- English

August 2024 BoE Preview: A 25bp Cut May Be A Hard Pill To Swallow

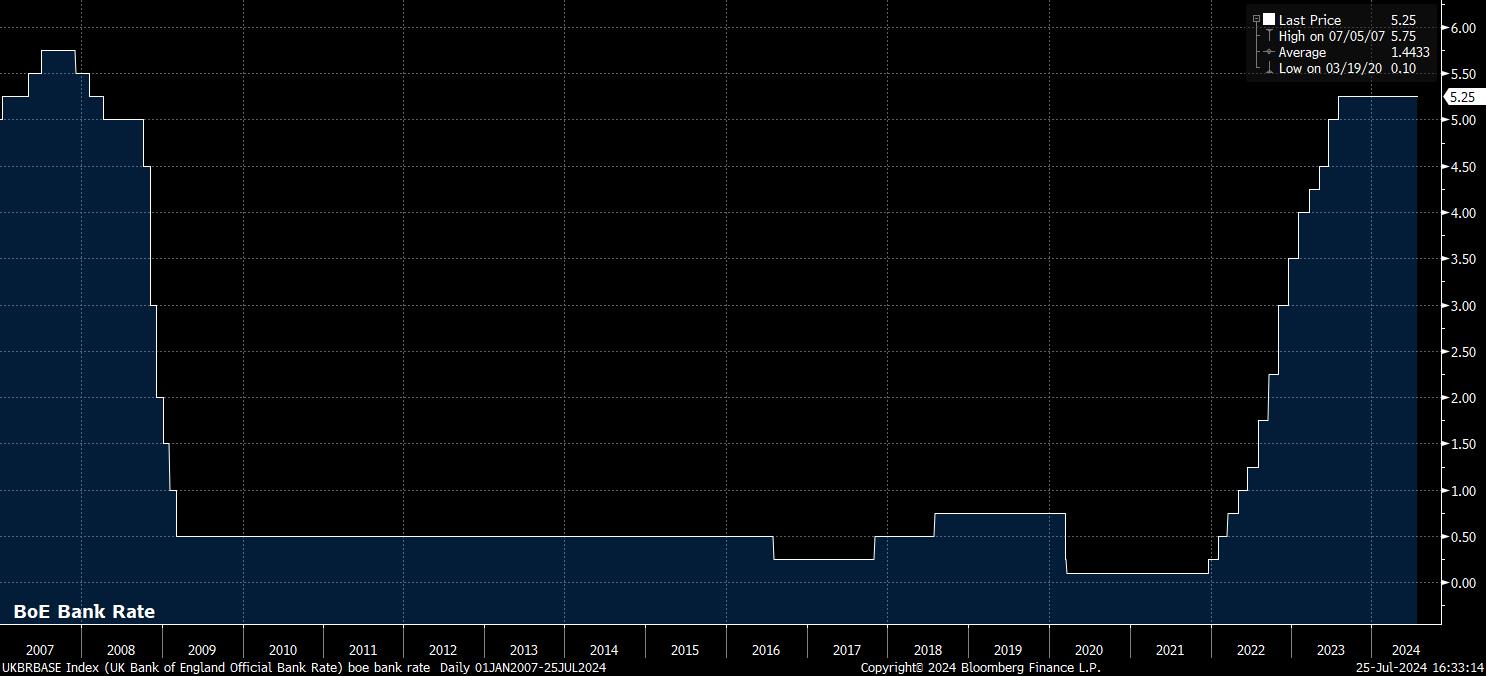

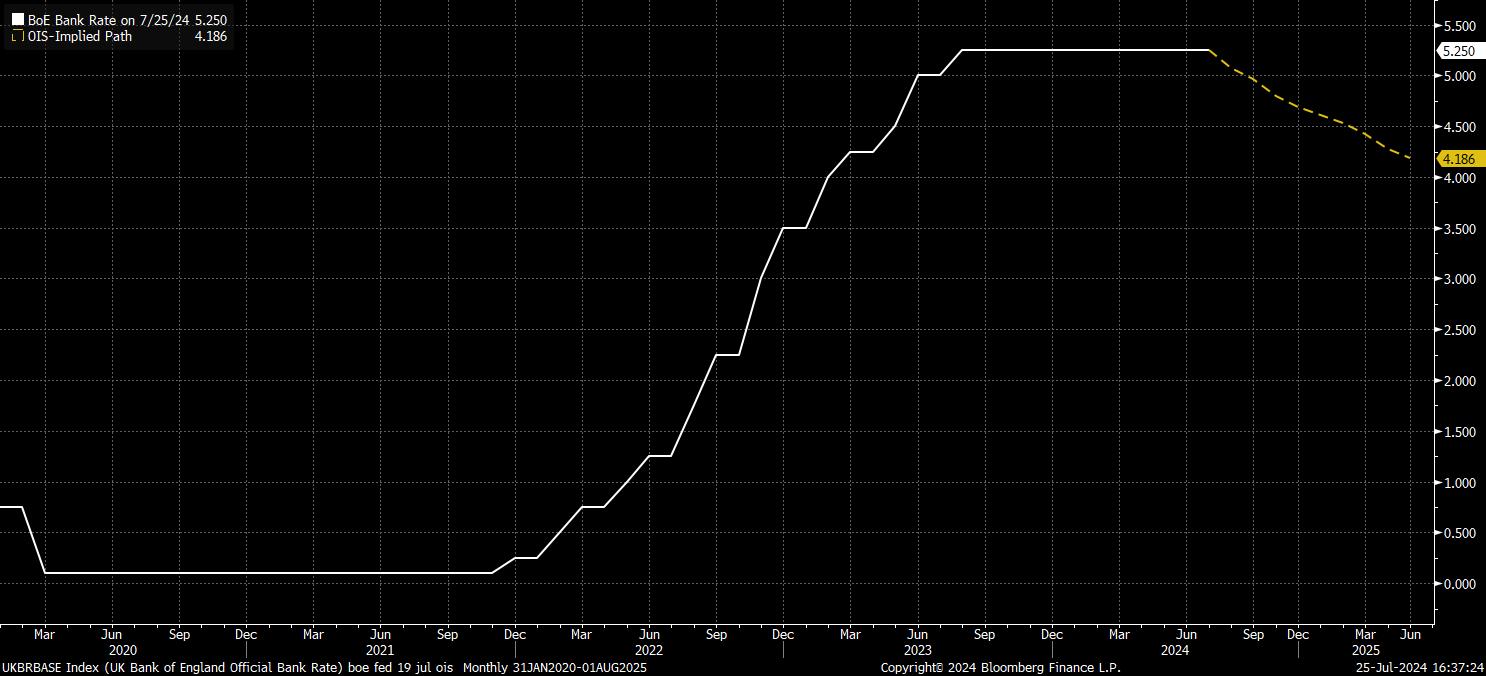

As noted, our expectation is for the MPC to deliver a 25bp Bank Rate cut at the August policy meeting, the first rate cut since the economy was in the midst of the pandemic, and a cut which would come precisely a year after Bank Rate reached its terminal level of 5.25%. It is, however, difficult to have a high degree of conviction in such a call given recent data, and the lack of communication from policymakers. Reflecting this, money markets – per the GBP OIS curve – price the meeting as a coin-flip, implying a 50/50 chance of a 25bp cut, while not fully discounting such a move until November.

In any case, no matter whether a rate cut is delivered or not, it appears near-certain that the MPC will again be divided in their views of the appropriate policy action.

Deputy Governor Ramsden, along with external member Dhingra, dissented in favour of an immediate 25bp cut at the prior policy meeting, and are likely to do so again this time around, with little in the data to deter either from their existing dovish stances.

Meanwhile, back in June, while the decision to hold rates steady was a 7-2 vote among MPC members, it was reportedly “finely balanced” for some on the MPC. Reports indicate that this group comprised of three policymakers, likely including Governor Bailey, as well as Deputy Governor Breeden. Former Deputy Governor Broadbent was likely also in this camp, though has since been replaced on the MPC by former Treasury official Lombardelli who, if convention holds, is likely to vote with the Governor at this, her first MPC meeting.

