- English

- عربي

It's been a fascinating week and one where the bond bulls and equity bears are hurting, and more-and-more strategists are advising clients to look at the reflation trade more readily.

Please click on the video to play:

The cynics would argue the steepening of the yield curve has been a position flush out and one that will re-exert itself once the data deteriorates again and suggests we are indeed in a late cycle environment. The world was long duration assets and safe-haven sectors of the financial markets in such great size – hedging against recession risk, a deterioration in trade relations and even a no-deal Brexit – that the recent news flow didn’t justify that one-sided positioning from real money and leveraged accounts.

What we’ve seen is less bad economic data, a commitment from central banks to allow economies to run hot, with the Fed eyeing a move to inflation averaging. While the prospect that an element of tariffs, potentially even all of them, will be rolled back.

I would also consider that the markets may even by front-running a Trump presidential victory in 2020 and the idea of de-regulation and fiscal stimulus, but that, I am sure, is open to debate.

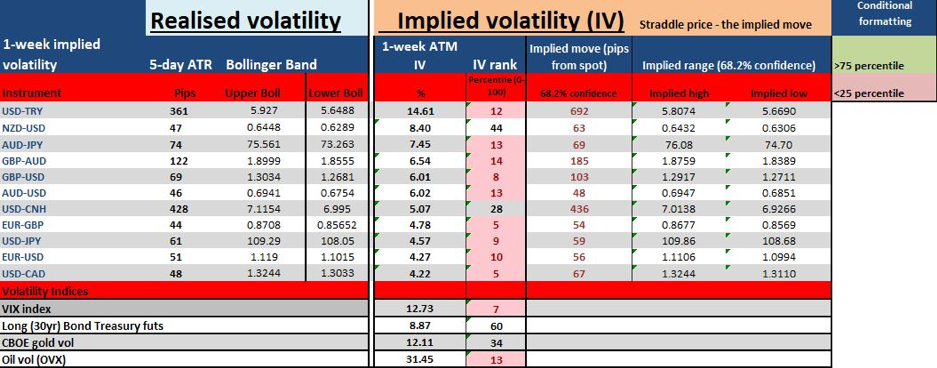

As, per each Friday I have put a video together looking at the movers and shakers in markets, with a specific focus on G10 FX. I have focused on implied volatility and the expected moves from spot, which reflects how the market sees the event risk for the week ahead.

I flagged that we are looking at a punchy ride in December, at a time when many would rather be winding down. But let’s assess what we see now.

- Nato Summit – 3 to 4 December

- OPEC – 5 December

- German election – 8 December

- FOMC meeting – 11 December

- Aramco IPO – 11 December

- ECB meeting and UK election – 12 December

- US-China trade talks??

All the best and have a super weekend,

Chris

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.