Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

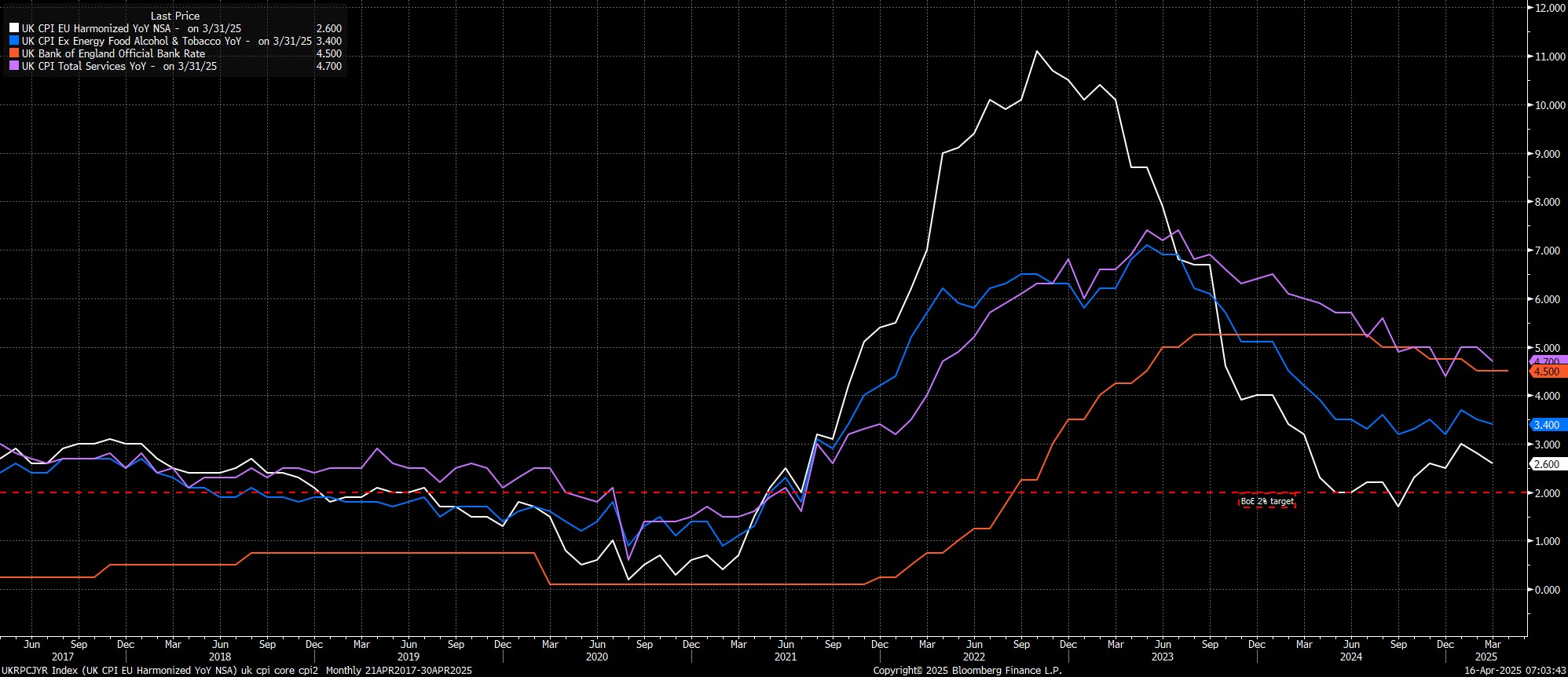

Headline prices rose 2.6% YoY last month, cooler than both market expectations, and the BoE's forecasts. Meanwhile, excluding food and energy, core CPI rose by 3.4% YoY over the same period, while the closely watched services CPI metric rose 4.7% YoY, also cooler than the Bank's expectations, and the lowest level so far this year.

This latter print is of particular importance, given the Bank of England's well-telegraphed focus on the risks of inflation persistence, and ongoing concern, particularly among the MPC's hawks, over the potential of stubborn price pressures becoming embedded within the UK economy. Concerns which may now begin to subside, though the trend in data is of course more important than just a single print.

On the whole, though, today's figures do little to materially shift the policy outlook for the 'Old Lady'. A 25bp cut at the next meeting, on 8th May, remains pretty much a certainty, though the pace of easing beyond then is likely to remain relatively gradual, with further cuts likely to be delivered on a quarterly basis, particularly with headline inflation still on a trajectory towards the 4% mark during the summer.

Nevertheless, risks to this outlook tilt firmly in a more dovish direction, amid mounting downside growth risks, stemming primarily from the tariffs imposed by President Trump. Were policymakers to become increasingly confident that those risks of inflation persistence had abated to a sufficient degree, a more rapid pace of policy normalisation could be on the table, though the bar for the Bank to deliver cuts at consecutive meetings still seems to be a relatively high one for the time being.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.