Of course, two policymakers already voting in favour of a cut, and potentially three more who view such a decision as ‘finely balanced’, leaves a relatively low bar for a 25bp cut to be delivered, even if by a narrow 5-4 vote. The key question, per minutes of the June decision, that this group of policymakers will need to answer is whether the hotter-than-expected inflation figures received since the last decision “significantly” alter the disinflationary trajectory on which the economy appears to be proceeding.

Interestingly, it seems likely that if the MPC are to deliver a cut, it will be a cut that’s not endorsed by Chief Economist Huw Pill – a rather unusual situation for policymakers to find themselves in. Pill noted in remarks recently that it is an “open question” as to whether now is the time for a cut, or not, while also detailing his view that inflation remains persistent within the UK economy. Pill seems likely to be joined in a hawkish dissent by external member Mann, who remains concerned about headline inflation remaining north of 2% for the remainder of 2024, along with external member Haskel, who departs the MPC after this meeting), and remains concerned about the impact of the tight labour market underpinning underlying inflationary pressures.

This process of deduction leads us to a likely 6-3 vote in favour of a 25bp cut, albeit with little visibility as to external member Greene’s view, having not made any public comments since mid-May. Hence a 5-4 vote is distinctly possible, with conviction in such a call considerably lower than it usually would be ahead of any G10 central bank decision.

While the vote split is one matter, policy guidance is another.

Naturally, were the MPC to hold rates steady, one would expect the present policy guidance to remain, with the Committee ‘keeping under review’ how long Bank Rate should remain at its present level.

However if, as we expect, the MPC do indeed deliver a 25bp rate cut, the statement guidance is unlikely to be explicit in the timing of further rate reductions, even if such a cut will likely be the start of a sequence of such moves, bringing policy back to a more neutral setting over time. Instead, and in keeping with G10 peers, the statement will likely stress a data-dependent approach to any further policy normalisation, with any further cuts likely to hinge on the risks of persistent inflation continuing to recede, as well as broader economic resilience. Both factors, of course, that the MPC are already monitoring closely in determining the timing of this cycle’s first rate cut.

