- English

- عربي

I’ve used headline CPI, and not core CPI for my back-of-the-envelope playbook, although core CPI is equally as important given headline inflation will be affected by sharp declines in gasoline through July. The fact we could be staring at a decline in headline inflation, but a rise in core inflation makes life a bit more problematic to strategize, but I guess semantics are in play and will drive price– the market is desperate to trade a peak inflation narrative and that is why I feel on balance the initial move will key off headline inflation.

A great place to start is the consensus expectations

The consensus is for 0.2% MoM with the distribution of estimates from economists seen between 0% to 0.4% - this suggests a median estimate for the year-on-year (YoY) pace of 8.7%. As we looked at yesterday, historically inflation has typically beaten estimates - so the form book suggests a higher probability that we get a number north of expectations.

The trader playbook

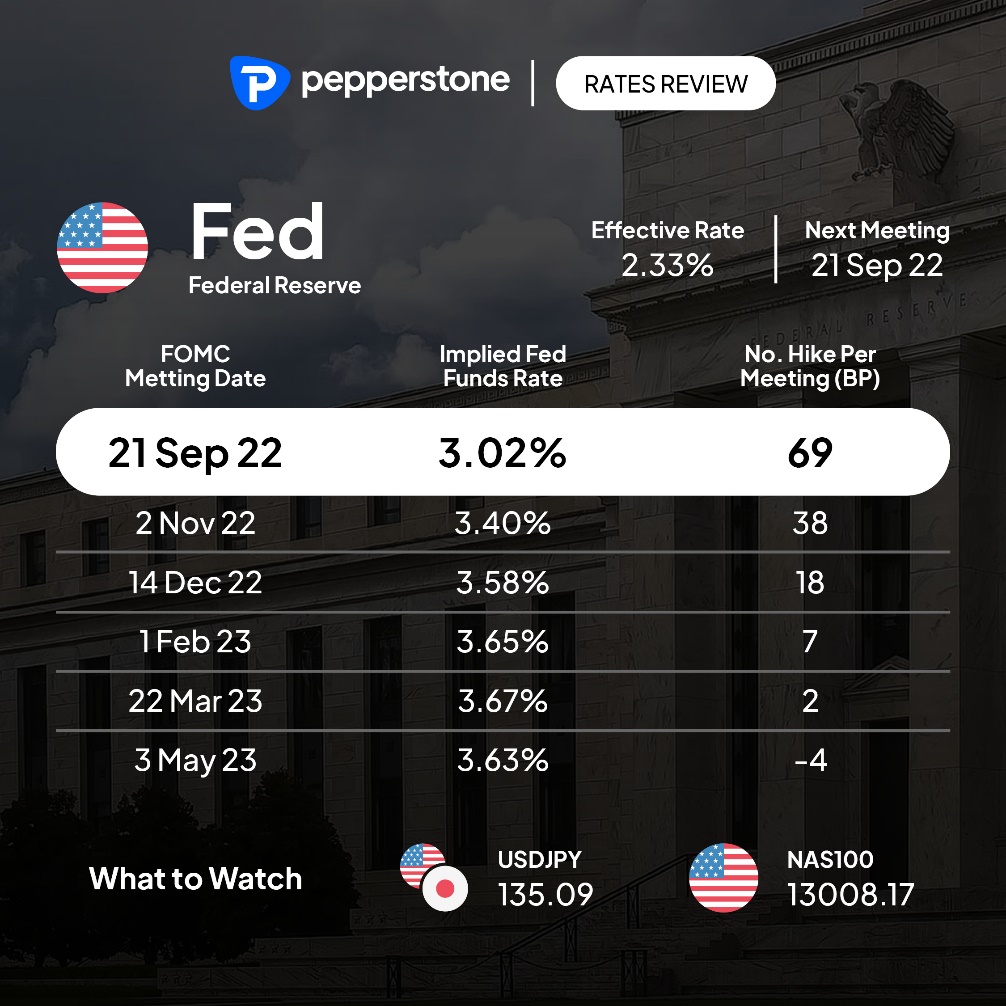

Pepperstone Rates Review – see current expectations priced for the Sept FOMC and then the step up (in basis points to the following meeting)

From a simplistic perceptive, if we see headline inflation print:

0.1% to 0.3% month-on month (MoM) - this is the grey area where the Fed’s thinking is unmoved and we likely see limited moves across markets – the current pricing of 69bp of hikes for the 21 September FOMC meeting should not be affected too intently, as the year-on-year print will still be in the high 8% range. So, while the market will explore the components of the inflation basket to see where the price pressures are coming from and how entrenched they will remain, with core inflation still above 6% nothing really changes - the Fed will still be hellbent on bringing down inflation, even at the expense of growth and a rise in unemployment.

<0% (i.e headline prices fall in July) – this would be a shock to the market, and we could hear much about ‘peak inflation’ – semantics are at play here, but I think the pricing for the September FOMC meeting comes closer to 50bp and we see the USD fall sharply, with AUDUSD working into and above 0.7000 – the NZD and MXN would also find strong upside. The NAS100 would likely find buyers easy to come by and moves of 2%+ seem likely – look for some bullish breakouts in crypto and meme stocks should see double-digit returns on the day. Gold will be interesting and while it should rally on potential USD weakness, I see evidence gold is being used more as a hedge against inflation again.

>0.5%MoM – this likely takes the YoY pace above 9% - it’s here that a 75bp hike in September is a done deal and we see US 2yr Treasuries sell-off aggressively taking the yield curve deeper into inversion. In this dynamic, the USD would rally hard vs the JPY and CHF and I’d expect tech and growth stocks to find heavy selling flow – again, the NAS100 is likely the most sensitive to this. Looking for volatility to ramp up and the US volatility index would push into 27% - could this start a leg lower in equity markets?

Could we see talk of an inter-meeting hike surface?

Consider we do get Fed members Charles Evans (01:00 AEST), Neel Kashkari (04:00 AEST) and Mary Daly (tomorrow 09:30 AEST) speaking after the CPI print – so they will give a clearer understanding to the market that the outcome of inflation means to their thinking – again, this is an event risk for exposure in itself.

My colleague Luke Suddards will be reviewing the US CPI print live – giving you instant analysis and review of price moves to help with your trading – register here to be notified - https://www.youtube.com/watch?v=_0QYwCv9czo

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.