Margin trading products are complex instruments and come with a high risk of losing money rapidly due to leverage. 88% of retail investor accounts lose money when trading on margin with this provider. You should consider whether you understand how margin trading works and whether you can afford to take the high risk of losing your money.

- English

Apple Q3 2025 Earnings Preview: Margins, AI Progress, and Supply Chain Risks in Focus

.jpg)

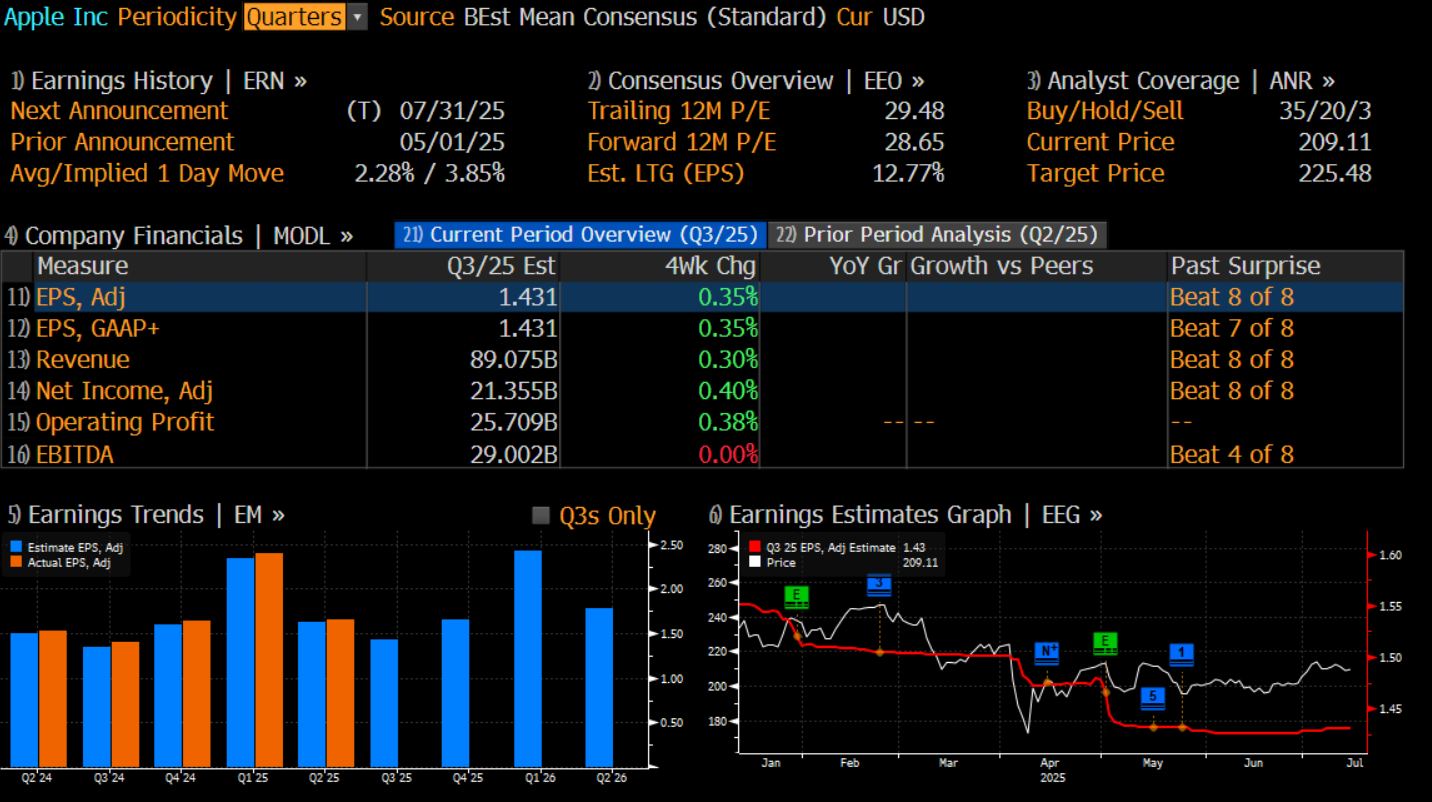

Apple will report its fiscal Q3 2025 earnings after the U.S. market closes on July 31 (morning of August 1 in Australia). Street consensus expects revenue of $88.5–89.0 billion, up roughly 4% YoY, with net income ranging from $21–22 billion and EPS of $1.42–1.45. While the headline numbers look solid, sentiment around this report remains cautious.

