- English

- عربي

Equity traders have largely ignored the negative news and there were a number of reasons we could have expected price to follow-on from Friday’s bearish price action. On a brief scan this morning I see that New Jersey has put plans to open indoor dining on ice, and NYC is looking to do the same. Florida has reported 5266 new cases and Houston ICU beds are running close to full capacity, with ICU admission rates growing at 3.5% a day. We also heard from the WHO who detailed that the “worst is yet to come” given the lack of global solidarity.

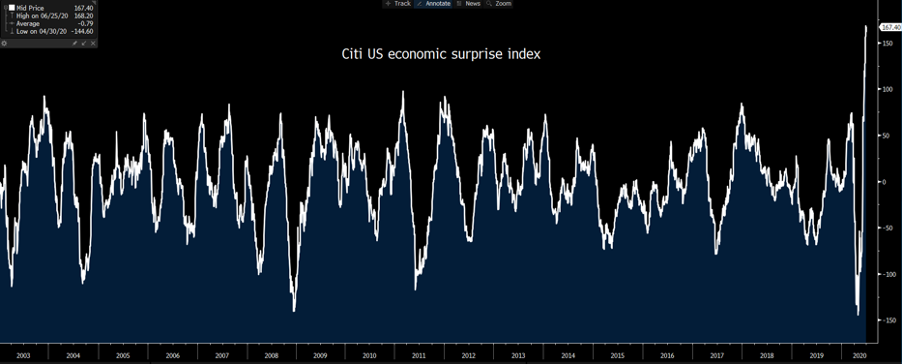

All sobering indeed but the markets have moved on. Perhaps this is a reflection that US economic data continues to improve (the Citigroup US economic surprise index sits at 167, which is an all-time high), where there is a belief that we’re staring at a trough in US earnings and perhaps consensus estimates are about to start being revised higher. The fact that we’ve seen solid buying in crude and copper largely reflect a better economic tone on the floors.

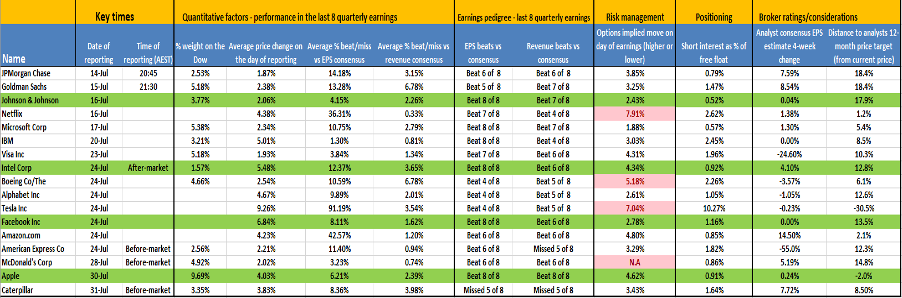

For the equity traders out there, I’ve put together a matrix of key company reports that I expect clients to focus on, with some stats you might find useful. Many of the reporting dates are yet to be confirmed and are Bloomberg estimates (I’ll update when all are confirmed).

*Stocks highlighted green denote a superior pedigree over earnings.

Pending homes sales up a lazy 44.3% and the Dallas Fed manufacturing index in at -6.1 (vs -49.2 in May and vs consensus of -21.4). The fact Boeing closed up 14.4% after US aviation regulators approved the company to start test flights on its 737 Max from next week put in 24 Dow points alone. Or perhaps it’s just because we’re into the final throws of the quarter and its some last-minute window dressing before reporting your numbers back to clients.

