- English

- عربي

A wild day on markets - flow, liquidations and high volatility

This can be achieved by taking timeframes down and above all respect the flows we’re seeing and the price action. Case in point - the VIX has pushed to 30%, having been as high as 39%, while the NAS100 VIX pushed into 44%, although again we’ve seen some volatility (vol) sellers and now sits at 35% - it’s this backdrop in which we work in and so often we can see significant reversals on limited news flow.

I had expected more of a bounce in risk assets into EU trade, as so much was looking grossly oversold, but as is the way with trading it’s about timing that flow. It was certainly looking promising through Asia with futures up, but then the market focused on another leg lower in the RUB (Russian ruble) and this resulted in Europe getting whacked, with EU Stoxx closing -4.1%. US futures fell hard, with our US500 index cracking the October lows around 4270 – at its low point, the S&P 500 was having the worst percentage move since June 2020, with various flow desks reporting further liquidations from trend- and momentum-funds – so more of the same, macro forces, flow, and liquidations in play.

Volumes have been massive and some 67% above the 30-day average in the S&P 500 cash market, while we’ve seen 3.6m S&P 500 futures traded, which again is huge. It speaks to a solid liquidation of systematic and leveraged positioning.

Crude, AUDJPY, and crypto followed closely, and correlations went towards 1.

Into the meat of US cash trade, we saw a flow change and the buyers stepped in – what we’ve seen is a simply remarkable defence of the October lows in the US500 and US equity markets more broadly and despite it looking bleak we’ve seen the S&P 500, NAS100 and Russell 2000 close higher on the day – the Russell 2k by far the standout +2.3%. Crypto has moved up sharply off the lows, and risk FX has gone along for the ride.

One questions if the algos sensed the liquidation was over and, in a market, grossly oversold covered shorts and aggressively entered trading longs.

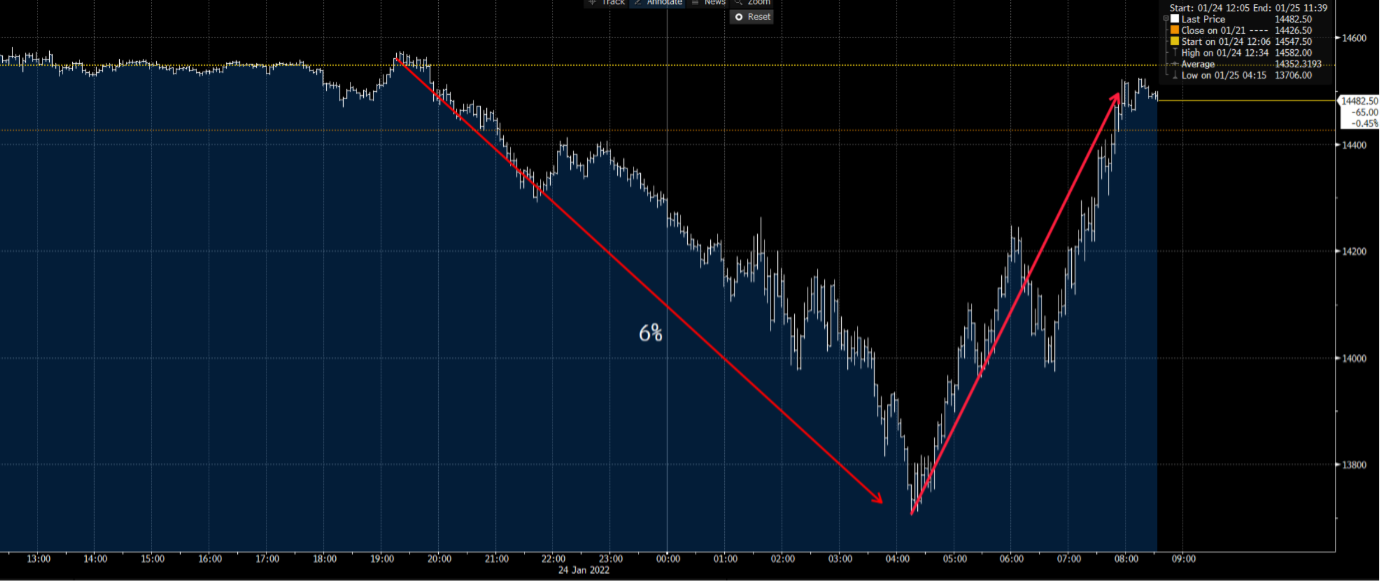

That intra-day tape in NAS100 is quite a sight – they call that a V-shaped bottom!

NAS futures intra-day

(Source: Bloomberg - Past performance is not indicative of future performance.)

Our calls for the EU and UK equity indices are flying and let’s see how Asia trades this, but at this stage, we’re calling the DAX up 1.8%.

The question now is will this move continue into the raft of mega-cap earnings and FOMC meeting this week, or is it a dead-cat bounce? With the VIX at 29%, it's clear we can expect still big moves and wild reversals.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.