That’s not surprising. Apple shares are down over 16% year-to-date, and since May, the stock has been stuck in a range between $216 and $193, underperforming both the S&P 500 and the broader semis sector. Its catch-up stance in the AI space also stands in sharp contrast to the likes of Meta and Microsoft.

Meanwhile, uncertainties around tariffs and pricing policies have made this quarter a key inflection point for reassessing Apple’s medium- to long-term investment case.

Discount-Driven Growth, Margin Under Pressure

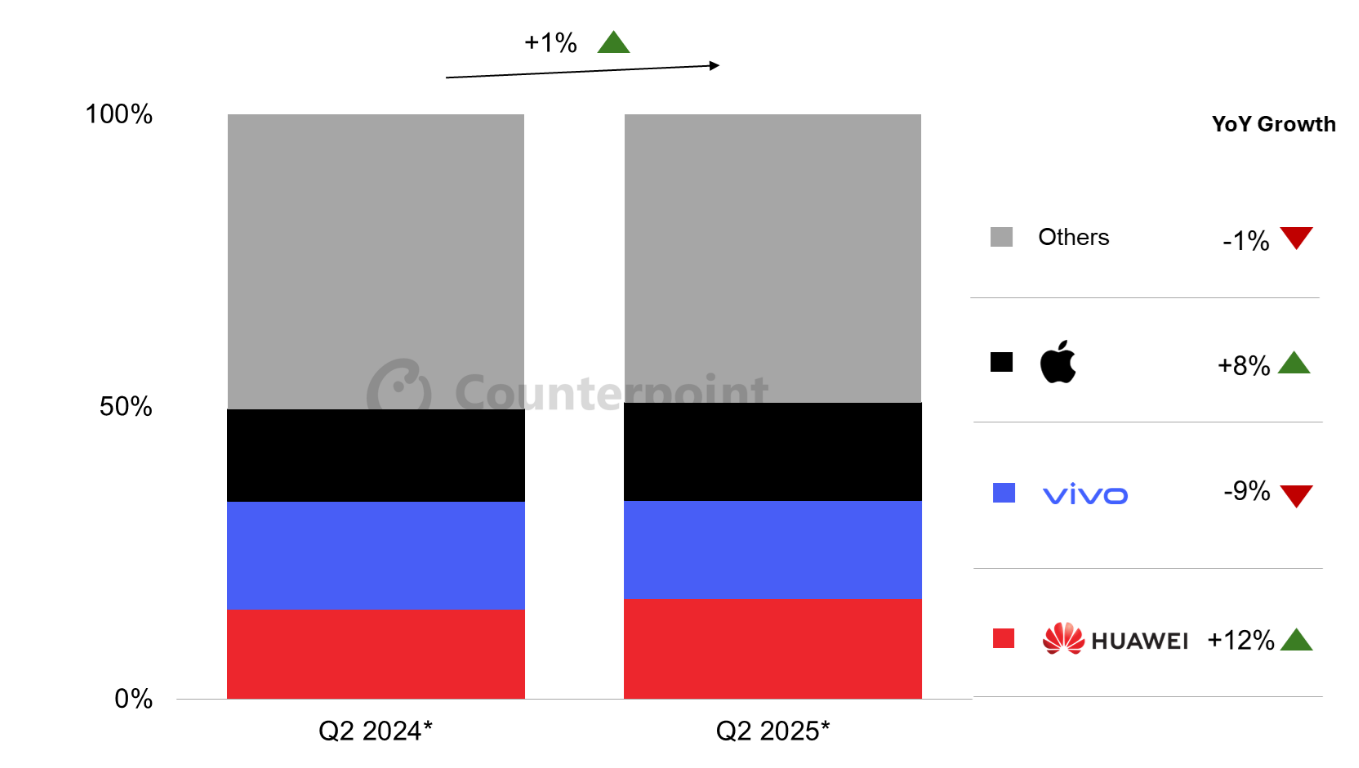

iPhone shipments in China rose approximately 8% YoY in Q2 - its first increase in nearly two years. However, this rebound was largely driven by aggressive pricing strategies. During the 618-shopping festival, Apple offered deep discounts, further supported by local government subsidies, which helped stimulate demand and expand into lower-tier markets.

