- English

- عربي

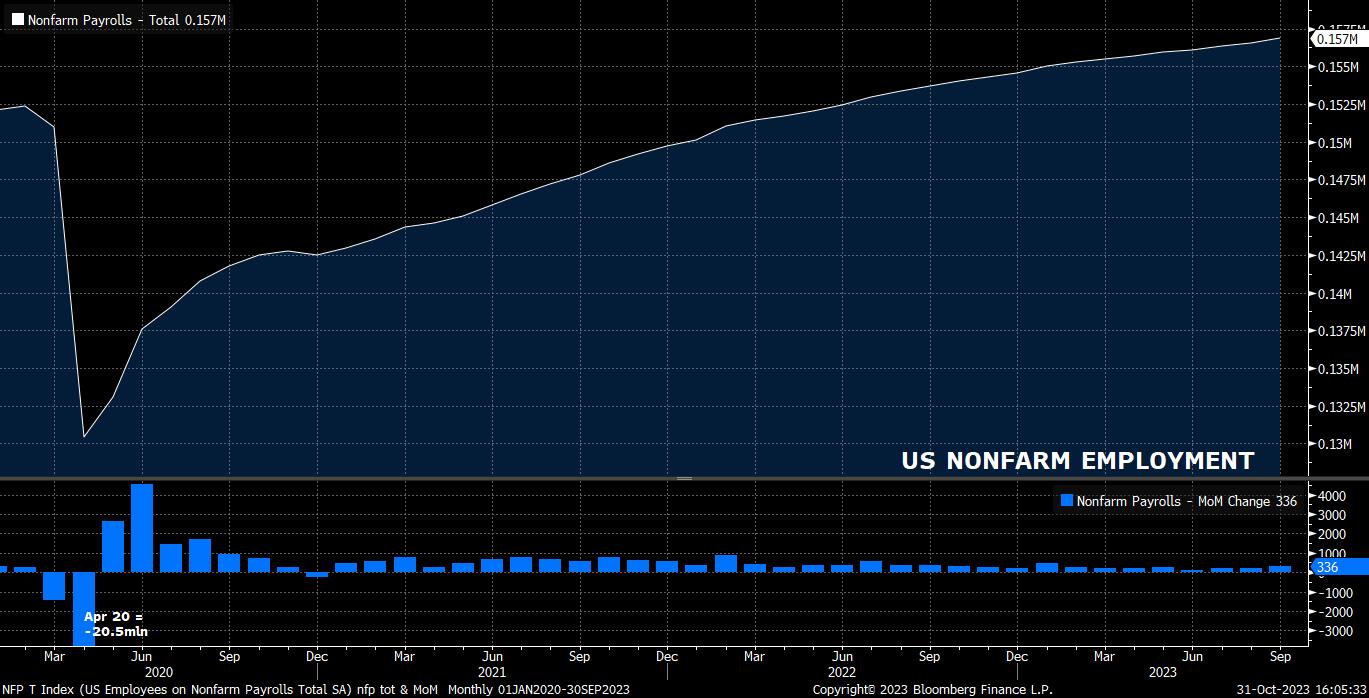

As noted, the jobs report should once again point to the remarkable resilience of the US labour market, despite 500bp of policy tightening over the last two years. After a blowout nonfarm payrolls print at +336k beat all expectations in September, consensus sees a slowing in the pace of job creation in October, expecting headline NFP to have risen +180k on the month.

Nevertheless, this would still represent a healthy increase, considerably above the 100-120k required to keep up with population growth, while also broadly in line with the average monthly gain seen during the latter stages of the prior economic cycle in 2019.

Leading indicators for the NFP print – for which, incidentally, estimates range between 125k and 235k – are a little mixed. While, at the time of writing, neither of the ISM PMI surveys, nor the ADP employment report have been released, jobless claims provide little clarity on the direction to which the balance of risks tilts. Initial claims fell to a 9-monht low just at 200k in the survey week, though continuing claims take some shine off that optimistic print, having risen over 60k during the same period.

A range of other, more minor, leading indicators do paint a positive picture, including a range of recent regional Fed sentiment surveys, the MNI Chicago PMI report, along with October’s consumer confidence survey from the Conference Board.

