Analysis

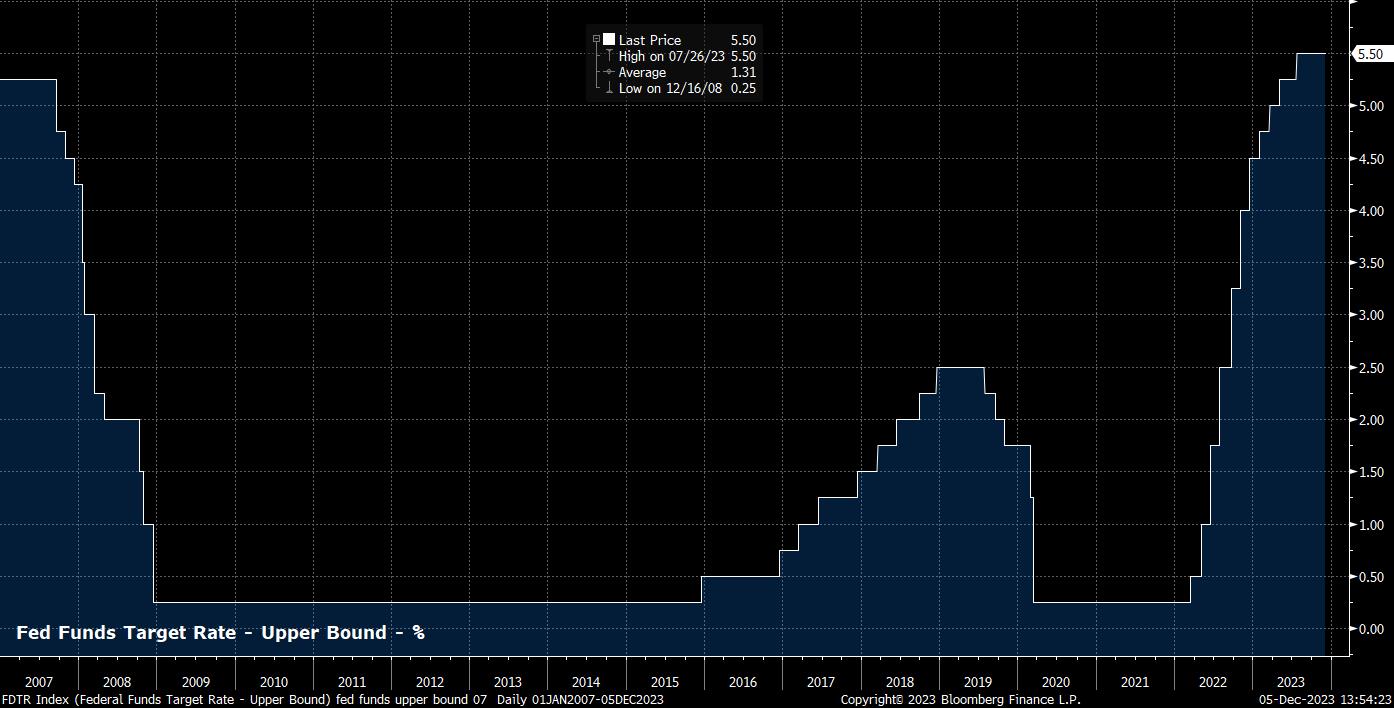

Having last hiked the fed funds rate in July, leaving rates unchanged this month would represent the third straight meeting that has produced such a decision strongly suggesting that, even if guidance were not changed, the hiking cycle is actually at an end, rather than merely being ‘on pause’, with the fed funds rate now at its terminal level. The decision to hold rates this month is set to be a unanimous vote among Committee members.

The question, therefore, becomes whether or not the FOMC provide an explicit signal that the tightening cycle is indeed at an end, in addition to whether there are any hints (akin to Governor Waller’s speech last week) as to what the Committee would need to see in order to consider lowering the fed funds rate next year.

Chiefly, focus will fall on whether the FOMC’s statement repeats a now-familiar reference to determining “the extend of additional policy firming” that may be required. The removal of this line, though a relatively small change, would be significant, and clearly nod towards the Committee’s belief that further tightening is unlikely to be required. Though the line may not be removed in its entirety, it is at least likely to be amended, to retain some degree of a tightening bias, while signalling that further hikes are significantly less probable than earlier in the cycle – discussing the more evenly-balanced risks to the FOMC’s dual mandate, as many speakers have done recently, may be a way to do this.

In any case, the statement is likely to repeat that the Committee will continue to ‘adjust policy as appropriate’ to ensure achievement of both the inflation and employment objectives, though this is a line that has been omnipresent for some time now.

