Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

To frame the Budget, it’s key to note the two ‘fiscal rules’ against which the OBR will score the Budget, and within which the Government must stick. These are:

- To ensure that the debt/GDP ratio is falling in the fifth year of the forecast horizon

- To ensure that borrowing is below 3% of GDP by the fifth year of the OBR’s forecast

In addition to those two formal rules in the fiscal framework, Chancellor Reeves is likely to make some changes to provide a greater degree of fiscal flexibility:

- Mandating that there is no government borrowing to fund “day-to-day spending”

- Exempting flows from the Bank of England’s Asset Purchase Facility from the net debt calculation

- Exempting borrowing made purely for capital investment purchases from the overall net debt measure

Though likely, the aforementioned changes are not guaranteed. However, they are highly likely to be delivered as the Treasury work to deliver a Budget within very tight fiscal constraints.

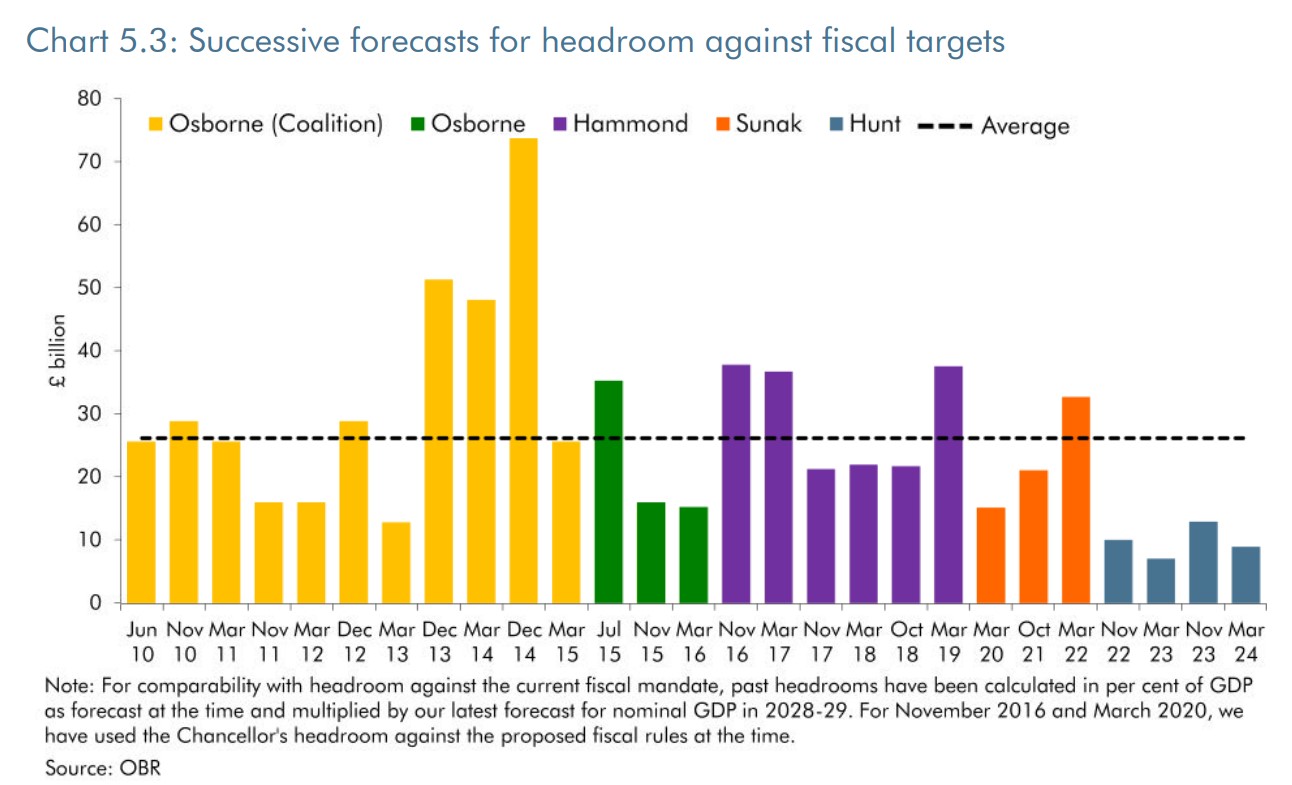

Firstly, there is the limited headroom that already exists compared to the fiscal framework. At the March Budget, headroom – defined as the amount by which fiscal policy can be loosened before fiscal rules are breached – was seen at just under £9bln by the OBR, meagre in the grand scheme of things. While the rolling forward of the forecast horizon has likely raised headroom to nearer £16bln, this is still cutting things far ‘too close for comfort’ for HM Treasury, and very low by historical standards.

