of those workers may have found alternative employment in the meantime.

As for other factors to watch in the August report, there is once again the potential for seasonal adjustment to skew the figures, likely to the upside. A number of states across the US begin their academic year in August, hence resulting in teachers and other workers in the education sector returning to payrolled employment.

Meanwhile, as noted above, revisions to the prior two months of data will also be closely watched, with these having trended consistently to the downside this cycle. One must question, though, the extent to which any significant revisions may take place this time out, given the large negative revisions seen to the June print in the prior report. That said, while data quality remains a concern, incoming BLS Labour Statistics Commissioner EJ Antoni has yet to be confirmed by the Senate, hence worries that this report could prove politically-influenced are likely wide of the mark.

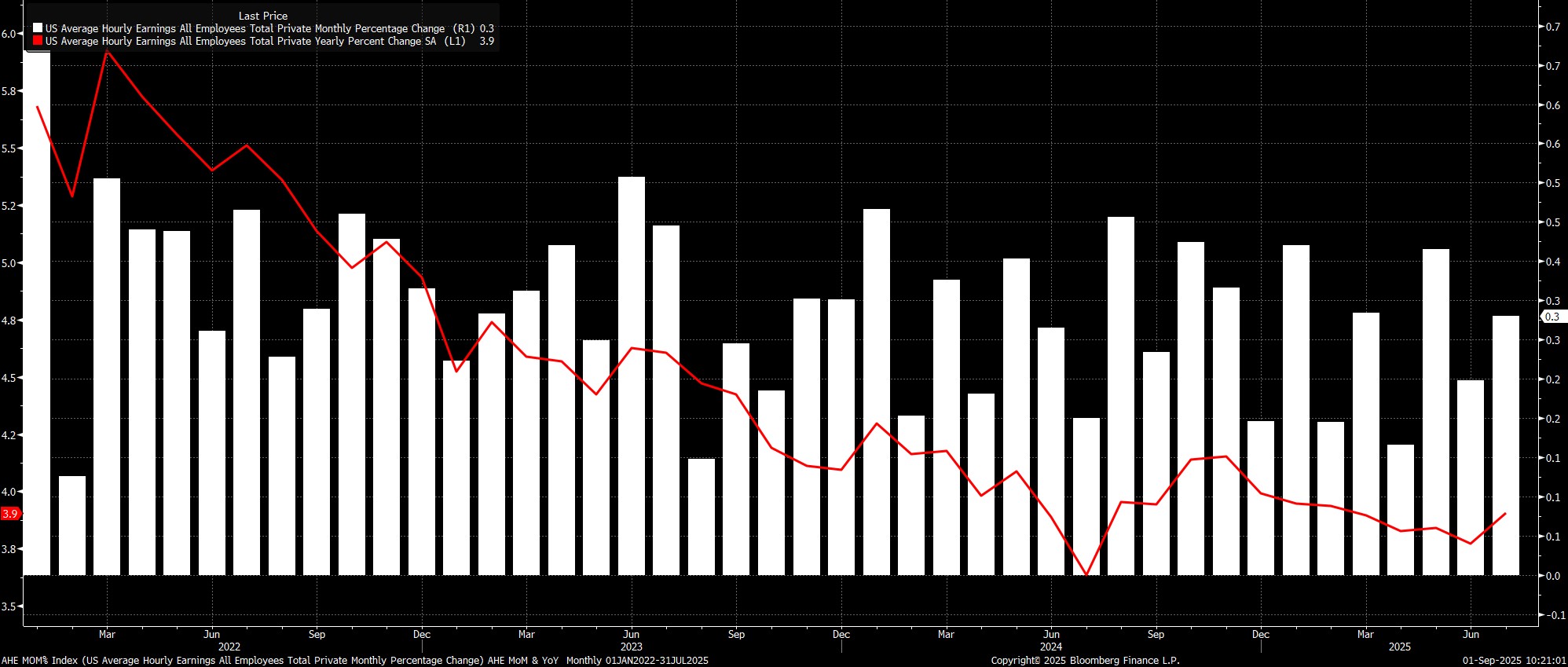

Sticking with the establishment survey, average hourly earnings are set to have risen by 0.3% MoM in August, unchanged from the pace seen in July. Such a pace would, however, see the annual rate of earnings growth dip 0.2pp to 3.7% YoY, helping to reinforce the FOMC’s long-standing view that the labour market is not a source of significant upside inflation risks at the current time.

