Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Headline CPI rose 2.9% YoY in December, a further acceleration from the rate seen in November, and the fastest such pace since July. Concurrently, core prices rose 3.2% YoY, a touch cooler than the pace seen a month prior, and the slowest rate since last August, pointing to some degree of underlying price pressures beginning to fade.

Meanwhile, on an MoM basis, where figures are less distorted by base effects from last year, headline inflation rose 0.4% MoM, while core prices rose 0.2% MoM, the latter also being a touch softer than market expectations.

Annualising these metrics helps to provide a clearer picture of underlying inflationary trends, which is unlikely to make for particularly happy reading for FOMC officials:

- 3-month annualised CPI: 3.9% (prior 3.0%)

- 6-month annualised CPI: 3.0% (prior 2.1%)

- 3-month annualised core CPI: 2.9% (prior 3.7%)

- 6-month annualised core CPI: 3.2% (prior 2.9%)

While FOMC officials have already taken 100bp worth of steps towards normalising policy, data of this ilk points to the disinflationary path continuing to be a relatively bumpy one, thus leading to policymakers proceeding in much more cautious fashion this year.

Taking a deeper look into the figures, the data showed further disinflationary progress being made in the services sector, with core services inflation falling to 4.4%, its lowest level since 2022. Core goods prices, however, while still in outright deflationary territory, have now bottomed out, with upside risk notable here amid President-elect Trump’s potential tariff plans.

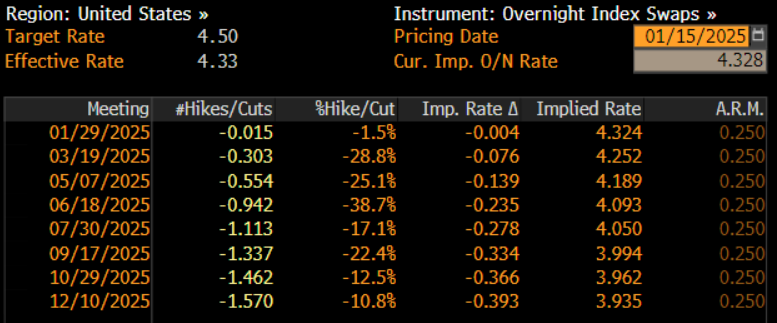

Speaking of the FOMC, the December CPI figures resulted in a notable dovish repricing of market rate expectations, by virtue of the cooler than expected core figures. The USD OIS curve, hence, now fully prices the first 25bp cut for July, from September previously, while seeing around 39bp of easing in total by year-end, up from around 32bp pre-release.

