- English

2025 Outlook: USA – Resilient Growth Amid Rising Uncertainty

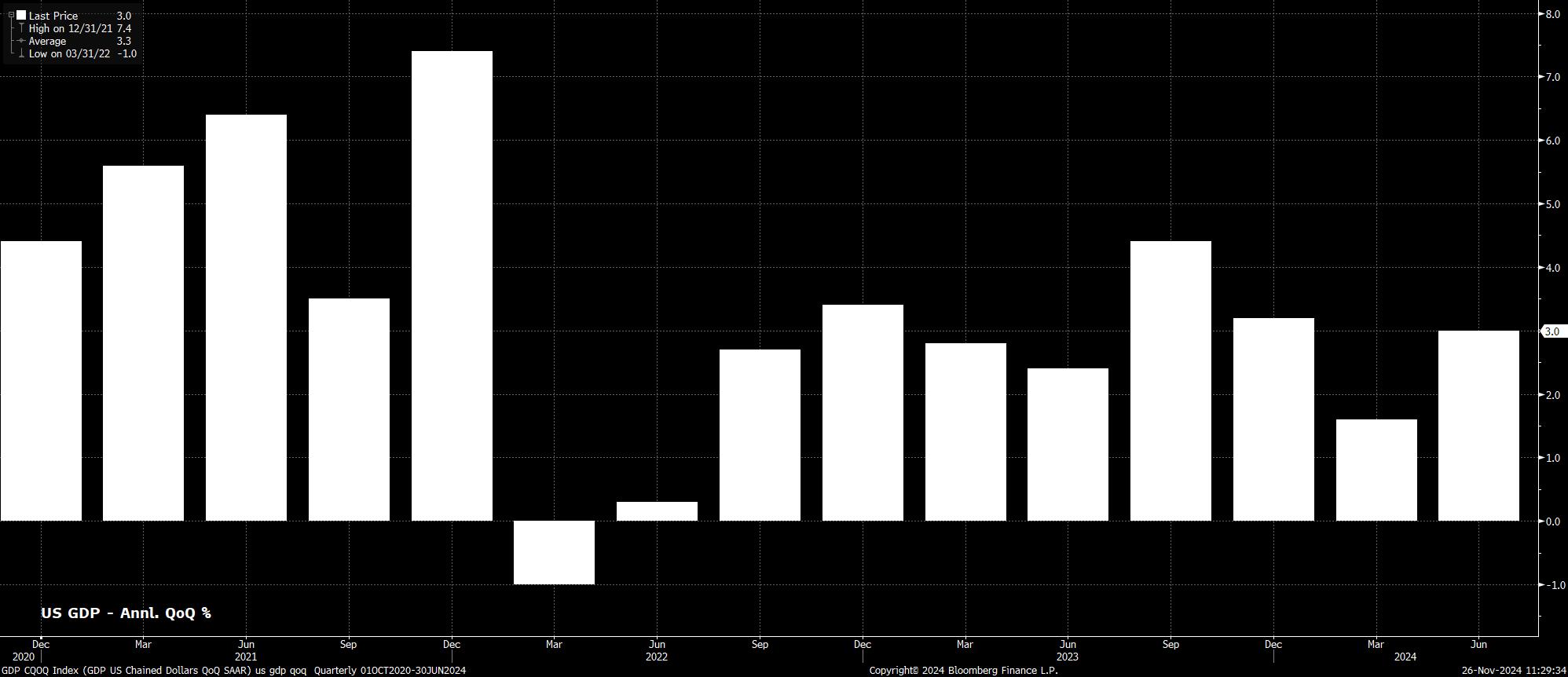

As noted, the US economy has performed well throughout the past 12 months, with GDP having grown at, or quicker than, 3% annualised QoQ in three of the last four quarters, and the economy having expanded by more than 2% annualised QoQ in all but one of the last 9 quarters. Not only is this a resilient pace of growth in isolation, it also represents continued US economic outperformance compared to other DM economies.

At the same time, the economy has continued to make progress back towards the FOMC’s 2% inflation aim. Headline CPI rose 2.6% YoY in October, a considerable decline from the 3.4% YoY pace seen at the tail end of 2023, while both core, and supercore, inflation metrics have also continued to subside. Judging by the Committee’s preferred price metric, the PCE price index, the battle against inflation has been all-but-won, with said index rising just 2.1% YoY in October, its slowest pace in over three years.

