Learn to trade

How To Get the Most Out Of Your CFD Demo Account: Tips and Tricks

First things first: what exactly is a demo account?

A demo account is a type of trading account offered by financial brokers at the start of their journey with that broker. It’s a trading simulator - in other word, a ‘practise account’ that you can use for a finite period of time in which you as a trader are furnished with virtual funds - a.k.a. ‘Pretend money’ - in order to trial your positions and trading strategies before using your own real money in a live account, on a live platform.

Demo accounts are completely free of charge to you the trader, and are offered on a non-obligatory basis. They should mimic exactly the functions and markets offered on the trading platform you’ll be using ‘live’, later on.

What are CFDs?

There are different types of accounts to trade with (like demo accounts), and likewise there are different ways to trade. One of the most popular financial products the world over are a type of derivatives, called Contracts for Difference (or CFDs for short).

CFDs, as a derivative, ‘derive’ their value and price movements exactly from the market prices of the underlying asset that they track - for instance forex pairs, a share price, the current gold price and more. With CFDs you can speculate on the price movements of your chosen market and will make a profit from your prediction if it’s correct and a loss if you’re incorrect. It is important to note that you do not own or have any rights to the underlying asset.

Another important thing to note is that CFDs are complex instruments that are leveraged. This means that, instead of paying 100% of the cost of your position at the outset of your trade, you only need to put up a small percentage of the full value of the underlying asset (known as margin - a type of minimum deposit). This allows you to open a position 10x, 20x or even 100x bigger than your initial margin amount.

It’s also important to note that CFD trading can be risky. That’s because both profits and loss levels are based on your full position size, not the margin you’ve paid. Add leverage into the picture, and that means that losses can accumulate quickly and outweigh your margin amount.*

Find out more about trading on leverage

What’s the importance of a demo account?

Many ways to improve your trading involve financial investment. But one of the very best things anyone can do is set up a demo account - and it's completely free.

Demo accounts allow beginner traders to practise trading, finetune their strategies and get familiar with the platform features using virtual money. This means learning what works and what doesn't in a risk-free environment, and it means making mistakes - crucial for learning - without risking any of your own real money.

Those who enter a live trading account with a clearly outlined trading plan and strategy, as well as a clear risk management plan, have a significant advantage over those who don't take this opportunity. They often make less costly mistakes and become more successful at trading faster. They can find it easier to master vital trader skills, such as sticking to your trading plan, managing your emotions and spotting a potential trend. They may also find the start of live trading less overwhelming, as they're familiar with the platform they've chosen already.

Choosing the right demo account

All demo accounts are not created equal - you want to choose the demo account that best fits your needs and exactly matches the live platform you'll be graduating onto, in order to have a seamless trading experience. There are two parts to finding the right demo for you: the platform itself, and the broker providing it.

Features to look out for

The closer your demo account experience is to the live trading you later go on to, the more quickly you'll get on your feet when trading with actual money and the easier it'll be to translate those valuable demo trading lessons learnt.