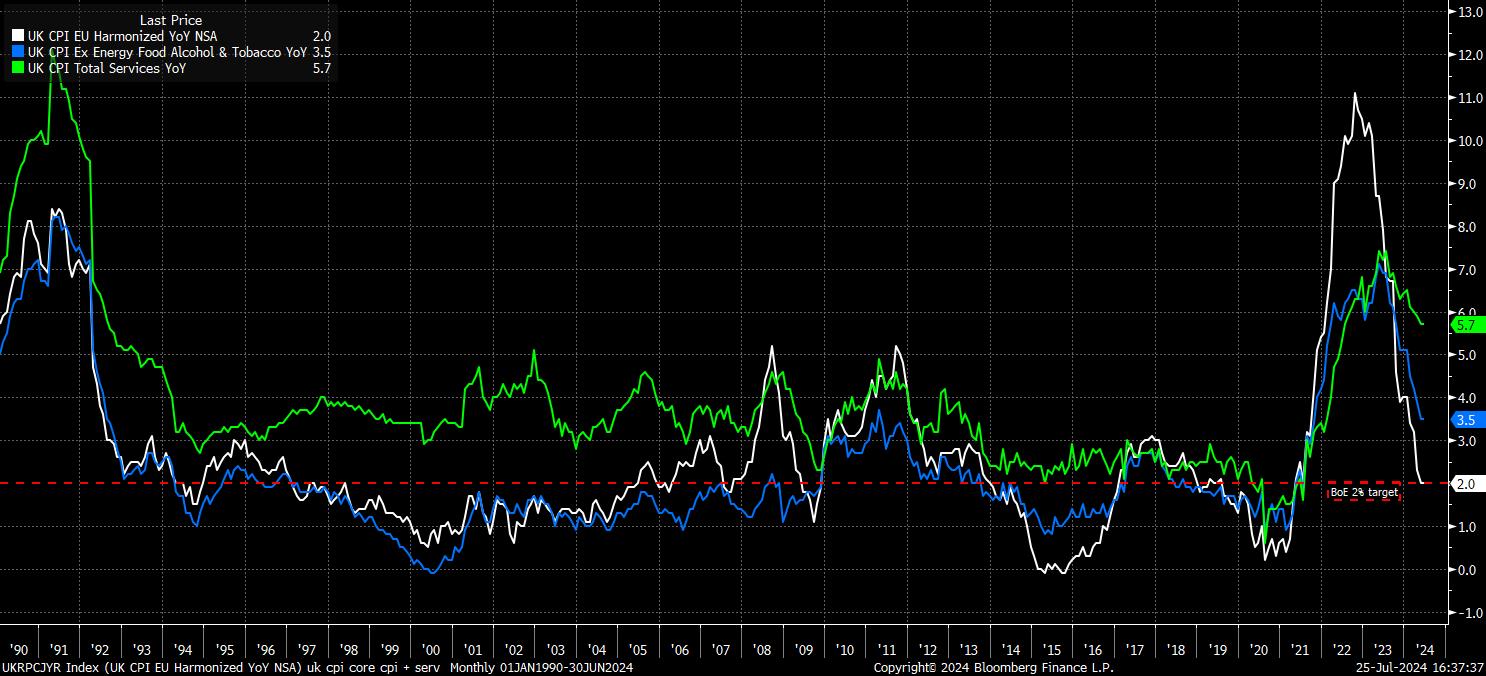

Speaking of inflation, and as flagged earlier in this note, the backdrop is something of a murky one. While headline CPI fell to the 2% YoY target in May, and stayed there in June, a significant degree of this decline owes to both lower consumer energy prices, and a favourable base effect. Measures of underlying inflation have made some progress back towards target, however continue to point towards price pressures remaining relatively sticky – core CPI has held steady at 3.5% YoY for two straight months, while services CPI (a metric upon which the MPC places a heavy emphasis) has run at 5.7% YoY for two months in a row, with the June print being a sizeable 0.6pp above the BoE’s May forecasts.

The August meeting will bring an update on those forecasts. On the inflation front, headline CPI is once again likely to be seen undershooting the 2% target in both 2026 and 2027, with the OIS curve little changed in terms of 1- and 2-year ahead pricing compared to that at the time of the May forecast round. As has been the case for some time, the market rate-based inflation forecast remains an implicit signalling mechanism for the MPC, with such an inflation undershoot implying that markets are still pricing a marginally too dovish rate path over the medium-run.