That said, the ‘easy’ work appears to have now been done, with risks to the inflation outlook tilting to the upside into the year ahead.

Some of said risks are already embedded, with services prices having remained elevated, and with the labour market remaining tight. Despite headline nonfarm payrolls growth having slowed of late, largely a result of weather events, headline unemployment remains just north of 4%, and participation just shy of cycle highs at 62.6%, indicating little by way of slack within the labour market. In turn, earnings pressures are likely to persist, with annual earnings growth still running around 4%.

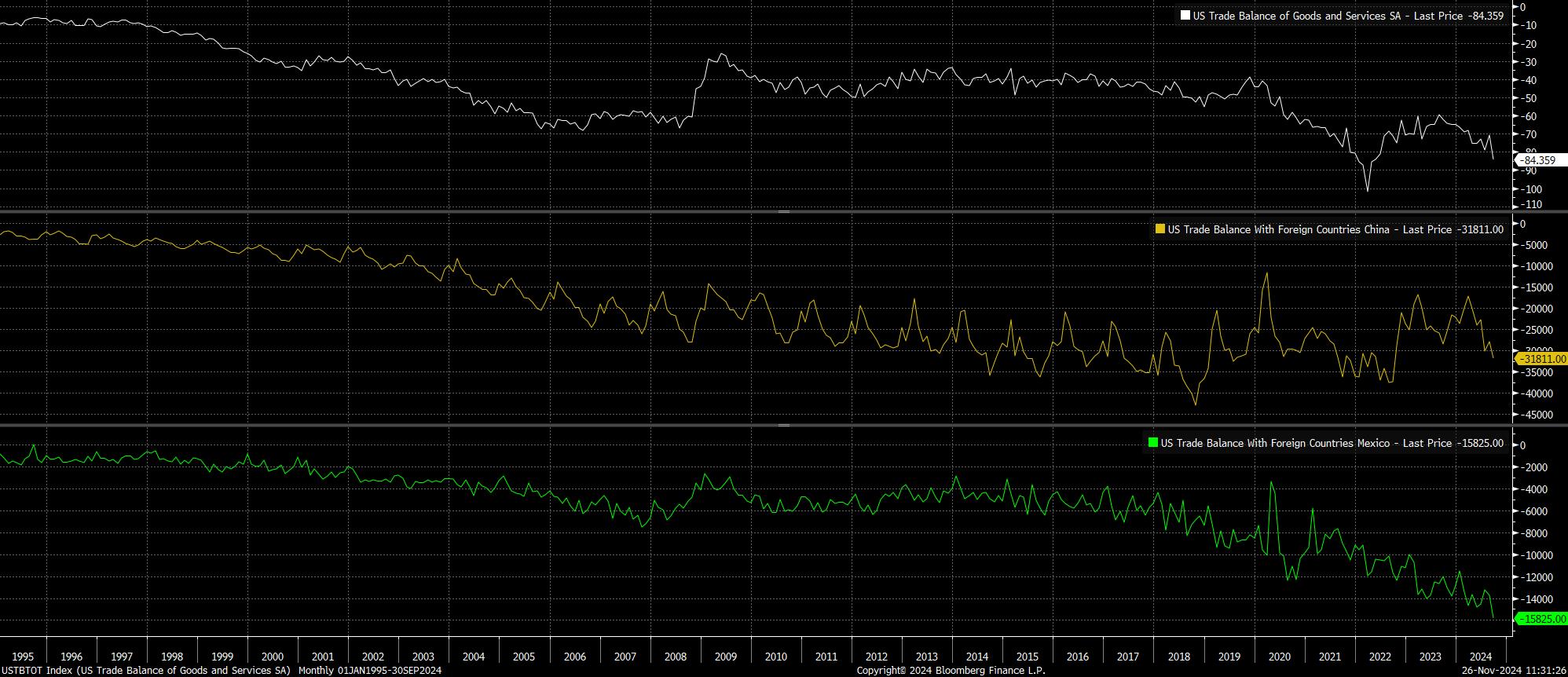

Meanwhile, recent political events also raise the probability of a resurgence in price pressures. The return of President Trump to the White House brings with it the prospect of a return to the 2016-2020 era of tit-for-tat trade tariffs being imposed, seemingly on a whim. Already, the incoming administration has announced 25% tariffs on imports from Canada and Mexico, as well as an additional 10% tariff on Chinese goods. During the election campaign, Trump also touted a ‘blanket’ 20% tariff on all imports into the US.