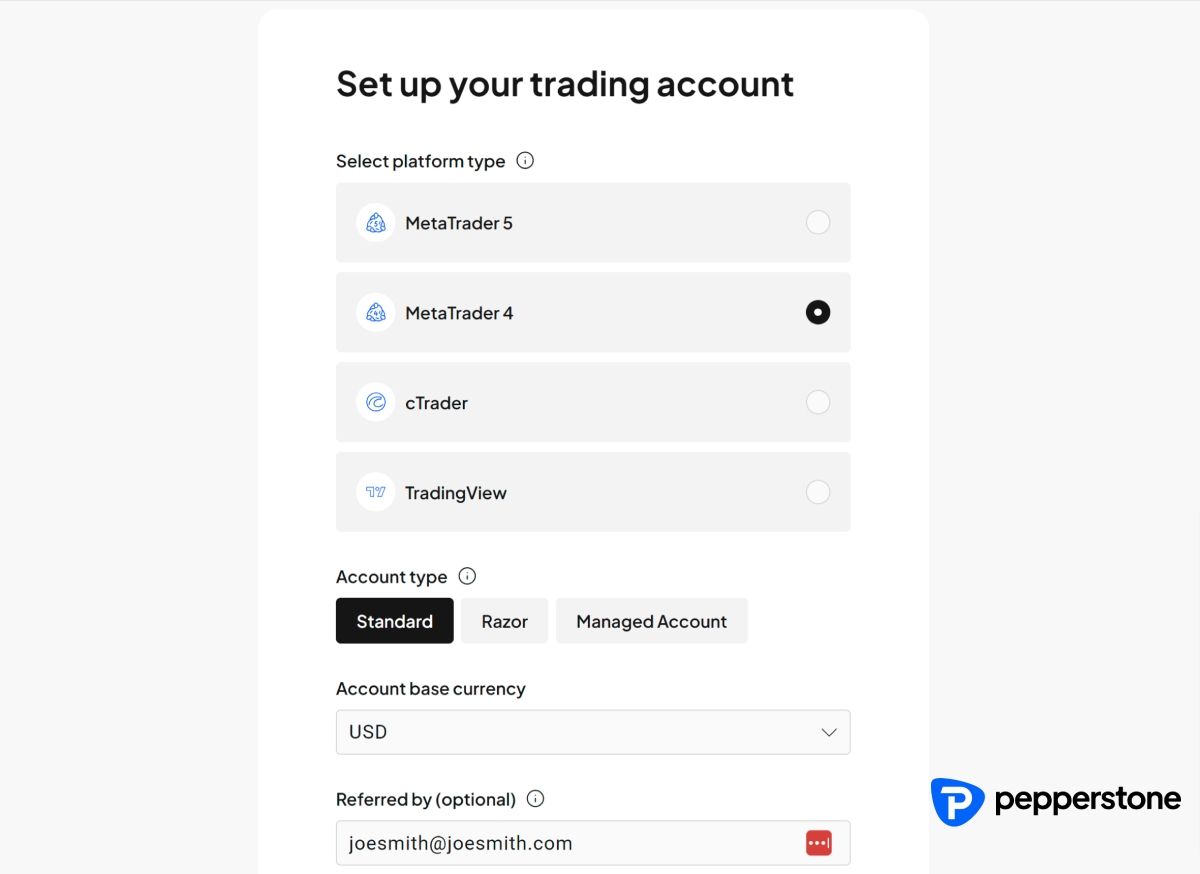

So, the first thing to ensure is that you can create a demo trading account that is a trading simulation of the exact platform you mean to trade on with your own money later. For example, Pepperstone offers the world's most popular trading platform, MetaTrader 4, as well as TradingView, MetaTrader 5 and cTrader.

Other things to look for include:

- The availability of real-time market data

- A wide variety of chart types and technical indicators on offer

- A reputation as an intuitive platform with the ability to customise indicators and other tools to your trading strategies

- A wide range of financial markets offered too: for example, Pepperstone offers 1200+ instruments including forex markets, CFDs in stocks, commodities, cryptocurrencies, indices and more

- The ability to customise the amount of virtual money in your demo account, so that it better reflects your ‘real life’ trading goals and circumstances

Researching CFD brokers

You won't be using the trading platform in isolation, though. The platform is usually provided by a trading broker, and it's them that will be your service provider, whom you'll have the relationship with as you move from a demo into live trading.

Here, reputation is everything, you want someone who is known to be a secure, trusted provider of the platform you want to use. For example, Pepperstone is the #1 MT4 broker, as awarded by Good Money Guide, and is also the TradingView Broker of the Year.

Other things to look for when researching and comparing brokers include:

- 100% compliance with financial regulation for secure, peace-of-mind trading

- Competitive trading fees: our spreads, commissions and swap rates are some of the lowest in the business

- Good customer support: Pepperstone offers award-winning client support 24/7

- Deep liquidity like Pepperstone’s, which is provided by Tier-1 banks

- Regular insights into the market, like Pepperstone’s daily market analysis, news updates, educational videos, trading guides, webinars and more

Setting up your CFD Demo Account

- Begin by clicking on the blue ‘join now’ button at the top right of the Pepperstone website.