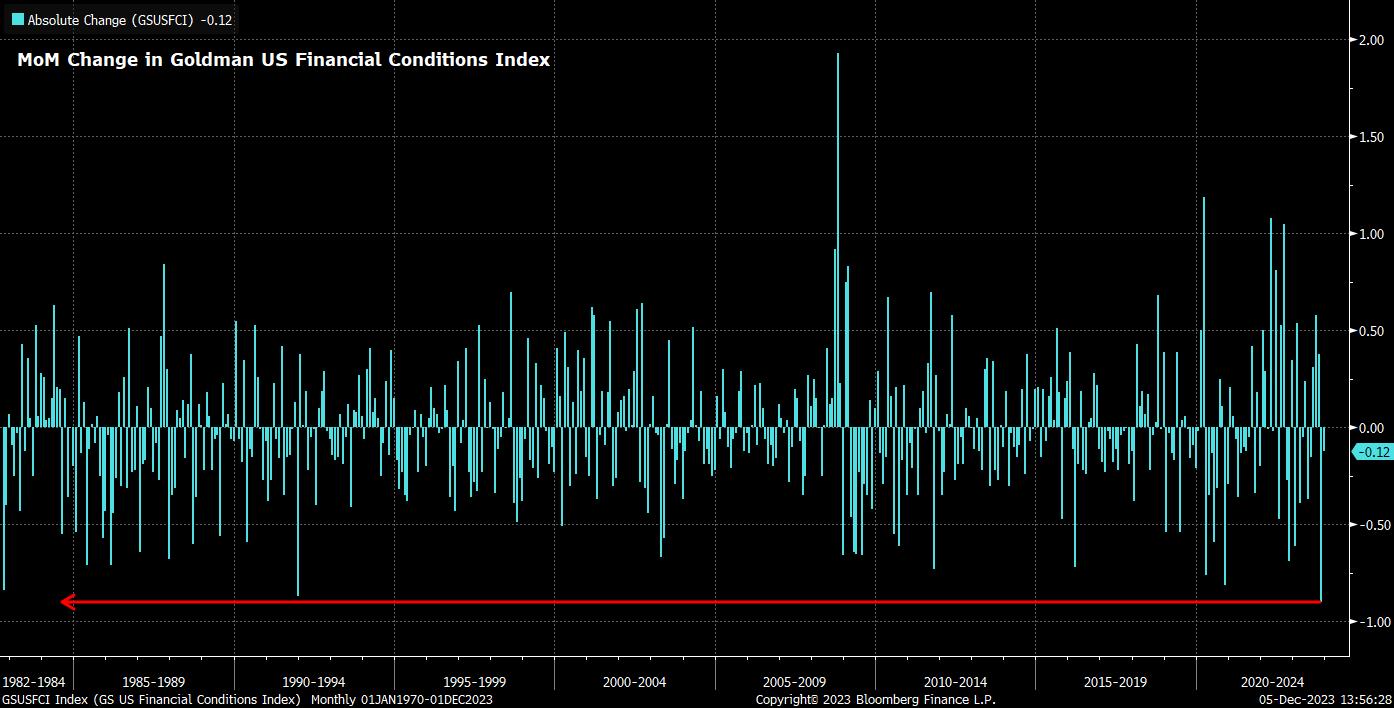

On the whole, the FOMC will seek to strike a delicate balance between taking a further step towards concluding the 18-month long hiking cycle, without sparking a significant easing in financial conditions that could put the return of inflation to target under threat, particularly after Goldman’s index of said conditions notched its biggest one-month loosening on record in November.

As a result of this, it seems unlikely that there will be any other significant changes to the policy statement, nor to the updated ‘dot plot’, released as part of the quarterly Summary of Economic Projections (SEP).

The median 2023 dot is likely to be revised to 5.325%, simply ‘marking to market’ the dots in relation to where the fed funds rate will actually end the year – barring a highly unlikely hike at the December meeting. Further out, the median 2024 dot may also be revised 25bp lower, though this would continue to imply a total of 50bp of cuts over the course of next year. Looking further ahead, the median dots are likely to be broadly unchanged from those released in September, though should show a tighter dispersion amid increasing confidence that inflation will make a swifter return to 2% than had been previously expected. In addition, there seems little reason to expect the FOMC to revise estimates of the ‘longer-run’ rate, currently at 2.5%.

Clearly, this would leave the dots somewhat out of sync with the aggressive pace of policy easing that markets continue to foresee in 2024, with OIS implying almost 125bp of easing over the course of the next 12 months. It seems unlikely that any dot plot revisions will significantly alter market pricing at this stage, however, with much of the FOMC’s recent remarks falling on apparently deaf ears. How this divergence resolves itself over the first half of the year, though, will be an important theme to keep an eye on.

