- English

November 2024 US Employment Report – Jobs Growth Rebounds As Unemployment Surprisingly Rises

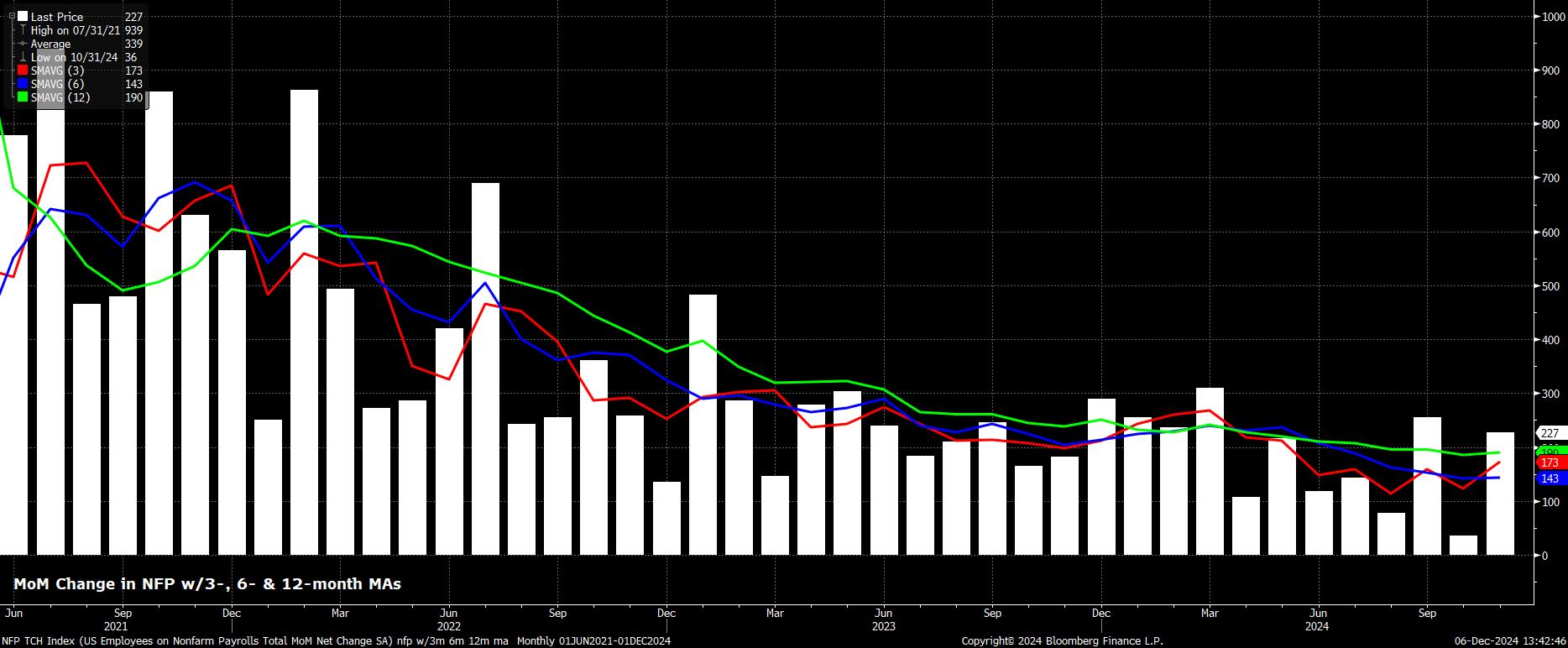

Headline nonfarm payrolls rose by 227k in November, a notable rebound from the dismal pace seen a month prior, and broadly in line with consensus expectations for a +220k increase. Concurrently, the October and September payrolls prints were revised by a net +56k, taking the 3-month average of job gains to +173k, its highest level since May.