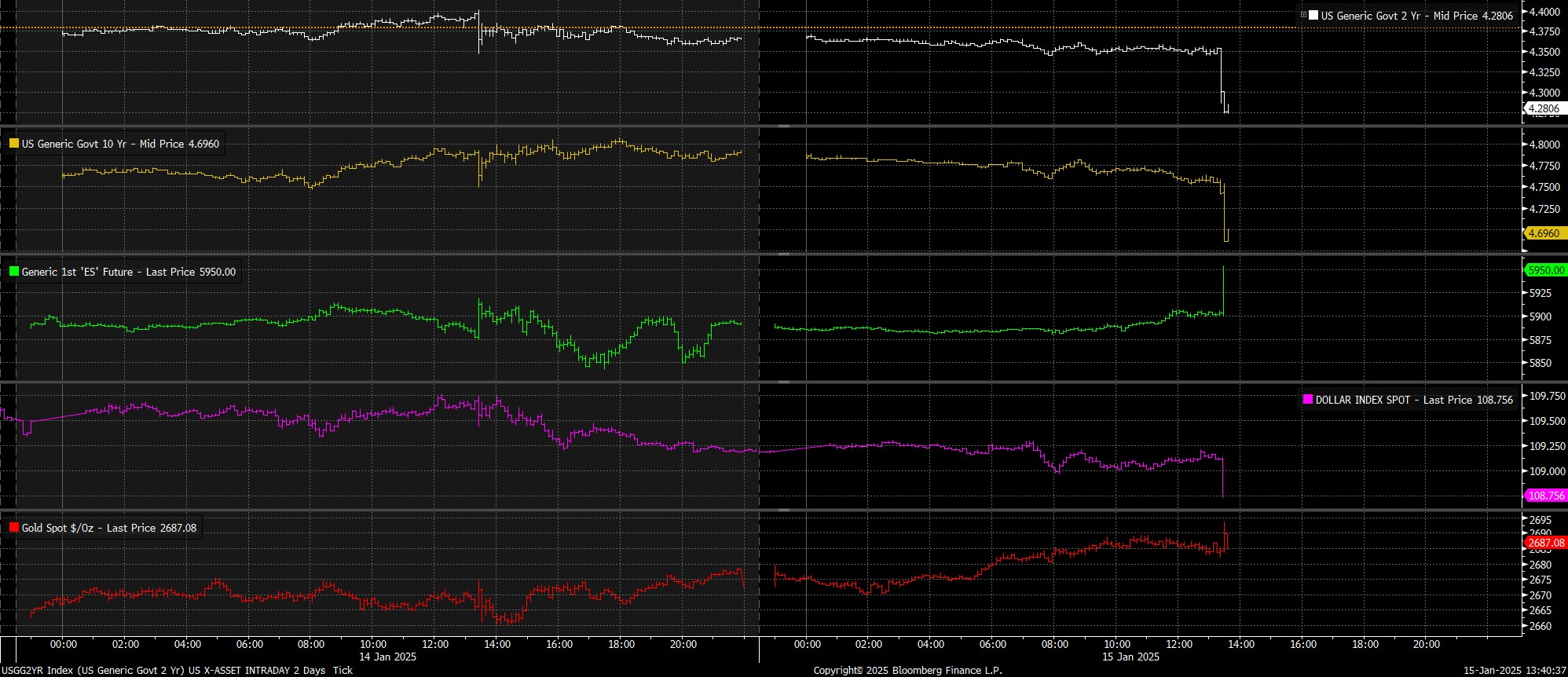

More broadly, markets experienced a dovish cross-asset reaction to the CPI figures. Hence, Treasuries rallied to day highs across the curve, led by the front-end, as benchmark 2-year yields fell over 10bp to fresh day tights. This, in turn, posed headwinds to the dollar, which dipped back below the 109 handle, allowing other G10s to gain ground, and also helping gold to vault higher. Stocks also vaulted higher, with the front S&P and Nasdaq futures both adding well over 1%, trading to new day highs.

Taking a step back, the CPI figures don’t add particularly much to the broader discourse, instead, serving to re-affirm that underlying price pressures remain relatively stubborn, and that the path back towards the 2% inflation target will be a relatively turbulent one.

Consequently, the FOMC remain on course to ‘skip’ the January meeting, particularly in light of the resilient nature of the labour market, and amid increased upside inflation risks stemming from the likely trade policies of President-elect Trump’s Administration.

The key question now is whether the FOMC’s ‘skip’ turns into a more prolonged ‘pause’. While further rate cuts, back towards neutral, remain likely this year, albeit at a much slower, and more cautious pace than seen in 2024. More data along the lines of what has been received in early-2025 will only serve to heighten expectations that Powell & Co. will remain on the sidelines for the time being, at least for the first quarter of 2025.

Taking this into account, risks around the policy outlook this year are considerably more two-sided than those seen last year, with a renewed hawkish risk re-introduced to the policy path. Consequently, the comfort blanket of a ‘fed put’ which has been ever-present for risk assets over the last 18 months or so is no longer present, and fades further each month that incoming data remains solid.

While this solid data, and subsequent solid earnings growth, should see the path of least resistance for equities continuing to lead to the upside, said path will likely be bumpier and more volatile than participants have become familiar with. Conviction, too, will likely be lacking for the time being, particularly with the key risks of Q4 earnings season, and President-elect Trump’s looming inauguration, on the horizon.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.