But this price war doesn’t come without cost. Short-term volume and revenue gains could erode Apple’s brand premium and long-term profitability. At the same time, unresolved U.S.–China trade tensions have added roughly $900 million in tariff expenses, weighing further on margins. Analysts expect gross margin to drop back toward 46%, suggesting limited earnings flexibility.

More critically, the competitive landscape in China’s premium smartphone market is shifting.

Domestic brands like Huawei and Xiaomi are gaining ground with innovations in foldables and AI imaging, steadily eating into Apple’s share. While promotions may mask the problem temporarily, lack of product innovation remains a concern. Re-establishing Apple’s edge through tech leadership and brand moat is vital for its long-term performance in China.

Services: Slower Momentum, Still Resilient

Services remain Apple’s core profit engine. App Store revenue grew 12% YoY in Q2, a solid result, but momentum has slowed from the prior 14%, signaling a potential plateau in user subscriptions. In core markets like the U.S. and Europe, user growth has begun to saturate, and service expansion may struggle to maintain its pace. Regulatory headwinds also add uncertainty, as EU antitrust actions challenge Apple’s App Store fee structure and could impact future revenue.

On the AI front, Apple has recently picked up pace. In June, the company unveiled its in-house Apple Foundation Model (AFM) to third-party developers and hinted at Siri and Safari integrations with external models like OpenAI and Anthropic. This hybrid AI strategy - combining internal and external capabilities - allows Apple to ease development burden while staying focused on privacy and ecosystem control.

Though monetization remains limited in the near term, AI services represent a promising subscription growth driver in the longer term. Investors will be watching closely for signs of execution—particularly with the iPhone 17 and Siri upgrades expected this fall.

Supply Chain Migration: Growing Pains in Risk Diversification

Beyond China iPhone sales and AI execution, Apple is accelerating efforts to diversify manufacturing in response to rising geopolitical risks. Nearly half of U.S.-bound iPhones are now made in India, and production capacity is expected to hit 60 million units by 2026.

While this move reduces trade risks, it comes with rising costs and operational friction. India’s yield rate sits around 85%, leading to more waste and rework. Cross-border component shipping and supply chain complexity have pushed logistics costs up by over 20% YoY. This raises unit production costs and puts further pressure on margins - potentially affecting profit. Comments from management and disclosures on this front will be key.

Although Apple is also expanding AirPods and Mac production in Vietnam and India, China remains a critical hub for high-end manufacturing and non-U.S. markets. Overall, the supply chain transition is still in its early stages. Striking a balance between geographic diversification, cost control, and economies of scale will be crucial for sustaining Apple’s profitability and operational efficiency.

Opportunities in Caution: Flexibly adjust positions

Could this earnings report be the catalyst Apple needs to catch up - or even spark a new uptrend?

In my view, Apple’s fiscal Q3 2025 results may reflect a pattern of “solid but slowing” growth, with markets more likely to treat it as a 2026 story. A rebound in sales driven by discounts and subsidies, the resilience of its services business, and diversification of its supply chain all help form a solid earnings floor. But weakening growth momentum, margin pressure, and a perceived lack of AI innovation remain key concerns.

Implied volatility suggests the stock could swing ±3.8% after earnings - somewhat higher than the historical average of 2.8%. This may reflect lowered expectations, and positioning in Apple isn’t as crowded as in other MAG7 names like Nvidia, Amazon, Meta, or Microsoft.

Traders are likely comfortable playing the $193 - $216 range, with current market dynamics indicating Apple’s valuation is seen as fair relative to its catalysts and earnings quality.

In the upcoming report, the focus should be on how Apple balances pricing, cost control, and innovation - especially whether AI services and hardware refreshes can reignite topline growth. If the AI ecosystem gains traction, paired with steady service income, a re-rating could follow. Conversely, if margins disappoint and AI progress remains sluggish, near-term downside risks may materialize.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.