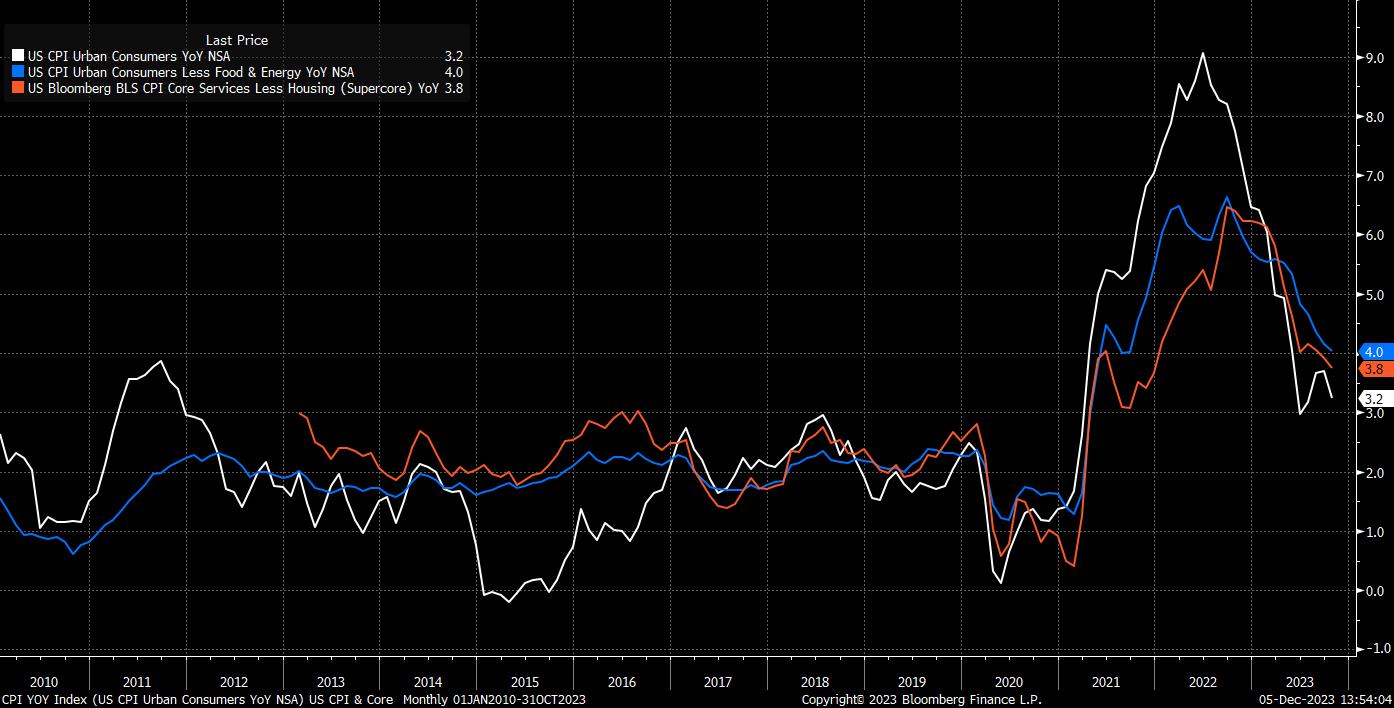

The modest downward revision to the dots should be facilitated by a cooler inflation path than that which was foreseen in September. Disinflation has continued apace within the US economy since the last forecast round, most importantly at a core, and ‘supercore’ (core services ex-housing) level, with the latter – a measure closely watched by numerous policymakers – now back below 4% for the first time since early-2022.

Though there are calculation differences between the above measures, and the PCE gauge preferred by the FOMC, the same disinflationary impulse largely applies. Consequently, the 2023 core PCE forecast of 3.7% is likely to be revised around 0.1-0.2pp lower, thus falling more in line with recent data. Further out, however, any dramatic changes appear unlikely, not least as the Committee will want to avoid signalling a premature ‘victory lap’ in the battle against price pressures within the economy.

