- English

- عربي

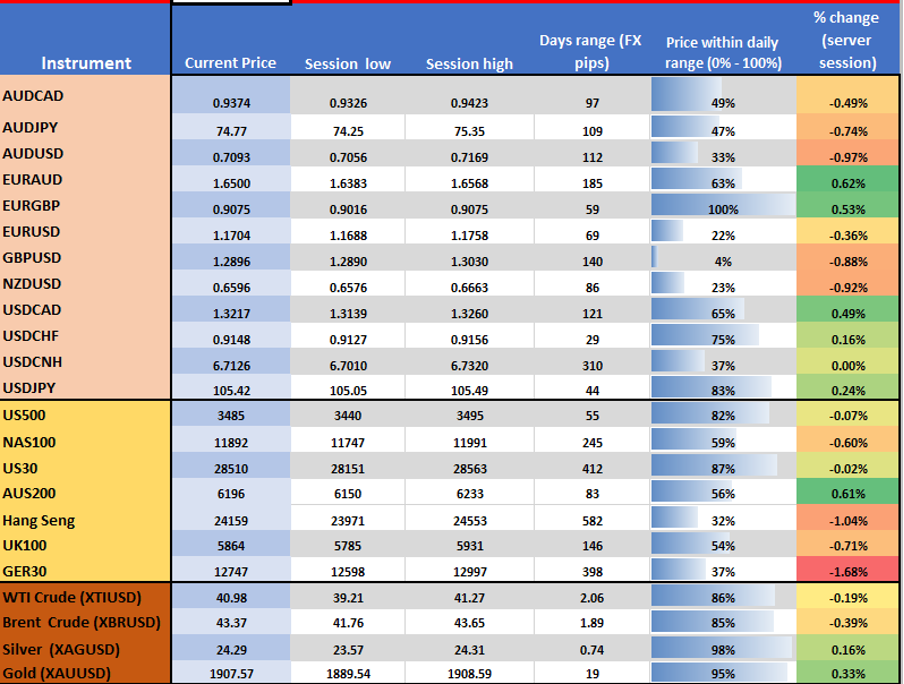

The Daily Fix: Volatility increases amid sizeable range expansion

US equity indices have also been whippy, with NAS100 trading a 245-point range, but we ultimately see the lows of 11,747 holding, the cash market closing -0.7%, and the market not wanting the index to close below the 5-day EMA just yet. It's not all gloom, as US small caps have worked well and the US2000 has closed +1% and Dow Transports +0.9%.

There's been little to inspire with US data largely worse than expected (weekly claims 898k vs 825k eyed, NY Fed index 10.5 vs 17 eyed, Philly Fed better at 32.3 vs 15), while the EU Summit resulted in UK chief negotiator, David Frost, saying he was “surprised and disappointed”. Despite the bearish tape in GBP, there has been little buying of GBP volatility (GBPUSD 1-month vol sits at 11.12%), although we’ve seen UK gilts well bid, with 10’s - 4bp to 17bp and moving closer to zero. Talk of US stimulus has also done the rounds, but there is little substance to it and the market is less sensitive to it than the headlines would have you believe.

The COVID19 restrictions placed in London and various European countries certainly caused some angst in EU equities, while Italian 10-year bonds have widened 7bp vs German 10-year bunds – typically a EUR negative, notably vs the JPY and one to watch. The rally off the lows in US equity futures has seen our EU indices rally after the cash close in line with US futures – for context, S&P 500 futures are 0.7% higher now than where the DAX closed in the cash. So, if the EU markets were to open now they would open higher. It feels as though strength is there to be sold, but these are unpredictable times and markets are getting into wild west territory. The eye of the storm beckons.

The USDX has rallied 0.5%, with the ‘basket’ breaking the downtrend drawn from the 25 September high and the result has been a bullish shift in stochastic momentum (on the daily). Again, there's been little to inspire the move other than select risk aversion, with US fixed income barely moving across the curve. The big percentage move has been seen against the NOK, AUD and NZD, so this is a risk move more anything, with risk FX failing to follow the rally higher in US equities.