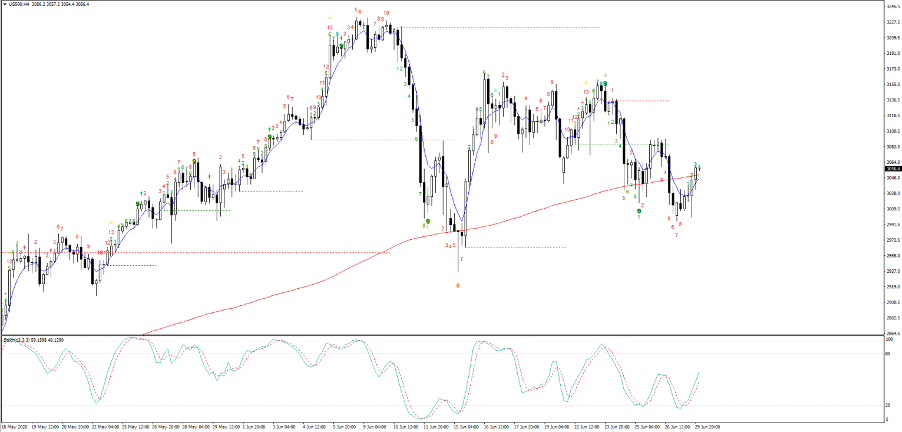

Either way, we’ve seen small caps firing up, with the Russell 2000 +3.1%, while the Dow Transports gained 2.3%. Cyclical stocks are generally working, where we’ve seen the index close 1.5% higher on turnover 20% below the 30-day average. Price is still holding below the 5-day EMA and we failed to materially threaten Friday’s high, so despite the positive move on the day, it’s hard to see price action in too bullish a light, and we really need the index to move through 3160 to get me excited about a resumption of the bullish trend.

The idea that we’re seeing the US benchmark index in a distribution phase has been brought up by a number of traders and that generally needs work to play out before a move lower. This picture still needs time, but the battle lines are drawn.

Another interesting theme has been calls that EU equity indices are due to outperform US indices for a sustained period. This was accelerated with Blackrock downgrading US shares and upgrading European shares. Certainly, the clouds are clearing in the EZ with headlines that the German parliament is to back the ECB’s bond-buying program. If I look at the DAX/S&P 500 ratio, we can see the German index outperforming of late and perhaps that can continue – long GER40/short US500?

FX markets have done very little, despite the move in equities, with AUD and NZD largely unchanged on the day.

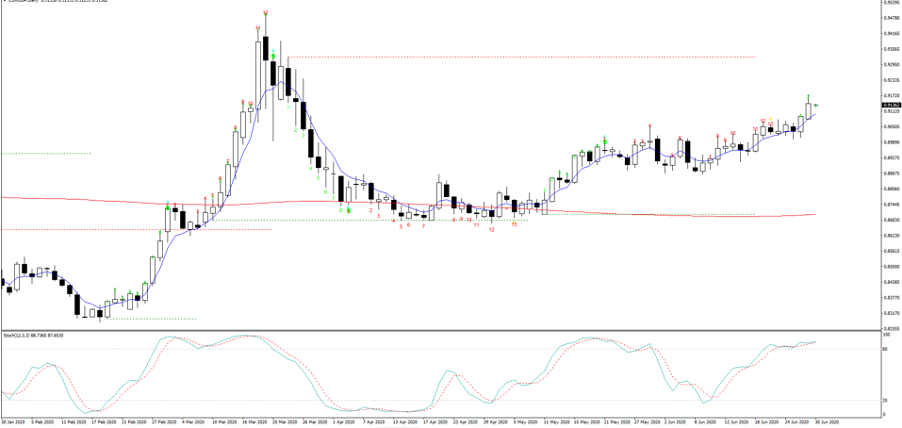

EURUSD continues to track the 1.1350 to 1.1180 range it’s found itself in, but it's EURGBP that is finding good interest given the resumption of the bullish trend we’ve seen since the start of May. One for the trend-followers.

USDJPY pushed into 107.87, matching the 10 June high before supply kicked in – momentum is to the upside it seems, and a daily close above 107.76 would signal a move into 108.40 in my opinion. USDJPY is probably a good pair to focus on as we head into the last session of the month and quarter.

Consider on the data side we get US consumer confidence (00:00 AEST) where the market expects a lift in the index to 91.4 (from 86.6), while Fed chair Powell and US Treasury Secretary Mnuchin speak before the House Financial Panel (02:30 AEST), which will get focus from traders. Expect Powell to push for more fiscal measures.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.