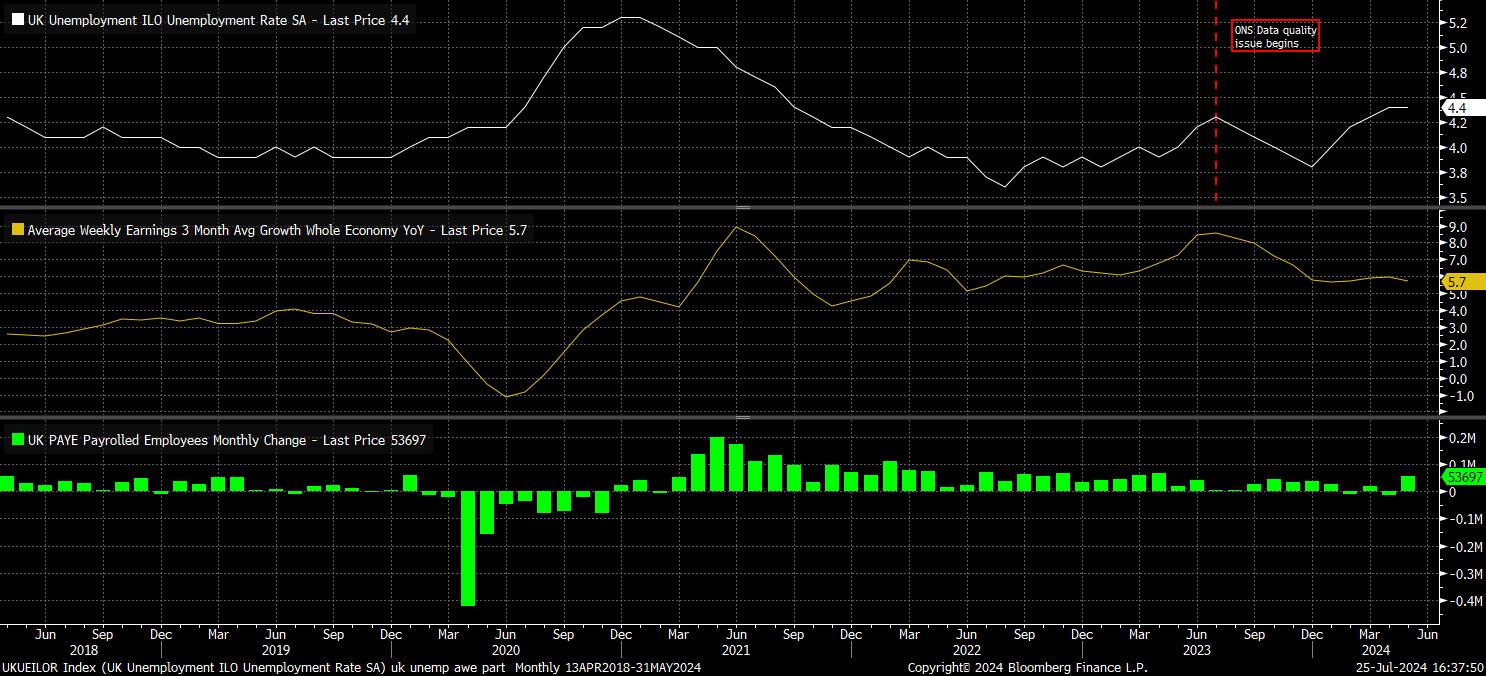

Meanwhile, turning to the labour market, things are again something of a ‘mixed bag’. Headline unemployment remained at 4.4% in the three months to May, though this metric continues to be unreliable owing to ongoing ONS data and survey quality issues, which show no sign of being resolved rapidly. Taking the data at face value, however, implies a labour market that continues to gradually weaken, with joblessness at its highest level since the tail end of 2021.

However, at the same time, earnings growth remains elevated, with upward wage pressures still significant. Earnings, both including, and excluding, bonuses rose by 5.7% YoY over the aforementioned period, a pace that is clearly incompatible with a return to the 2% inflation target over the medium term, albeit one that has been skewed higher in recent months by the annual hike to the minimum wage.

The BoE seem likely to ‘mark to market’ the near-term unemployment forecast at this meeting, though said forecasts should remain broadly unchanged further out into the mid-2020s.

