- English

Headline CPI rose 2.7% YoY last month, a touch hotter than consensus expectations, and the fastest rate since February. Meanwhile, underlying inflation also accelerated in June, with core prices rising 2.9% YoY, and ‘supercore’ inflation (aka core services less housing) rising by 3.0% YoY.

On an MoM basis, price pressures also intensified. Headline prices rose 0.3% MoM, while core prices rose by 0.2% MoM, the latter being a touch softer than expected, but both prints providing further evidence that the inflationary effects of the Trump Admin’s tariff policies are beginning to be passed on in the form of higher prices.

Annualising those MoM prints produces the following figures, and helps to provide a clearer picture of underlying inflationary trends:

- 3-month annualised CPI: 2.4% (prior 1.0%)

- 6-month annualised CPI: 2.5% (prior 2.6%)

- 3-month annualised core CPI: 2.4% (prior 1.7%)

- 6-month annualised core CPI: 2.7% (prior 2.6%)

Another useful way to gleam further information on the broader inflationary backdrop, particularly when it comes to gauging the impact that tariffs are having on price pressures, is to dig deeper than the headline metrics, and to separate the goods and services components of the data.

Here, core goods inflation quickened to 0.7% YoY, the fastest pace in almost two years, and a clear sign of tariff costs are beginning to be passed onto consumers. Concerningly, core services inflation also quickened a touch, to 3.6% YoY, raising the risks of persistent price pressures becoming embedded within the economy.

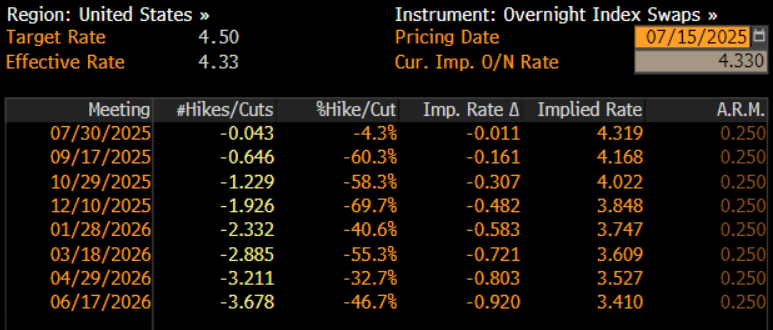

In reaction to the data, money markets were pretty much unmoved. As such, the USD OIS curve continues to price next-to-no chance of any action at the June meeting, while also still fully pricing the next 25bp cut by October, and discounting just under 50bp of easing by year-end.

Stepping back, the latest inflation figures reinforce the FOMC’s ‘wait and see’ stance on monetary policy, as policymakers continue to stand pat, amid the significant degree of uncertainty that continues to cloud the economic outlook.

The path to two 25bp cuts this year, as outlined in the June ‘dots’ is a relatively narrow one, requiring not only that price pressures remain contained over the summer, but also that the FOMC are content to forecast disinflation in the September SEP, in order to unlock a cut at that meeting. Both of those, for now, seem unlikely. Hence, my base case remains that just one such rate reduction is likely to be delivered this year, most likely at the December confab.

While such a cautious path of easing remains the most appropriate one, especially given the resilient nature of the labour market, it is nevertheless likely to come much to the chagrin of President Trump. Calls for sizeable rate cuts from the Oval Office are unlikely to cease anytime soon, while Trump and his acolytes are likely to continue to pressure Powell to leave his post early.

Thankfully, the FOMC appear determined to stand firm against these threats to monetary policy independence, setting rates objectively, based on the data in front of them. Right now, that data points to little if any need to lower rates, with inflation risks firmly tilted to the upside in the short-term.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.