Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

WHERE WE STAND – I guess I best start with the July jobs report.

Was it a dismal report? Yes. Was it a disaster? No. Is the labour market dead & buried? Also, no.

As the old adage goes, one swallow doesn’t make a summer. To butcher that slightly, one downbeat jobs report doesn’t make a recession, either.

That said, it is tough to find any positives from the employment report. Payrolls rose just +73k last month, bad enough on its own, but even worse when you chuck in the huge net -258k revision to the prior two prints. That takes the 3-month average of job gains to a meagre +35k, less than half the ‘breakeven’ pace. Earnings, meanwhile, rose 0.3% on the month, in line with expectations, though the annual rate ticked higher to 3.9% YoY. In the household survey, unemployment rose to 4.2%, as expected, though participation fell to cycle lows at 62.2%, likely again dragged lower by tighter immigration enforcement.

I guess the biggest takeaway from all that is the net revision. We’ve all seen poor NFP prints in the past, that we can explain away as a ‘one-off’, but such a chunky net downward revision suggests that this could well be a more pronounced weakening in labour market conditions that is underway. Still, the FOMC rightly will not over-react to the report, especially with inflation risks still tilted firmly to the upside, and with another set of employment figures due before the September meeting in any case.

The bigger issue for the FOMC, though, is that the labour market is not being inhibited by financial conditions being too tight, or by the cost of credit being too high. Instead, it is quite obviously trade-related uncertainties that have created this crippling inertia that we are now seeing borne out in the data. Really, the FOMC could cut the fed funds rate as much as they wanted to, but unless and until that uncertainty lifts, it’s tough to imagine a dramatic labour market turnaround being on the cards. For now, I stick with my base case of just one 25bp cut this year, especially with consensus on the FOMC still viewing inflation as being further from target than the employment side of the dual mandate. Market pricing of 61bp easing by year-end feels very toppy indeed.

Speaking of the FOMC, there’s also now the question of what happens next with the vacancy resulting from Governor Kugler’s surprise late-Friday resignation. The natural assumption here is that Trump will fill the spot not only with a ‘yes man’ (or woman), but also with someone who he envisages could step up to the Chair role next May. Whoever gets the job, this likely means that there will be at least three votes for rate cuts on the Fed Board whenever Kugler’s replacement takes their seat. Monetary policy independence continues to be eroded at a rate of knots.

Besides rate cuts, which he’s still calling for, President Trump’s apparent other solution to fix the labour market, is to fire the Commissioner of Labor Statistics at the BLS. Proper banana republic stuff here and, if we carry on down this sort of a path, there is nowhere near enough risk premium priced into either the USD or USTs. The ‘Land of the Free’ feels more like a ‘Banana Republic’ right now.

Unsurprisingly, all of this, coupled with the imposition of sizeable tariffs on countries that were unable to negotiate a ‘deal’ with the US, sparked a distinctly risk-off vibe to end the week.

Stocks slumped across the board, with the S&P having its worst day since May, while Treasuries rallied hard across the curve, led by the front-end, as gold vaulted higher on haven demand, and the dollar slumped against all major peers, seeing the DXY end the week under the 99 figure.

Naturally, given the way in which the landscape has shifted so dramatically over the last trading day or so, I need to re-assess my tactical equity bull case.

The first leg of that, namely progress towards trade deals and calmer heads prevailing, is looking somewhat shaky. ‘TACO time’ didn’t arrive on Friday, as Trump followed through on his tariff threats, while we still remain in the dark as to whether the China trade truce, expiring 12 August, will be extended. The second leg, a solid underlying economy, is also looking rather perilous, given the jobs data out on Friday, and the logical extrapolation that a weaker labour market could lead to a pullback in consumer spending in the coming months, especially if trade uncertainty persists. Though the final leg of my bull case, solid earnings growth, continues to ring true, one wonders how long that can remain the case, if the economy does indeed begin to falter.

As such, and when considering the typically poor seasonality at this time of year, my conviction in further equity gains in the short-term has diminished, even if the longer-run path of least resistance continues to lead to the upside. Sentiment is likely to continue to face headwinds for now, unless and until the narrative on either trade, or the economy, flips once again.

Ordinarily, I’d argue that that sort of environment would be bullish Treasuries and, at the front-end, it probably will be. The net result though is likely to be a steepening of the curve, as Trump’s ongoing attacks on the economic institutions of the United States create ongoing investor jitters. Benchmark 10s and 30s slipped towards the tighter end of recent trading bands on Friday, at 4.20% and 4.80% respectively, and I wouldn’t be surprised to see those moves reverse course this week.

The same, in my mind, goes for the dollar. Friday’s sell-off looks to have killed the short squeeze-ish relief rally for the time being, with not only jitters over the health of the US economy, but also a dovish repricing of policy expectations, and the erosion of policy independence exerting pressure too. While I’m not exactly uber-bullish on the prospects of economies elsewhere, least of all here in the UK, all of that will probably see capital outflows from the USD accelerate once more, likely most significantly benefitting the EUR.

Gold should also start to shine once more in this sort of an environment, with a move in spot back above $3,400/oz probably putting a rally back towards record highs on the cards.

