- English

- عربي

UK Data Cements Another BoE Hike; But Looks Like Bad News For GBP

On the whole, the releases – covering the labour market, inflation, retail sales, and the latest PMI gauges – tell a rather dismal story; one of an economy that continues to plod along, with inflation remaining far too high, and the labour market beginning to soften.

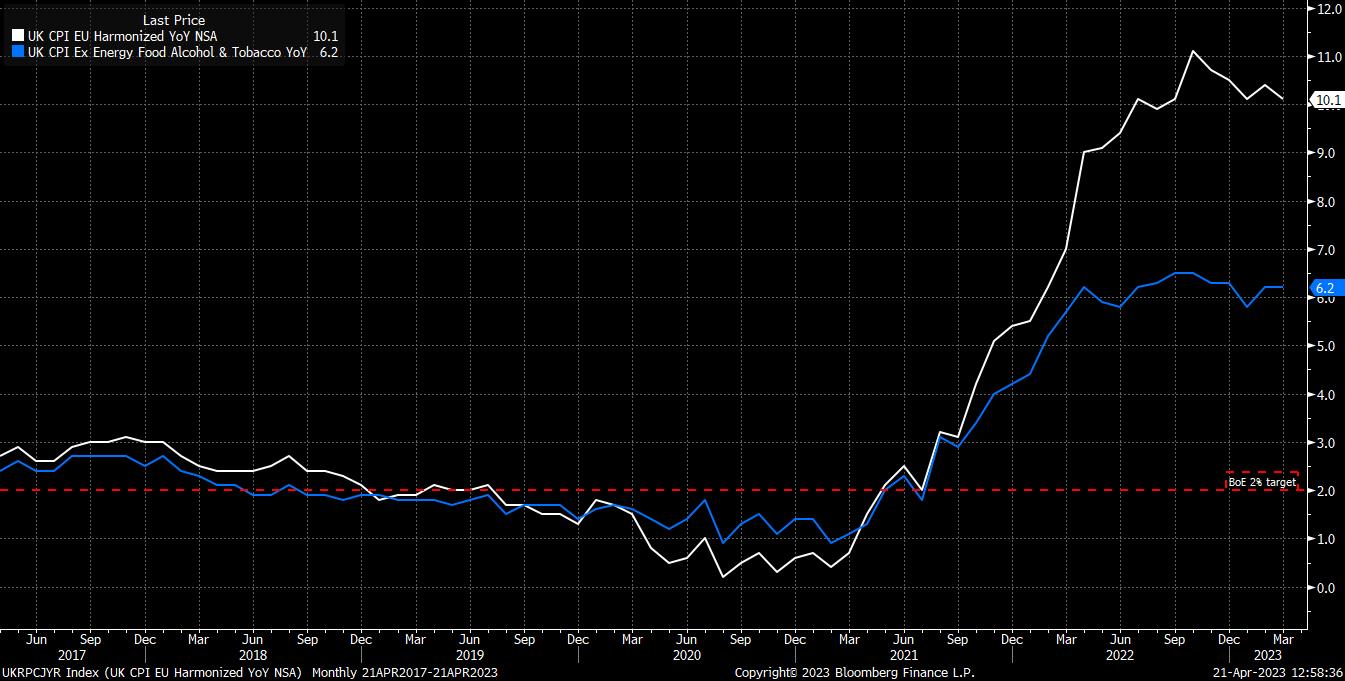

Of all of those points, it is inflation which is by far the most important when it comes to the BoE’s next move. Headline CPI rose by 10.1% YoY in March, above expectations, and the seventh straight month that CPI has printed in excess of five times the BoE’s 2% inflation goal. Core CPI, which excludes food and energy, rose 6.2% YoY, unchanged compared to the pace seen in February, and a sign that price pressures are becoming increasingly embedded within the UK economy.

Whatever way you cut it, this is clearly incredibly bad news. While headline inflation will likely fall from April onwards, as the impact of falling energy prices feeds into the data. However, core inflation shows no sign of slowing, despite the BoE having delivered over 400bps worth of tightening this cycle.

