Analysis

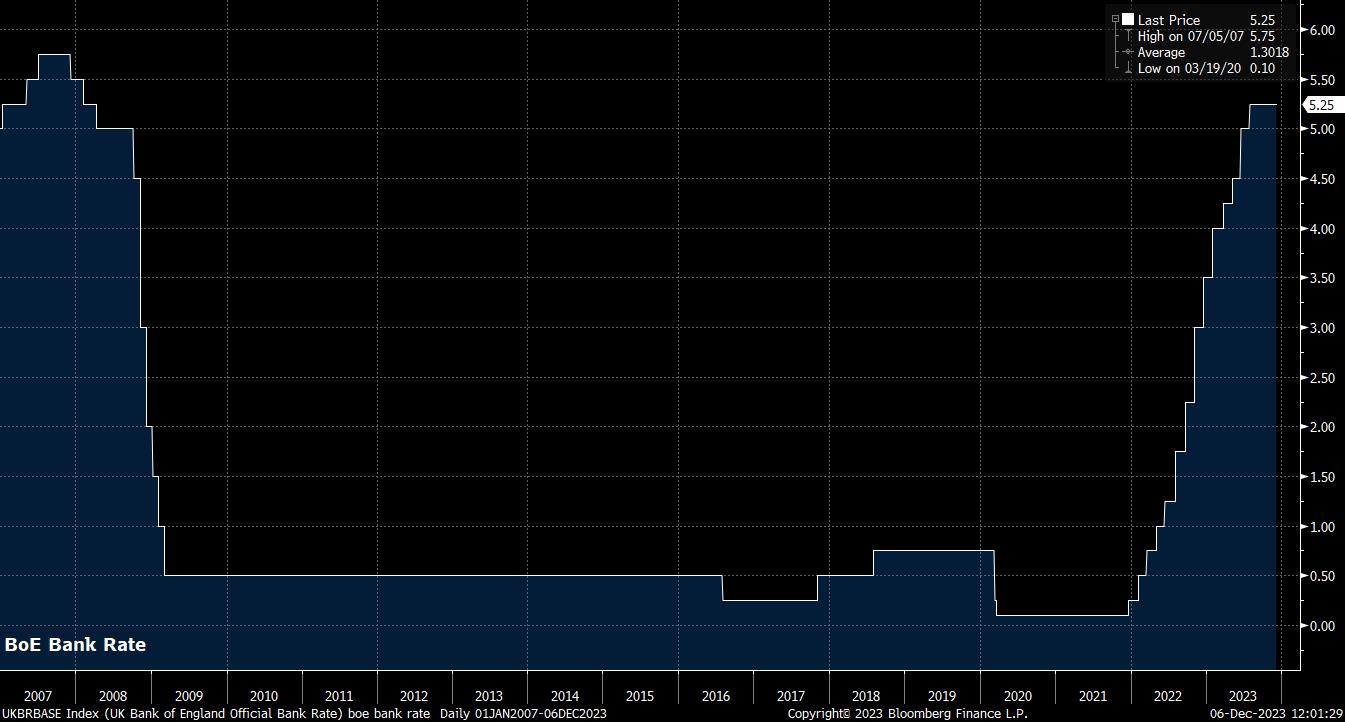

As noted, there is no expectation of a rate move at the December meeting, with recent data giving the MPC little reason to shift away from the ‘on pause’ stance that has been in place for much of the last couple of quarters. Money markets, incidentally, price no chance of a hike at this meeting, or at any point over the next year.

Nevertheless, the vote split may be again of interest, particularly after the 6-3 vote in November to leave Bank Rate on hold. While there has, again, been relatively little fresh economic information since that meeting, the continued disinflation seen since the prior meeting may convince one, or more, of external members Greene, Haskel, and Mann to shift their stance and vote in favour of policy remaining on hold. Recent remarks, however, from all three, suggested little inclination to make a dovish tilt, amid concern over the risk of inflation rearing its head once more.

In light of this risk, the MPC’s guidance is likely to be broadly unchanged from that issued at the November meeting. Once more, the policy statement should repeat that the current stance ‘is restrictive’, and that the stance will remain ‘sufficiently restrictive for sufficiently long’ to bring about a return of inflation to the 2% target. That said, there is unlikely to be any clarity on the length of the ‘extended period’ that rates will remain at their current level, despite markets pricing an aggressive pace of cuts next year, with futures currently implying Bank Rate will end 2024 at around 4.4%.

In contrast to other developed markets, however, there remains relatively little in incoming UK data to suggest that such an aggressive pace of easing will be delivered.

