We've the final day of month-end position squaring, but thus far the idea of recalibrating equities and bond exposures due to the incredibly performance of equities has yet to show its hand.

Gold is interesting as the yellow metal has completely diverged from both real yields and the USD. With price closing below the 200-day MA and trend support will this liquidation continue or will see the dip buyers come back? I remain cautious and would like better buying to come back in before I trade this from the long side – happy to miss the initial rally to see the flow turn more positive.

Blue – USD index (inverted), white – US 10-yr real yields (inverted), Orange – XAUUSD

(Source: Bloomberg)

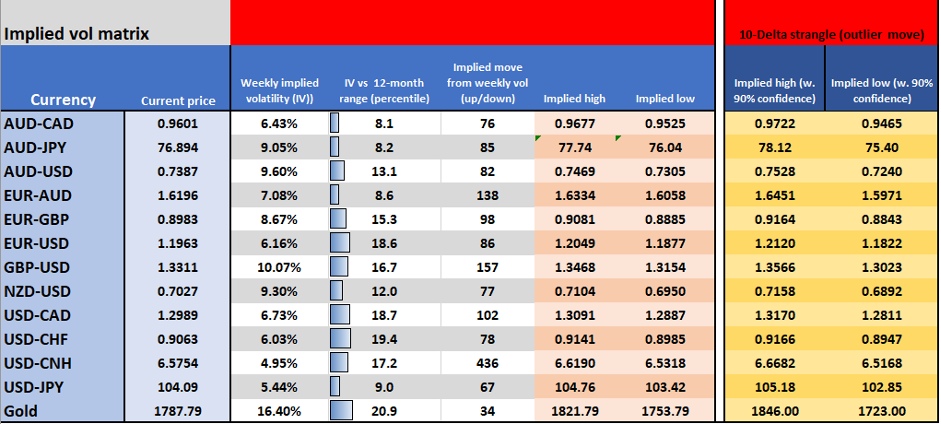

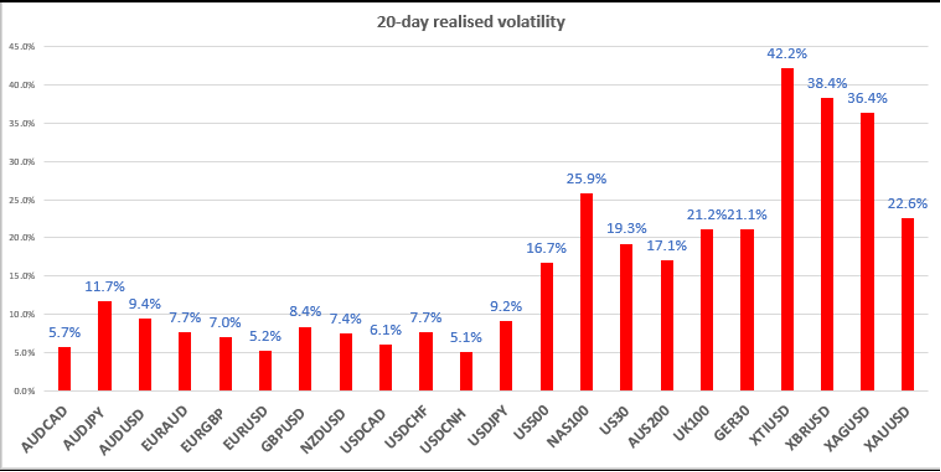

The event risk this week does increase and while we’ve seen some lift in implied volatility (vols), the implied moves are hardly prolific. This will suit some, while others who like to operate in a more extreme movement backdrop will be hoping that something sets the market alive into December when historically volatility traditionally fires up. It feels like the reflation trade will need to come under serious debate for vols to pick up materially and I'm not so sure this'll be the case on one week's worth of data, especially with the charts of Copper, Iron ore and global equities looking so strong.