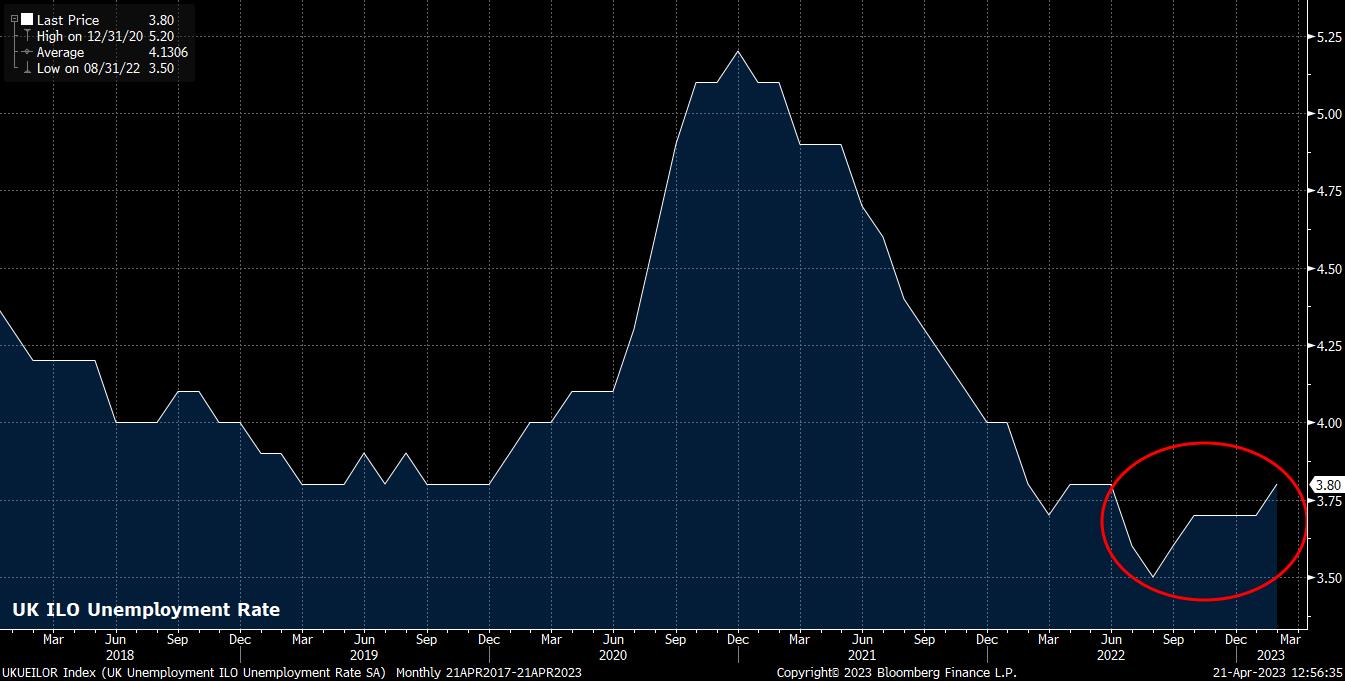

Even more worryingly, there are signs in the latest employment data that the labour market is beginning to soften, as the impact of said tightening begins to bite. Headline unemployment rose to 3.8% in the three months to February, the second straight monthly rise, while the number claiming unemployment benefits rose by the most in two years.

At the same time, earnings continue to rise at a rapid clip, and a pace that is incompatible with a return to the Bank’s 2% inflation goal. Including bonuses, earnings rose 5.9% on an annual basis, while pay excluding bonuses rose 6.6% YoY – both signs that pay demands continue to rise in an attempt to keep up with inflation. Of course, these figures must also be viewed in the context of the wave of industrial action and public sector pay disputes that remains unresolved, and upon resolution is likely to further intensify upward wage pressures.

Nevertheless, as inflation remains far above target, consumers are increasingly showing spending restraint. Headline retail sales fell 0.9% in the month of March, a sign that consumers continue to tighten their belts as the impacts of the cost of living crisis continue to be felt. The retail sales report provided a good illustration of how inflation is impacting spending; compared to a year prior, the total amount spent on retail purchases rose 4.5%, however the quantity of items bought fell 3.1% over the same period. Spend more, get less.

Looking at the data on the whole, it is clear that the Bank of England will now need to continue to tighten policy, contrary to the pause that had been expected. A 25bps hike is now locked-in in the market’s view for the May meeting, while money markets have also revised their estimate of the terminal rate higher by around 20bps compared to a week prior.

Ordinarily, one would expect this hawkish repricing to be a positive catalyst for the currency, particularly at a time when other G10 central banks are looking to bring their own hiking cycles to an end, or have already done so.

However, this has not been the case this week, with the pound struggling to gain much traction, albeit in an FX market which remains rangebound, and with implied volatilities continuing to sit close to the bottom of the 12 month ranges across the G10 board. This is largely due to the data pointing to an economy that is in, or very close to, stagflation – a period of little to no growth, but with persistently high inflation. While further rate hikes will now be needed to bring inflation under control, the Bank’s sluggishness in beginning to tighten policy means that further such tightening will now serve to deepen the economic slowdown being experienced. A rather grim combination, and clearly one that is unlikely to be a positive catalyst for the pound.

_2023-04-21_12-54-04.jpg)

From a technical perspective we have again – for a third time – seen cable’s rally run out of steam around the 1.25 handle, meaning that the broad range in which we have traded since last November remains intact. Though vol clearly remains low, the bears do look to have the upper hand from both a technical and fundamental viewpoint. The 1.23 handle lurks as the most obvious near-term support level, below which the 1.22-1.2210 area is likely the target, with both the 50- and 100-day moving averages sitting in this region. On the other hand, it would take a closing break of 1.25, and ideally the prior 1.2246 highs, for the bulls to properly re-establish control.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.