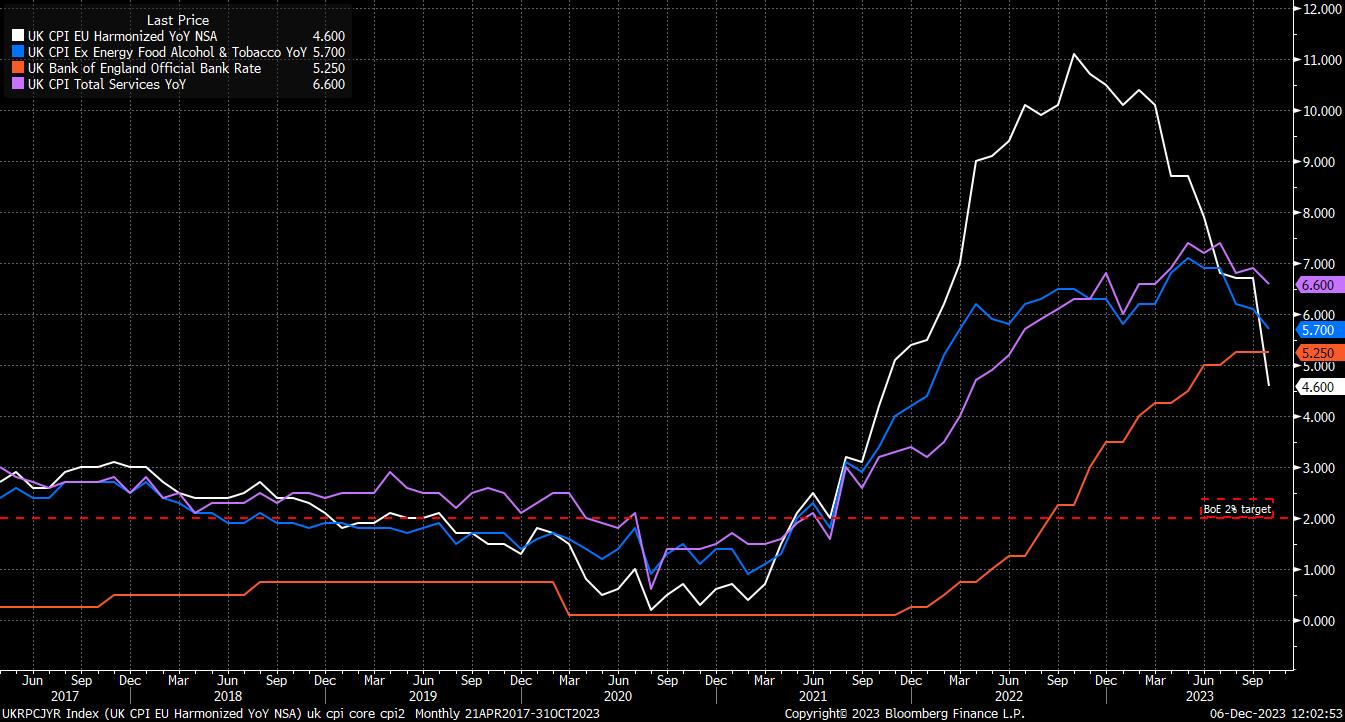

Inflation, for instance, has fallen steeply of late at the headline level, with CPI rising by 4.6% YoY in October, though the substantial drop in this gauge, from 6.7% prior, was driven almost entirely by a combination of a lower energy price cap, along with the base effects of 2022’s commodity price surge.

Hence, policymakers are paying greater attention to other inflation measures, namely the core CPI gauge, which remains close to 6% YoY, albeit some way below the sprint peak, along with services inflation. It is here that few signs of easing price pressures have emerged, with services inflation still running just shy of 7% YoY, and leading indicators pointing to said price pressures persisting for some time to come, somewhat counter-acting the goods disinflation that is now well-embedded.

Continued labour market tightness is clearly contributing to the stickiness of services prices, although one must recall that the employment/unemployment figures remain unreliable, with the ONS continuing to revise the methodology used to calculate the data. As if to epitomise that fact, while the Labour Force Survey pointed to unemployment sitting at 4.2% in both Q2 and Q3, the new ‘experimental’, and supposedly more accurate, survey method pinned unemployment at 3.5%, a level seen just once since the 1970s. Clearly, making policy with such uncertainty is near-impossible, hence the MPC largely ignoring these figures of late.

Earnings data, however, is still considered to be reliable, and remains at an uncomfortably high level for policymakers. Regular pay rose 7.7% YoY in the three months to September, having been above 7% for every month since April, a pace that is clearly incompatible with a return to the 2% inflation aim, and a major factor in the continued persistence of services inflation. The MPC will be hoping that, as the lagged effects of the 515bp of tightening delivered this cycle continue to be felt, the pace of earnings growth will increasingly cool, aiding the disinflation process.