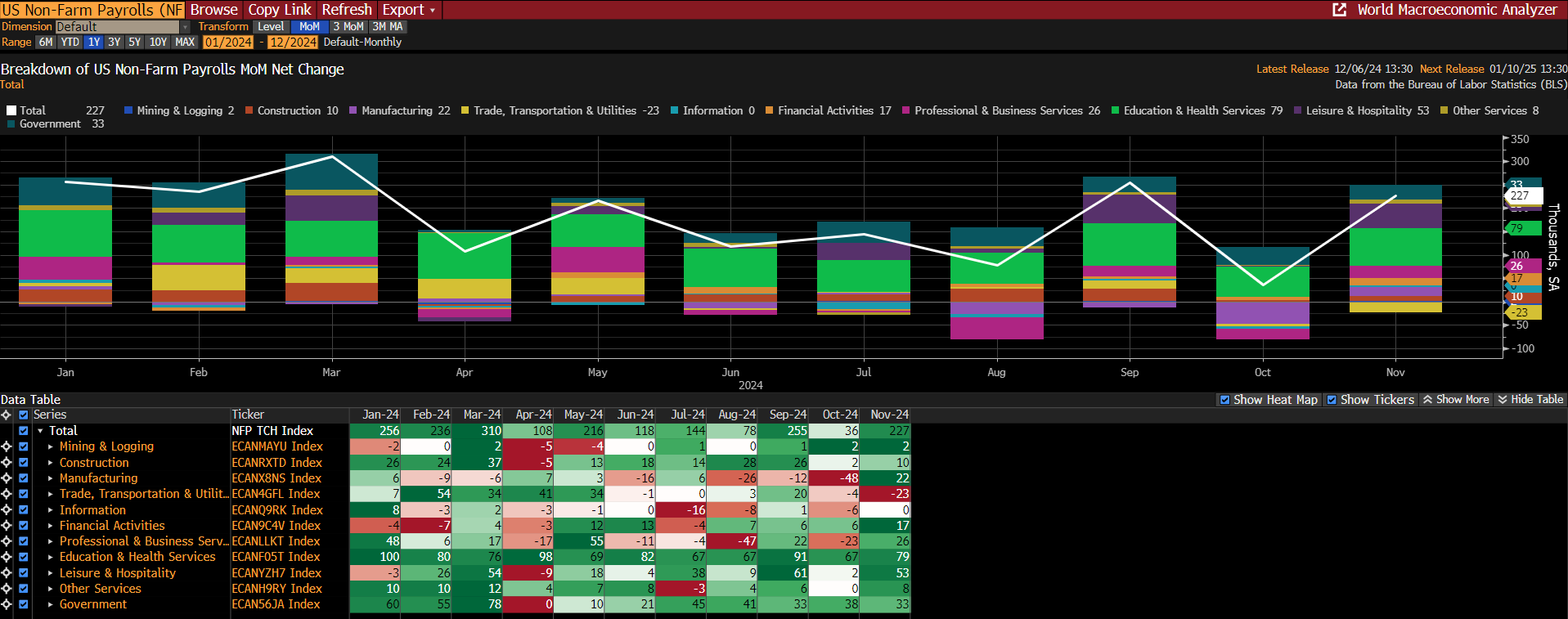

Digging deeper into the jobs report, at a sectoral level, the figures showed job gains being relatively broad-based across the economy. Gains were seen in all sectors besides Trade, Transportation & Utilities, with the biggest upward contributions to the payrolls print once more coming from Education & Health, as well as Leisure & Hospitality.