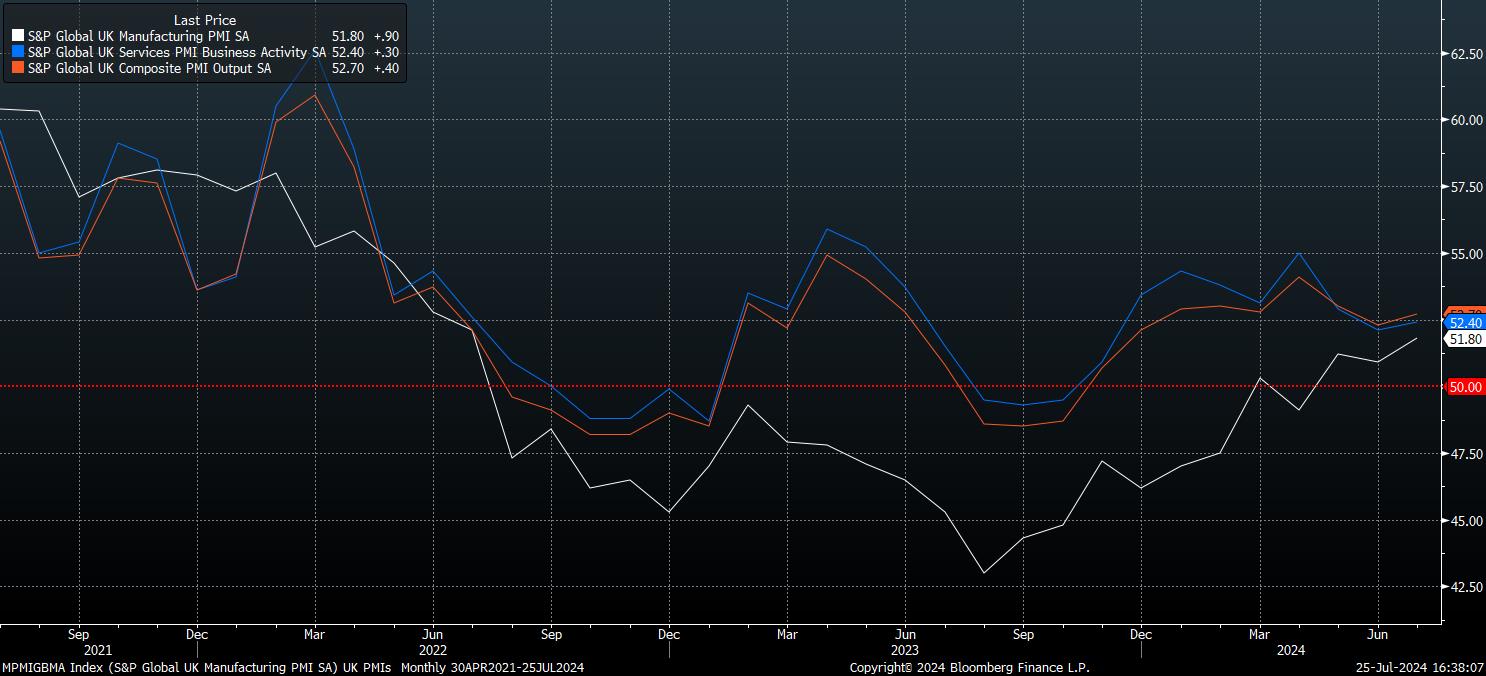

Nevertheless, even as the labour market has gradually weakened, economic growth has remained resilient. GDP grew by 0.7% QoQ in the first three months of the year, as the economy recovered from a shallow recession at the tail end of 2023. Leading indicators point to this solid momentum having continued into the following months; recent PMI surveys have pointed to a continued pick-up in economic activity, most notably in the manufacturing sector, where the PMI rose to a 24-month high per the ‘flash’ July reading. The Bank’s current growth projections, particularly for this year, look overly pessimistic.

With the August meeting seeing the release of the latest quarterly Monetary Policy Report, the meeting will also be followed by a press conference from Governor Bailey.

This, incidentally, is another argument in favour of a 25bp cut this time around, given that said press conference provides the Governor, and colleagues, an opportunity to explain and expand upon the policy decision. The next such press conference, and forecast release, is not until November, by which point, if rates were to be held steady, the economy would’ve spent 15 months with Bank Rate at its terminal level.

At the presser, Bailey is likely to broadly repeat the flexible, data-dependent guidance that we expect to be issued in the policy statement, seeking not to box policymakers in to a pre-determined rate path, or offer too much in the way of explicit hints as to the timing of any further rate reductions.

