As we close the page on October and head into hopefully a lively November, I have put together a few thoughts in this video on the trading week ahead. If you have a 15 minutes, then the idea of the video is to prepare and to specifically help with your risk and position sizing, which is fundamental to trading.

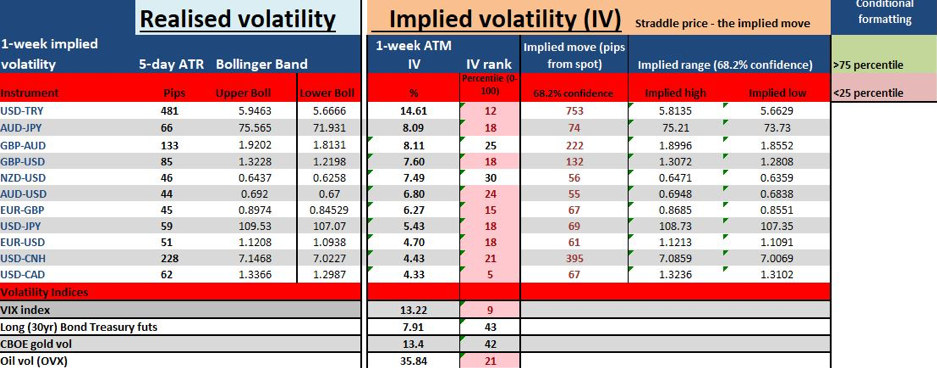

As always, I have not just looked at the key event risk but taken a more holistic approach to understanding our risk-to reward profile. Here, I have included the weekly volatility report, which is essential to me to understand how the market interprets risk, and the expected moves on the week (up or down from spot). Most will use realised vol measures to assess their risk on entry, and then adopt for correct position sizing, and if that provides an edge don’t change that, but my preference is to look ahead and therefore implied volatility.

"Realised vs implied volatility, November 1st"

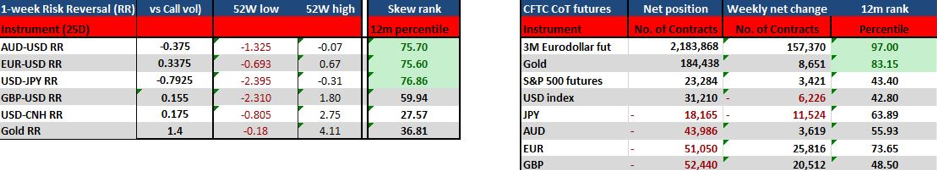

I have also included sentiment and positioning indicators, with 1-week risk reversals and the Commitment of Trader’s report. The latter is due to be updated tonight and will represent FX futures holdings (from non-commercial accounts) as of Tuesday.

"One week risk reversal and CoT report"

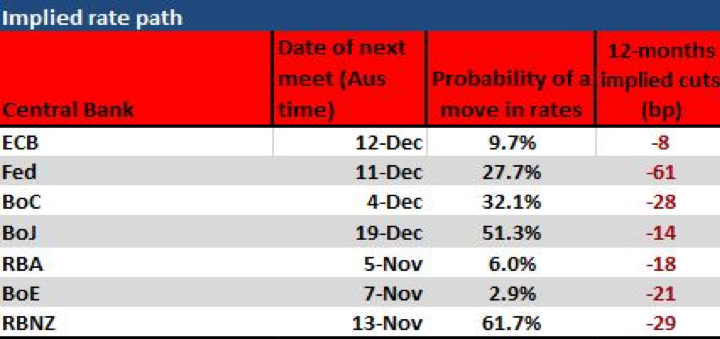

I’ve included an update to the interest rate pricing model, which has garnered some focus after a big week of central bank action. Of course, let’s see how the outcomes of tonight’s US NFP (23:30 AEDT), ahead of the US ISM manufacturing report (1am AEDT), and Fed VC Clarida (4am AEDT). While this rates pricing will likely change on the outcome of the data, it gives you a sense of expectations, not just the upcoming meeting, but what’s priced across the curve.

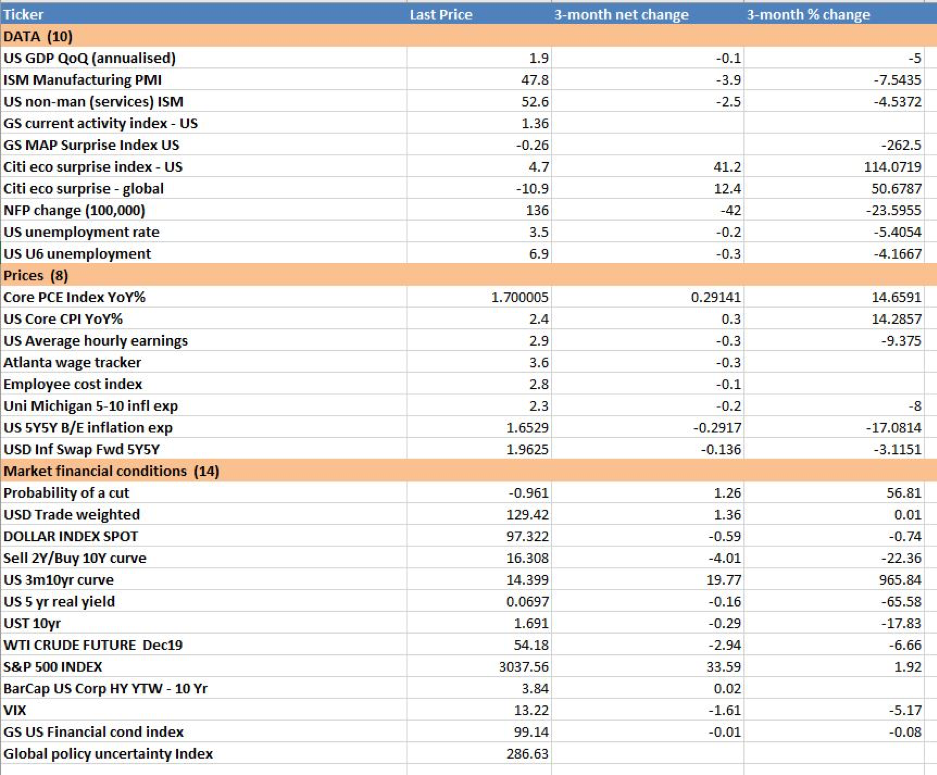

My colleague Sean put out a good review on the Fed meeting yesterday (https://pepperstone.com/au/market-analysis/cut-and-pause) and with the move to a more definitive data-dependent model, with their mantra changed to “assessing the appropriate policy path”. Sean and I have built a basic FOMC considerations model. These are the factors we feel they look at closely when assessing monetary policy setting. We will update this weekly, but if there is anything you feel we have missed then reach out.

The only thing left is to say is good luck to all the South African readers and while I hope England put on a similar display as we saw against the All Blacks, I hope Jerome Garces can let the game flow like Nigel Owens would have. #WearTheRose

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.