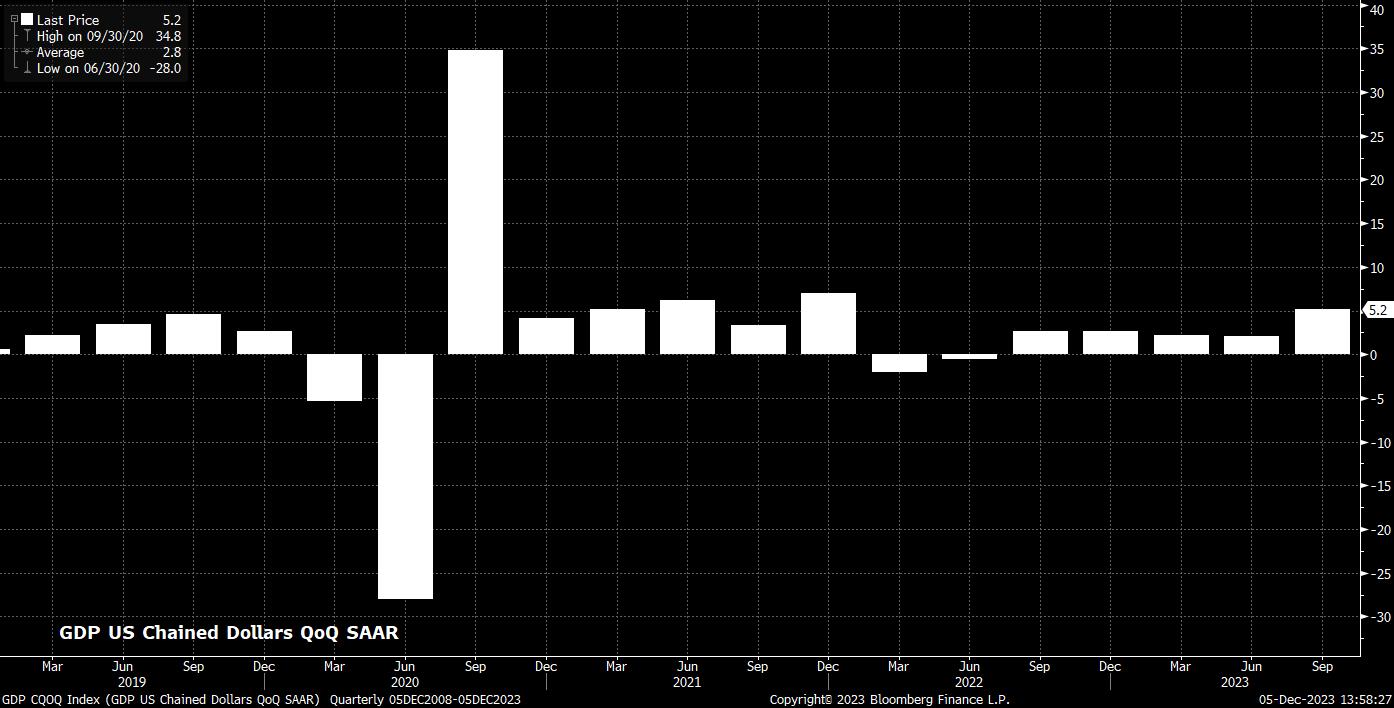

A more optimistic growth outlook is also likely to be presented, with 2023’s real GDP expectation set to be revised as high as 2.5%, a sharp revision from the 2.1% pace seen in September, and a staggering 1.5pp above the June forecast. A significantly stronger than expected pace of growth in the third quarter, along with continued resilience in consumer spending, are the main contributory factors to such a revision.

This may, however, result in a marginal downward revision to the 1.5% GDP growth currently forecast for 2024, due to the tougher YoY comparisons that it will provoke.

Finally, on the SEP, the unemployment rate is unlikely to be revised in any significant way, despite the recent softening in a range of labour market indicators, including a rise in continuing jobless claims to a 2-year high. A rate of around 4% is likely to be foreseen over the entirety of the forecast horizon, epitomising how, along with the market’s consensus view, the FOMC themselves view a ‘soft landing’ as achievable, and as a baseline expectation.

Speaking of financial markets, one must recognise that the bar for a dovish surprise from the December FOMC is a rather high one, taking into account the five 25bp cuts fully priced for next year, and the substantial rally seen in Treasuries of late, with 10-year yields having rallied over 80bp from the 5% cycle highs seen in mid-October.

As a result, though the ‘path of least resistance’ likely still points towards higher equities, lower Treasury yields, and a softer USD into year-end, the FOMC may throw something of a spanner in the works, particularly if either the statement, or Chair Powell’s press conference, or both, are interpreted as leaning to the more hawkish side of the spectrum. The recent rejection of the move to new highs in gold goes down as the first chink in the ‘buy everything’ trade that has dominated since mid-November, with Powell potentially dealing that theme another blow.

Lastly, given the time of year, it is important to recognise that the December FOMC is likely to see more illiquid market conditions than usual, with many institutional players having already closed their books for the year. For those that haven’t, many desks will shut down for the festive period after the FOMC decision is done and dusted, again thinning trading conditions, as Christmas and year-end rapidly approach.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.