Naturally, one would expect the cost of any tariffs to be borne by the US consumer, as opposed to corporates absorbing costs, and eroding profit margins. Hence, the risk of a bounce in inflation towards the middle of 2025 is a significant one, with a much bumpier inflation path set to be followed next year. Said tariffs also introduce downside growth risks, though these should – at least to some extent – be offset by fiscal loosening, and are unlikely to become fully apparent over the course of the coming year.

Upside inflation risks also stem from Trump’s immigration proposals, particularly the potential mass deportation of undocumented immigrants. While the precise impact of immigration on the employment situation is difficult to quantify, such a policy, were it enacted, could result in as many as 8 million workers being forced to leave the labour force, likely sparking a scramble for skills among employers, raising wages in the process.

Though the second Trump Presidency poses a significant risk of higher inflation, via tariffs, fiscal policies outlined by the incoming administration are likely to be reflationary in nature.

Chiefly, Trump’s initial plans centre around tax cuts, firstly extending those that were introduced during his first time, while likely also bringing further such measures to the table to provide an additional economic sugar rush. That said, how incoming Treasury Secretary Bessent squares further tax cuts with a desire to half the budget deficit to 3% of GDP remains to be seen. Deregulation proposals are also likely to act as a fillip to growth, while helping the equity market as well, though specifics here remain relatively thin on the ground. One would expect the majority of these proposals to be ‘front-loaded’, as Trump attempts to take advantage of the ‘red wave’ before the 2026 midterm elections.

For the FOMC, this fiscal policy mix poses something of a conundrum, and creates significantly greater 2-sided monetary policy risks than have been present for much of the last 12-18 months.