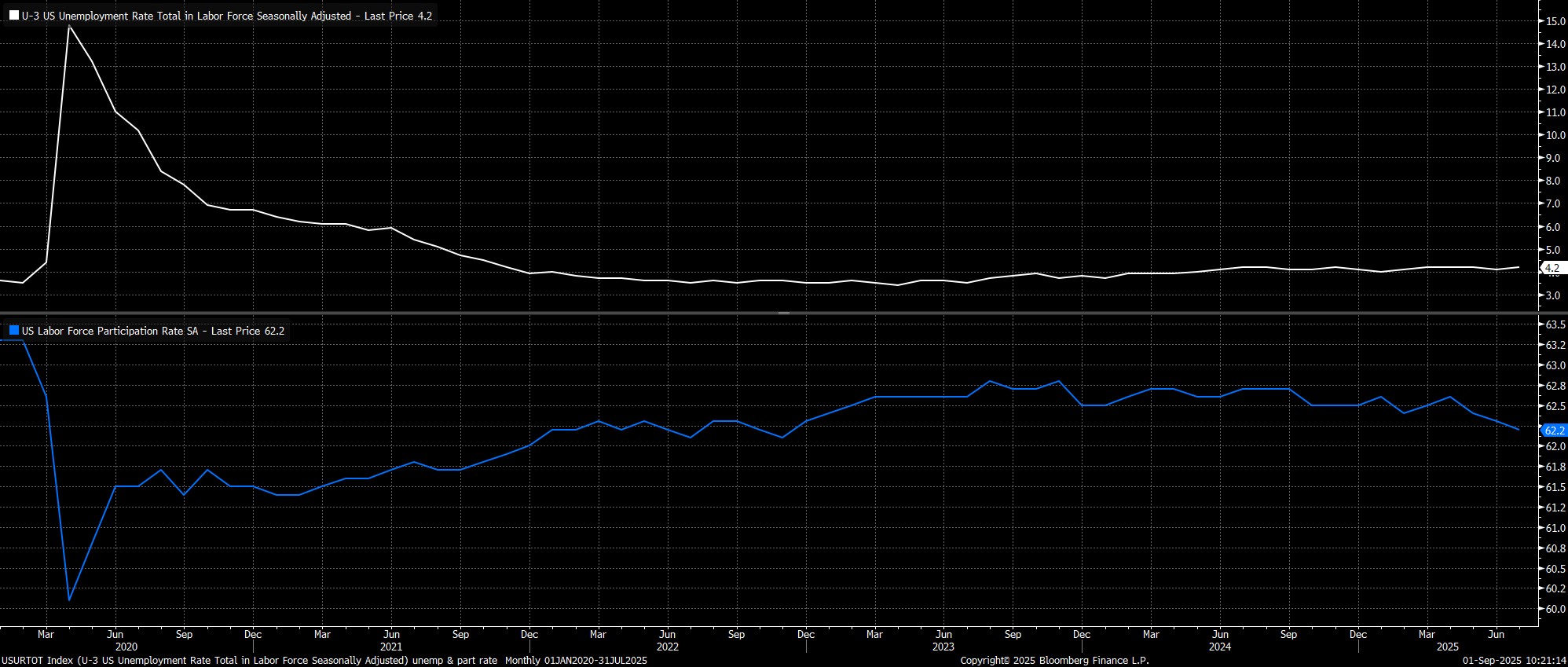

Turning to the household survey, the headline unemployment rate (U-3) is set to have risen to 4.3% last month, up from 4.2% in July, which would mark a fresh cycle high. That said, the jump from the July print is not exactly as huge as it would seem, given that the unrounded print last time out was 4.2479%, meaning that we were very close to that rounding up to 4.3% in any case.

Meanwhile, labour force participation is set to have held steady at a cycle low 62.2%, though risks to this call are clearly tilted to the downside given notable weakness here in recent months, and as much more stringent immigration enforcement continues to depress participation more broadly. That changing labour force composition, though, does mean that the household survey has been, and continues to be, unusually volatile this cycle, hence some caution is still required in interpreting the data.

Taking a step back, the implications of the August report in terms of the Fed policy outlook are relatively straightforward. This is particularly true after Chair Powell used his address at the Jackson Hole Symposium to note that the ‘shifting balance of risks may warrant adjusting our policy stance’. In essence, that’s Powell going as far as he’s ever likely to in terms of pre-committing to a rate reduction at the next meeting, especially when combined with his view that tariffs represent ‘a one-time shift in the price level’ and likely don’t pose a risk of persistent price pressures developing.

With that in mind, and a 25bp September cut all-but-guaranteed even in the case of a surprisingly upbeat jobs report later this week, Friday’s data will be key in determining how that rate cut is framed.

Another soft(ish) report, in keeping with the downbeat nature of the July labour market figures, is likely to see this month’s cut framed as a resumption in the journey back towards a neutral fed funds rate, which paused at the start of the year. Such a report also raises the risk of further dovish dissent on the FOMC, and the potential that some policymakers view a larger 50bp move as more appropriate.

On the other hand, a more resilient set of employment figures is unlikely to be enough to deter policymakers from a rate cut later in the month, nor would it likely be enough to convince the FOMC that downside risks to the labour market have considerably diminished. It would, however, likely lead to the September cut being framed as a much more cautious move.

For the time being, though, my base case is now that the FOMC will indeed deliver two 25bp cuts before the year is out, likely at each of the September and December meetings, as policymakers ‘look-through’ any further tariff-induced inflation, as focus instead shifts to the ‘maximum employment’ side of the dual mandate.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.