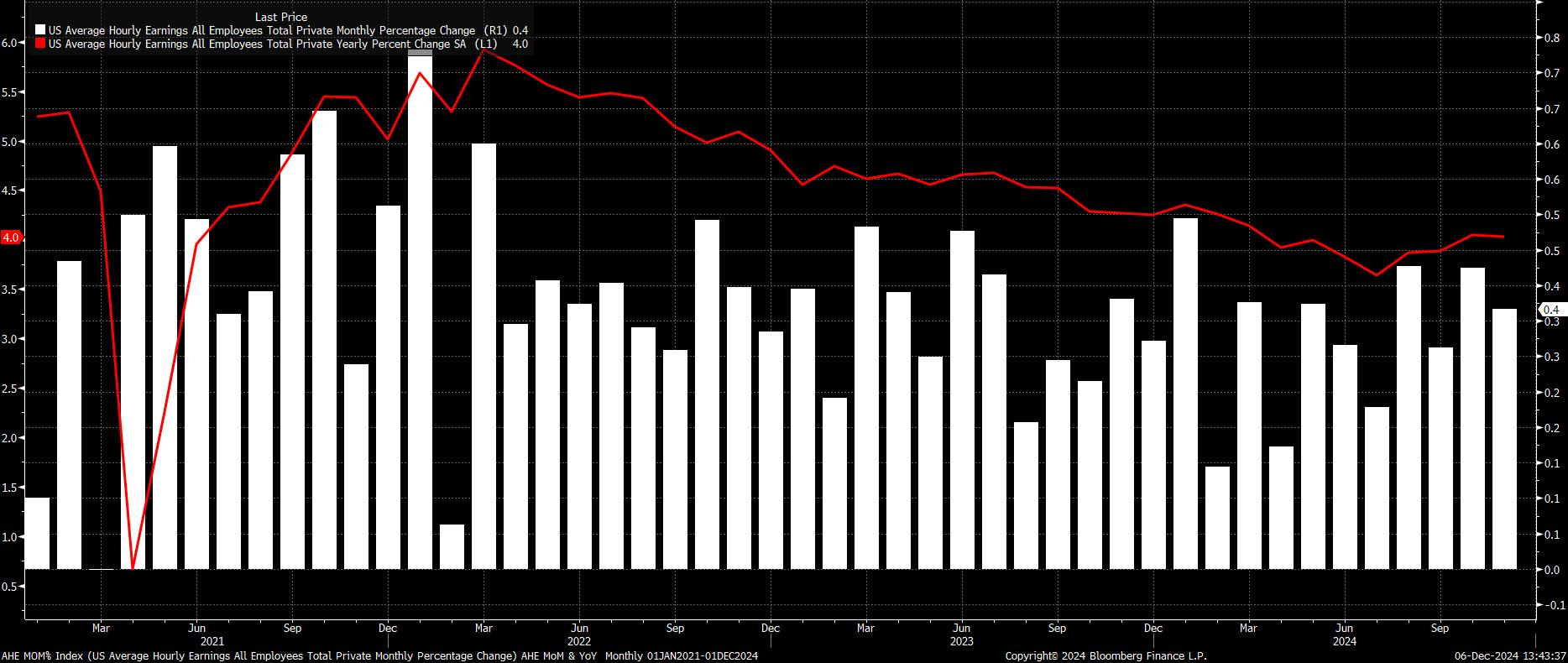

Sticking with the establishment survey, the employment report also pointed to earnings pressures remaining somewhat subdued, though the figures were just a touch hotter than expected. Average hourly earnings rose 0.4% MoM, and 4.0% YoY, with both metrics unchanged from the pace seen in October.

While still a little warm, this is a pace of earnings growth that remains broadly compatible with a sustainable return towards the 2% inflation target over the medium term. As a result, earnings are likely to remain of relatively little concern to FOMC policymakers, who continue to possess sufficient confidence in inflation returning to target, and hence should continue to normalise policy at this year’s final meeting, in December.