LOOK AHEAD – After the week that we’ve just had, I’m loath to try and predict what the next few trading days may hold. I suppose it depends on which way the wind is blowing in Washington DC, and which side of the bed Donald gets out of each morning.

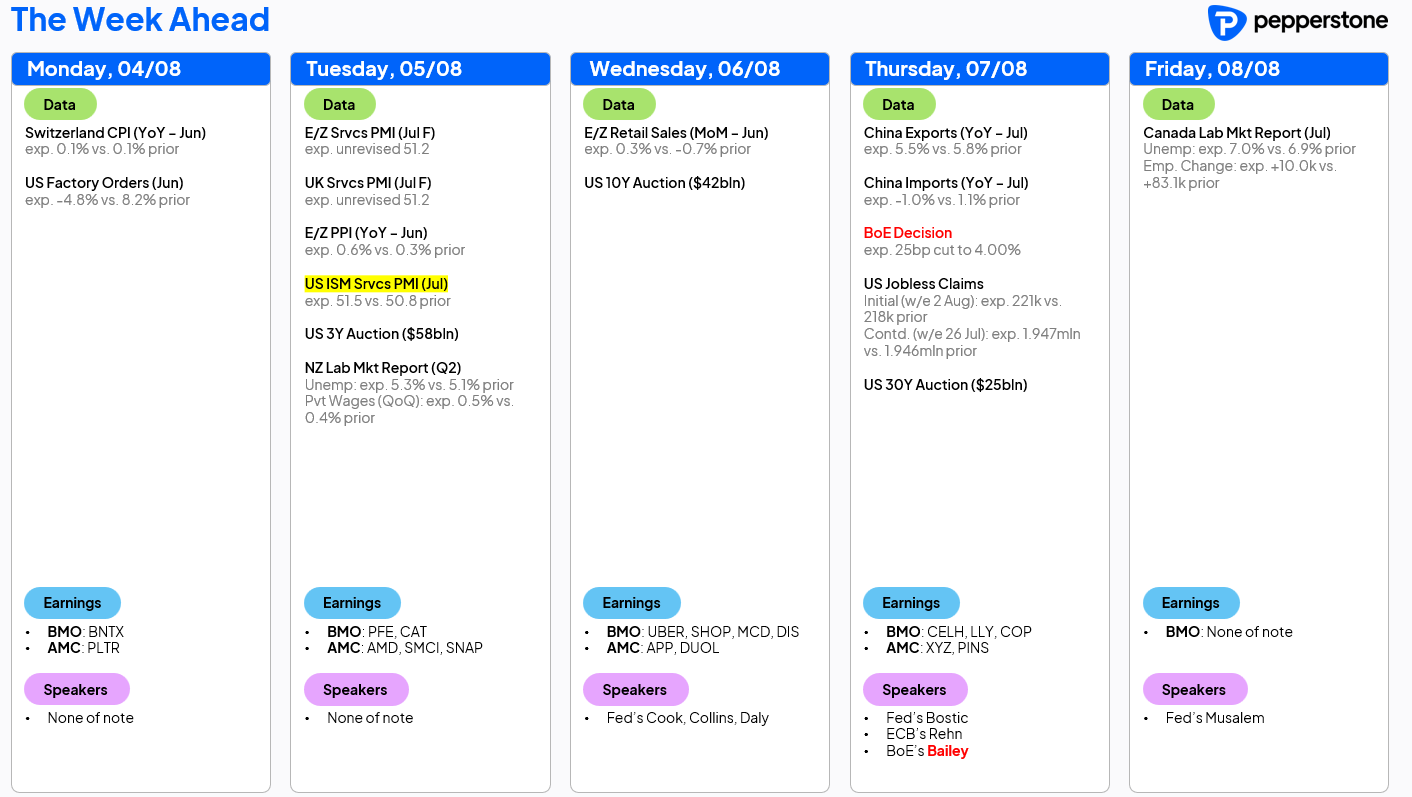

Anyway, in terms of scheduled events, the docket is rather lighter this week. The latest ISM services figures stand as the most obvious highlight, particularly amid the question marks that now linger over the state of the US economy, in the aftermath of Friday’s jobs report. Expect any softness here to be spark a continuation of the defensive trade that we saw as last week came to a conclusion. Elsewhere, the weekly jobless claims stats will also attract extra attention in light of the dismal NFP print, while jobs data is also due from New Zealand and Canada this week.

On the policy front, the Bank of England are set to deliver their third 25bp cut of the year on Thursday, lowering Bank Rate to 4.00%. That decision, though, will again come amid a bitterly divided MPC, with external member Dhingra likely to dissent in favour of a larger 50bp reduction, and external member Mann potentially favouring holding rates steady. In any case, the MPC will again reiterate a ‘gradual and careful’ approach to policy easing, while the Bank’s latest projections will probably nudge near-term inflation forecasts higher, and growth expectations lower.

Besides that, a chunky week of Treasury supply lies ahead, with 3-, 10- and 30-year auctions scheduled. Earnings season, on Wall Street, also continues, even if we’re now into the dregs of corporate reports, with the next most notable report not coming until we hear from Nvidia (NVDA) at the end of the month.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.