On the subject of lagged effects, the impact of these will of course continue to be felt on growth in coming months, with risks facing the economy continuing to be tilted to the downside. The BoE themselves estimate that only around 50% of the tightening delivered thus far has passed through into the broader economy, with this impact chiefly being concentrated among those remortgaging away from sub-2% fixed rate deals taken out during the pandemic.

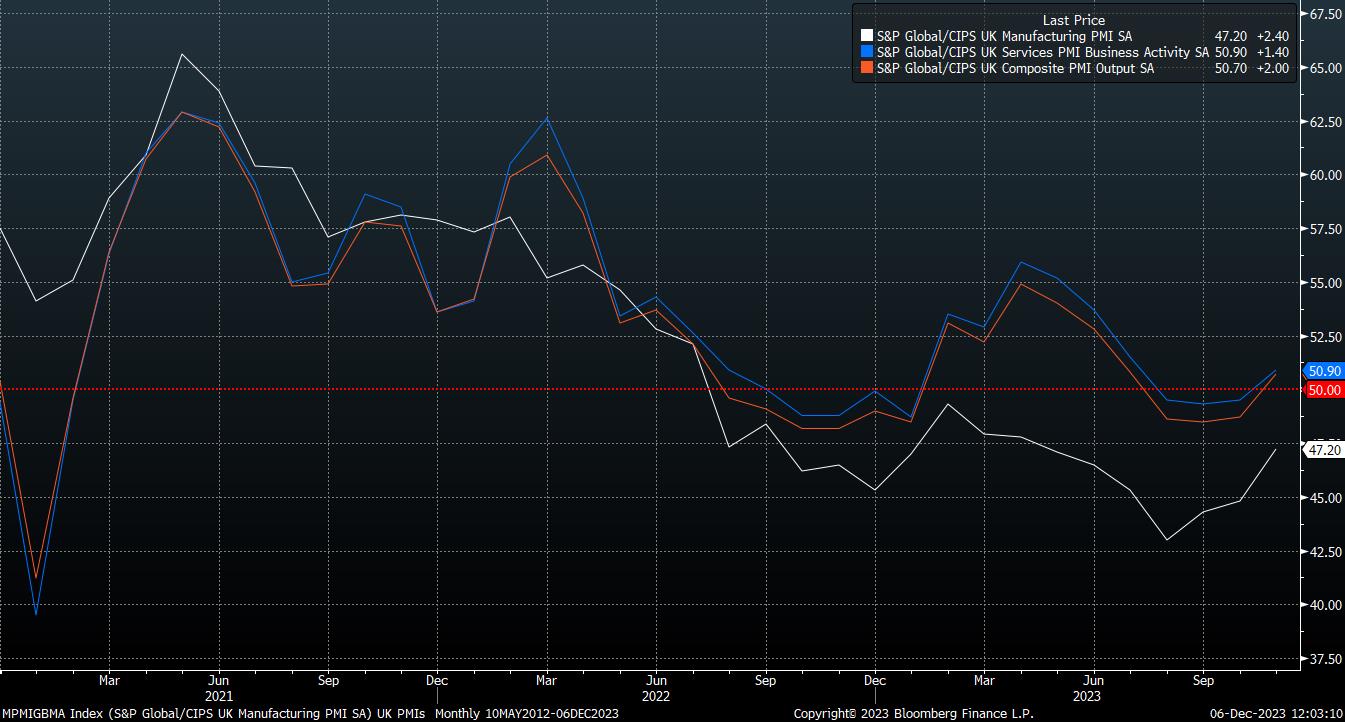

Despite this, there have been some more optimistic signs of late, with the latest round of PMI surveys pointing to a surprising rebound in both the services and composite gauges in November, with the manufacturing sector also contracting at a substantially slower pace. This is likely, however, to prove little more than a short-term blip.

For the GBP, the December BoE meeting is unlikely to be a game-changer, with the chances of any deviation from recent commentary remote, and there being no press conference following the decision.

Instead, focus for the GBP in terms of monetary policy as we move into 2024 will likely revolve around whether the BoE do indeed end up as one of the ‘hawkish outliers’ among G10 central banks, though any GBP strength stemming from this status likely relies on growth continuing to hold up relatively well.

_2023-12-06_12-04-08.jpg)

It is here that traders may need to become more selective over the next year, and perhaps look more closely at FX crosses – EUR/GBP, for instance, should see further downside, below the 85 handle, if the ECB do indeed cut as soon as the first quarter.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.