US non-farm payrolls preview - where good news is bad news for markets

For context, there are 1.98 jobs open for every unemployed person looking for work – with this ratio lifting from 1.87x in June. While the labour market is typically one of the last data points to be affected in the business cycle, we know the Fed is keen to see a slowing in labour as a signal they can slow the pace of rate hikes from an “unusually large” pace of 75bp hikes a meeting, to perhaps something more conventional like 25bp over time.

The JOLTS report made us believe a hike of 75bp at the 21 Sept FOMC meeting is firm the default position.

Risky markets fell on good data

The fact is when we saw that incredible level of job openings (and a better US consumer confidence report) we perversely saw traders de-risking and risky assets fell – US treasury yields rose (as more rate hikes were priced in 2023), with the US 2yr Treasury pushing to 3.50%. The USD rallied in response to moves in the bond market and equity markets fell to session lows.

The fact is when the Fed is centred on getting inflation down to target over time and prepared to force a sustained period of below-trend growth, they know it will require a softening in labour market conditions – that, as multiple Fed members have said, is the cost of moving away from a high inflation regime.

We know the market is discounting the fed funds rate getting close to 4% by April 2023 – so we ask, are we at peak rates, or while we know the Fed is ramping up its balance sheet reduction plan (“Quantitative Tightening”) to $95b p/m, could they go even harder and push markets-based expectations of the future fed funds rate above 4%?

It throws up the idea that good (economic) news is bad news for risky assets, such as NAS100, US30, AUD, and crypto. It means bad news is perversely good for these markets.

To some in the market, this is a hard view to grasp – it just doesn’t make sense to sell equity on good data. But the eyes of the market are on the triggers for the Fed to ease off on hiking at such an aggressive pace and for that, we need lower inflation and a softer labour market.

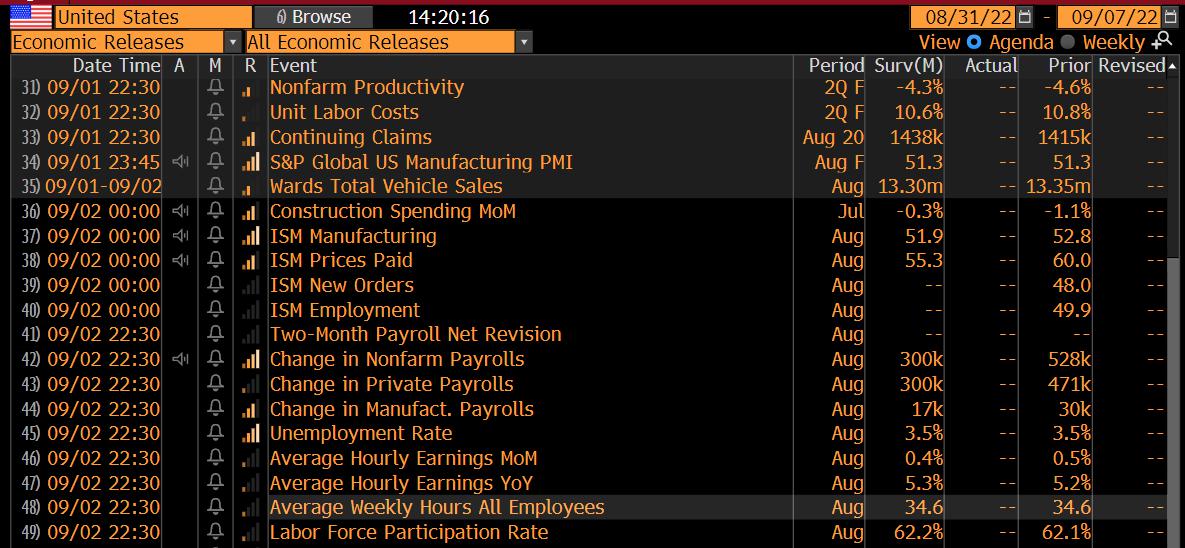

The US payrolls preview

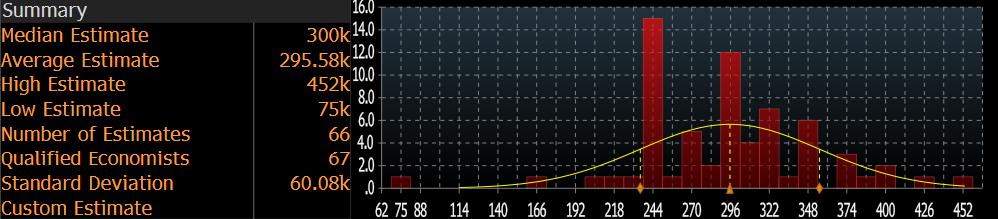

We see the US non-farm payrolls report on Friday at 22:30 AEST/ 13:30 BST. With the 6- and 12-month average monthly pace at 416k and 512k jobs respectively, it suggests the probability of another month of very strong level creation, with consensus expectations for this report at 300k – with the distribution of economists’ expectations ranging from 452k to 75k. When you see this sort of dispersion in views you know the conviction to forecast is low and the ability to price risk is therefore highly uncertain – volatility is usually the result.

We also see expectations for the unemployment rate (U/E) at 3.5%, despite the participation rate expected to tick up to 62.2. Hourly earnings are expected at 5.3%, up from 5.2%, and this could be influential as it is an inflation consideration.

While the August US CPI print (on 13 Sept) is still a major consideration, with 70bp being priced for the 21 Sept FOMC meeting, the market is placing an 80% chance of a 75bp hike here. A good NFP print likely seals a 75bp hike but also pushes pricing for the fed funds rate above 4% in April 2023.

(Distribution of economists’ estimates)

What constitutes a good number? This is hard to say, as we probably need to think what a bad number is that changes the market thinking towards a 50bp hike. I’d argue that is 150k jobs or less, with the U/R rising. Still, even then we get the odds of a 75bp hike closer to 50:50, with the CPI print the likely clincher.

A print below 150k to 100k would be a big surprise given the trend, but it would be enough to cause a solid move lower in the USD, while equities reverse and move up 1%-2%. Given the market is pricing a 300k print, the risk for an equity decline comes if we see a 400k+ jobs print – again, this may seem positive, but it just encourages the Fed to go harder on the hiking cycle.

Good news is bad for risky assets – conversely, bad news is good news.

What’s your position?

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)