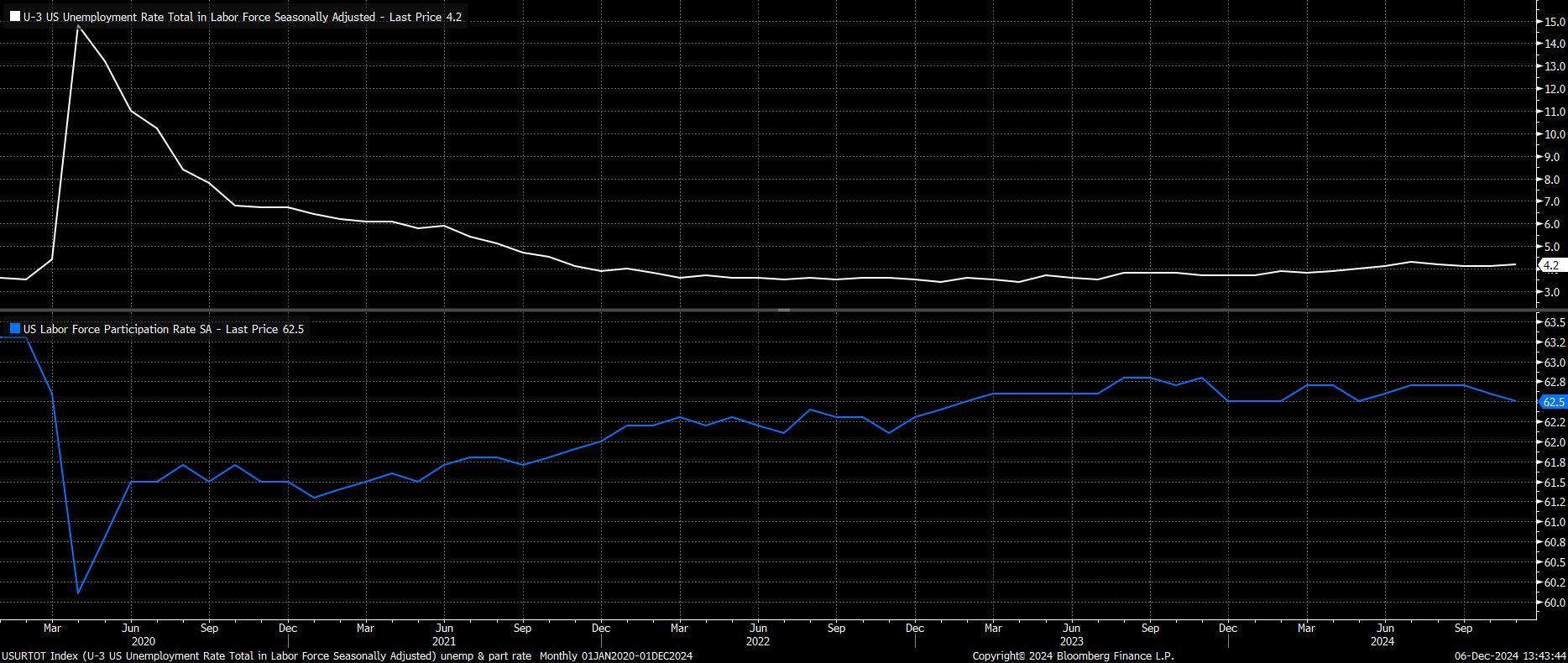

Meanwhile, turning to the household survey, unemployment unexpectedly rose to 4.2% last month, inching back towards the cycle high 4.3% level seen in July. This rise in unemployment, worrying, was accompanied by a fall in the labour force participation rate, which now stands at 62.5%, its lowest level since May.

A health warning, however, is needed here, given the volatile nature of the HH survey in recent months, which has struggled to account for the changing composition of the US labour market, particularly the potential impacts of immigration.

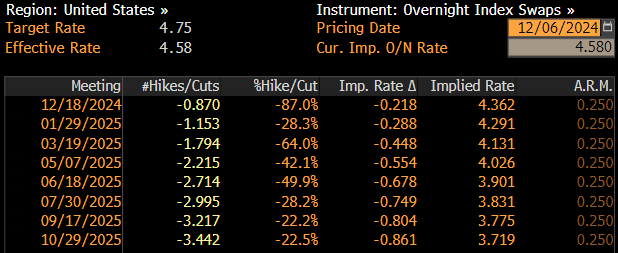

In reaction to the jobs report, money market expectations for a December cut have solidified. Per the USD OIS curve, pricing now implies around an 85% chance that the FOMC will deliver a 25bp cut at the final meeting of the year, up from around 68% pre-release. Looking further out, an additional 4bp of easing has been priced into the January 2025 meeting, while a total of 85bp of cuts is now discounted by next October, compared to just over 77bp pre-NFP.

For markets more broadly, the jobs report came at a tricky juncture, with many participants having already shut up shop for the year, resulting in thinner liquidity, and lighter volumes, than is typically seen.