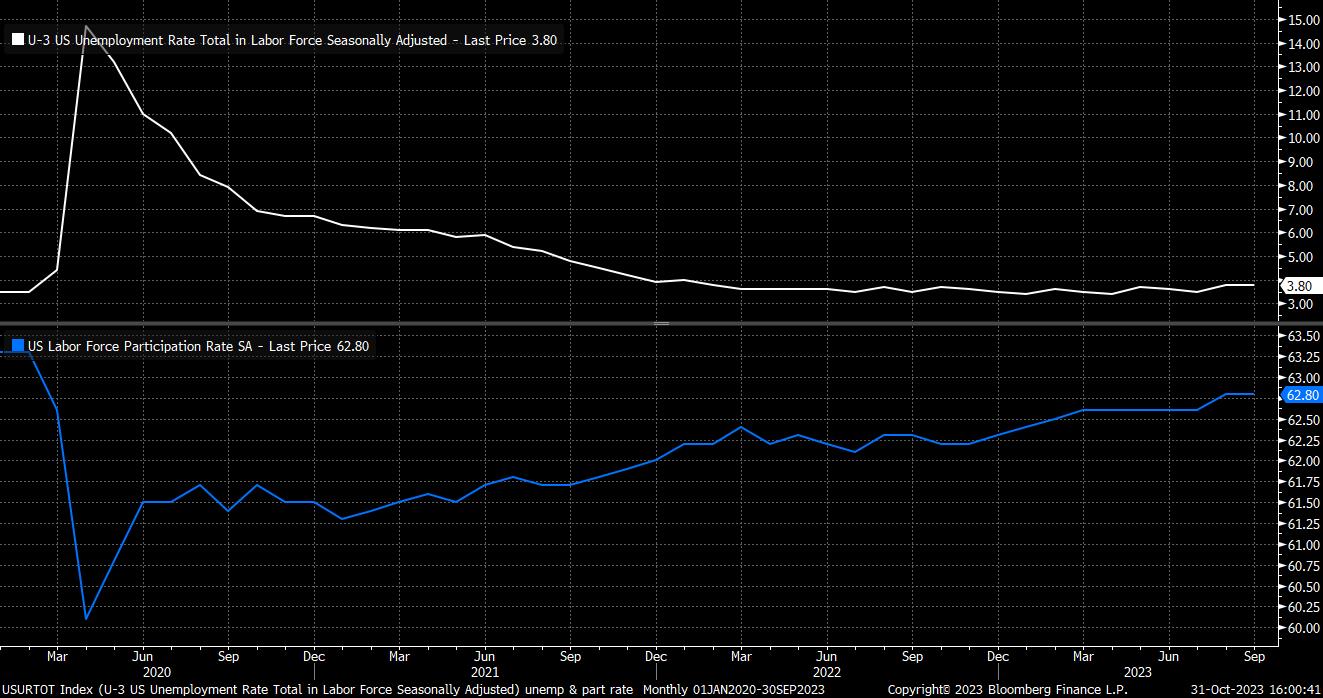

Turning to other parts of the report, little change on the month is expected. Unemployment is seen remaining at 3.8%, bang in line with the FOMC’s year-end forecast, while underemployment should once again print around 7%.

Furthermore, participation is expected to remain at a cycle high 62.8%, with participation among prime-age workers set to remain at a multi-decade high 83.5%. Both would be pleasing signs for the FOMC, even more so were the data to surprise to the upside, as evidence of that some modest slack may remain within the jobs market, explaining why upward earnings pressures do not appear as intense as some had expected.

