- English

January 2024 ECB Review: Rate Outlook Hints Thin On The Ground

The policy statement accompanying the rate decision was, for all intents and purposes, a ‘copy and paste’ from that delivered at the December meeting. The Governing Council reiterated the prior language and timing for PEPP purchases/reinvestments; repeated the prior language relating to “forceful transmission” of monetary policy; repeated the prior guidance of the need to keep policy sufficiently restrictive for a sufficiently long time; and, repeated the desire to follow a data-dependent policy approach.

In many ways this repetition of the prior statement provides a good illustration of exactly what this ECB meeting was – something of a placeholder between the PEPP tweak and forecast round in December, and the March meeting whereby greater information will be known on wage negotiations across the bloc, and when another round of staff macroeconomic projections will be produced.

Market participants, therefore, looked to President Lagarde’s post-decision press conference for any hints on the policy outlook, given that said hints were incredibly thin on the ground.

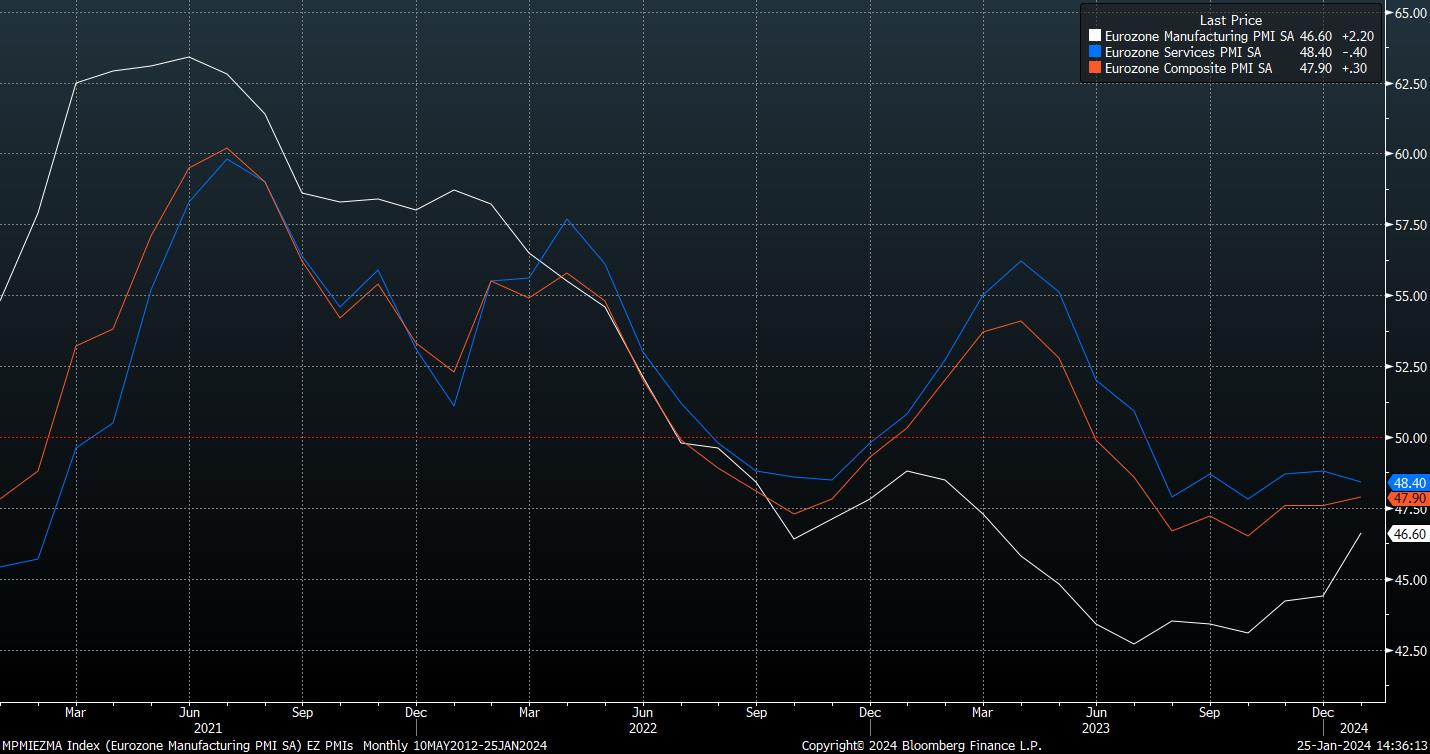

At the press conference, Lagarde also stuck largely to a now all-too-familiar script, noting that the overall trend of declining inflation has continued, and that risks to the growth outlook remain to the downside. Given this week’s ‘flash’ PMI figures, it would have been difficult for Lagarde to justify saying anything different on either of these points.

Nevertheless, the ‘Q&A’ part of the presser was marginally more interesting, not least owing to the revelation that there was a consensus among Governing Council that it was premature to discuss rate cuts at this meeting. While interesting, however, this thinking was broadly in line with remarks given by almost all ECB speakers who have stood in front of a microphone this year, and hence shouldn’t have come as too significant a surprise.

Speaking of microphones, Lagarde noted that she ‘stood by’ comments made in Davos last week, that a rate cut could come in the summer – this was followed by a rather moot debate as to when exactly summer begins (is it June or July?), followed by an incredibly long-winded and rambling answer to a question on earnings growth and its relation to inflationary pressures. Suffice to say, neither added particularly much value, nor significantly moved the needle significantly in terms of market rate pricing.

EUR OIS has repriced in a marginally more dovish direction – with 20bp of cuts now priced by April, compared to 16bp pre-meeting, followed by almost 50bp of easing being implied by June, and 139bp of cuts priced by year-end, the latter being around 9bp more than before the decision dropped.

This dovish repricing, perhaps, was sparked by the lack of explicit pushback on market rate pricing, likely spurred by Lagarde’s reluctance to ‘elaborate further’ on the triggers for, and the timing of, an eventual rate reduction.

On the whole, though, we learnt little by way of new information at the January ECB – either from the rate decision itself, the policy statement, or the press conference. Besides, that is, a rather bizarre remark from Lagarde that we ‘shouldn’t pay too much attention’ to changes in the policy statement; which rather begs the question as to why bother publishing one in the first place.

In any case, given the lack of incremental news or developments, resultant market moves – modest EUR downside, a notable rally at the front-end of the German curve, and some small European equity upside – during the event, likely stemmed from a combination of position unwinds, as well as a reaction to significantly stronger than expected US GDP figures – pointing to 3.3% growth in the fourth quarter.

_4_Days_T_2024-01-25_14-35-45.jpg)

Overall, the January ECB decision was an intermediate one. No significant new information was provided, no new guidance was forthcoming, and the assessment of the economic outlook remains largely unchanged. Hence, we remain in something of a ‘wait and see’ mode, with policymakers still requiring further data before being comfortable in making a more explicit dovish pivot, and eventually pulling the trigger on rate cuts.

Said pivot may come as soon as the next meeting in March, along with the next forecast round, followed by a cut a meeting or two after that. In the meantime, the EUR seems unlikely to strengthen significantly, particularly with downside growth risks remaining significant, and any further escalation in geopolitical tensions in the Red Sea likely to hit the bloc relatively harder than G10 peers.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.