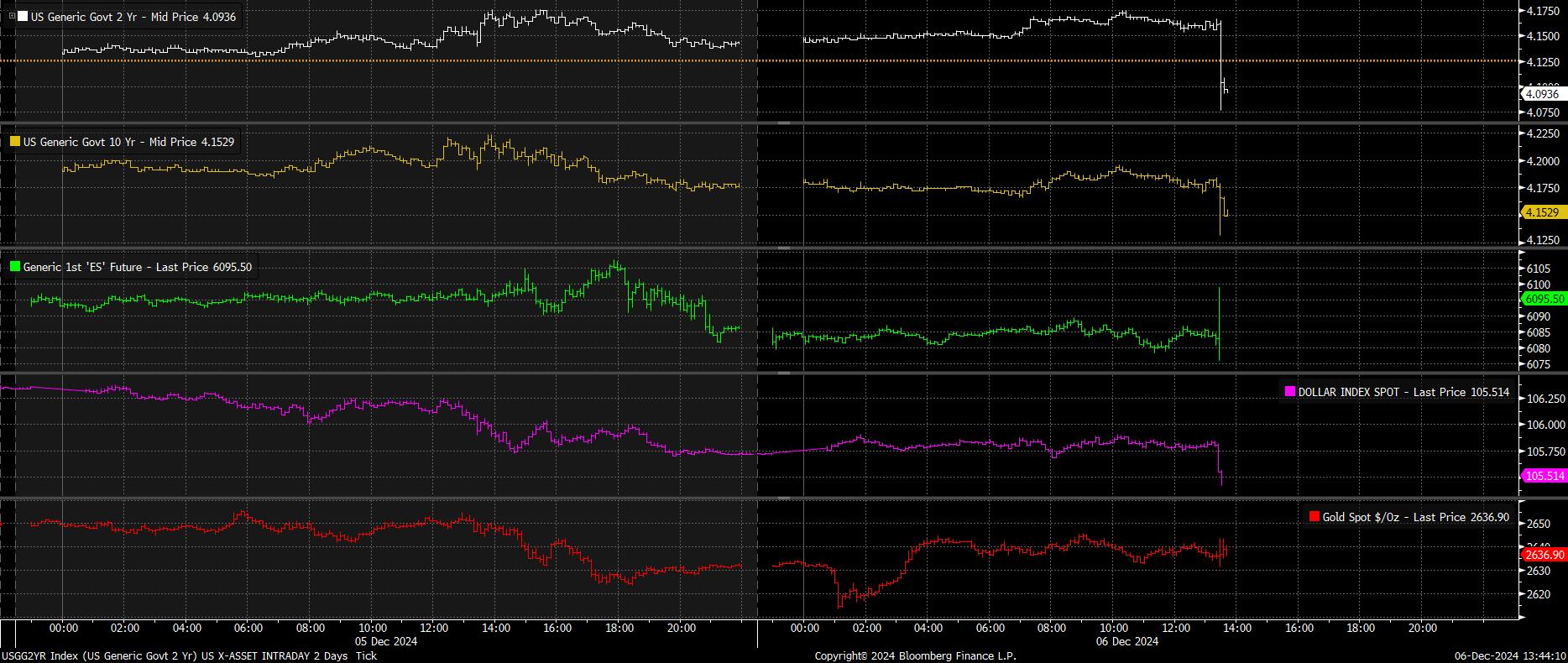

Nevertheless, a dovish cross-asset reaction did ensue, albeit to a very limited extend. Treasuries rallied across the curve, led by the front-end, with 2-year yields falling 6bp to 4.10% as the payrolls print crossed news wires, hitting day lows, with 10- and 30-year yields also sliding, albeit to a lesser degree.

Elsewhere, stocks ticked to fresh day highs, as the front S&P future rallied towards the 6,100 handle, in a move symbolic of the market focusing on the potential dovish policy implications of a soft unemployment print, as opposed to focusing on the macroeconomic picture painted by the data. The dollar, meanwhile, softened to fresh lows at 105.40, allowing the EUR to reclaim the 1.06 figure, and cable to climb back above 1.28.

Taking a step back, my base case remains that the FOMC will still deliver a 25bp cut later this month, continuing to normalise the monetary policy stance, as the labour market also continues to normalise. Naturally, the Committee will seek not to over-react to a single data point, particularly when incoming figures remain skewed by a number of one-off factors, though the modest rise in unemployment will embolden some of the Committee's doves for now.

That said, if the current degree of labour market resilience persists into 2025, the employment situation could force the FOMC into a slower pace of policy normalisation, particularly as risks around the inflation outlook become increasingly two-sided, amid the incoming Trump Administration's tariff plans, and likely delivery of further tax cuts.

Though the FOMC, clearly, are unable to react to policy rumours at this stage, next year will likely see significantly more uncertainty introduced to both the monetary and fiscal outlooks. A ‘skip’ at the January meeting remains a distinct possibility.

Consequently, with a renewed hawkish risk introduced to the rate path, the ‘policy put’ that has been in place over the last 18 months is set to become considerably less forceful. Hence, the market’s ‘comfort blanket’ – the prospect of deeper, or faster, rate cuts – likely won’t be present to the same extent next year.

Hence, while strong earnings and economic growth should continue to paint a positive backdrop for risk, and see the path of least resistance still leading to the upside, said path is likely to be somewhat bumpier, and considerably more volatile, than that seen over the last year or so.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.