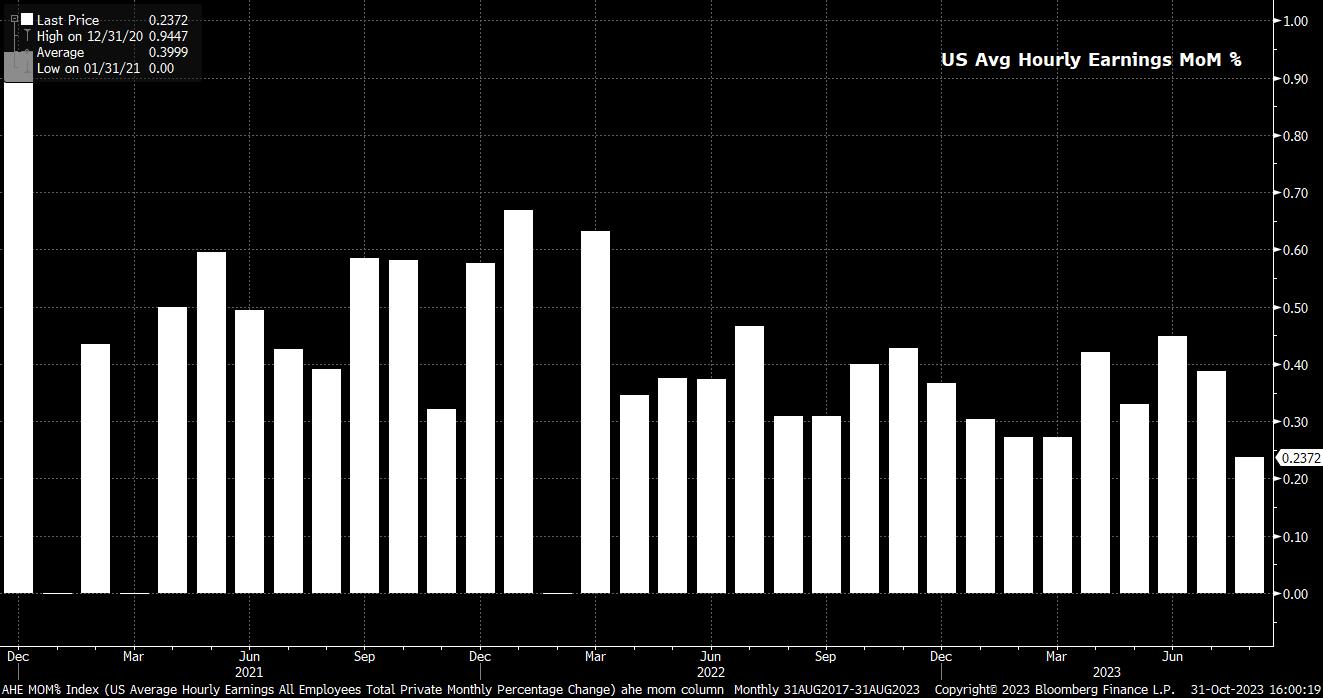

On the subject of earnings, average hourly earnings are set to have risen 0.3% MoM in October, a modest quickening from the 0.2% pace seen a month prior, though still not at a rate incompatible with a return of inflation back to the FOMC’s 2% target. Furthermore, such an increase would drag the annual pace back to 4.0% YoY, a modest slowing from September’s 4.2%, though a fair chunk of this decline owes itself to base effects from last year feeding into the data.

All in all, the report should once more paint a solid picture of the state of the US jobs market. However, the policy implications from such a report seem likely to be relatively limited, with the data coming less than 48 hours after the FOMC’s November policy announcement. Furthermore, with the ‘higher for longer’ stance now firmly embedded, one labour market report – no matter how strong or weak – will significantly alter the near-term rate outlook.

That said, OIS currently fully prices a 25bp Fed cut in the early part of H2 23, pricing that may be brought modestly forward to June 24 were data to come in cooler than expected.

The impact of such a move on other markets is perhaps harder to discern than usual, owing not just to the NFP release’s proximity to key policy decisions from both the FOMC and BoE, but also due to the recent trend among market participants to hedge potential headline risk and trim exposures, rotating into safe havens, prior to the weekend, amid the evolving and fluid geopolitical situation in the Middle East.

Nevertheless, going into the FOMC, the DXY remains in a relatively tight 105.50 – 107.20 range, with the 50-day moving average also lurking right at the bottom of this region. Risks continue to point towards the upside for the greenback, particularly with risk appetite remaining on shaky ground, and with the US economy continuing to vastly outperform its DM peers.

_D_2023-10-31_15-58-37.jpg)

Elsewhere, while the NFP print may cause a knee-jerk reaction in other asset classes, there are once more bigger forces at play that are likely to have a more prolonged impact.

In fixed income, for instance, though the long-end of the Treasury curve has found some demand of late, concerns over mounting bond issuance continue to be the main driver here. Similarly, in the equity market focus remains on Q3 earnings season, with Apple, the largest stock in the S&P 500, reporting after market on Thursday, in addition to ongoing geopolitical developments. That said, with the S&P 500 trading back under its 200-day moving average for the first time since March, and below the 4,200 handle, the trend certainly favours the bears for now.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.