Furthermore, there is the not-insignificant matter of the supposed fiscal “black hole”, first brought to public attention in late-July, shortly after the Labour government took office. While estimates of the size of the “black hole” have varied, most believe that this amounts to £22bln – split roughly evenly between in-year overspend compared to previously outlined budgets by government departments; and discretionary spending on public sector pay increases, overseas aid, and such like, made by the new administration since the summer.

A combination of the desire to plug the aforementioned “black hole”, increase the degree of fiscal headroom, and ensure certain ‘protected’ departments (e.g. Health and Defence) receive real-terms spending increases, sees the Chancellor likely seeking to raise up to an additional £40-£45bln in the Budget. This amount is likely to come via a combination of tax hikes, and spending cuts, albeit with a heavy lean towards the former.

On the matter of tax, it is important to recall that the UK’s overall tax burden is already at its highest level in over seven decades, with the OBR – in March – projecting a further increase to a level north of 37% by the end of the prior forecast horizon, which would be the highest in 80 years.

Nevertheless, tax hikes are on the way.

Here, though, the Chancellor is presented with another issue, given the following two pledges made in the recent Labour manifesto:

- Not to increase National Insurance; the “basic, higher, or additional rates” of income tax; or VAT

- To “ensure taxes on working people are kept as low as possible”

Taking into account that the three taxes above sum to approximately 65% of the overall tax take, this again leaves very little room to manoeuvre.

According to pre-Budget media reports, the most significant revenue raiser is likely to be an increase in the National Insurance contributions (NICs) paid by employers, with the Chancellor said to be mulling a 2% increase to employer NICs, as well as the possible axing of an exemption which currently ensures that NICs are not levied on employer pension contributions. A combination of these two measures is likely to raise £10-15bln.

Though the above sounds very technical, the crux of the matter is that such measures would increase the cost of employing, and hiring, workers in the UK. The net result would likely be that businesses either hire fewer workers due to the additional expense, or that pay grows at a slower pace. In other words, this measure would be a huge tax on both businesses, and employees.

Other tax measures are reportedly also under consideration, including:

- Raising the rates of capital gains tax (CGT), possibly to as high as £39bln

- Tweaking inheritance tax (IHT), extending the tax-free giving period from the current 7 years to as much as a decade

- Lowering the stamp duty thresholds for property purchases, to £125k for most buyers, and £300k for first-time buyers (from the current £250k and £425k respectively)

- A potential increase in the tax levied on firms operating in the gambling sector

- An increase in fuel duty, by as much as 5p in every litre sold

- Potential changes to pensions rules, including a lower limit on the amount of tax-free cash that can be withdrawn

- Potential changes to ISA rules, placing a lifetime cap on the amount that can be saved or invested into such accounts

While that is quite a ‘laundry list’ of measures, it is by no means exhaustive. Furthermore, there is a significant risk that many of these measures – particularly on CGT – do not raise the intended revenues, thus leaving the economy liable to further substantial tax hikes later in this Parliament.

In combination with the aforementioned tax hikes, governmental spending is likely to be curtailed. Outside of ‘protected’ departments such as Defence and Health, budgets are likely to see significant real-terms cuts over the forecast horizon. That said, the results of a multi-year Spending Review will not be known until the spring.

That combination – higher taxes, and lower spending – has a name with which we are all sadly very familiar; austerity.

Nevertheless, despite a likely return to those dark days, HM Treasury also seem set to embark on a plan to “borrow to invest”, given the likely fiscal rule change alluded to earlier on. Such a programme of capex is likely to start relatively slowly, but could run to a level as high as £20bln per year by the end of the forecast horizon. Importantly, while said investment might well be exempt from the fiscal rules, it will nonetheless still have a significant impact on market sentiment, and the perception of how the Budget is received.

Speaking of financial markets, the most important consideration for Gilt participants will be the degree of net issuance that results from the Budget announcements.

