ASIC Product Intervention: Platform & Trading Condition Changes

ASIC’s new product intervention measures restricts retail leverage, requires the minimum stop out level to remain at 50% and requires that you place margin for hedged positions. To satisfy these requirements, we’ve introduced retail only symbols with the addition of an .a suffix (for example EURUSD.a or XAUUSD.a) for MT4 and MT5 only. These new symbols for retail clients will be live from 28 March. This also means that you’ll no longer be able trade on the current .d symbols.

More details about the impact these changes will have on cTrader can be found below.

How will this affect my trading?

| Instruments | New maximum leverage from 28 March 2021 |

|---|---|

| Major currency pairs | 30:1 |

| Minor currency pairs | 20:1 |

| Major indices & Gold | 20:1 |

| Commodities & minor indices | 10:1 |

| Shares or other underlying assets | 5:1 |

| Digital Assets | 2:1 |

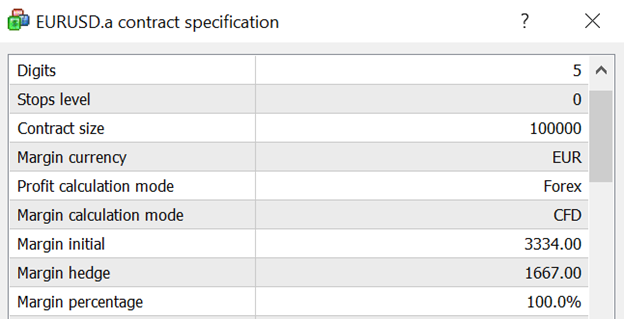

How to calculate your margin requirement

How to trade retail symbols after ASIC Product Intervention

How to enable new retail trading symbols on your phone

MT4/5

If you’re using MT4/5, then you’ll notice some key differences as a retail client

cTrader

If you’re using cTrader, then you’ll only notice a difference in the leverage offered on new positions as of 28 March.

.png)

.png)