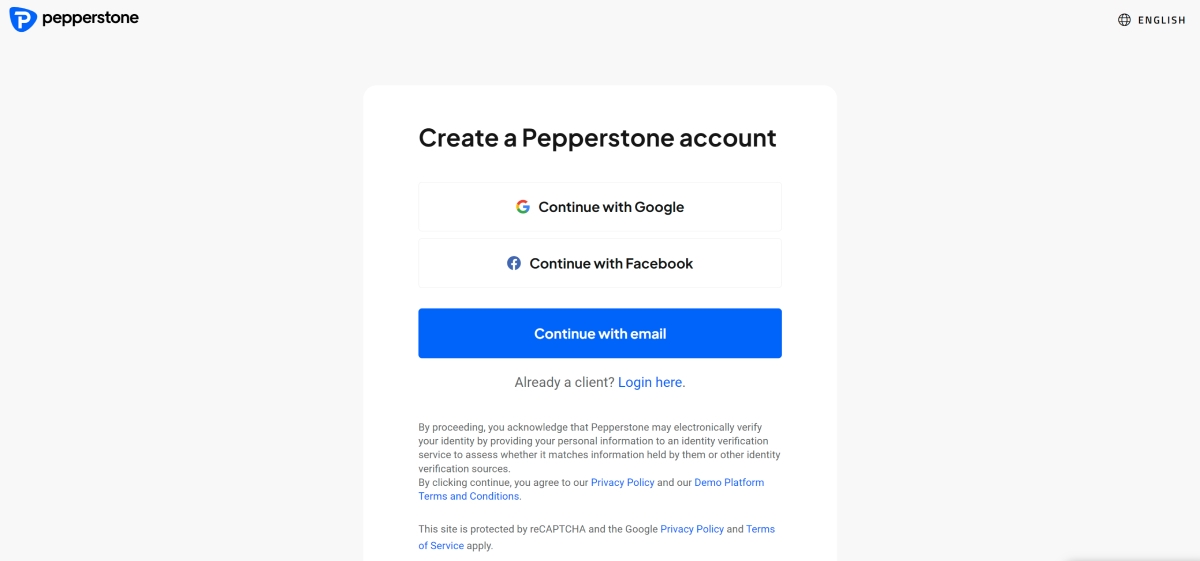

2. Thereafter, you’ll be asked to create a Pepperstone account by inputting some login details. Don’t worry - this is completely free and will take you to the demo account option of your choice, or to a live account if you wish.

3. You’ll be required to give some personal information to quickly create a trading profile.

4. Once you have a profile, you’ll be led through to your very own Secure Client Area. Here, you’ll input your trading preferences and what kind of account you want to open (i.e. a demo account) and which platform you’d prefer to use (MT4, TradingView, MT5 or cTrader).

5. Once you’ve successfully put in all your details - including your trading preferences, previous trading experience (if any) personal details and also signed the declaration, you’re ready to begin trading on your demo!

