- English

- عربي

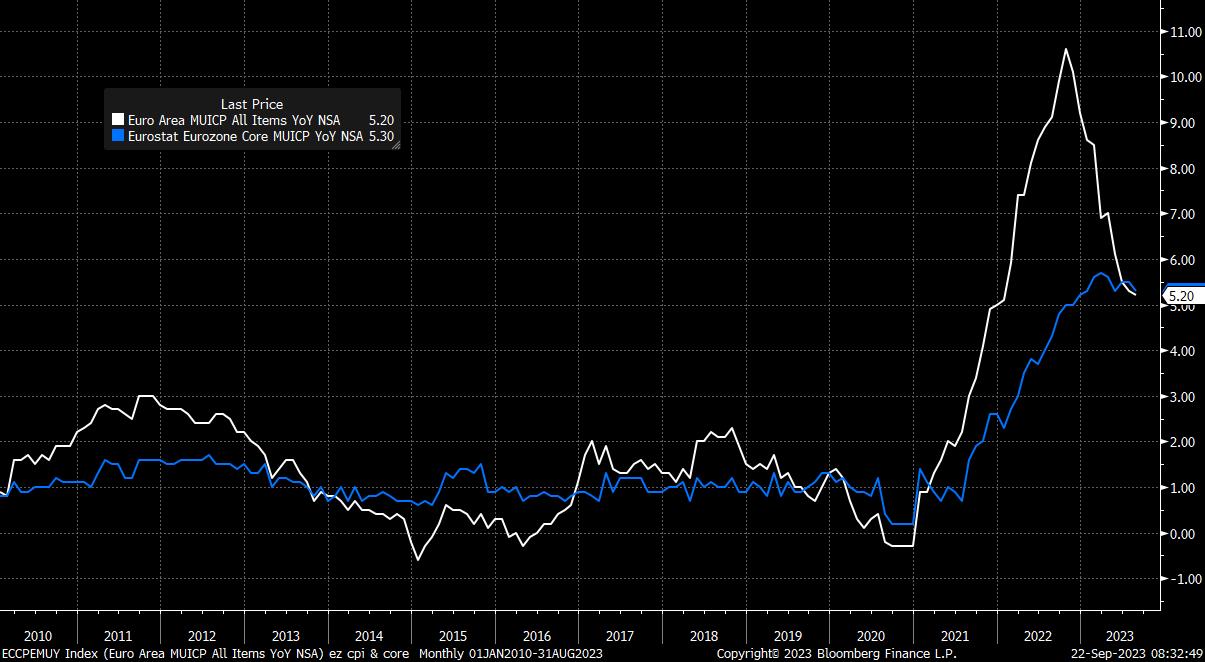

Though all estimates have yet to be compiled by Bloomberg, headline inflation is likely to have slipped just under the 5% YoY handle this month, with core prices set to remain at 5% YoY; a promising decline on both metrics, though clearly still some distance away from the ECB’s 2% price target.

Overall, however, the policy implications of the release are likely to be relatively limited, especially with policymakers continuing to project headline inflation remaining above the 2% target for the entirety of the forecast horizon, until the end of 2025. Markets appear largely onboard with this view, pricing just a one-in-five chance that the ECB tighten policy further before the end of the year.

Where a string of cooler than expected prints may have an impact, however, is in the pricing of rate cuts, with OIS currently implying that the first 25bp depo rate cut will come early in the second half of 2024. This pricing is likely to be brought forward, despite rhetoric from ECB policymakers to the contrary, were inflation to cool more rapidly than expected or, perhaps a more likely scenario, if economic momentum continues to wane at the rapid rate currently being seen.

For the common currency, it is these longer-run growth dynamics that will determine the EUR’s most likely direction, with the G10 FX market clearly trading on the theme of relative growth differentials, as evidenced by the USD’s continued solid performance.

From a technical standpoint, with EUR/USD having now taken out long-standing support at 1.0650, the 1.0500 handle is rapidly coming into view, a level at which the bears may look to take some profit off the table, and where price may begin to consolidate a little. However, with risks to the eurozone economy intensifying, and the Fed set to retain their hawkish stance for some time to come, a further decline to the mid-1.03s cannot be ruled out.

_eurusd_mb_2023-09-22_08-32-24.jpg)

To the upside, for any rallies to be sustained, price will need to reclaim, and hold a retest of, the 200-day moving average at 1.0830; beneath which, rally selling is likely to remain the market’s preferred strategy.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.