20-day realised volatility

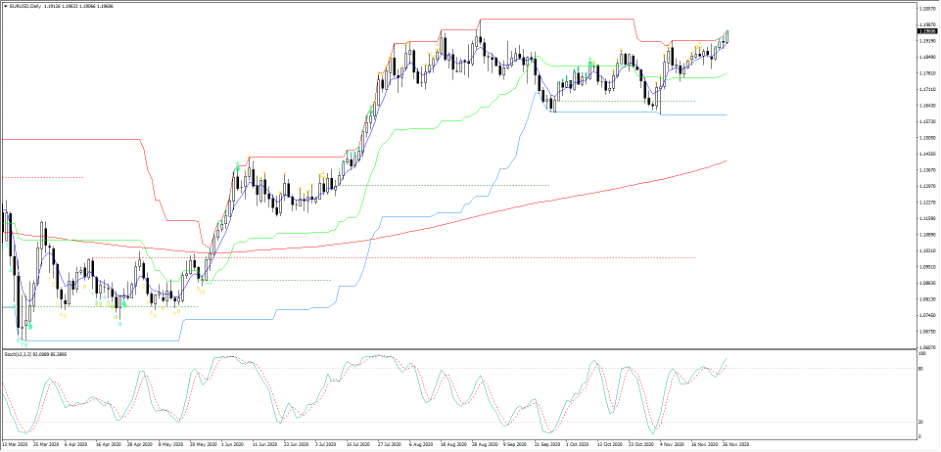

Looking at the implied moves I can't help but look at EURUSD and see the top of the implied range (with a 68.2% level of confidence and one standard deviation) sitting at 1.2049. I certainly can't see the 10-delta strange level at 1.2120 being tested and there’s a reason why the market has placed a 10% probability of this coming into play. Any moves above 1.2050 on the week and I’ll be fading, although I'll assess the news at the time.

(EURUSD daily)

Certainly, the USD looks weak, with the USDX closing at the lowest levels since 2018. GBPUSD vols are hardly screaming out that EU-UK trade talks are going to result in a rapid move in price and again this is a factor very much on the radar as talks come down to the wire. As Foreign Secretary Raab said, there's a deal to be done, but is a deal worth 1.3500 in cable? Or does the market de-risk as the days roll on without an agreement, taking the pair towards the 50-day MA as 1.3053. We'll see, but a deal still seems the more likely outcome.

What’s on the radar and driving us this week:

Monday

OPEC+ – The focus turns to the energy markets and the petro-currencies, with OPEC+ meeting and traders keen to see if the group delay altering its previously agreed 7.7 mbd in crude output cuts, perhaps until April when they may reduce this to around 5.8 Mbps. Should we see OPEC surprise and taper the cuts then crude could reverse the ST bull trend, and this could have implications on inflation expectations and lift implied volatility.

China – At 12:00 AEDT we see the November manufacturing and non-manufacturing PMI –the consensus eyes 51.5 and 56.0 respectively. Both would be solid numbers, and if in line, should reinforce the notion that China is at the backbone of the 2021 reflation trade. USDCNH looks heavy and rallies above 6.6000 will likely find sellers.

EU – ECB President Lagarde speaks at the European Policy Centre Forum (21:00 AEDT). With expectations elevated that the ECB are likely to do more in its 10 December meeting, traders will be watching for clues on how responsive they will be. Christine Lagrade also speaks again on Wednesday at 23:45 AEDT.

Tuesday

Australia – December RBA meeting (14:30 AEDT). After the last meeting saw the RBA go hard on the easing, little is expected here, and it will be a pause for reflection. While traders will see modest upside risks in the AUD (from the meeting), expect the AUD to be buffeted around by positioning more than anything. That is before we see the market settle down and re-focus back on drivers such as copper, iron ore, Hang Seng and S&P 500 futures. AUDUSD looks strong, and on the week rallies look at be capped into 0.7500

Wednesday

US – Fed chair Powell speaks before the Senate Banking Committee (02:00 AEDT) to discuss the CARES act.

US – November ISM manufacturing (02:00 AEDT). Consensus expects the index to print 58 (from 59.3), and thus grow at a slower pace from October. 58 is still a healthy level of growth though, which in turn should support the reflation trade. We’d need to see a big miss for this to drive broad market volatility higher.

Australia – Q3 GDP (11:30 AEDT). Consensus expects -4.5% YoY, +2.4% QoQ. Hard to see this data point being a driver of volatility in the AUD or AUS200, but it should garner headlines as Australia formally comes out of recession.

Thursday

EU – We get the final PMI revisions across Europe and the UK. Economists don’t expect any major changes here, so this is unlikely to move the dial too greatly.

Friday

US – Initial jobless and continued claims (00:30 AEDT). Consensus expects 765k and 5.81 million respectively. After a back-to-back weekly rise in initial claims, this may get some attention and promote some vol back into the market if it comes out higher than expected. At 02:00 AEDT we see ISM services with the expectation the index comes in at 56.0 (from 56.6 in October).

Saturday

US – Non-farm payrolls (00:30 AEDT). The market expects 500,000 net jobs to be created, with the unemployment rate to firm to 6.8%, although there is no survey for the participation rate. Hourly earnings are set to decline to 4.2% YoY pace. NFPs always get a reasonable look from traders, but again will this really derail the '2021 is a better year' trade? I’m so sure.

Canada – November payrolls (00:30 AEDT). The market expects to see 20,000 net jobs created, with the unemployment rate to remain at 8.9%. USDCAD is holding the 1.3000 level for dear life and should this go, then I am sure it will get good attention from clients. As we saw on 9 November, there is likely good support below the figure that may be present this time around.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.