- English

- عربي

The race for the White House is on. While Trump is set to lead the Republican party into the election, the Democratic nomination is a heated contest. Four contenders have carved an edge and lead the polls, each offering a very different deal for the United States and global financial markets.

Of a crowded field that started with more than 20 candidates, four have emerged as favourites. Two are moderate liberals: former Vice President Joe Biden and South Bend Mayor Pete Buttigieg. The other two are more progressive candidates, campaigning on radical financial and social reform: Vermont Senator Bernie Sanders and Massachusetts Senator Elizabeth Warren.

Polls show the race is between Biden and Sanders: stability vs revolution. The former VP and Vermont Senator are the two most likely to take on Trump at the presidential election in November.

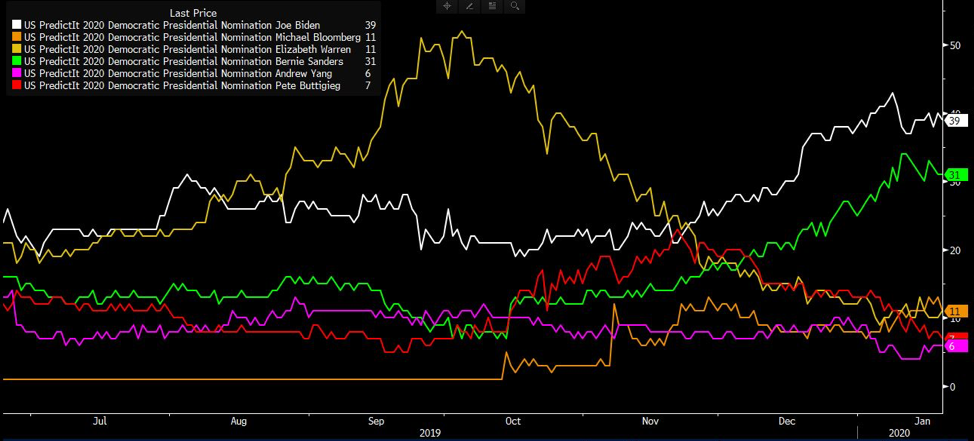

Source: Bloomberg

PredictIt’s polling puts Biden ahead of the pack at 39%, Sanders follows at 31%, Warren 13% and Buttigieg 8%. Just a week ago, the difference between Biden and Sanders was narrower, polling at 37% and 34%. Some polls have them even closer.

A Biden administration is the Democratic party status quo, Clinton-Obama in style. In fact, Biden often talks about continuing “our” work, positioning himself as a continuation of the Obama era. Biden is the stability ticket: a softer approach to China, reversing Trump’s “excessive” corporate tax cuts, and fairly friendly to Wall Street.

A Sanders administration on the other hand would be a radical shift left for the democrats. His campaign is built on an anti Wall Street message: a wave of financial taxes, wealth taxes, and breaking up big tech companies he views as anti-competitive. Sanders could be an even harder ticket for China, bringing climate and human rights issues into any possible deal, and is likely to campaign that Trump hasn’t done enough to protect American workers as he promised.

Markets will be spooked if Sanders takes out the democratic nomination, and if voting starts to go in his favour, price action will start accounting for the risk. US equities would take a hit, which would ricochet to global stock indices. Meanwhile investors would flee to safe havens, with gold (XAUUSD) and forex pairs like USDJPY seeing significant bids up.

How do the primaries work?

To nominate a preferred candidate, US citizens will vote in a series of state primaries and caucuses February through June. Each state has a number of delegates determined by its population: more populous states have a greater number of delegates, which are awarded proportionate to their vote. So if a candidate wins 40% of a vote in a state primary, they win 40% of the state’s delegates, which will determine a party leader in the Democratic Nominating Convention (13-16 July).

A primary takes leadership to the ballot much like in a general election. Some states though opt for a more traditional process: the caucuses. A caucus is a cheaper and more complex process than the primary, and dates back to the 18th century. Voters congregate at a town hall and express their vote by standing in a designated area of the room. Candidates with less than 15% threshold are deemed unviable and those voters choose their second candidate.

The important difference between a primary and a caucus is the second choice vote, which counts in a caucus but not a primary.

The first state to vote for Democratic nomination is Iowa, which will hold caucuses on 3 February. Despite being a small rural state with demographics that do not represent the rest of the country, the Iowa caucus attracts a lot of media attention and the winning candidate gets a first movers’ advantage.

Polls show Biden and Sanders neck-and-neck for Iowa, but Sanders is an established name here. He swept 49.6% of the vote in the 2016 caucuses, losing by only 0.3 of a percentage point to Hilary Clinton’s 49.9% victory. After Iowa comes New Hampshire, where Sanders won in 2016 and is predicted to win again this year. Two initial wins and he’s in the national spotlight. The question is: would the early advantage be enough to propel him to Democratic nominee?

The Republican primaries are a non-event this year, as the incumbent is often handed the nomination. The GOP has hosted no primary debates, and seven states have cancelled their primaries to bolster support for Trump.

Markets like continuity

Markets enjoy the status quo, especially when things are working. US equities are posting record highs almost daily at the moment, and markets will want assurance of continuity to extend this rally.

See the chart below, where the red line is the percentage point lead a Republican win has over a Democratic win in the November election, according to PredictIt. The higher the chances of a second-term Trump administration, the higher equities seem to rally.

Now consider how equities might react to polls that start to suggest a Democratic victory in November, and how that would differ again between a Biden or a Sanders administration.

We’ll be covering event risk and trade opportunities as the November general election approaches. For more election news and market commentary, subscribe to The Daily Fix newsletter.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.