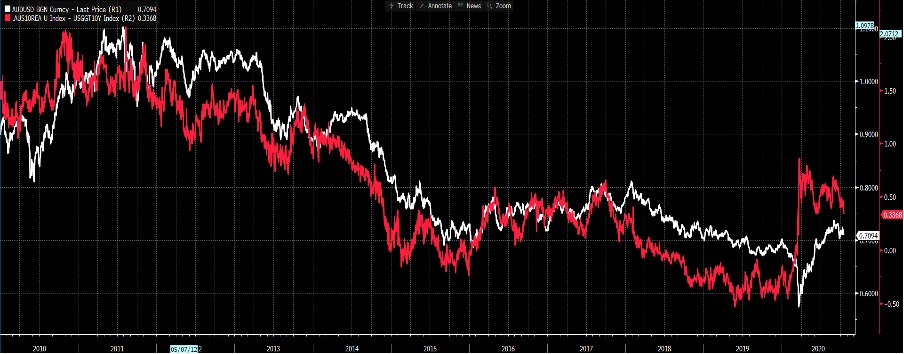

AUDUSD has certainly caught the attention of clients, and flow has been upbeat, with Governor Lowe’s speech certainly giving those calling for easing at the November RBA meeting even more conviction. The prospect that we get the cash rate lowered to 10bp, the yield cap taken to 10bp, as will the term funding facility (TFF) seem high. Lowe has opened the door for more QE, perhaps even in November, but this is unclear. Unlike yield curve control, QE is a set amount of bonds the RBA will buy each month from banks. Kudos to the RBA, as they managed to bring down the 10-yr ACGB by 7bp while lifting inflation expectations (Aussie breakevens were up 3bp), so the result was a 10bp fall in Aussie ‘real’ yields – if you want to get your currency down you have to get ‘real’ yields lower and on a relative basis.

(White – AUDUSD, red – AUS-US 10-yr real yield spread)

(Source: Bloomberg)

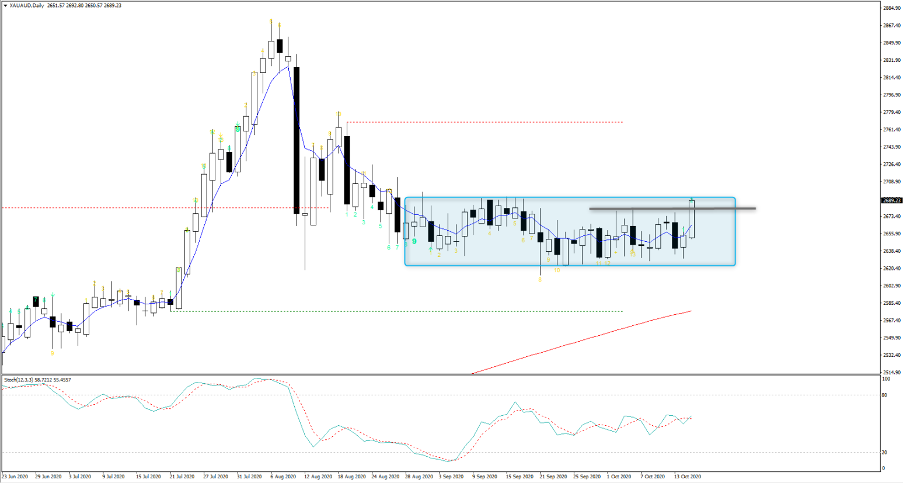

I was impressed with price action in gold, with XAUUSD holding up well in a stronger USD environment. The lack of movement in US fixed income may have helped, but I still see traders using gold as a hedge against the election, alongside optionality, with the cost of S&P 500 25-delta puts into expiries past 3 November sky high. XAUUSD has printed a higher low, but there's been no impetus to push price through Wednesdays high of 1912.92 and the daily shows a lack of conviction either way. Flip the chart to XAUAUD and look at the effects of gold priced in AUD and things look far more interesting, with price looking to break out topside. Buying an asset in the weakest currency can be tactically advantageous.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.