- English

April 2025 UK Inflation: The Start Of The Temporary Headline Surge

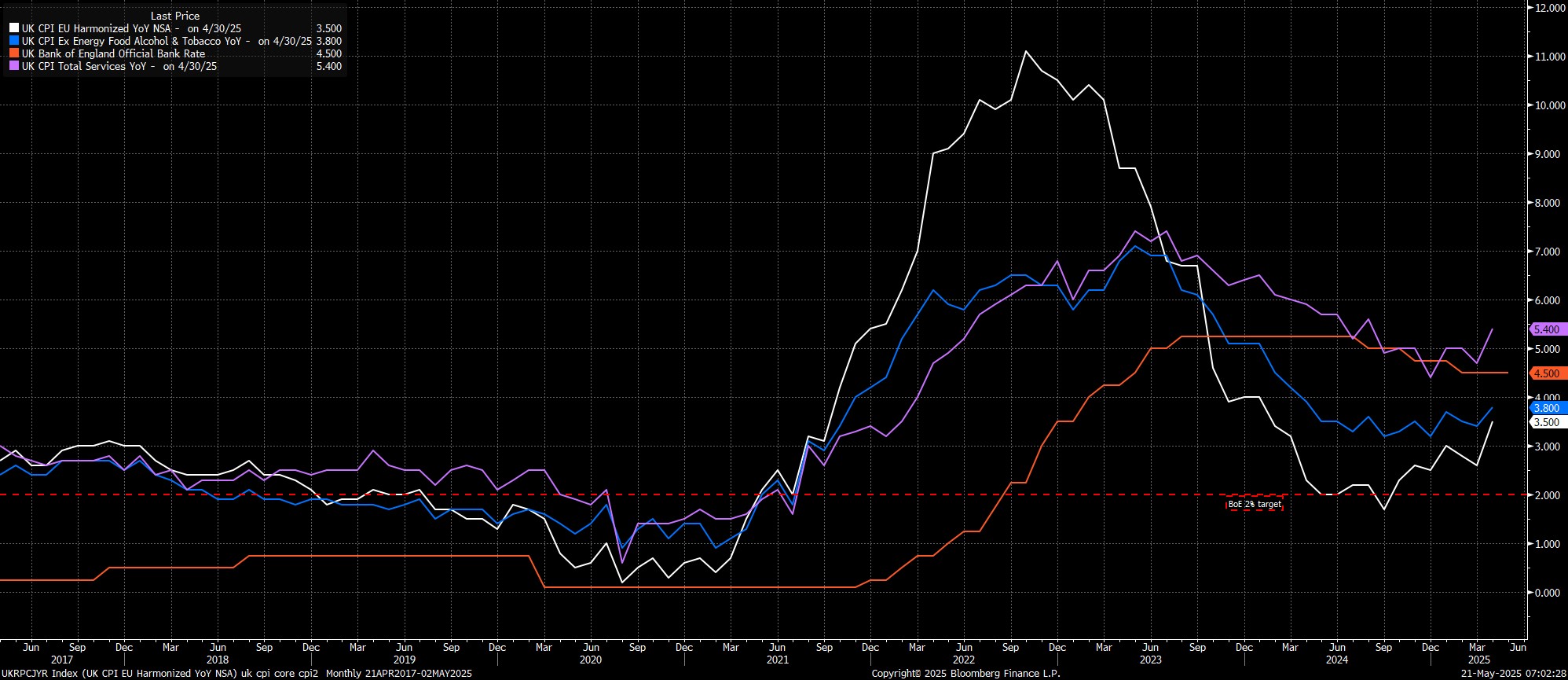

Headline CPI rose 3.5% YoY, above the 3% mark for the first time since last March, markedly above market expectations, but only marginally above the BoE's 3.4% forecast. Meanwhile, measures of underlying price pressures also moved higher, with core CPI rising 3.8% YoY, and the closely-watched service CPI metric rising 5.4% YoY, back above 5% for the first time since last summer, and considerably above the BoE's expectations.

As alluded to, April’s rise in inflation had been widely expected, with the month’s data always volatile, and usually much higher than that for the rest of the year. As usual, the figures were skewed higher by a host of annual price rises at the start of the fiscal year, most notably a substantial increase in energy prices, which was exacerbated by an unfavourable base effect from 2024.

However, while headline inflation is likely to continue to move higher through the summer, especially as firms pass on the costs of higher employer National Insurance contributions, it is difficult to argue that these price pressures will become persistent. Primarily, this is due to the fragile state of the domestic labour market, coupled with anaemic underlying economic growth, and with the outlook still peppered with significant downside risks. This all suggests a weak demand picture, limiting the ability for higher inflation to become embedded within the economy.

That said, given the hawkish vote split at the May MPC, where two policymakers favoured holding rates steady, and the unchanged ‘gradual and careful’ policy guidance, the bar for a June cut was already a high one. This morning’s data is likely the final nail in that particular coffin.

As such, the base case remains that the next 25bp Bank Rate cut will be delivered at the August MPC meeting, in conjunction with the Bank’s updated economic forecasts. However, the current policy guidance, and sluggish pace of easing, are likely both on borrowed time. Fading risks of inflation persistence, and an even more dour growth backdrop, towards the end of summer, will likely force the ‘Old Lady’ to move faster, and possibly in larger clips, in the last few months of the year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.