- English

- عربي

Trader thoughts - can the USD rally regardless of the payrolls outcome?

Why? ‘Because the market is open’ is one cynical cry. But we see small-caps outperforming with the Russell 2k (+1.8%) eyeing a push into the 50- and 100-day MA. Cyclicals are working well, with energy and financials doing nicely, although materials are flat. Volumes have been in-line with the 30-day average in the S&P 500 cash market, but 749k S&P 500 futures contracts traded on the day is woeful.

Staying long for now, but would fade any intra-day rallies into 4460 – although, on the US500 we see divergence between price and the RSI which could indicate an impending reversal. One to put on the radar and you can trade the opportunity with us at Pepperstone.

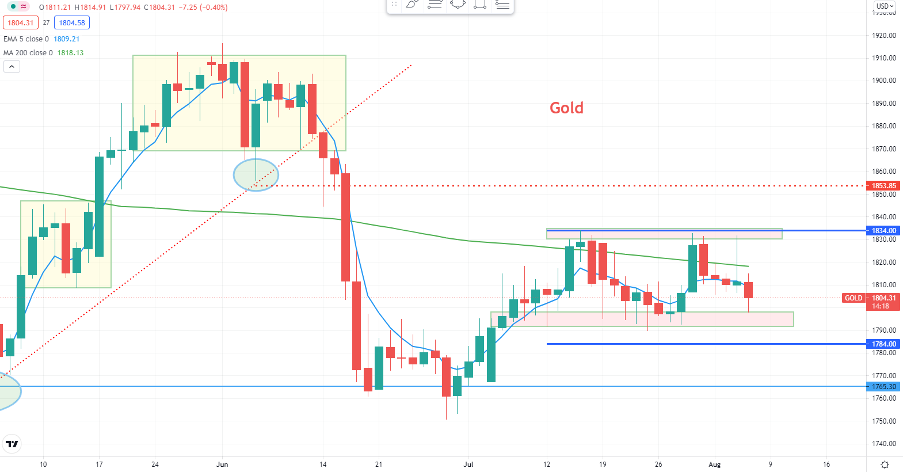

US Treasuries have sold off with yields higher across the board. 10s sit at 1.22%, with US real rates +6bp and while the USD is unchanged on the day, and really failing to follow through after yesterday bullish outside day reversal. The move in real rates would be negatively impacting gold which is eyeing a move into the well-worn bid zone at 1795. Playing the range has been a great trade of late in XAUUSD, but a break of 1790 or 1834 and we could see better-trending conditions. US payrolls will decide the fate today.

See my ‘Good as Gold’ live stream yesterday on set-ups, flows and positioning

AUDUSD daily

(Source: Tradingview)

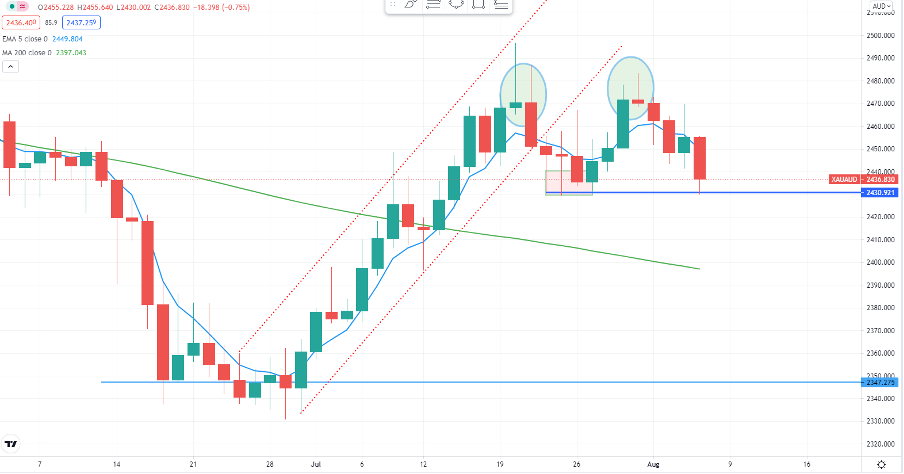

Flip to XAUAUD and the trade seems clear – a pronounced double top, with the neckline at 2431, not too far off current levels. A close through 2431 and the target is 2380, so one for the radar, but this requires gold to fall while we get a flat/stronger AUD. The AUDUSD chart springs up, and the set-up looks ominously like the pair is trying to put in a bottoming formation - subsequently, a break of horizontal resistance at 0.7416 would get XAUAUD falling into the target. Another big ‘if’ given payrolls and next Wednesday (22:30aest) US CPI (consensus for core inflation at 4.3% from 4.5%).

XAUAUD daily

(Source: Tradingview)

GBP has seen some interest given the BoE meeting, with the GBP bulls getting a better move in long GBPJPY or even GBPZAR (+1.21%) positions, the latter helped by increased anxiety after the SA cabinet reshuffle with a change of finance minister. GBPUSD hit an intra-day low of 1.3873 at 16:30 AEST, before finding buyers into the BoE meeting, where we saw whippy two way moves through US trade. A later statement from BoE head Bailey, that if inflation persists there is no question the bank will act, enforced the hawkish undertones of the BoE meeting.

At a top-level, if the UK labour market doesn’t get too negatively affected by the end of the furlough scheme (ends 30 Sept), then the BoE should tighten in Q4 2022. New guidance on reducing its balance sheet (QT) when interest rates reach 0.5%, as opposed to 1.5% (prior guidance), seems to be a GBP positive too.

Playing US payrolls

So the attention fully turns to US payrolls (22:30 AEST) – my colleague Luke put out a piece on payrolls that may be of interest here. From my own take, and by way of expectations, there are no doubt some would have seen yesterday’s poor ADP private payrolls (330k vs 690k eyed) and said there are downside risks to the NF private payrolls survey. Countering that, we also saw the ISM service data coming in hotter, and the employment sub-component showed solid growth there – so maybe that offsets the ADP report. We can also see the split in economists’ expectations ranging from 1.2m (Jefferies) to 350k (Berliner Sparkasse), which is some divergence and making a call on payrolls is finger in the air predictions.

How do we price risk when there is such uncertainty in the outcome?

After yesterday’s hawkish comments from Fed VC Clarida, it certainly feels this is a big jobs report that carries real meaning. So, a print north of 1m which takes the unemployment rate nicely lower on a good participation rate should cause a violent selloff in rates and bonds and put real upside in the USD, certainly against the EUR, CHF, and JPY. Being long US banks via single stocks, such as Bank of America or JP Morgan, or long the S&P Bank ETF would work well.

Gold would presumably find sellers on a solid jobs print, especially if the USD goes bid on a Treasury run.

XAUUSD daily

(Source: Tradingview)

However, in my mind, gold is a hedge against a poor jobs print - a number sub 650k, with the unemployment rate falling to tick lower from 5.9% - this enforces a belief that substantial economic progress is not being made and therefore the idea of tapering asset purchases and talk of hikes in 2022/23 while growth is being called into question by the market moves closer to a policy mistake.

The question I have then on a poor print is whether equity, specifically tech, rally as bond yields fall? Or will falling bond yields signal that we’re eyeing greater stagflation risks ahead and subsequently equity falls, which takes the USD higher on risk aversion flows?

I know many will disagree, but in effect the USD could benefit from a hot or cold jobs print. Ready to trade the potential opportunity?

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.