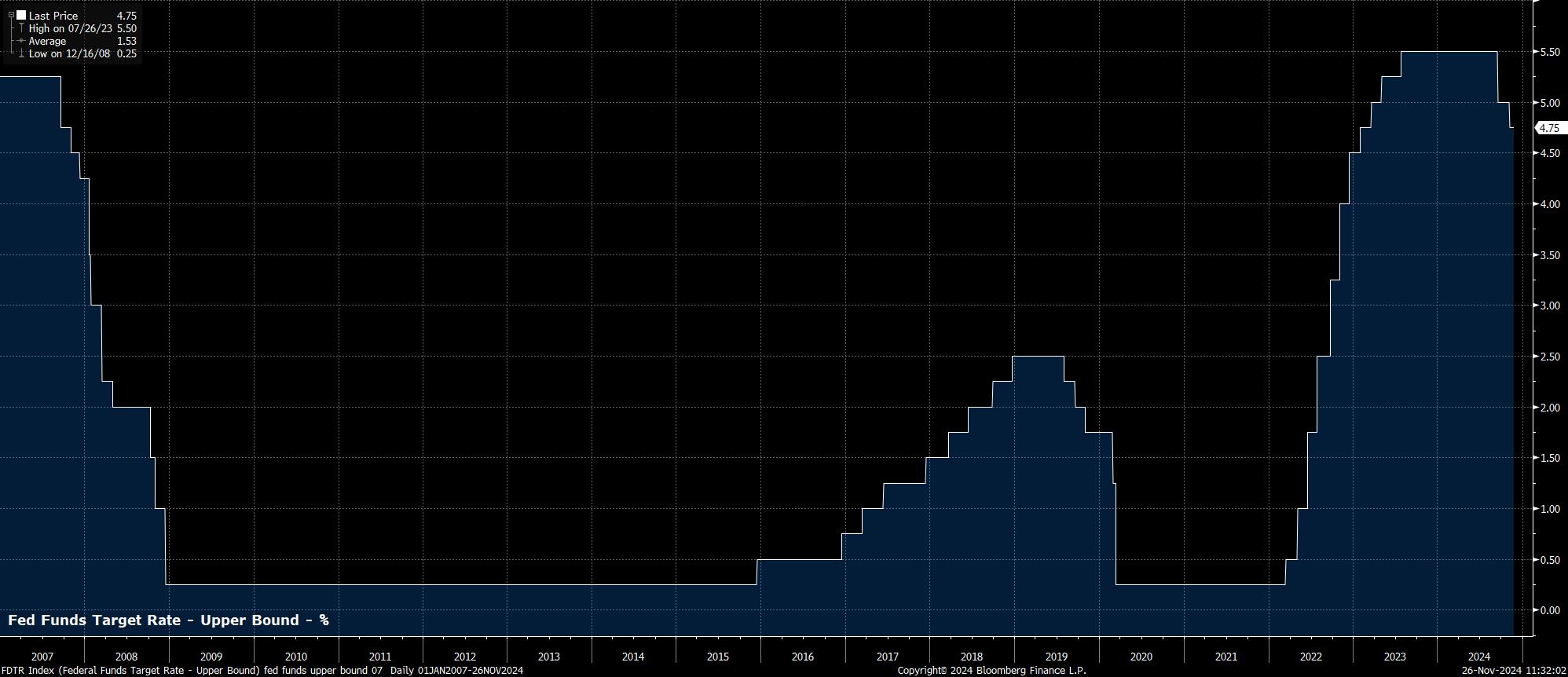

During 2024, even though the first fed funds rate cut did not come until September, it’s been clear that the ‘Fed put’ is well and truly alive once again. On numerous occasions, Chair Powell, and other Committee members, have noted that now sufficient confidence in inflation returning to the 2% target has been obtained, focus has shifted to the other side of the dual mandate, and to preventing further labour market weakness. As such, there has been a near-constant dovish risk embedded in the policy outlook.

While that dovish risk remains, a hawkish risk is likely to be introduced come 2025, owing to the aforementioned fiscal policies from the Trump Administration. Were tariffs, or immigration reforms, a fiscal sugar rush, or a combination of all three to cause a resurgence in price pressures, a policy response would likely follow.

Hence, while the base case remains that the FOMC will deliver a 25bp cut at each meeting until we return to neutral next summer, there are now 2 other scenarios that deserve due consideration. Were labour market conditions to soften, likely meaning unemployment rising north of the 4.4% end-25 median SEP forecast, the prospect of another ‘jumbo’ 50bp cut comes back onto the table. On the other hand, were disinflationary progress to stall, Powell & Co are likely to pause the process of policy normalisation, ‘skipping’ a meeting if necessary.

One must also consider the balance sheet. Though the pace of QT was more than halved in 2024, to just $25bln in Treasury securities per month, the continued process of balance sheet run-off remains somewhat at odds with the delivery of cuts to the fed funds rate. Effectively, policy is being loosened via interest rates, and tightened via the balance sheet. Hence, it seems likely that the QT process will be drawn to a close towards the end of the first quarter, especially as usage of the NY Fed’s overnight reverse repo facility continues to dwindle, implying an increasing scarcity in bank reserves.

On the whole, despite greater inflation risks, 2025 is likely to see US economic growth once more outperform that of developed market peers. This, in turn, should see the USD remain firm against its G10 counterparts, as the focus of FX participants remains on ‘buying growth’, and as the greenback continues to inhabit the left hand side of the ‘dollar smile’. Of course, a surprising pick-up in RoW growth is the principal risk to this view, though risks to the outlook remain tilted firmly to the downside in both the eurozone, and China.

For equities, the path of least resistance should continue to lead to the upside, with resilient economic growth likely leading to another year of solid corporate earnings growth. That said, the forceful support provided in 2024 via the flexible ‘Fed put’ is likely to be somewhat reduced over the next 12 months, though this shouldn’t be too steep a hurdle for participants to overcome, with another year of gains set to pan out.

In the Treasury complex, finally, 2025 is likely to see a bull steepening of the curve. Such a move will come as the front-end rallies amid continued Fed policy normalisation, while the long-end seems set to underperform as growth expectations continue to re-rate higher, and as said cuts are delivered with inflation both above target, and amid continued upside risks to prices. One must also consider the potential for greater issuance through 2025, amid anticipated fiscal largesse, though the end of QT will clearly lift some of the burden here.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.