- English

Economic Recovery in Mexico Unable to Support the Mexican Peso

This favorable GDP performance demonstrates relative economic resilience in a challenging environment. Annually, GDP grew by 1.5%, with cumulative growth from January to September 2024 reaching 1.7%. However, these results, although encouraging, have not been sufficient to boost the Mexican peso, which continues to depreciate against the U.S. dollar due to a combination of internal and external factors.

External Factors and Market Risk Aversion

The strength of the dollar is one of the main obstacles for the peso. Today, the U.S. economy reported an annualized growth of 2.8% in the third quarter, slightly below the 3% expectation but with robust consumer spending, the highest since early 2023. This increase in consumption, a cornerstone of the U.S. economy, was well-received by investors and has sustained demand for the dollar. Additionally, investors’ preference for safe-haven assets and market risk aversion today have adversely impacted major emerging market currencies, including the Mexican peso.

Another factor capturing market attention is the growing political uncertainty in the United States. With the 2024 presidential election approaching and the possibility of former President Donald Trump’s re-election, what is known as the “Trump Trade” has resurfaced, driving demand for the dollar.

Impact on the Peso and Short-Term Outlook

As these factors gain prominence, the Mexican peso is losing the key psychological level of 20 pesos per dollar today, reflecting pressure from the international context and domestic concerns. In the short term, attention is on the upcoming U.S. employment data, which could further influence perceptions of the U.S. economy and, in turn, dollar strength.

Looking ahead, the U.S. presidential election represents a high-volatility factor for the Mexican peso. If Donald Trump were to return to the presidency, the MXN could face additional depreciation, targeting around 22 pesos per dollar. This potential weakness reflects market expectations surrounding increased protectionist policies and a tougher stance on foreign policy, which could reshape capital flows to and from emerging economies like Mexico.

Technical Analysis USD/MXN

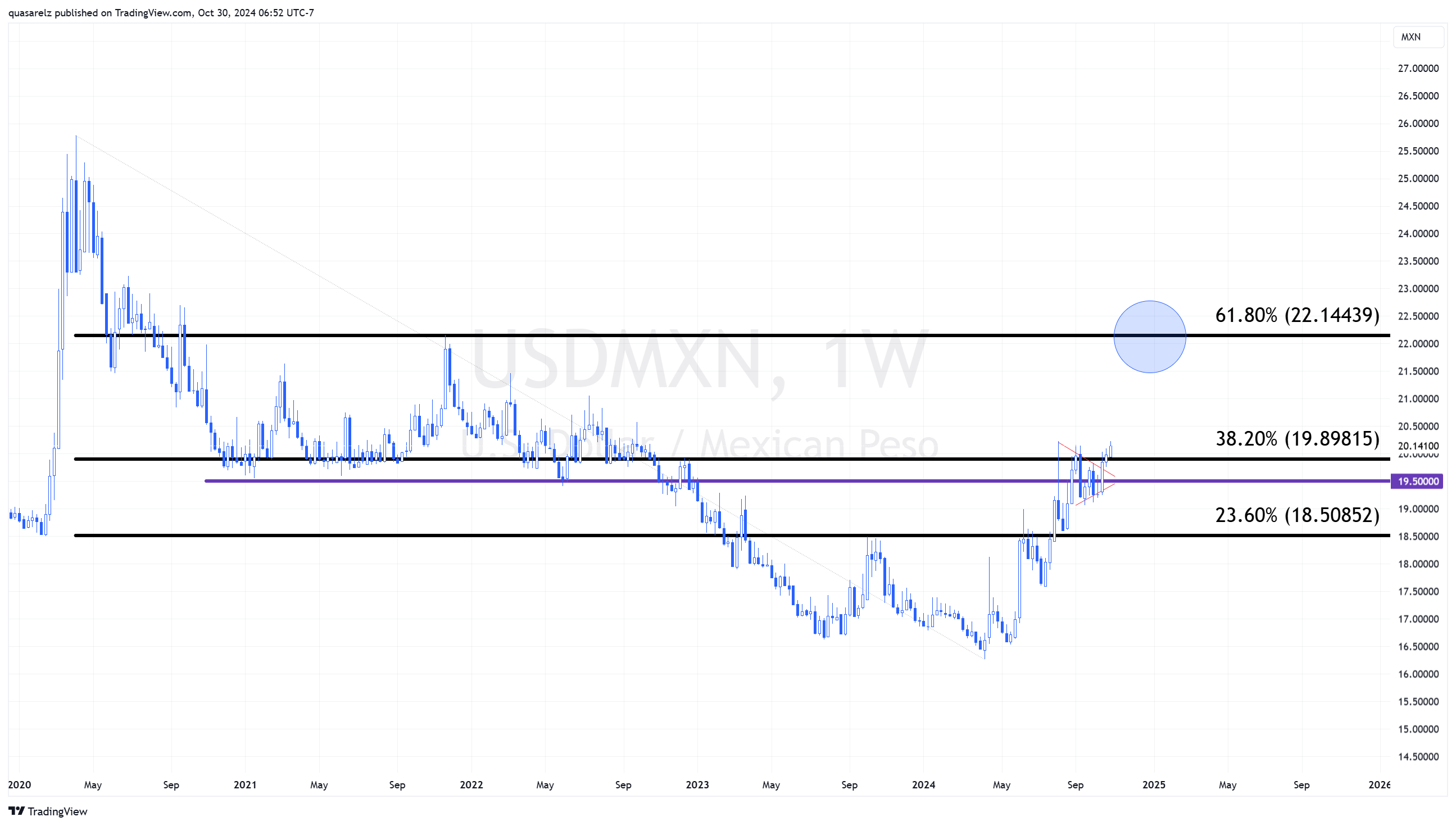

Weekly USD/MXN Chart

The weekly chart for USD/MXN presents an intriguing outlook, with the pair breaking through the confluence resistance area around the 19.89 level, corresponding to the 38.2% Fibonacci retracement, and the key psychological level of 20 pesos per dollar. This area, reinforced by its technical and psychological significance, has previously halted the peso’s advances multiple times, acting as a significant short-term barrier. A sustained break above this threshold could pave the way toward the 61.8% level at 22.14, signaling a potential shift toward further peso depreciation.

In the current context and with the U.S. presidential election approaching, the “Trump Trade” could play a decisive role, favoring the dollar. Consolidation above 20 pesos would reinforce expectations of additional appreciation for the U.S. currency.

Conclusion

The recent economic growth provides a reprieve for the Mexican economy, which had shown anemic performance over several previous quarters. However, the international environment and political dynamics in the United States pose a significant challenge for the Mexican currency. The coming weeks, marked by electoral uncertainty and key economic data, will be decisive for the peso’s future. Thus, despite its progress, the Mexican economy may face a challenging context in which dollar strength and changes in the global landscape continue to pressure the MXN.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.