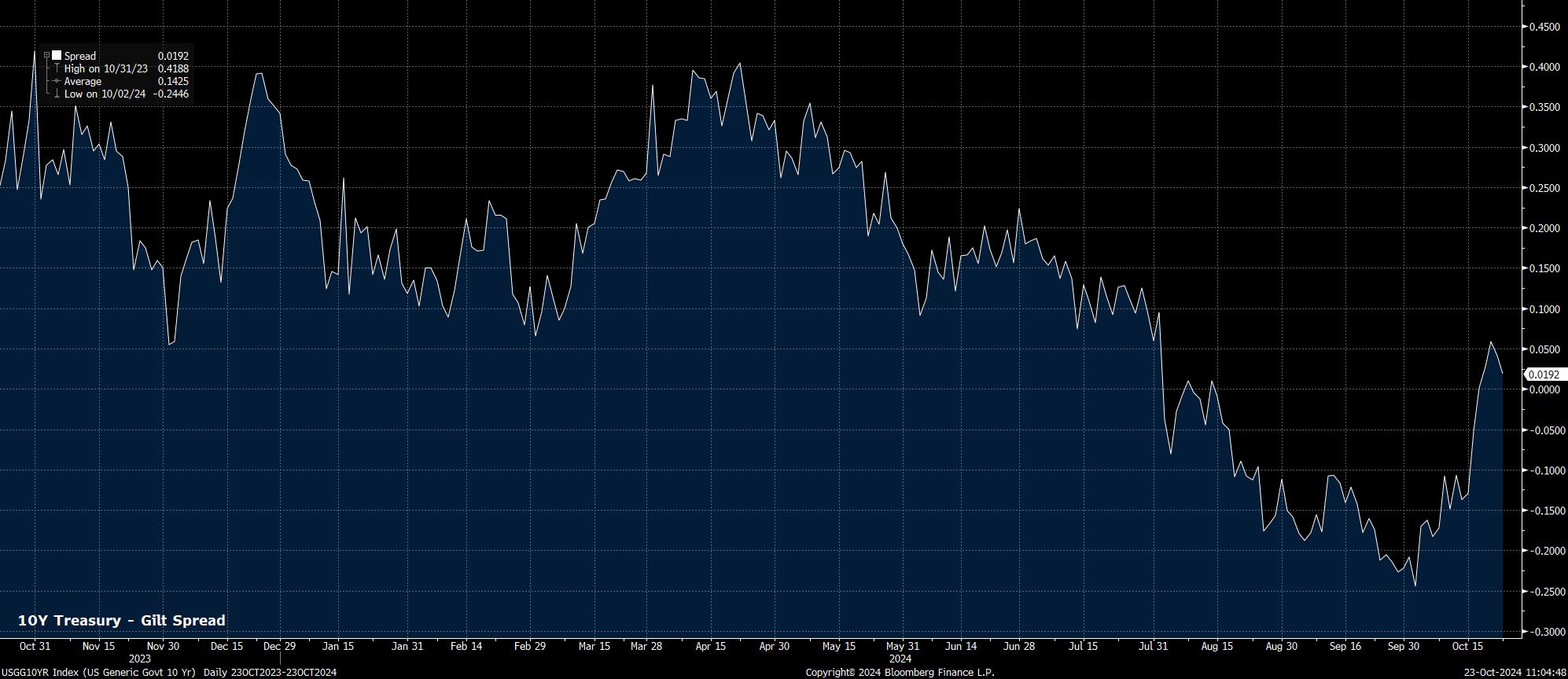

For this year, net issuance is likely to be relatively little changed, perhaps being boosted by around £10bln to approx. £285bln. Beyond this year, though, net issuance is likely to increase significantly compared to the DMO’s most recent round of forecasts, perhaps by as much as £30bln in each remaining year of the forecast horizon. For context, though, this is around half the additional one-year borrowing amount initially required by the Truss Administration after the ill-fated ‘mini-Budget’ 2 years ago.

Still, such a degree of borrowing is a substantial amount of additional supply for markets to absorb, helping to explain the continued widening of the 10-year Gilt-Treasury spread seen in the run up to the Budget. Further downside risks for Gilts remain, given the likelihood that announced fiscal tightening measures prove greater than those already trailed in advance of Budget day.

In the FX space, the pound faces a rather grim mix. Measures announced in the Budget are likely to represent a significant tightening of the overall fiscal stance, significantly raising the risks the economic growth will be choked off, slamming the brakes on the current solid momentum seen so far this year.

Couple this with the BoE’s increasingly dovish stance, with recent soft inflation figures having raised the chances of back-to-back cuts in both November and December, and the headwinds facing the GBP become even stiffer. The path of least resistance seems to lead to the downside for the pound for now, pending – of course – the US election result on 5th November.

_2024-10-23_11-03-42.jpg)

For UK equities, the Budget is likely to do little to see the FTSE 100 break out of the range in which the market has traded since the second quarter. That said, there may well be some sector-specific stories to focus on, with gambling stocks potentially suffering were levies to be raised, and homebuilders likely to suffer as a result off stamp duty tweaks.

_Dail_2024-10-23_11-02-55.jpg)

Overall, while the Budget is unlikely to bring much by way of positivity on its own, there is also likely to be relatively little by way of good fiscal news in the medium-term.

Next spring’s Spending Review will see the fiscal backdrop remain in the headlines for the time being, though that ignores the ‘elephant in the room’. Said elephant is the possibility that the measures announced in Reeves’ first Budget don’t raise the expected revenue, leaving further swingeing spending cuts, and additional tax hikes – possibly including a manifesto breach – on the cards during the remainder of this Parliament.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.