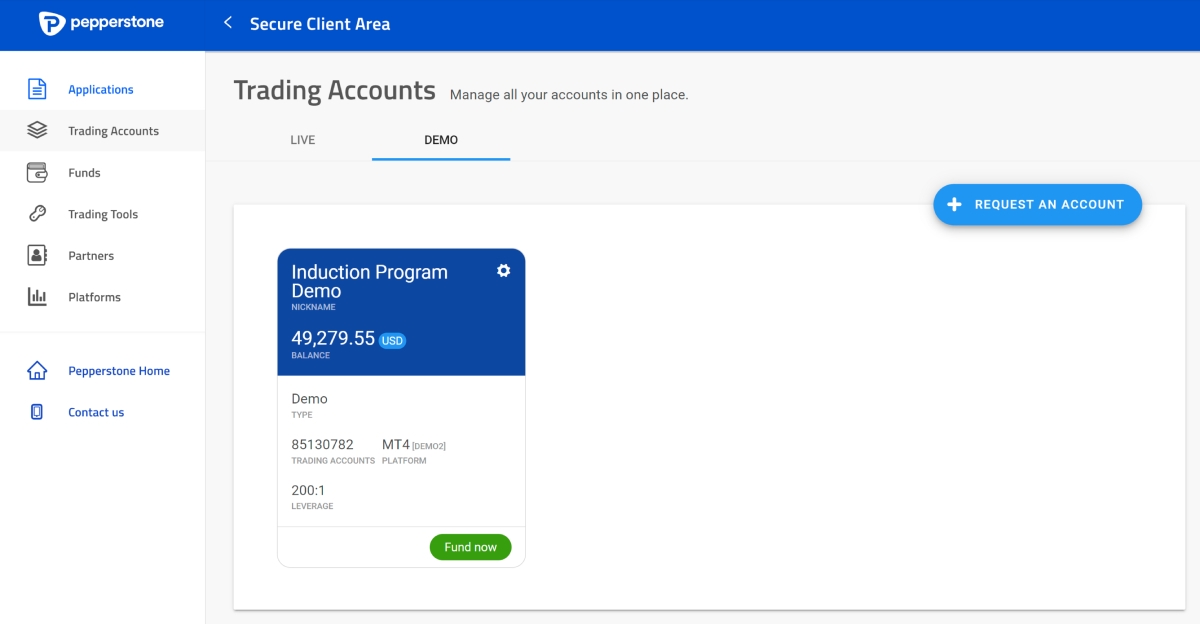

6. At this point, your Secure Client Area should look like the screenshot below. And when you want to begin trading for real profits and losses? It’s as easy as clicking on the ‘fund now’ or ‘request an account’ buttons.

Tips and tricks to make the most of your demo account

There are a few things you can do to maximise the effectiveness of your time using your demo account:

- Explore trading as many different asset classes as possible to find which one suits you best.

- Research the most utilised and most popular trading strategies for beginner traders and trial them systematically, learning what works for you and what doesn't. To aid with this, many beginners keep a trading journal.

- Learn your chosen trading platform inside out, including all the main technical indicators, trading signals and how they work. Pepperstone also offers extra ones like expert advisor tools.

- Rehearse a risk management strategy, learning exactly where to put your stop loss and take profit orders and what level or loss and profit you're comfortable with.

- Try out both technical analysis and fundamental analysis on your trading demo, as you can learn vital skills from each for your strategy going forward.

- Open as many, diverse trades as possible with your demo and try different things. You're not only trying to develop your trading style and discover your preferred financial markets - you're also learning to manage your emotions around trading.

FAQs

How long does it take to set up a demo account with Pepperstone?

It doesn’t take long at all to set up a Pepperstone demo account. Many of our clients are up and running in minutes. What you’ll do is:

- Fill in your personal information and verify it

- Answer questions on your trading background and preferences

- Choose which platform to try in demo form

- Launch the platform and link it to your Pepperstone account

Which platforms can I trade with Pepperstone on a demo account?

We offer all of our trading platforms in demo form. This includes MetaTrader 4, TradingView, MetaTrader 5 and cTrader.

Do I need to pay to open a demo account?

Not at all - a demo account is completely free. You won't need to input any credit card details either.

Do I have to open a demo account? Can't I just go straight to live trading?

There are no restrictions that stop you from beginning live trading with real money, without ever having sampled a demo. However, we strongly recommend opening a demo account and trying it out. It's only 30 days of your life, or less, and it helps plenty of successful traders to make less costly mistakes and more informed trading decisions with their own money through that vital practise.

If you find that you feel you need more practice before live trading after your 30-day demo, you can even extend your demo account. Contact us and we’ll set that up for you.

How do I switch from demo trading to live trading?

You can open a live account in just a few simple steps from your Secure Client Area at any time. Simply add your personal details in, verify and fund it to get started on making profits (and losses) with real money.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.