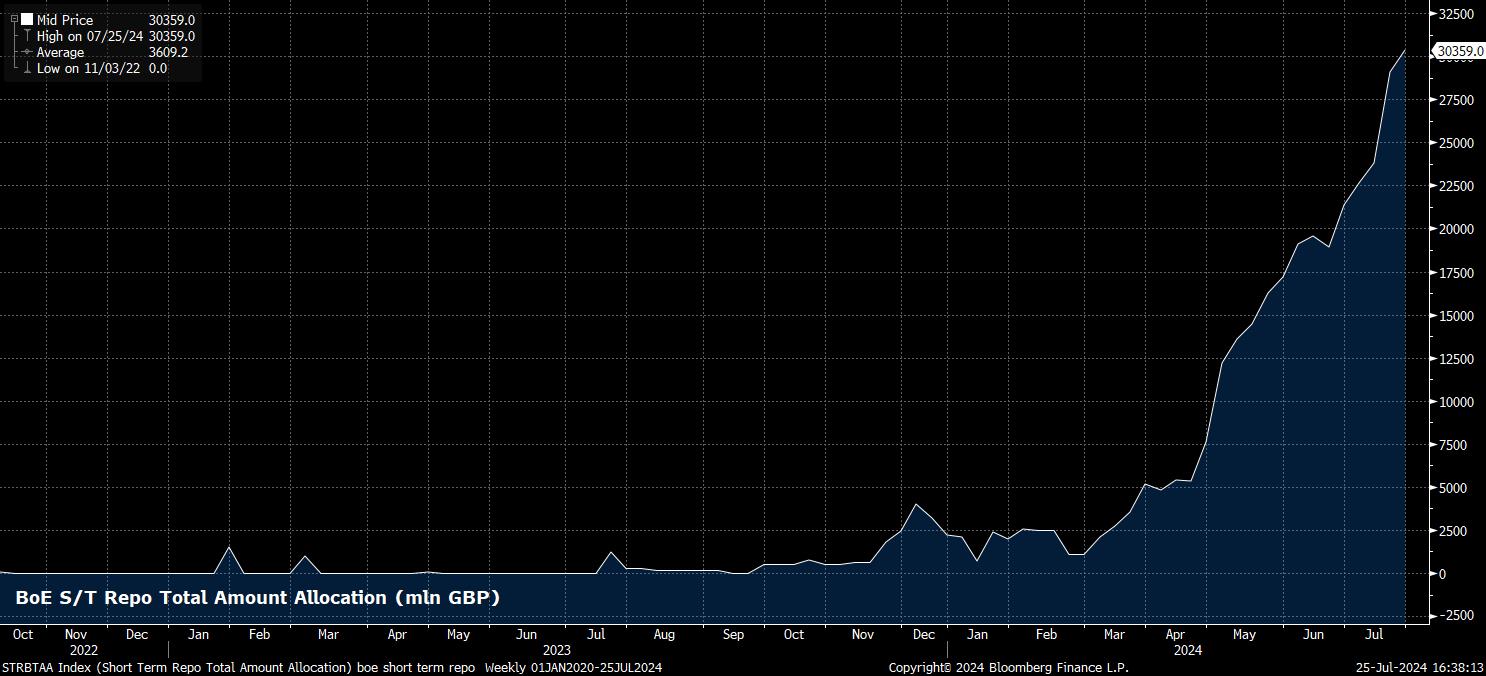

Of note, Bailey has not made any public comments since the end of May, due to the self-imposed election ‘blackout’ period, meaning that remarks not only on the policy outlook, but on other topics, will be of interest. A particular area of focus is likely to be the increasing use of the BoE’s weekly short-term repo facility, which now tops £30bln, and rising s/t repo rates, both of which imply a shortage of cash among UK banks, and the potential for a funding squeeze, as the Bank continue active gilt sales. Hints on the future of the quantitative tightening process will be worth listening out for, ahead of the annual QT review in September, and with expectations lofty that the BoE will soon bring gilt sales to an end.

For the GBP, and in contrast to many recent BoE decisions, the August meeting is likely to be a significant vol event over which traders must manage risk, owing to the two-sided risks associated with the decision.

While the reaction is likely to be relatively binary – cable upside on a decision to stand pat, downside on a rate cut – much will also hinge on both the vote split, and policy guidance, particularly whether further rate reductions are explicitly mentioned.

_2024-07-25_16-38-18.jpg)

1.3000 remains the key figure to watch to the upside, with the July 2023 highs at 1.3140 likely in the bulls’ sights on a break north of the big figure. On the other hand, the 1.28 figure, and 50-day moving average just below, stand as the most notable support levels, beneath which the 100- and 200-day moving averages lurk close by.

Personally, I remain inclined to sell into any GBP strength that may occur, particularly with US economic growth continuing to vastly outpace that of DM peers, and with the USD OIS curve discounting an overly-aggressive 65bp of Fed cuts by year-end. That said, the greenback, and G10 FX space more broadly, should remain rangebound for some time, with policy divergence between major central banks remaining narrow in nature.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.